Politics through the Lens of Economics

Lecture 3: Income Redistribution

Masayuki Kudamatsu

18 October, 2017

Did you pick a policy?

For your term paper...

Now it's

Discussion time

For your term paper...

Discussion Time

For your term paper...

Does the Median Voter Theorem explain

why the consumption tax rate isn't higher than 8% in Japan today?

Value-added tax rate across OECD countries in 2015

Background information for discussions

VAT tax revenue as % of total tax revenue in 2014

Source: OECD (2017) "Goods and services as percentage of total taxation" Government At A Glance 2017

Background information for discussions (cont.)

2012

Pass the bill for a rise to 8% in 2014

Lost the majority in Lower House

2010

Propose a rise to 10%

Prime Minister resigned

1994 Feb

Propose a rise to 7%

Prime Minister resigned

1979

Propose 3%

Lose many seats in Lower House

1981

Propose 5%

Lose many seats in local elections

1989

Pass the bill to introduce 3% tax

Pass the bill for a rise to 5% in 1997

Lost the majority in Upper House

A consumption tax rise is politically suicidal in Japan

Background information for discussions (cont.)

1994 Nov

Discussion Time

For your term paper...

Does the Median Voter Theorem explain

why the consumption tax rate isn't higher than 8% in Japan today?

When can we say a theory explains reality?

Theory

II

Assumptions

Predictions

+

Hold in reality?

Consistent with reality?

For your term paper...

What are the assumptions and predictions

of the Median Voter Theorem? (cf. Lecture 2)

Aim: Come up with a wrong answer

For today...

Today's Road Map

Inequality and Income Redistribution

Economic Impact of Democracy

Inequality and Income Redistribution

Economic Impact of Democracy

Optimization of how much to consume

Sources of economic growth

Today's Economics Lessons

Today's Road Map

Inequality and Income Redistribution

Economic Impact of Democracy

Median Voter Theorem predicts:

Falling Median Income

(relative to GDP)

More

Redistribution

Median Voter Theorem predicts:

Falling Median Income

(relative to GDP)

