Think Consortium on Blockchain

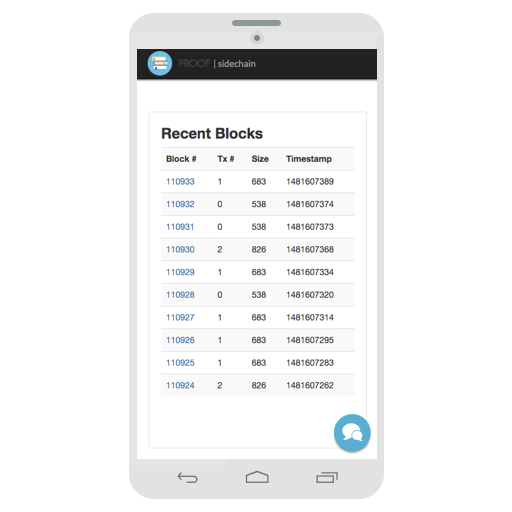

the makers of the Proof Blockchain and Dashboard

Developing easy-to-use interfaces for managing digital assets

- Loyalty Points

- Community Currency

- Corporate Shares

- Corporate Bonds

- Intellectual Property

- Property Deeds

Developing strong strategies to integrate blockchain solutions

with existing business practices and technology

Delivering enterprise-grade blockchain solutions to cut costs and

enhance interorganizational transaction efficiency

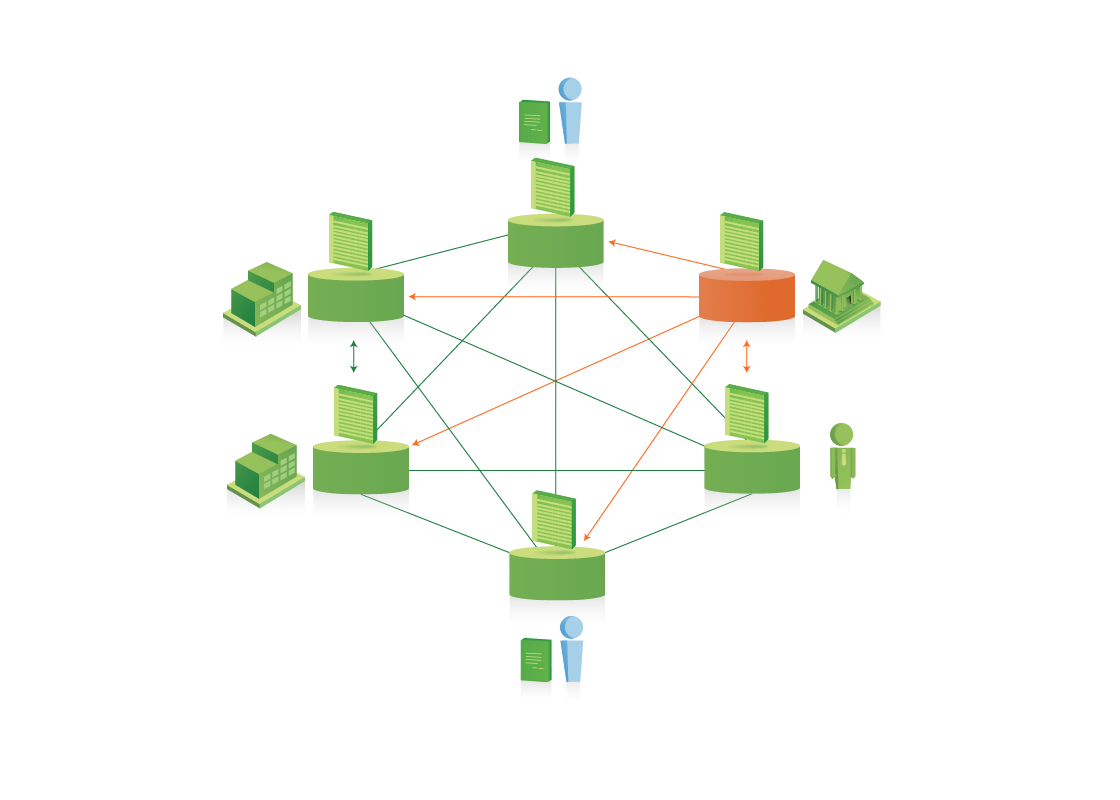

How blockchains are transforming transactions

ownership recordation redefined

the transaction is the settlement

new consumer empowerment

new transparency capabilities

middleman evolution

Every day, blockchain innovations are presenting ways to bypass intermediaries. This presents an opportunity for intermediaries to leverage open-sourced blockchain innovations to develop new kinds of offerings.

Building strong ecosystems

proprietorship possession

marketplace

desirable assets

community

security

As the need for intermediaries lessens and the market begins managing more of its own assets, from currency to loyalty points, building strong blockchain-based ecosystems through new kinds of synergetic alignments is essential to growth.

- Financial Institutions -

The first mover with effective blockchain execution takes the cake.

