LP Wealth Growth in Uniswap

Preliminaries

- \(X_t, Y_t \) are the quantities of numeraire and asset held by the LPs in the AMM

- The price process of the asset is defined as \(S_0 = 1, S_t = S_{t-1}e^{\delta U_t}\)

- \(\{U_i\}_{i \in \mathbb{N}}\) are i.i.d random variables s.t. \(\mathbb{P}[U_i = 1] = p, \ \mathbb{P}[U_i = -1] = 1-p\)

- The implicit price given by the curve at time \(t\) is given by \(S_t^{\ast} = \frac{X_t}{Y_t}\)

- Percentage fee: \((1 - \gamma)\), we constrain \(\gamma\) to be of the form \(e^{- k_{\gamma} \delta}, k_{\gamma} \in \mathbb{Z}\)

- Trading equation \((X_t + \Delta X_t)^{\gamma} (Y_t - \Delta Y_t) = X_t^{\gamma} Y_t\)

- Note that this is equivalent to \((X_t + \gamma\Delta X_t) (Y_t - \Delta Y_t) = X_t Y_t\)

Markov Chains

- A stochastic model describing a sequence of possible events in which the probability of each event depends only on the current system state.

- A discrete-time Markov chain is a sequence of random variables \(X_1, X_2, X_3, \ldots \) s.t.

Credits: https://setosa.io/ev/markov-chains/

Markov Chains

- State space: \(S = \{A, B\}\), Transition matrix \(P \in \mathbb{R}_{[0, 1]}^{|S| \times |S|}\)

- Stationary distribution: A probability distribution \(\pi = (p_A, p_B)\) that remains unchanged in the Markov chain as time progresses.

- Clearly, \(\pi\) is the left eigenvector of P for the eigenvalue \(\lambda = 1\).

- For the above \(P\), we would have \(\pi = \left(\frac{5}{8}, \frac{3}{8}\right)\)

Implicit Price Manipulation

- Suppose at time \(t\), we have \(S_t = \gamma^{-1}\left(\frac{X_t}{Y_t}\right) e^{\delta} = \gamma S_t^{\ast} e^{\delta}\)

- We wish to bring the implicit price to \(S_{t+1}^{\ast} = \left(\frac{X_t}{Y_t}\right) e^{\delta}\) by trading \(\Delta Y_t\) for \(\Delta X_t\)

- Thus, we have

- Similarly, if \(S_t = \gamma \left(\frac{X_t}{Y_t}\right) e^{-\delta}\) and we pull the implicit price to \(S_{t+1}^{\ast} = \left(\frac{X_t}{Y_t}\right) e^{-\delta}\)

Price as Markov Process

- Recall, we traded \(\Delta Y_t\) for \(\Delta X_t\) when \(S_t = \gamma^{-1} S_t^{\ast} e^{\delta} \implies S_t > \gamma^{-1} S_t^{\ast} \)

- Similarly, we traded \(\Delta X_t\) for \(\Delta Y_t\) when \(S_t = \gamma S_t^{\ast} e^{-\delta} \implies S_t < \gamma S_t^{\ast} \)

Not profitable

Get \(\Delta Y_t\) for \(\Delta X_t\)

Get \(\Delta X_t\) for \(\Delta Y_t\)

\(0\)

\(\delta\)

\(-\delta\)

\(k_{\gamma}\delta\)

\(-k_{\gamma}\delta\)

\(\dots\)

\(\dots\)

\(k_{\gamma}\delta+\delta\)

\(-k_{\gamma}\delta-\delta\)

- Thus, \(M_t = \text{log}\left(\frac{S_t}{S_t^{\ast}}\right)\) is a Markov process with \(S = \{-k_{\gamma}\delta, \dots, -1, 0, 1, \dots, k_{\gamma}\delta\}\).

- A trade occurs when \(M_t\) stays on one of the two end states.