More

Redistribution

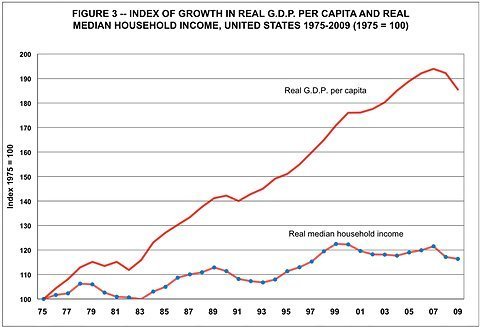

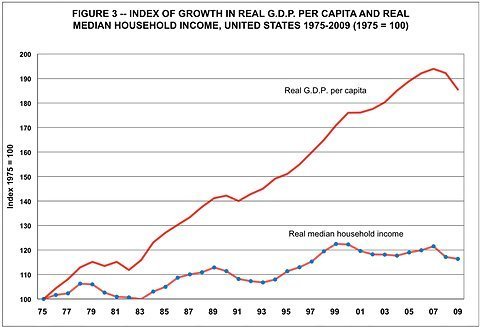

What's been happening in US for the past 40 years

In U.S., median income doesn't grow much while GDP grows fast

In U.S., median income doesn't grow much while GDP grows fast

This happens when

economic growth mostly benefits top income earners

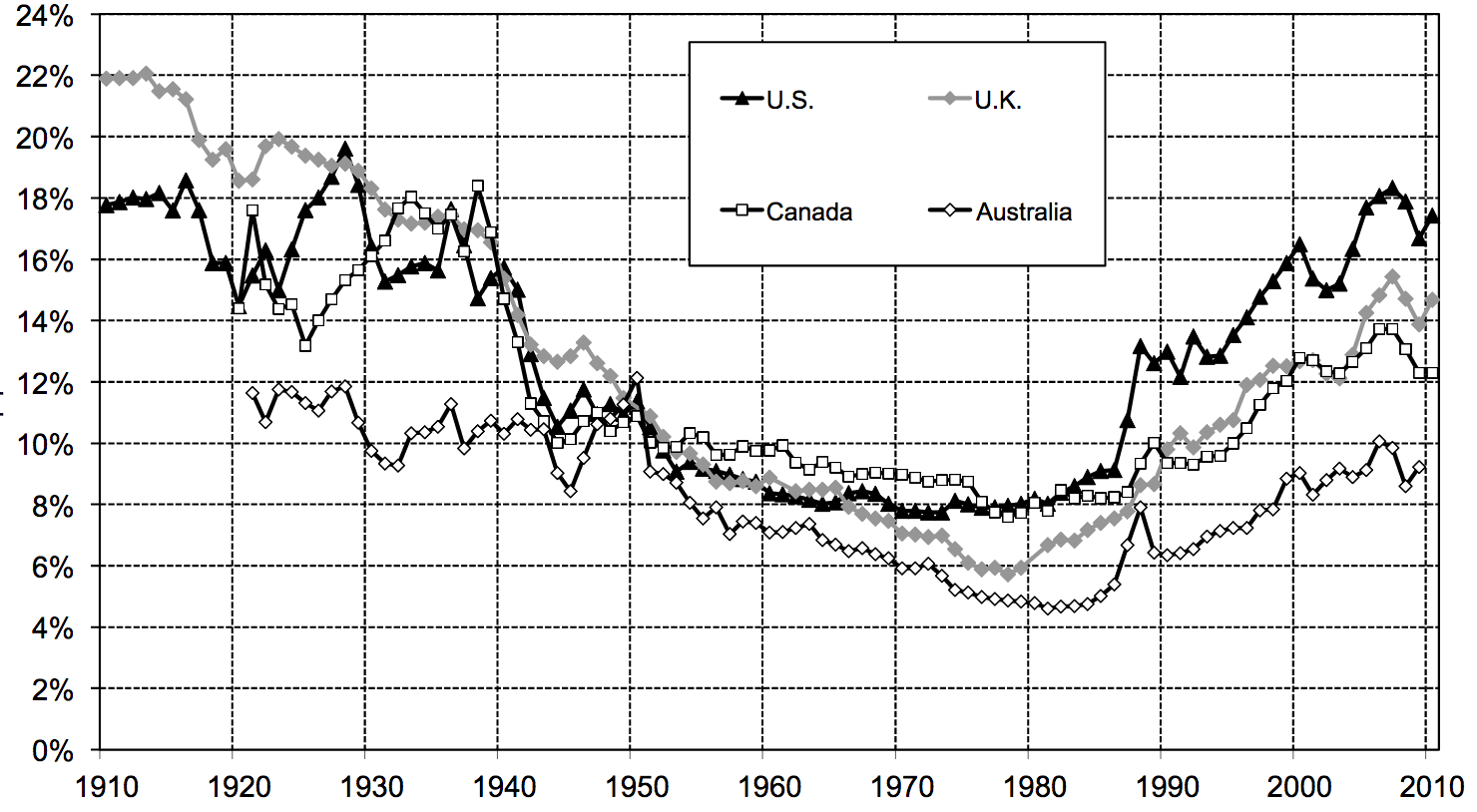

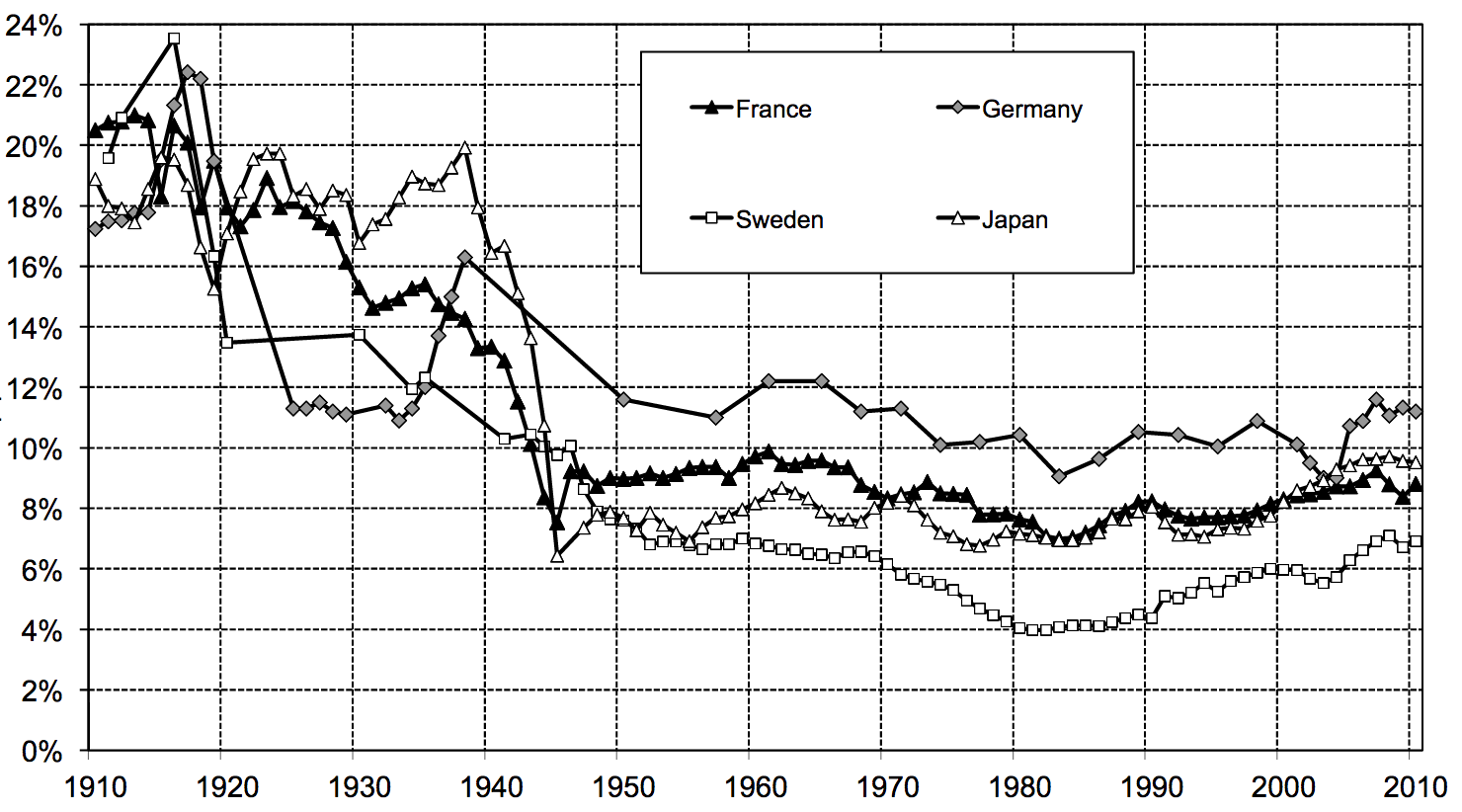

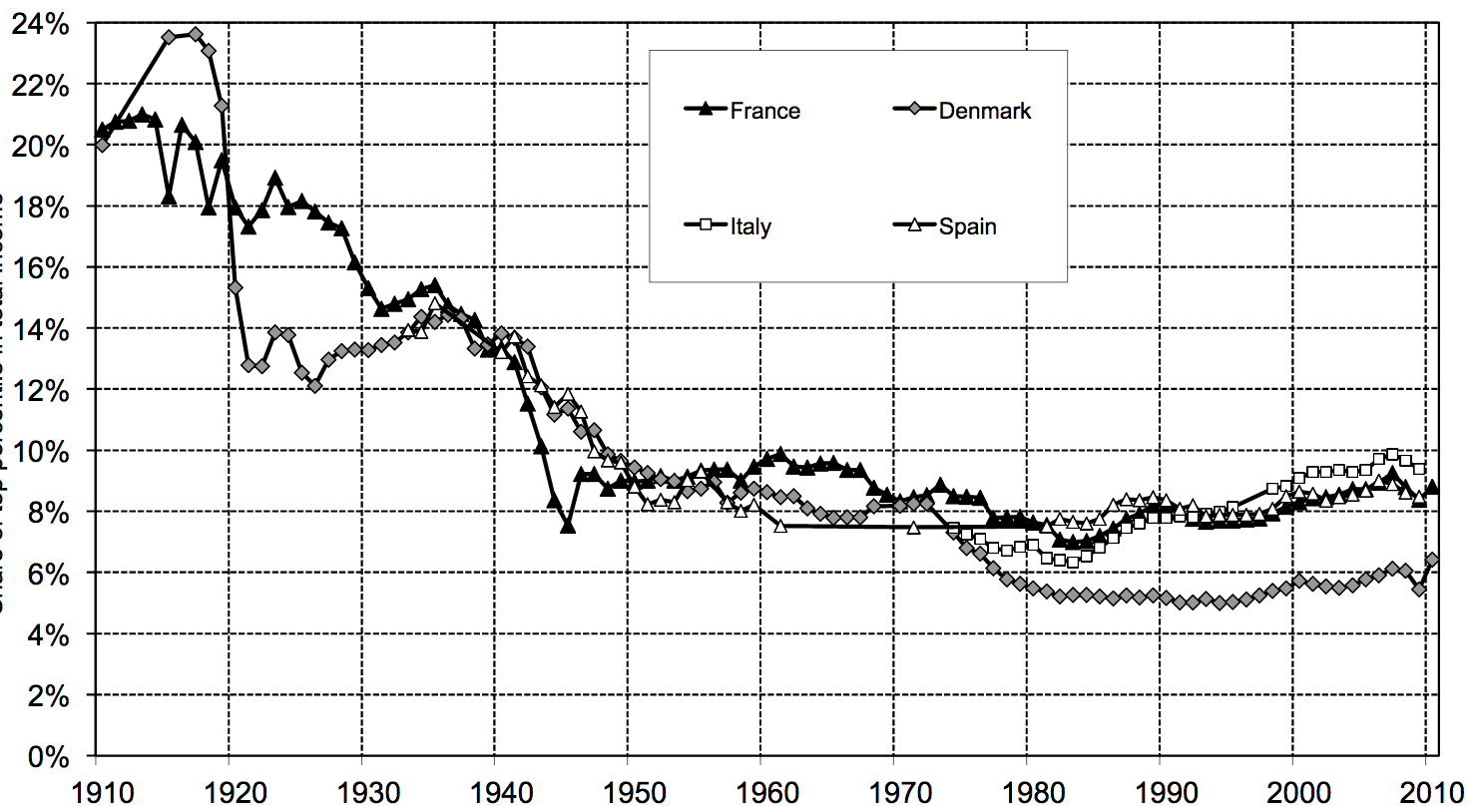

And this appears to be the world-wide trend in the past 35 years

Top 1% income earners' share of GDP

1910-2010

Figure 9.2 of Piketty (2014)

Top 1% income earners' share of GDP

1910-2010

Figure 9.3 of Piketty (2014)

Top 1% income earners' share of GDP

1910-2010

Figure 9.4 of Piketty (2014)

These figures of rising inequality were

published in this academic book

by a French economist

Unusually for an academic book,

it became a worldwide best-seller

(1.5 million copies sold since 2013)

Inequality

is a hot topic worldwide

Median Voter Theorem predicts:

Falling Median Income

(relative to GDP)

More

Redistribution

Publicly funded

healthcare

education

Unemployment benefit

Food stamps

Child benefit

Sick leave

Why does Median Voter Theorem predict this relationship?