Becoming the channel for competitors to operate.

Value Proposition

Value Proposition

From loyalty points transfer capabilities to new outlooks on asset title control, consumers are empowered to bypass red tape across environments

- Consumers -

Blockchain-based Loyalty Points

Consumer Engagement

Boosting Repeat Customers

The Interest Paradox

Consumer can use loyalty points like currency, becoming more engaged with points programs. There is less points waste

Companies exceed rewards program enrollment targets

Customers' abilities to use their loyalty points anywhere doesn't promote loyalty. Also, more redemption of points reduces sales margins.

5,600 miles = 5,600 Delta points

5,600 Delta points = $56 on Delta/Visa Rewards sites

with blockchain-based points, she owns the points, not the card company or airline

Meet Mary

Mary flies from SFO to ICN

Mary posts her 5,600 points for a 20% discount, in exchange for cash on Proof

Her points are quickly purchased by someone who wants to fly Delta later that day

The airline and card companies complain. They received no loyalty from Mary while sales margins lowered due to consumer points engagement explosion

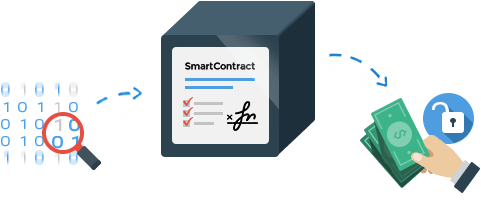

Card companies

generate

points generating smart contract

A smart contract generates points in which 80% of value is lost when blockchain-based points are transferred to non-Rewards sites.

Consumer engagement with points is higher than before the blockchain, but consumers want lowered transfer fees.

American Airlines & American Express charge lower transfer fees for non-rewards site usage

Delta & Visa counter with even lower fees, after the competitors' lowered fees announcement

Over time, the free market eventually prevails for consumer interests, giving card companies time to establish renewed strategies for growth

Proof provides a platform for the seamless integration of blockchain-based points programs between companies, allowing integrators to collect sales commissions from counterparties who join their points networks.

Whole new revenue streams open and points program success is based on successful integration with points partners.

Points usage by consumers grow points providers' bottom lines.

Thanks, blockchain!

The Points Wastage Landscape

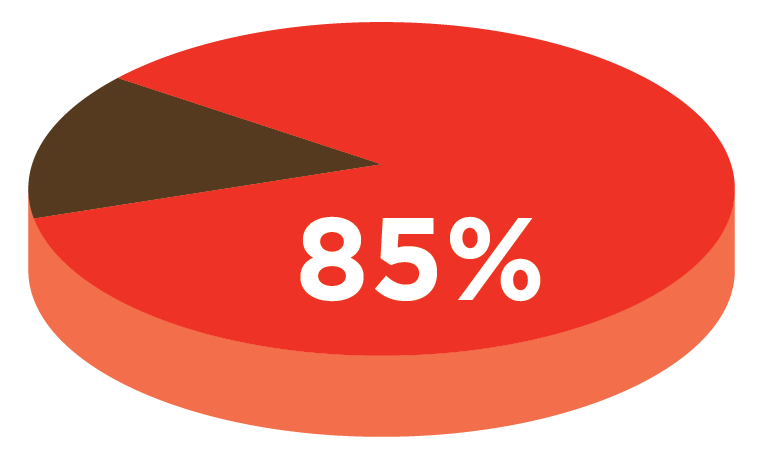

U.S. based millennials expressed dissatisfaction with reward programs

50% of U.S. consumers abandon points program annually

Points programs are essentially broken from lack of fungibility

Korean engagement is higher due to higher fungibility and is a prime market for blockchain-based points adoption

Solving the Fungible Points Paradox

Higher Consumer Engagement

Strong Ecosystem

Strategy

Greater

Returns

Easy-to-use interfaces for managing points and the ability to trade points for other assets engages consumers.

Integration with existing rewards mobile apps makes the consumer experience frictionless.

Card companies gain from the fungibility of points with Proof-based marketplaces that allow for the snappy integration with other programs in exchange for transaction fees imposed on partners.

The first card companies to provide "freedom of navigation" and blockchain-based points, obtain new and existing customer booms, pulling marketshare from competitors.

The Value Add of Proof for Blockchain-based Rewards

Without Proof

With Proof

- Extendable user interface for consumers and enterprises to manage points

- Sidechain capability for managing digital assets across multiple blockchain architectures. Great flexability.

- Secure, tested smart contract templates for introducing business logic

- Large costs to start from scratch building basic user interfaces for managing digital assets

- Lack of cross-blockchain transfer capabilities. Companies and users are more vulnerable to attack

- Basic, secure, tested business logic smart contracts must be crafted, adding costs

Other Use Cases

Financial Instutitions

Rewards Points

Developing Countries

Recent Cases & Forecasts

Learn more @

thinkconsortium.com

&

proofdashboard.com