- Let's construct the transition matrix \(P\) and find a stationary distribution \(\pi\)

Price as Markov Process

- Let's construct the transition matrix \(P\) and find a stationary distribution \(\pi\)

\(-k_{\gamma}\delta\)

\(-k_{\gamma}\delta + \delta\)

\(-k_{\gamma}\delta + \delta\)

\(-k_{\gamma}\delta\)

\(\ldots\)

\(k_{\gamma}\delta\)

\(k_{\gamma}\delta\)

\(\ldots\)

\(-k_{\gamma}\delta + 2\delta\)

\(1-p\)

\(p\)

\(0\)

\(1-p\)

\(1-p\)

\(p\)

\(1-p\)

\(p\)

\(p\)

\(0\)

\(0\)

\(p\)

\(0\)

Constant Growth of Invariant

- After each trade the product \(C_t = X_tY_t\) is increased by the same factor \(K_{\gamma}\)

- If \(N_t\) trades occur until time \(t\), the wealth in the AMM at time \(t\) in the absence of fees is

Expected Geometric Return for LPs

- The wealth of LPs at time \(t\) is given as \(W_t = Y_t S_t + X_t\). Expected wealth is

But we have,

\(m\) (constant)

\(\because \ K_{\gamma}^{-\frac{N_t}{2}}(Y_t S_t^{\ast} + X_t) = 2(S_t^{\ast})^{\frac{1}{2}} \)

Asymptotic Geometric Return for LPs

Average number of trades during an interval of time while in the stationary distribution of the Markov chain.

Let \(\pi = \left[\pi(-k_{\gamma}\delta), \dots, \pi(-k_{\gamma}\delta) \right]\)

\(\mathbb{E}(N_t) = nt [(1 - p)\pi(-k_{\gamma}\delta) + p\pi(k_{\gamma}\delta)]\), \(\frac{1}{n}\) is the time interval

Therefore, we finally have a closed form expression for the wealth growth of LPs!

Understanding Volatility Drag

Geometric Brownian Motion

- Stock prices in traditional finance are modeled using GBM

- \(\mu \Delta t\) - the expected returns of the stock

- \(\sigma \sqrt{\Delta t} \varepsilon\) - models the random fluctuations of the stock price

- On solving the above SDE, we note that \(S_t\) is log-normally distributed

Volatility

Random process

Markov process

Drift

Price Process as a GBM

- For the price process \(S_t\) of the asset \(Y_t\), we have

- Mean: \(\mathbb{E}(\text{log}(S_t)) = \delta p + (-\delta)(1 - p) = \delta(2p-1)\)

- Variance: \(\mathbb{V}(\text{log}(S_t)) = \mathbb{E}((\text{log}(S_t))^2) - (\mathbb{E}(\text{log}(S_t)))^2 = \delta^2 - \delta^2(2p-1)^2 = 4\delta^2 p(1-p)\)

- Let us assume that \(\delta\) depends on \(\Delta t = \frac{1}{n}\). For \(S_t\) to be GBM, we must have

- Thus, we get \(\delta_n \approx \frac{\sigma}{\sqrt{n}}\) and \(p_n \approx \frac{1}{2} + \frac{d}{2\sigma \sqrt{n}} \) where \(d = \left(\mu - \frac{\sigma^2}{2} \right)\).

LP Wealth Growth

- For a time interval \(\Delta_t = \frac{1}{n}\) and let \(a = \frac{1-p}{p}\), the growth rate of LP wealth is

- The wealth of LP at time \(t\), given by \(W_t = X_t + S_t Y_t\)

- The factor by which the price \(S_t\) can change

- Fee percentage \(1 - \gamma\), note that \(\gamma \rightarrow 1\)

- Substituting \((p_n, \delta_n)\) from previous slide, we can obtain LP wealth growth for a continuous case.

- Case I: \(p = \frac{1}{2} \implies d = 0\). Substituting \(\delta_n = \frac{\sigma}{\sqrt{n}}\) for \(n \rightarrow \infty\)