Falling Median Income

(relative to GDP)

More

Redistribution

We need to understand

the optimization of how much to consume

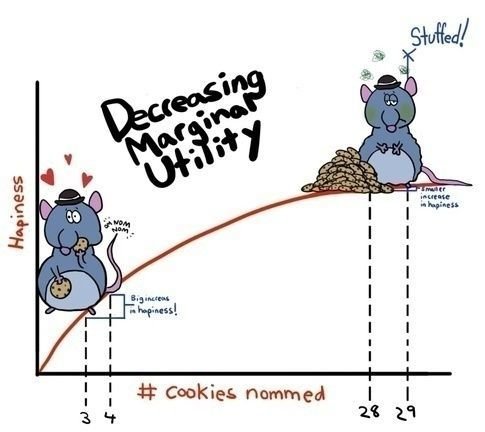

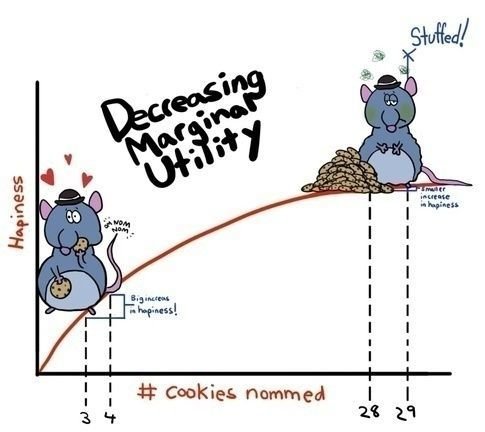

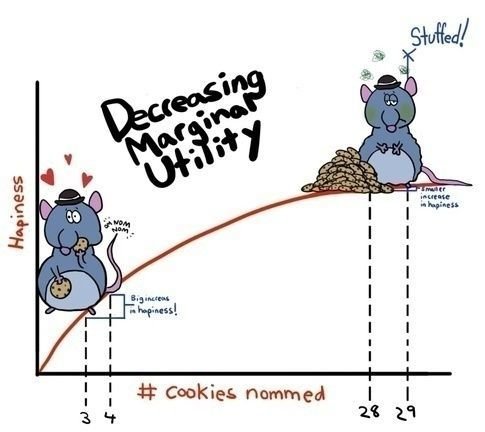

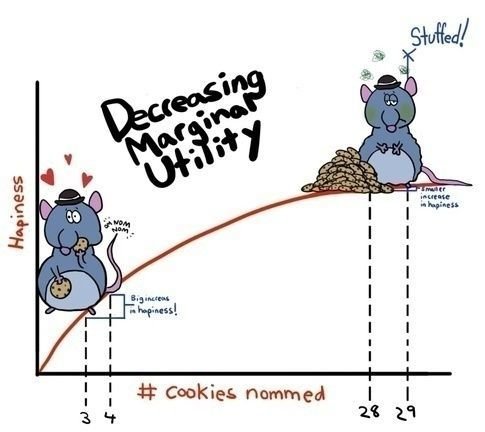

The more you eat,

the happier you become

Optimization of how much to consume

Today's economics lesson #1

But extra happiness

from eating one more

decreases

as you keep eating more

Optimization of how much to consume (cont.)

Today's economics lesson #1

Extra happiness

# of cookies

Known as the Law of Diminishing Marginal Utility

Optimization of how much to consume (cont.)

Today's economics lesson #1

Extra happiness

# of cookies

Now consider the best affordable # of cookies

You need to pay the price to eat more cookies

price per piece

Optimization of how much to consume (cont.)

Today's economics lesson #1

Extra happiness

# of cookies

Now consider the best affordable # of cookies

Eating more cookies still gives

more extra happiness than price

price per piece

Optimization of how much to consume (cont.)

Today's economics lesson #1

Extra happiness

# of cookies

Now consider the best affordable # of cookies

Eating more cookies gives

less extra happiness than price

price per piece

Optimization of how much to consume (cont.)

Today's economics lesson #1

Extra happiness

# of cookies

Now consider the best affordable # of cookies

Total happiness minus paid price is maximized

price per piece

Optimization of how much to consume (cont.)

Today's economics lesson #1

Extra happiness

# of cookies

This is

the best affordable # of cookies

price per piece

Optimization of how much to consume (cont.)

Today's economics lesson #1

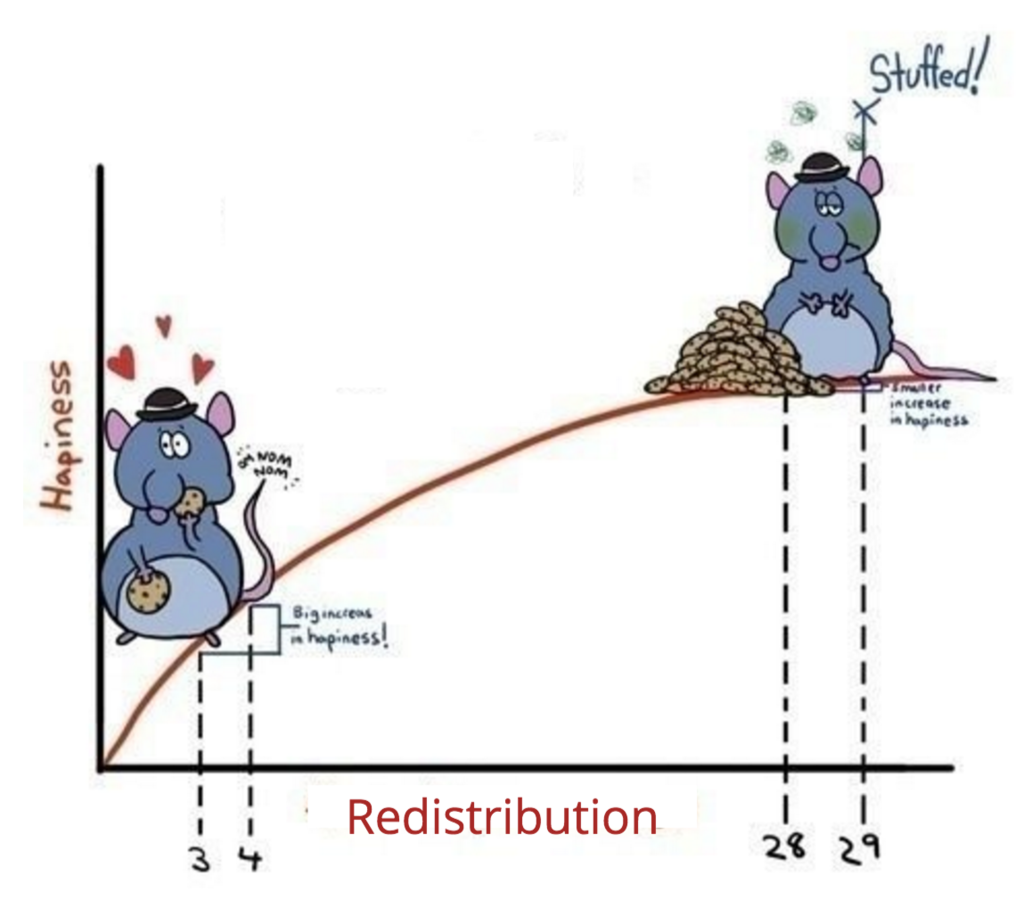

Same should be true

for redistribution

instead of cookies

Redistribution

Voter's optimal level of redistribution

Extra happiness

Redistribution

Voter's optimal level of redistribution (cont.)

