The time is right for electric cars.

In fact the time is critical.

Carlos Ghosn, CEO Renault & Nissan

Can China's EVs kill petrol?

Beijing is keen to cut pollution in the world's biggest car market.

Tesla boosted

Shares in Tesla have risen after Elon Musk said Model 3 would be ready by Friday, two weeks ahead of schedule.

Pollution Leads to

7 Million Deaths per Year.

Is this Acceptable?

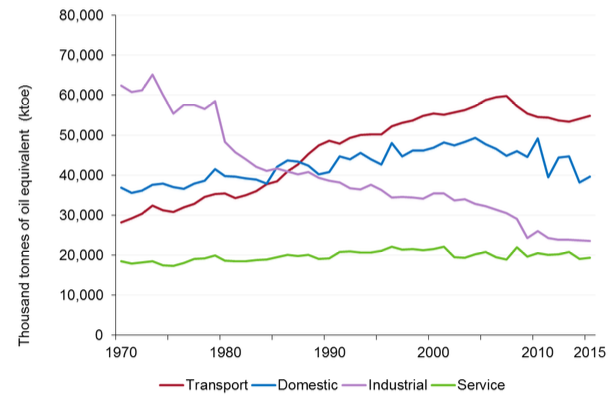

UK Energy Consumption

147K in 1970

137K in 2016

UK Energy Sources

Heat & Noise

Chassis & Body

Under Utilisation

Driving Style

Gas Guzzling Inefficiency

100m new vehicles per annum

- Circa 1 billion cars and light trucks on the road.

- Consuming circa 250 billion gallons fuel yearly.

The Revenge of the EV

1832-1839: First practical EV

1900-1912: EVs soar on US roads

1930s: EVs face extinction

Source: EV BOX

The Road to the

Roaring Twenties

- 1901 Tarmacadam

- 1916 Federal Aid Road Act

- 1921 Federal Aid Highway Act

- 1924 US has 31,000 miles of paved road

- 1925 The height of the "roaring twenties"

- Motels & Drive-ins

- Consumer Credit

- Suburbia

Electric Vehicles - EV

Are overcoming barriers

- High first cost

- Limited range

- Slow speed of recharging

Fuel Cell Vehicles - FCV

Suffer from all 7 of the sins.

- Fuel cell vehicles available commercially in very limited quantities.

- Difficult to engineer

- Flammability of hydrogen

- Expensive

- Limited Range

- Slow Charging or Refuelling

- Few Stations for Fuel or Charge

- Safety and Liability

- Competition

- Apathy & FUD

Source: www.thinkprogress.org

Barriers to AFVs

1

H

7

Li

- 565,000 sold in 2015

- EVs have long had a per-mile fuel cost less than gasoline.

- With renewable generation, EV's have holistic low emission.

-

On going improvements in

- Range

- Recharging

- Initial Vehicle Cost

- Perceptions

- Renault/Nissan - Big Auto scale

- Tesla - Silicon Valley boldness

- Ather Energy - Indian confidence

- River Simple - British quirkiness

- Uniti - Nordic efficiency & design

Some of my Favourite EVs

Big Auto Scale

-

Company

Power

- Tier 1 auto maker

- 8.5M vehicles p/a (#4 globally)

- $180B revenue. 450,000 employees

-

Market Power

- A leader in the EV segment

-

85,000/565,000 EVs sold in 2015

=> 15% of niche

=> 1% of group volume

-

Offer Power

- Mid-low market vehicles.

- Cars, vans, batteries & charging.

-

Execution

Power

- Early to EV market & steady growth over several years.

- Dampened by vested interest in gasoline cars.

Silicon Valley Boldness

-

Company

Power

- $ 4B revenue. 13,000 employees.

- 125,000 cars sold in 8 years.

- 0.03% total market share

-

Market Power

- A leader in the EV segment

-

40,000/565,000 EVs sold in 2015

=> 7% of niche -

5M luxury vehicles sold per year, worth $220B

=> 0.6% of niche

-

Offer Power

- More than an auto company

- Electric luxury cars

- Automotive components

- Rechargeable energy storage systems

-

Execution

Power

- Over promising & under delivering

British Quirkiness

-

Offer Power

- 300 mile range

- 3 minute recharge

- Hydrogen-fuel cell vehicle

-

Execution

Power

- Rasa prototype is on road.

- Into production end of 2018.

- Roll out across the UK town by town, in tandem with hydrogen refilling stations.

-

Company

Power

- Pre-revenue. Crowd funding now.

- <50 employees

-

Market Power

- Founded OScar Automotive in 2001

- Became Riversimple in 2007.

Indian Jugaad

-

Company

Power

- Pre-revenue.

- Circa 100 employees

-

Market Power

- Founded early 2014

- $1M seed funding Dec 2014

- $12M series A May 2015.

-

Offer Power

- Top speed of 72 kph

- Range of up to 60 km

- Charge up to 80% in 50 minutes.

-

Execution

Power

- S340 unveiled on 23 Feb 2016.

- Will start taking pre-orders by Q2 end 2016. Price yet to be disclosed.

- Manufacturing will have the capacity to produce 50 scooters a day.

Nordic Efficiency & Design

-

Company

Power

- Founded 2015 in Lund, Sweden

- Pre-revenue. Crowd funding soon.

- <50 employees

-

Market Power

- Underpinned by world class research, engineering & automotive capabilities.

- Tapping into open source communities.

- Strong voice in social media.

-

Offer Power

- Ultra sustainable

- Two seats in tandem ( EU L7e quadricycle)

- 90km/h max speed, 150km range (weighing 400kg)

- Induction or plug-in charge. Removable battery.

- Unique driver experience

- Designed for autonomy

-

Execution

Power

- Kepler Pod floor show at Cebit Feb 2016.

- Uniti Arc shipping May 2016.

- Prototype car expected end of 2016.

- On street charging posts

- Electric Buses

- Electric Trucks

- Inductive Charging

Source: First Group

Source: Innoventum

Other Electrification in Transport

April 2017, deal worth $600+ million over several years.

Replacing lead acid batteries with hydrogen fuel cells makes forklift operation more efficient.

Wal-Mart have been a Plug Power customer for 3-4 years.

Every New Transit Bus Will Be Electric by 2030. We’re already beating and diesel and CNG on pricing.

Ryan Popple, CEO Proterra

Electric trucks and vans cut pollution faster than cars @ BBC News (27 Jul 2017)