Convergence to Continuity

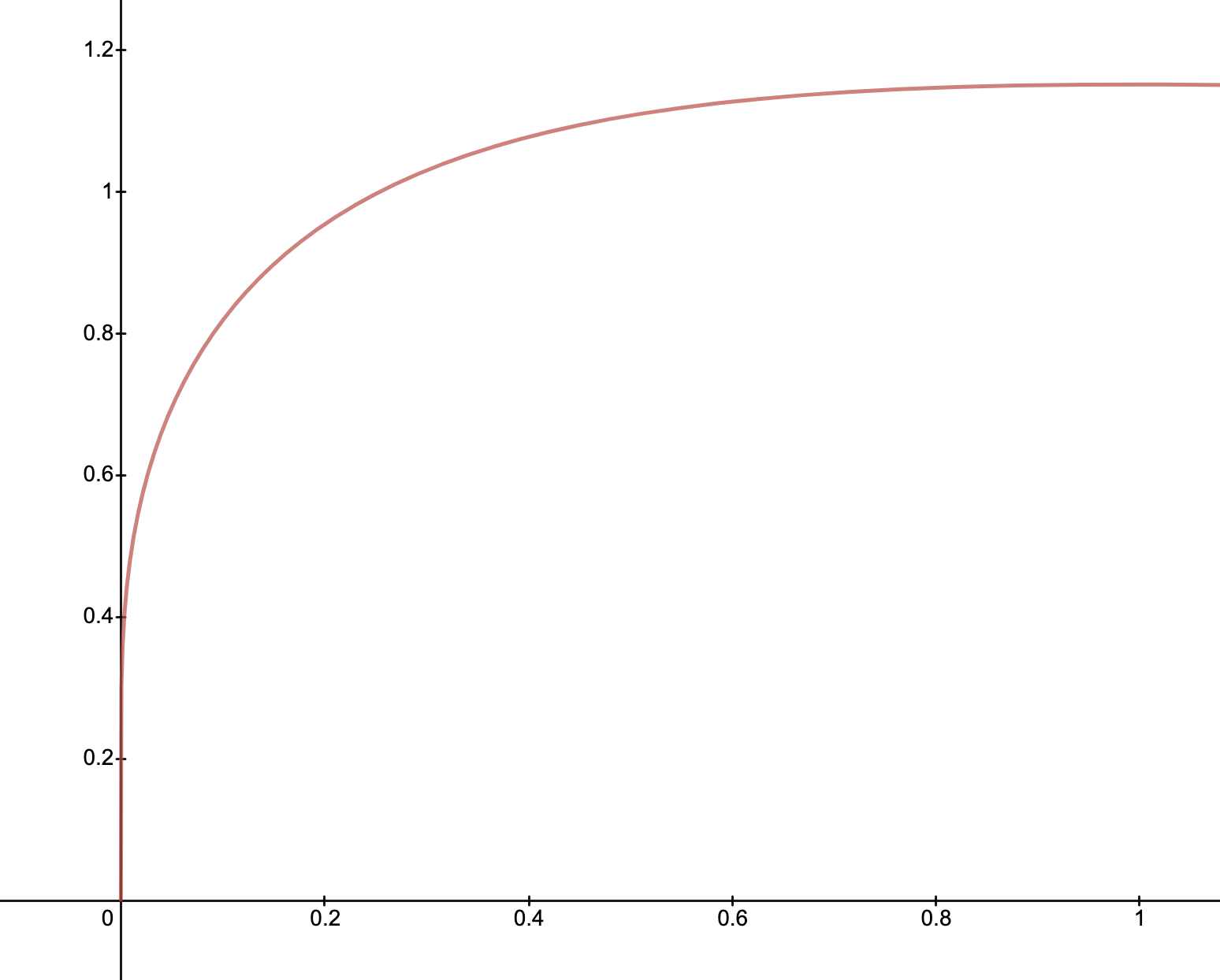

- The LP wealth increases in \(\gamma \in [0,1]\)

- For \(\gamma \rightarrow 1\), the return is

- The un-rebalanced portfolio is zero!

Convergence to Continuity

- Case II: \(p > \frac{1}{2}\). Substituting \(p_n\) and \(\delta_n\)