Extra happiness

Now consider the best affordable level of redistribution

Price of redistribution

Extra

tax

paid

Voter's optimal level of redistribution (cont.)

=

Redistribution

Since the tax system is VERY complicated in reality,

consider a model of the world where:

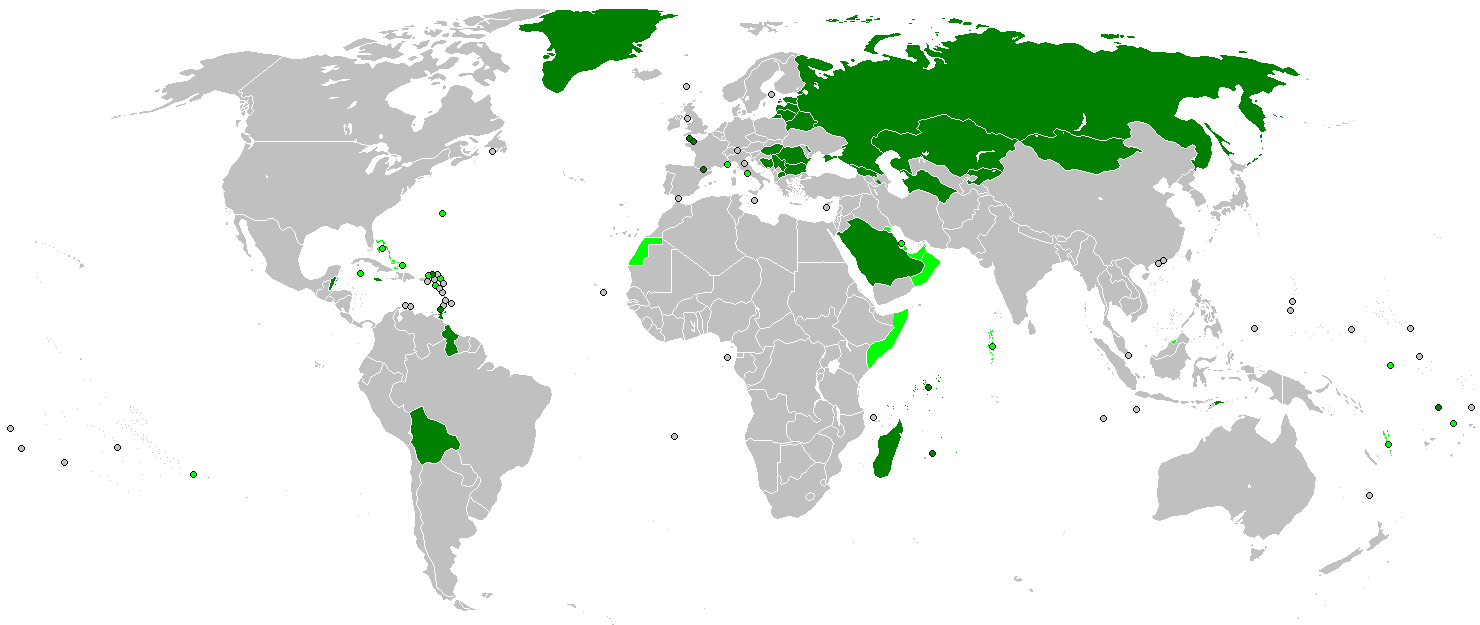

What's the price of redistribution?

Everyone pays the same % of their income as tax

(known as "flat tax")

A flat tax is not completely unrealistic

To redistribute one more unit, the flat tax rate needs to go up

The richer the individual, the more tax they will pay

Richer individual

Poorer individual

Price of redistribution #1

Price of redistribution #1 (cont.)

The richer the individual, the higher the price of redistribution

Richer individual

Poorer individual

Extra happiness = Extra tax paid

Extra tax paid

Optimal level of redistribution

Extra happiness

Voter's optimal level of redistribution

Now remember...

and the lower optimal level of redistribution

Extra tax paid

Extra happiness

Richer

Optimal level of redistribution

The richer the individual, the higher the price of redistribution

Who's the median voter in this world?

the person who earns

the median level of income

Extra tax paid by poorest

Extra happiness

Median voter's ideal level of redistribution

Extra tax paid by richest

Median income earner

The richer the country, the smaller the necessary tax rate hike

Richer country

Poorer country

Additional amount of redistribution

Price of redistribution #2

National income

20% of national income

10% of national income

Richer country

Poorer country

Additional amount of redistribution

National income

20% of national income

10% of national income

The higher the GDP, the lower the price of redistribution

Price of redistribution #2 (cont.)

(i.e. Rising inequality)

If GDP goes up, but only rich people earn more

Extra happiness

Median voter's ideal level of redistribution increases

Median income earner's

pro-rich GDP growth

Summary

Median Voter Theorem predicts:

Pro-rich

Economic

Growth

(thus rising inequality)

More

Income

Redistribution

Median Voter Theorem predicts:

Pro-rich

Economic

Growth

(thus rising inequality)

