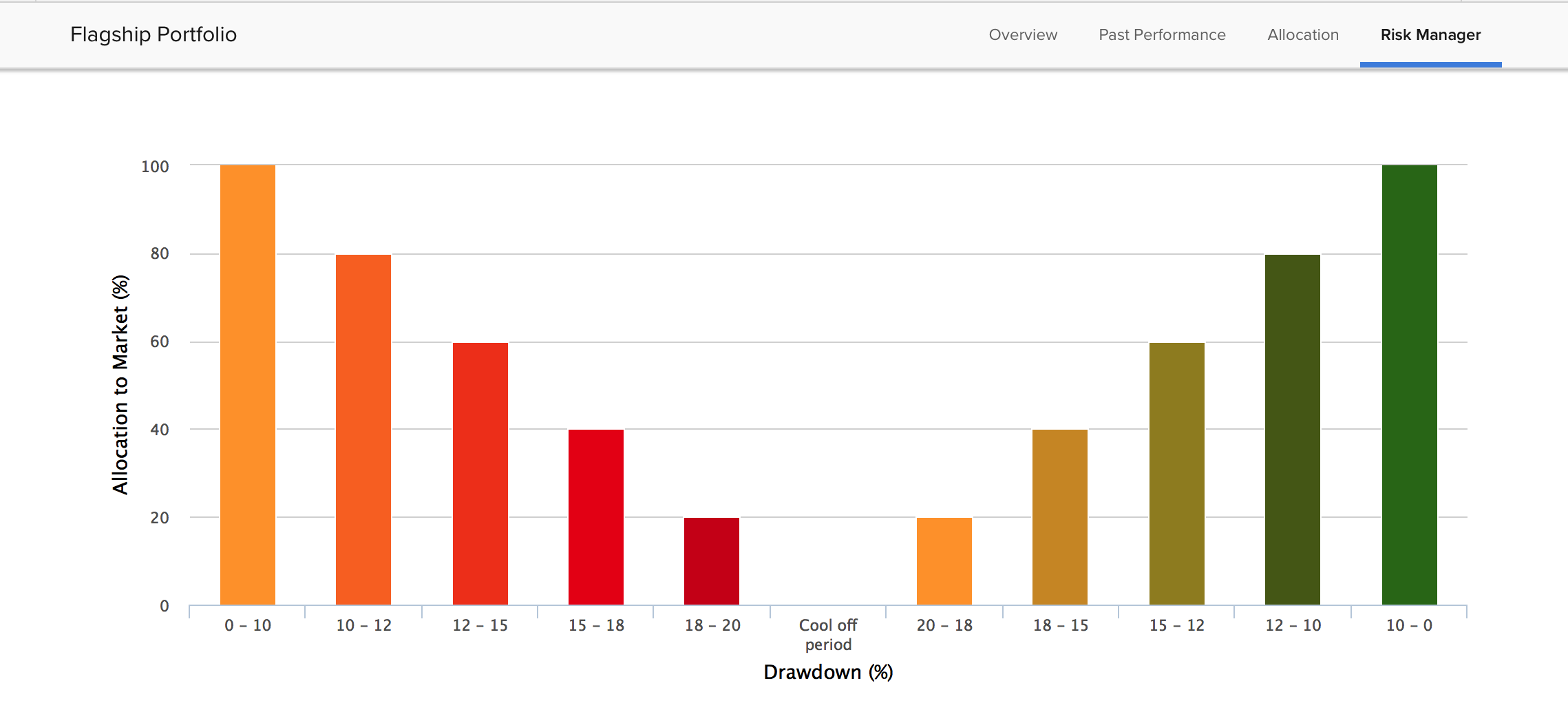

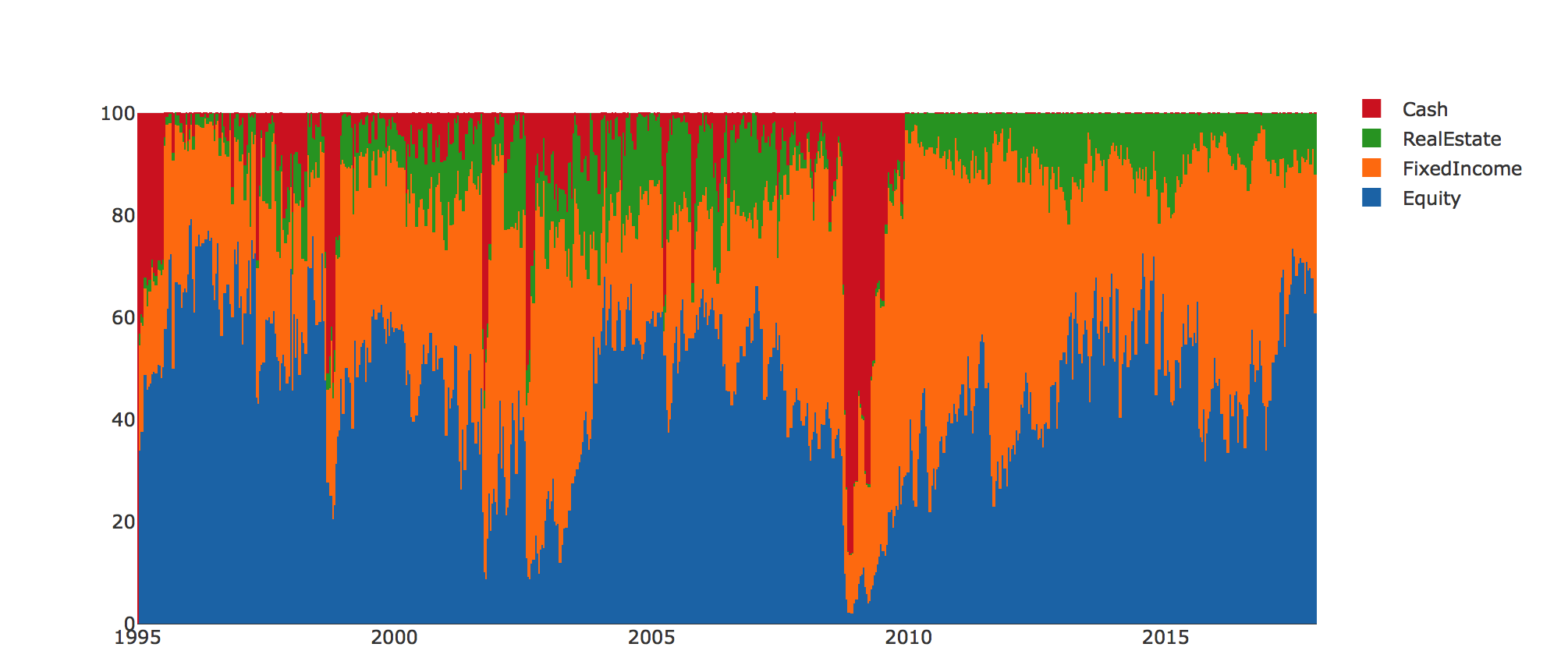

“By choosing to place asset allocation at the center of the investment process, investors ground the decision-making framework on the stable foundation of long-term policy actions.

Focus on asset allocation relegates market timing and security selection decisions to the background, reducing the degree to which investment results depend on mercurial, unreliable factors.