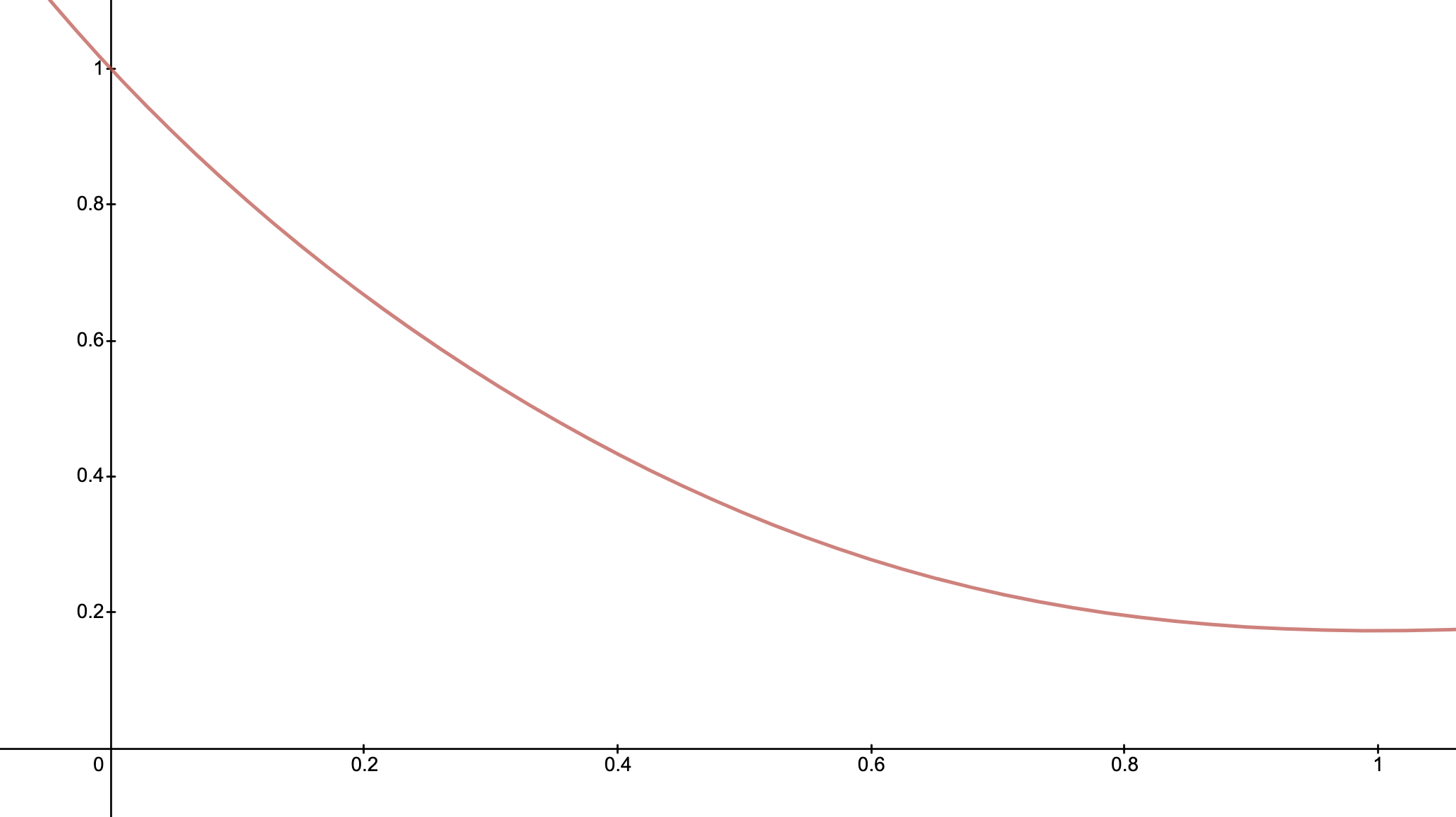

- The LP wealth decreases in \(\gamma \in [0,1]\) if \(4d > \sigma^2\). \(\gamma \rightarrow 0\) gives best possible growth \(d\).