More

Income

Redistribution

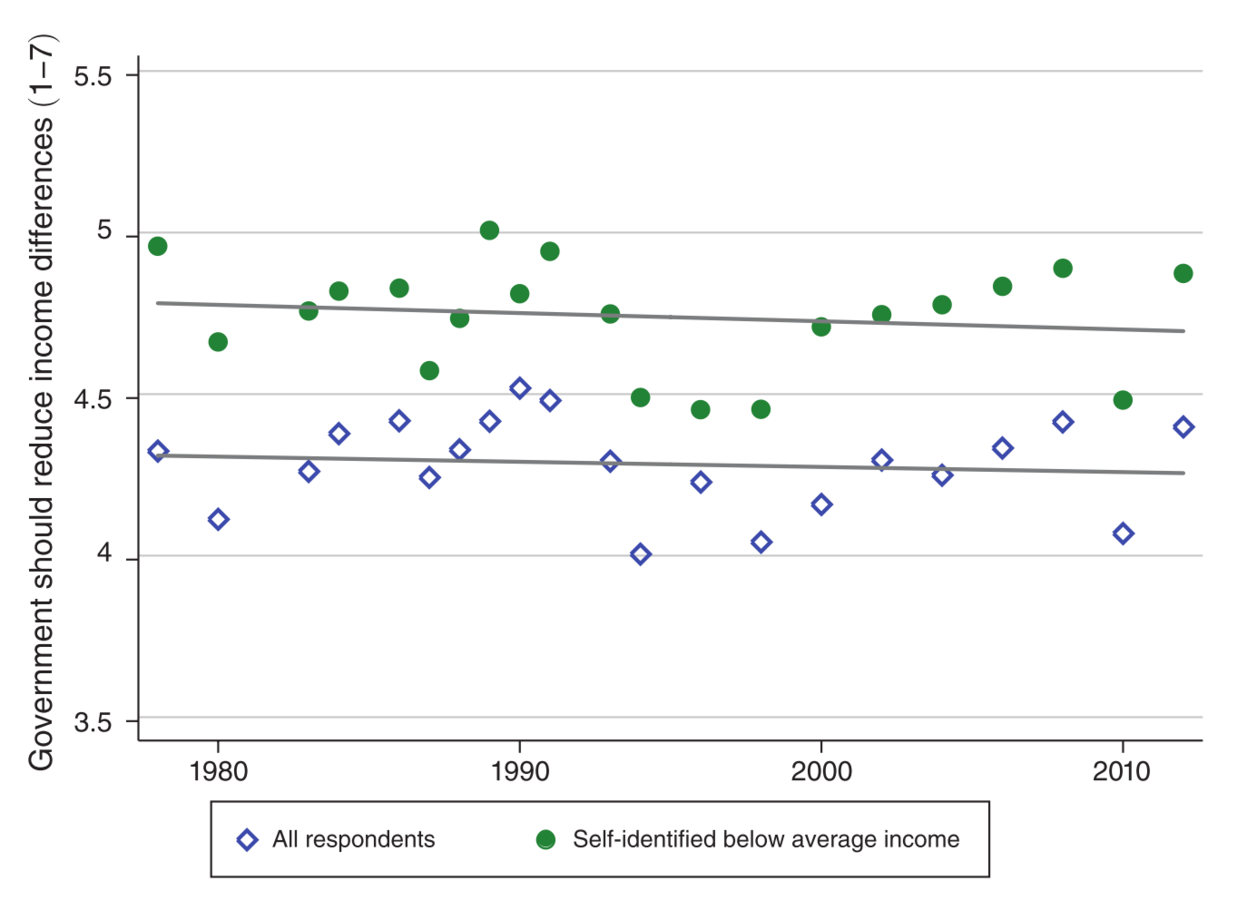

But reality isn't like this at all

In U.S., median income doesn't grow much while GDP grows fast

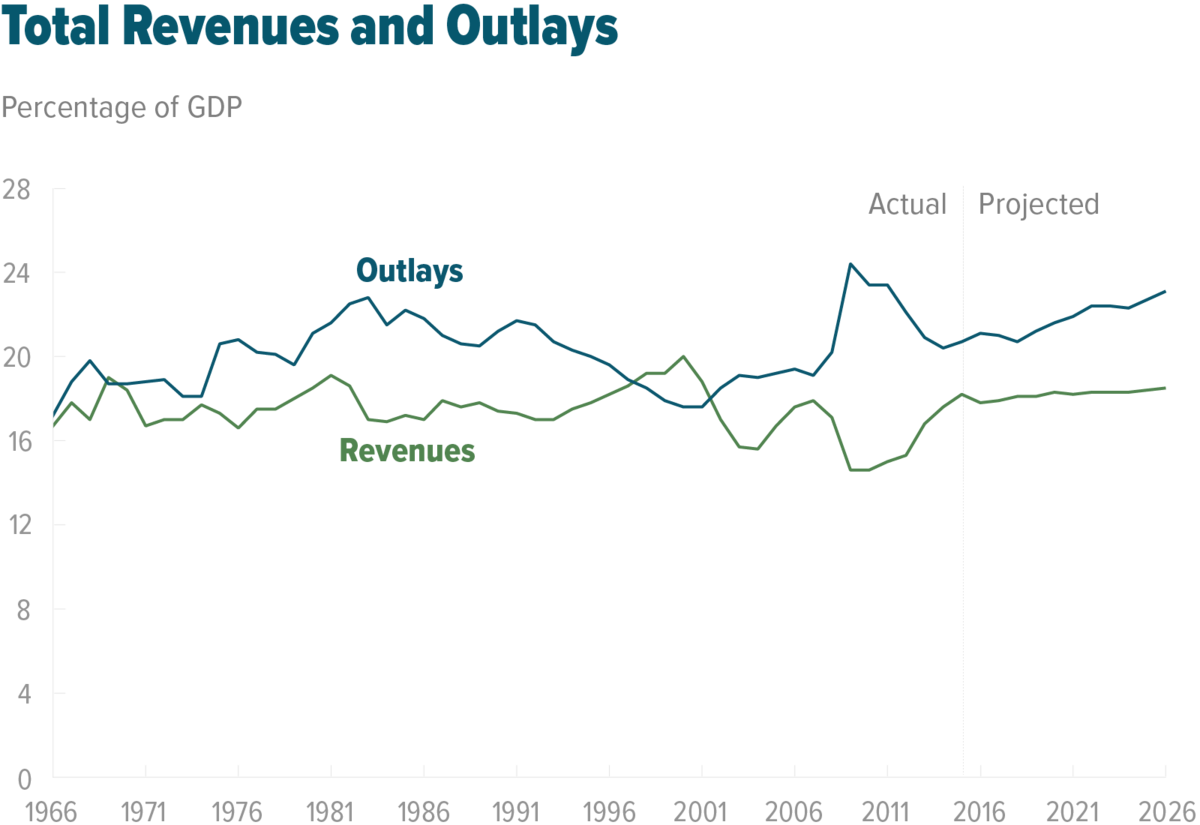

But government size as % of GDP hasn't changed much in US

And demand for redistribution hasn't been on the rise, either

Figure 1 of Kuziemko et al. (2015)

Why?

The Median Voter Theorem may be wrong

But it could also be due to...

Possible reasons

US citizens

just don't know about

the rising inequality

US citizens

don't trust the government

Economists recently examined these possibilities

by running survey experiments on...

Amazon mTurk

Image source: the screen shot of www.mturk.com (17 October 2016)