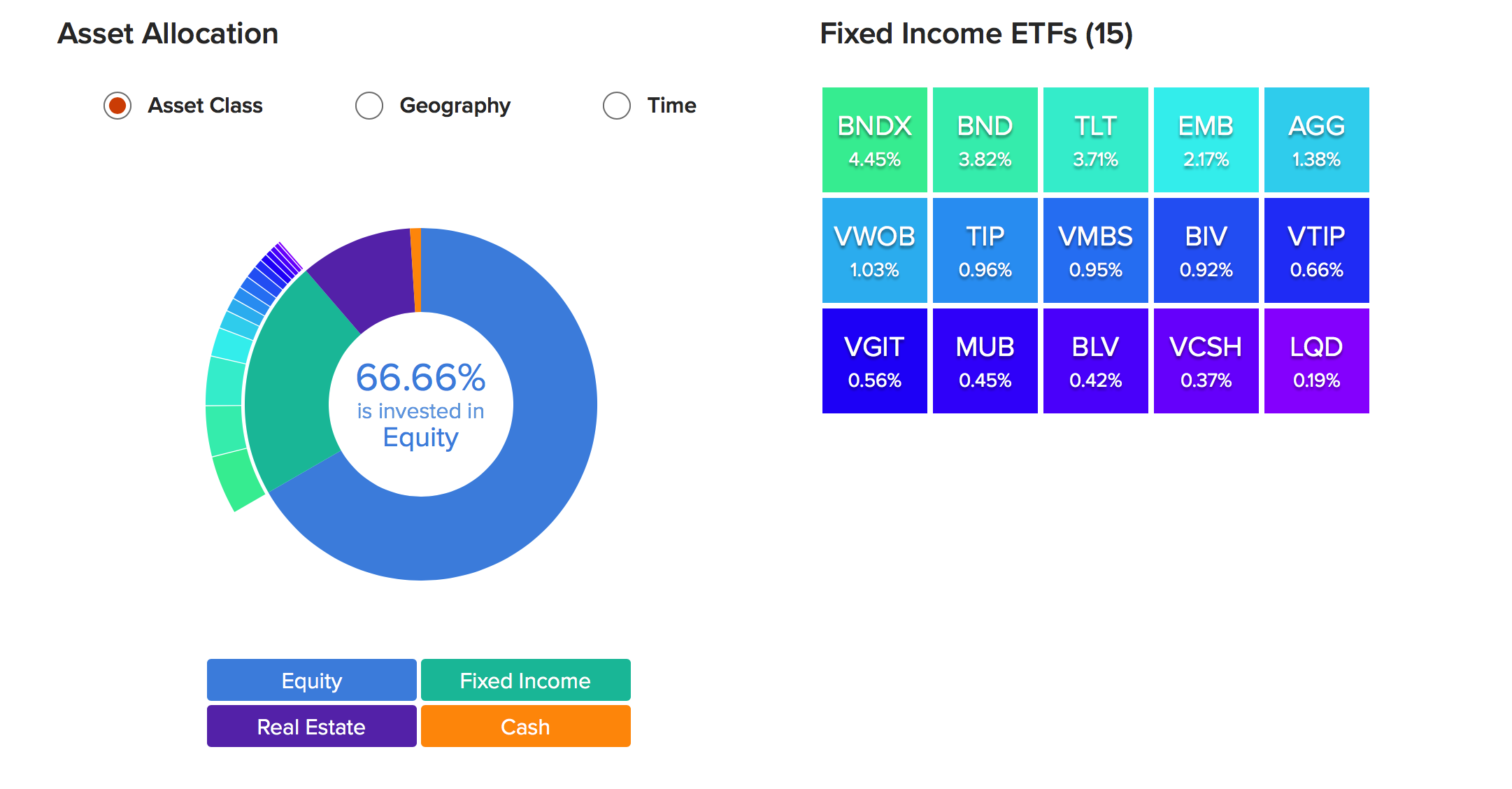

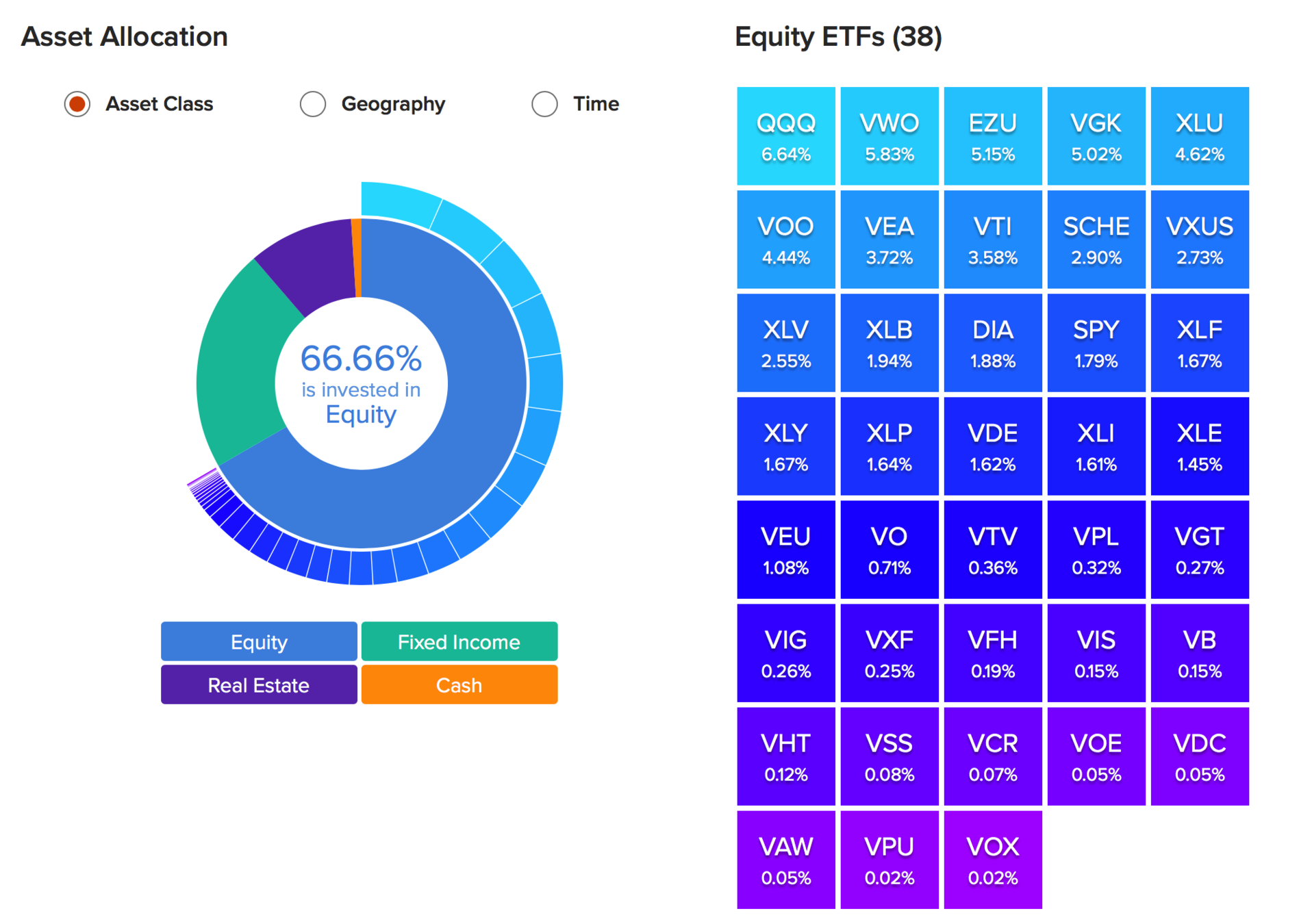

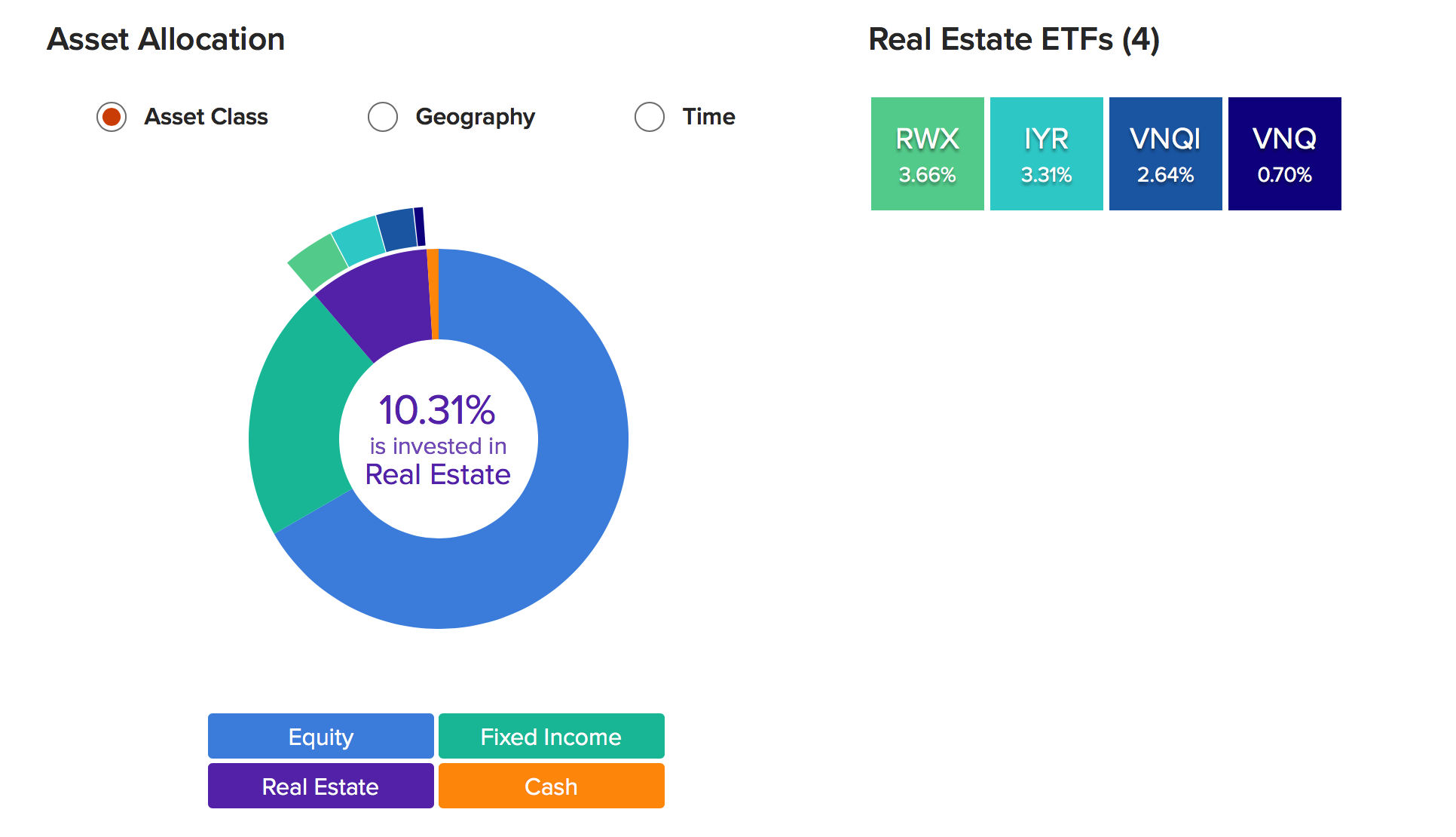

Selecting the asset classes for a portfolio constitutes a critically important set of decisions, contributing in large measure to a portfolio’s success or failure. Identifying appropriate asset classes requires focus on functional characteristics, considering potential to deliver returns and to mitigate portfolio risk. Commitment to an equity bias enhances returns, while pursuit of diversification reduces risks. Thoughtful, deliberate focus on asset allocation dominates the agenda of long-term investors.”

– David Swensen