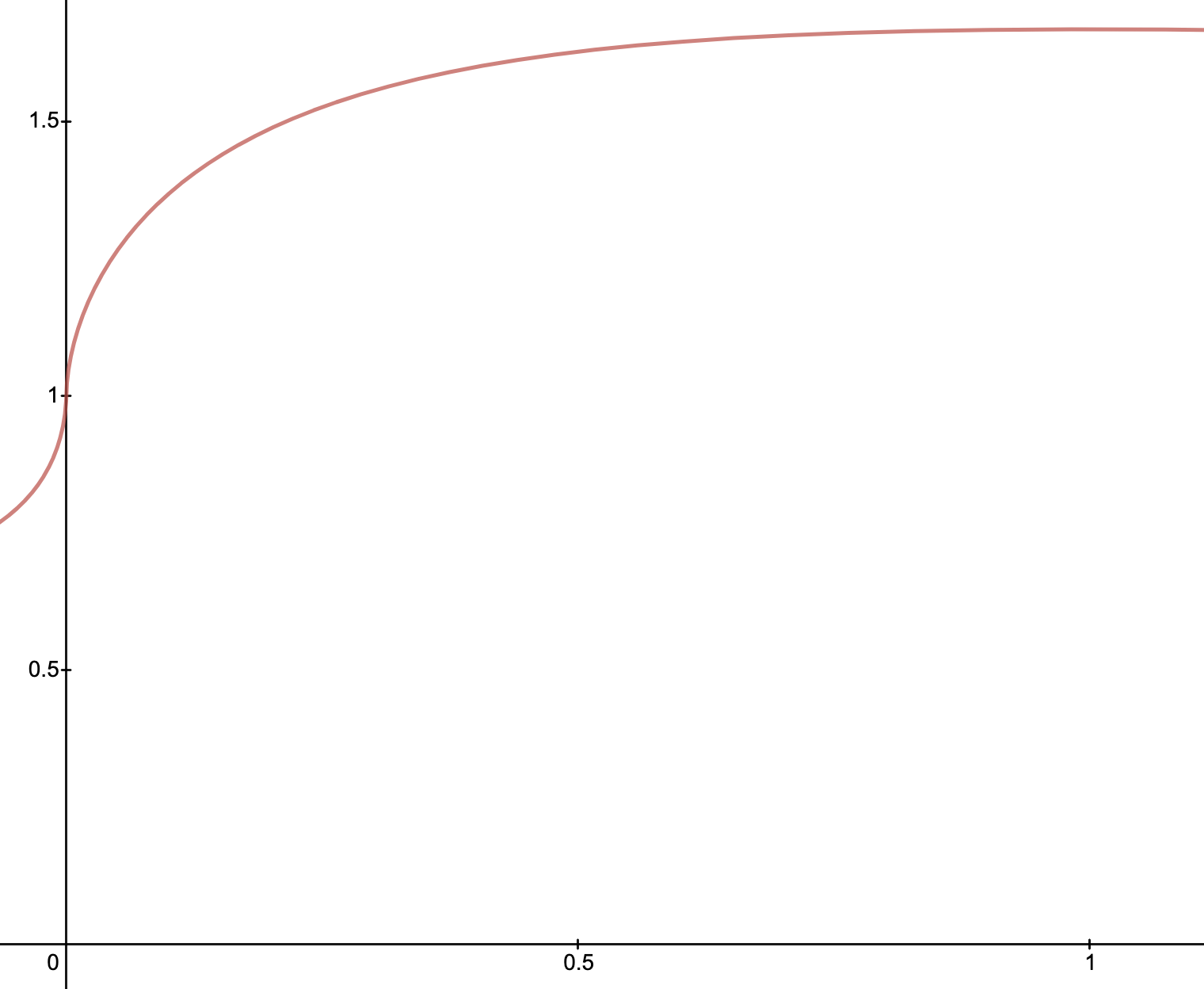

- The wealth increases in \(\gamma \in [0,1]\) if \(4d < \sigma^2\). \(\gamma \rightarrow 1\) gives best growth \(\frac{d}{2} + \frac{\sigma^2}{8}\).

\(\frac{4d}{\sigma^2} > 1\)

\(\frac{4d}{\sigma^2} < 1\)

Summary

\(p = \frac{1}{2}\)

\(p > \frac{1}{2}\)

HOLDers

LPs

\(0\)

\(\mu - \frac{\sigma^2}{2}\)

\(3\sigma^{2}> 4\mu\)

\(3\sigma^{2} < 4\mu\)

\(\frac{\sigma^2}{8}\)

\(\frac{1}{2}\left(\mu - \frac{\sigma^2}{4}\right)\)

\(3\sigma^{2}= 4\mu\)

\(\mu - \frac{\sigma^2}{2}\)

\(\mu - \frac{\sigma^2}{2}\)

- Therefore, LPs always do either equal or better than HODLers!

- For LPs to always do better, we must that: \(3\sigma^2 > 4\mu\) and \(\mu > \frac{\sigma^2}{4}\). Thus,

Volatility Drag

- When \(p > 0.5\), the expected growth rate of the price of the asset is

- Here the term \(-\frac{\sigma^2}{2}\) is known as the volatility drag.

- In the same case of \(p > 0.5\), if we have \(\frac{2\sqrt{\mu}}{\sqrt{3}} < \sigma < 2\sqrt{\mu},\) we have

Within that range, being a Uniswap LP will eventually make you rich, and in fact richer than you could become by holding any unrebalanced portfolio consisting of cash and the asset.

- LP Wealth paper Authors