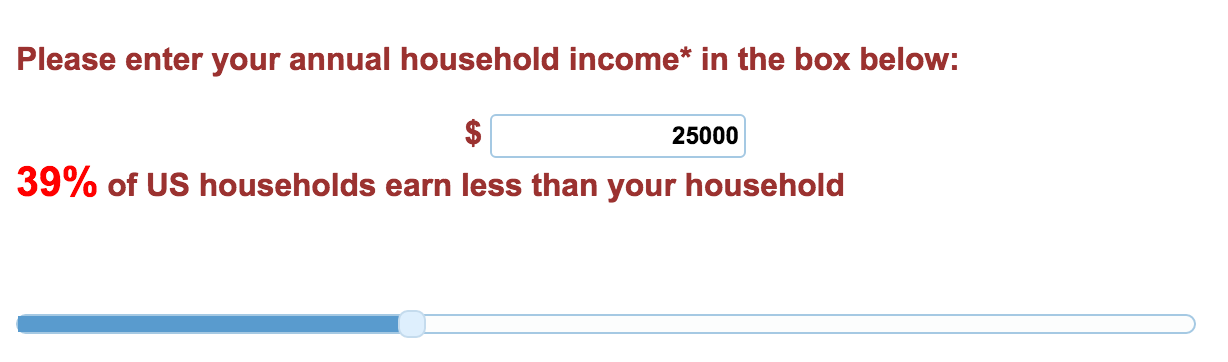

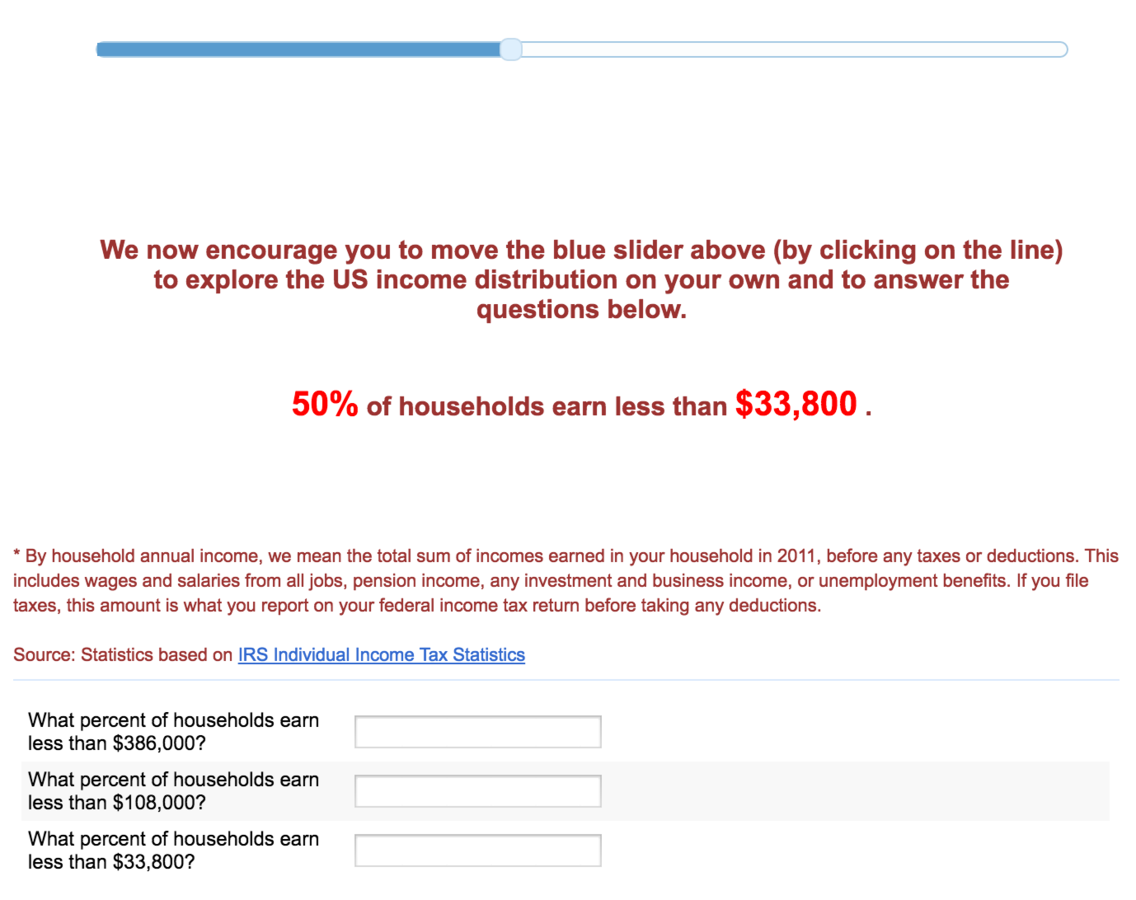

Researchers recruit 3741 subjects from Amazon mTurk

1. All subjects answer questions on their background

2. Randomly chosen half learn about income inequality in US

Experiment proceeds as follows (try yourself)

3. All subjects answer questions on their opinion

about inequality and redistribution policies

Any difference in opinions at Step 3

is thus the impact of learning about inequality at Step 2

To see if information matters...

Screenshot from the experiment

Image source: hbs.qualtrics.com/jfe/form/SV_77fSvTy12ZSBihn

Image source: hbs.qualtrics.com/jfe/form/SV_77fSvTy12ZSBihn

Image source: hbs.qualtrics.com/jfe/form/SV_77fSvTy12ZSBihn

Results

% of subjects chose "Increased"

86%

of treated

74%

of control

Source: Table 4 (column 3) of Kuziemko et al. (2015)

Do you think income inequality in the United States has increased or decreased since 1980?

Source: Appendix Table 4 (column 9) of Kuziemko et al. (2015)

Results

% of subjects chose "Support"

70%

of treated

69%

of control

Do you support or oppose the Food Stamps program?

Possible reasons

US citizens

just don't know about

the rising inequality

US citizens

don't trust the government

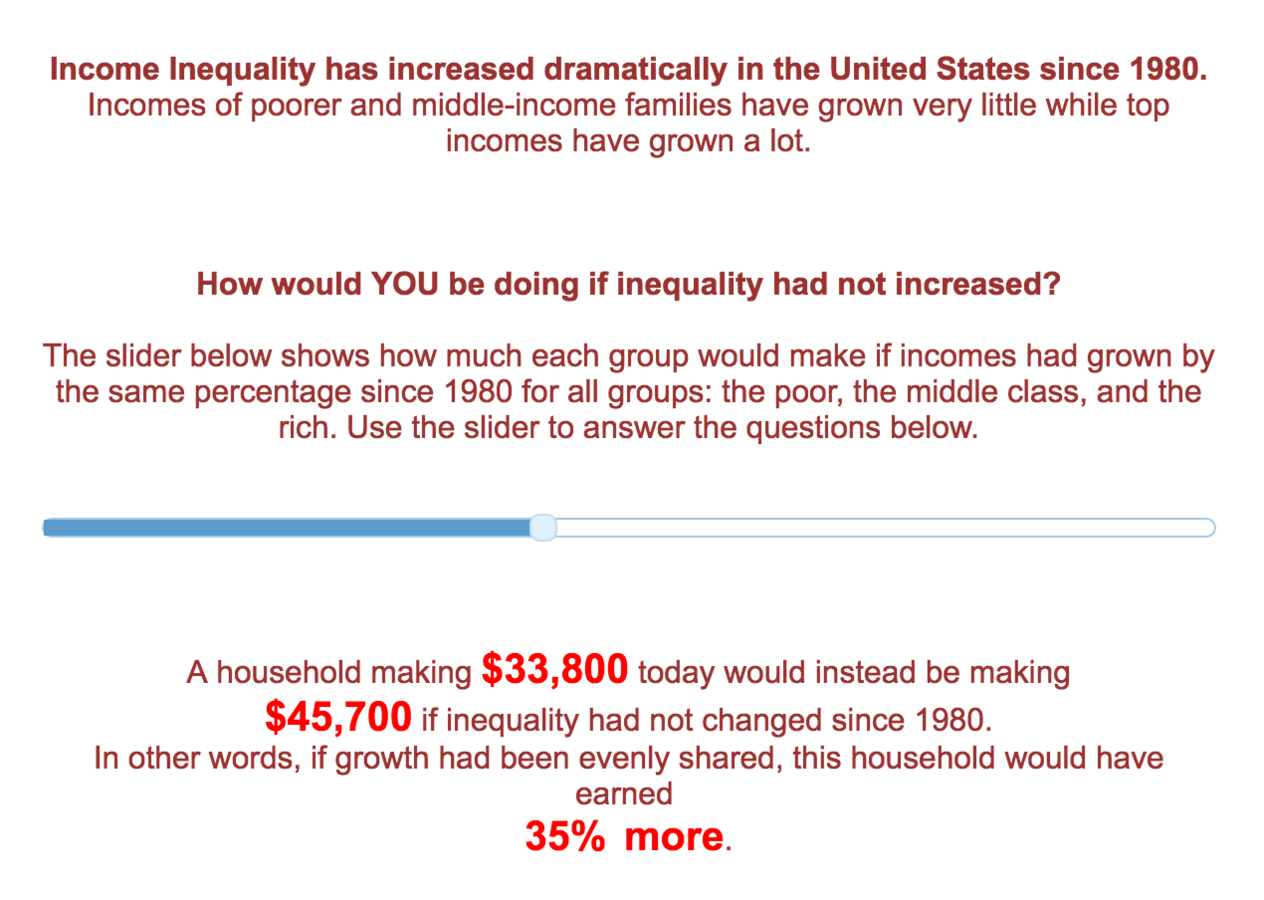

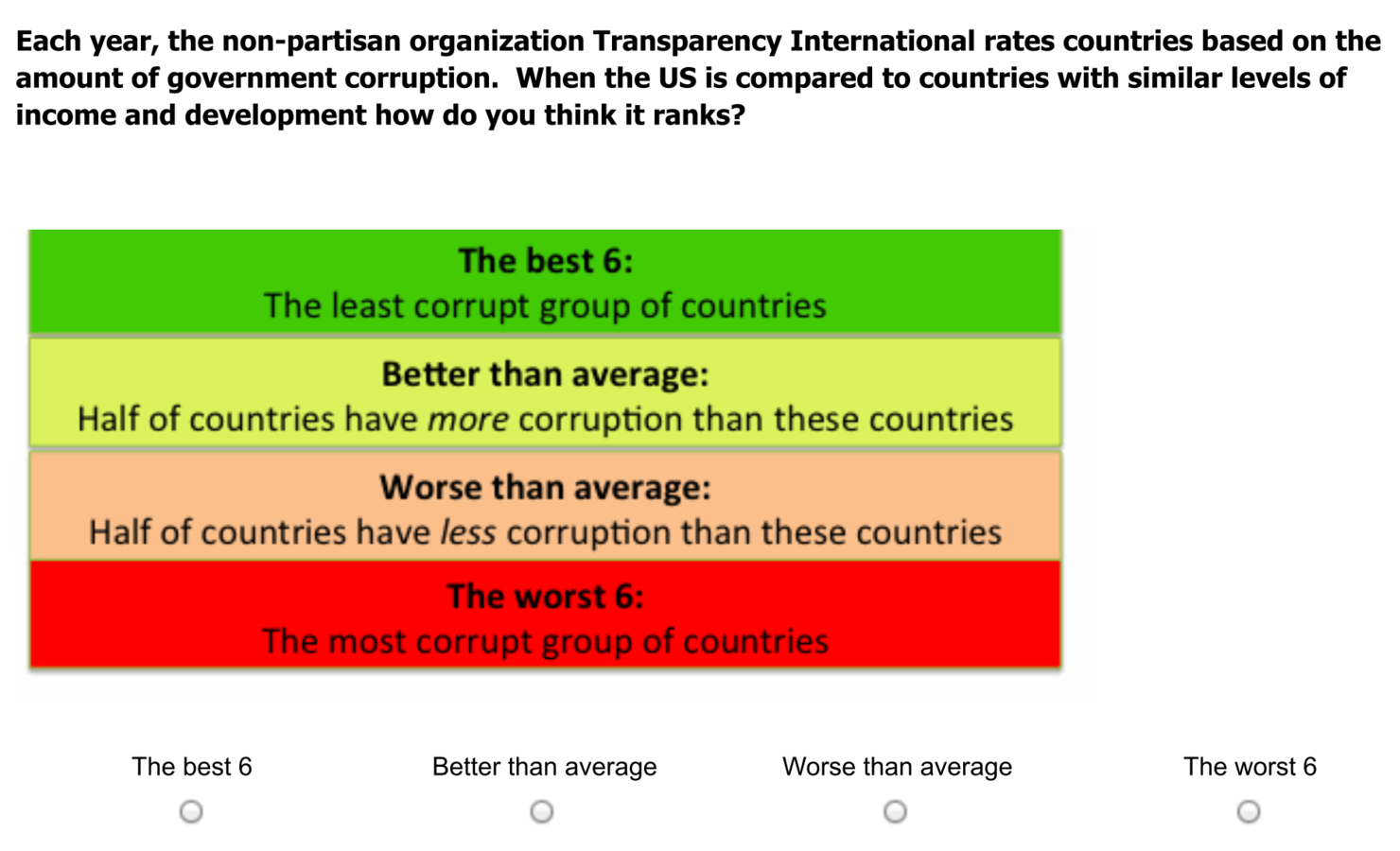

Researchers recruit 1000 subjects from Amazon mTurk

1. All subjects answer questions on their background

2. Randomly chosen half learn about

how corrupt the US government is

2nd Experiment proceeds as follows (try yourself)

3. All subjects answer questions on their opinion

about inequality and redistribution policies

Any difference in opinions at Step 3

is thus the impact of distrust in government raised at Step 2

To see if trust in government matters...

Appendix Figure 8 of Kuziemko et al. (2015)

Screenshot from the experiment

Appendix Figure 8 of Kuziemko et al. (2015)

Source: Table 8 (column 1) of Kuziemko et al. (2015)

Results

% of subjects chose "Always" or "Most of the time"

7%

of treated

13%

of control

How much of the time do you think you can trust government in Washington to do what is right?

Always Most of the time Only some of the time Never

Source: Table 8 (column 1) of Kuziemko et al. (2015)

Results

2.3

of treated

2.5

of control

Average score that subjects give:

Should the federal government increase or decrease its spending on food stamps?

4 (Significantly increase) 3 (Slightly increase)

2 (Keep at current level)

1 (Slightly decrease) 0 (Significantly decrease)

Small difference

but not by chance

Possible reasons

US citizens

just don't know about

the rising inequality

US citizens

don't trust the government

Distrust in government appears to be one reason

for the lack of support for redistribution in US

What we've seen is an example of

Empiricism in economics

A model of the world:

rising inequality

leads to more redistribution

Rejected by data

A revised model of the world:

ignorance about inequality

Run an experiment

to reject the model

3rd model of the world:

distrust in government

Run an experiment to find

some support for the model

Today's Road Map

Inequality and Income Redistribution

Economic Impact of Democracy

Where does economic growth come from?

Democracy

Economic Growth

Who chooses economic policy?

?

Democracy

Economic Growth

?

Who chooses economic policy?

Where does economic growth come from?

Who chooses economic policy?

Workers

Employees

The poor

Capitalists

Firm managers

The rich

Consider a model of the world where:

Two groups of people engage in economic activities

Who chooses economic policy?

Workers

Employees

The poor

Capitalists

Firm managers

The rich

Consider a model of the world where:

control policy-making

in aristocracy

Who chooses economic policy?

Workers

Employees

The poor

Capitalists

Firm managers

The rich

Consider a model of the world where:

In democracy, everyone has one vote

Who chooses economic policy?

Workers

Employees

The poor

Capitalists

Firm owners

The rich

Consider a model of the world where:

In democracy, everyone has one vote

Workers are the majority

A worker is the median voter

Median Voter Theorem predicts:

Workers choose economic policy in democracy

Democracy

Economic Growth

Who chooses economic policy?

?

Where does economic growth come from?

Sources of economic growth

Investment

Innovation

Developing countries

Industries far from frontier

Developed countries

Industries at world frontier

Today's economics lesson #2

Sources of economic growth

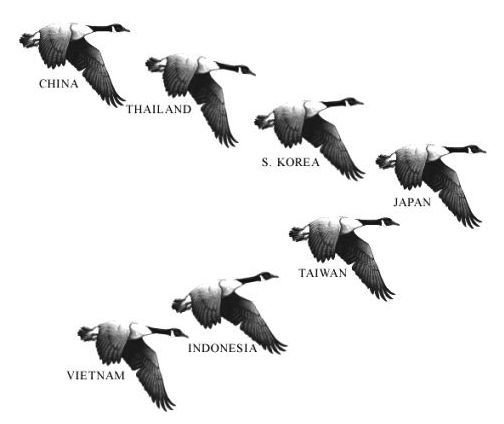

Image source: images.slideplayer.com/16/5128640/slides/slide_35.jpg

e.g. East Asian economic growth until the 1990s

Innovationdriven

Investmentdriven

Innovation or Investment

Democracy

Economic Growth

Workers, not capitalists, choose economic policy

What policies discourage

innovation or investment?

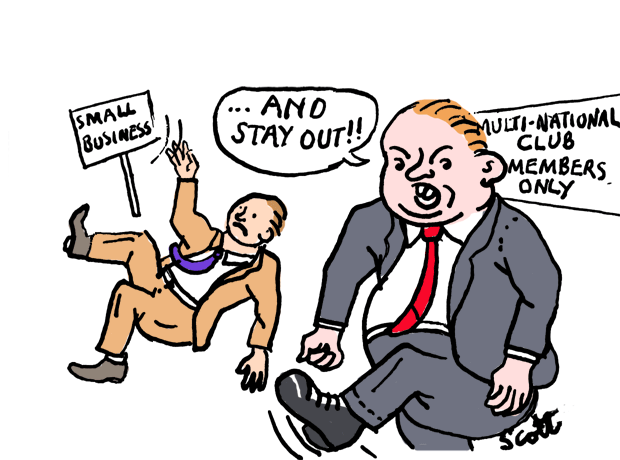

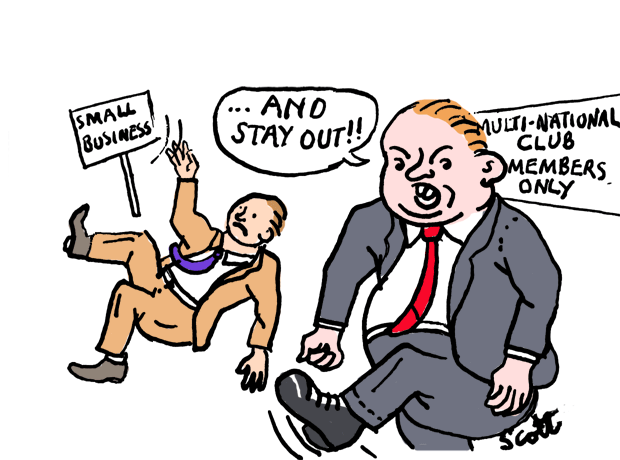

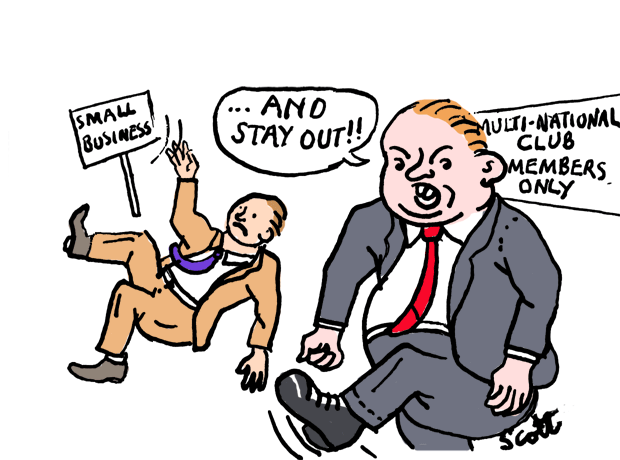

Policy that discourages innovation:

Entry Barrier

Competitors drive prices down

>> Profit shrinks

Incumbent firms want entry barrier

Image source: www.romeconomics.com/barriers-to-entry-explained/

Policy that discourages innovation:

Entry Barrier

Workers don't want entry barrier

Image source: www.romeconomics.com/barriers-to-entry-explained/

More producers

= More labor demand

= Higher wage

Policy that discourages innovation:

Entry Barrier

Entry barrier stifles innovation

Image source: www.romeconomics.com/barriers-to-entry-explained/

Incumbent firms may not be the most innovative producer

Policy that discourages investment:

Redistribution

Workers want higher wages

Redistribution achieves this by taxing profits and paying benefits to workers

But then capitalists are less willing to invest to earn profits

Ideal policies

Redistribution

No entry barrier

Entry barrier

No redistribution

In Aristocracy

Redistribution

No entry barrier

Entry barrier

No redistribution

Less innovation

More investment

Higher growth in developing countries

In Aristocracy

Redistribution

No entry barrier

Entry barrier

No redistribution

Less innovation

More investment

Higher growth in catching-up industries

In Democracy

Redistribution

No entry barrier

Entry barrier

No redistribution

Less investment

More innovation

Higher growth in developed countries

In Democracy

Redistribution

No entry barrier

Entry barrier

No redistribution

Less investment

More innovation

Higher growth in frontier industries

Evidence?

Identifying the impact of democracy is really hard

Democracy may be caused by economic growth

Culture may cause both democracy and economic growth

We cannot randomly assign democracy across countries

Evidence?

A solution: compare industries over time within each country

year

Democratization

Industry

output

Industry far from frontier

Industry close to frontier

Evidence?

year

Democratization

Industry

output

Industry far from frontier

Industry close to frontier

A specific industry's growth is unlikely to cause democracy

Evidence?

year

Democratization

Industry

output

Industry far from frontier

Industry close to frontier

Cultural change (which may cause democratization)

is unlikely to affect industries differentially by distance to frontier

Evidence?

year

Democratization

Industry

output

Industry far from frontier

Industry close to frontier

So if data shows the graph as below,

we can interpret it as the impact of democratization (do you agree?)

Evidence

Collect industry-level annual output data (UNIDO-INDSTAT)

from 180 countries for 1963-2003

>>> Difference from max = Distance to technological frontier

Measure output per worker for each industry in each country

>>> Obtain the maximum for each industry across countries

How to measure the distance to frontier?

Evidence

Industries at the frontier

= Democratization increases growth rate by 12%

Industries half as productive as at the frontier

= Democratization decreases growth rate by 57%

Source: p. 15 of Aghion et al. (2007)

Note: "Democratization" is defined as a 10-point increase in POLITY IV Index

Summary #1

Median Voter Theorem predicts

Falling median income relative to GDP

More income redistribution

Evidence suggests

Distrust in government breaks down this prediction

Summary #2

Median Voter Theorem predicts

Democracy adopts workers' preferred policies

= Income redistribution + No entry barrier

Industry-level evidence confirms this prediction

Democracy causes innovation-driven economic growth, but not investment-driven growth

Next lecture

Citizen-candidate model

To what extent does the Median Voter Theorem still holds

if candidates

have their own ideal policy, and

cannot commit to electoral promise?

Model of Politics #2

This lecture is based on the following academic articles:

Economic Origin of Democratization

Acemoglu and Robinson (2000) (See also their book)

Economic Impacts of Democracy

Income Redistribution

Politics through the Lens of Economics: Lecture 3 Income Redistribution

By Masayuki Kudamatsu

Politics through the Lens of Economics: Lecture 3 Income Redistribution

- 3,402