Protocol fees lead to attacks

Article: Stackelberg Attacks on Protocol Fee Governance

Alex @lajarre | 🧈 Butter

Edge City

🧈

1. 🦄 AMM model

2. 🧛🏼 Attack

🧈

🦄 AMM model

🧈

AMM fork competition

Game:

- 2 competing AMMs

- Swappers allocation:

cost ≃ price impact - LPs allocation:

revenue ≃ volume

🧈

Fee switch

🧈

Dynamic competition

block i-1

block i

block ii+1

Traders allocate

LPs allocate

Traders allocate

LPs allocate

Traders allocate

LPs allocate

...

Traders allocation

Price impact:

🧈

See Angeris et al: "An analysis of Uniswap markets", 2019

Traders allocation

Utility:

🧈

Allocate more towards AMM with larger reserves:

Traders allocation

🧈

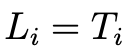

LPs marginal allocation

🧈

If no protocol fee: proportional allocation

If protocol fee :

🧛🏼 Attack

🧈

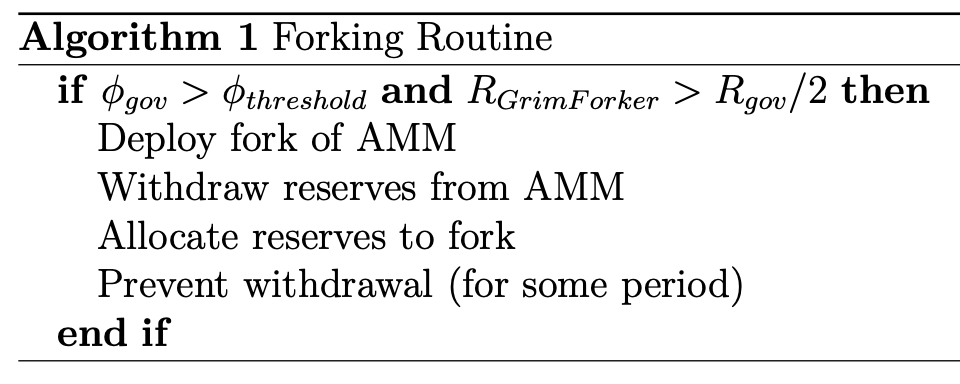

Game:

- Governance: set fee

- LPs: commit to any smart contract strategy

=> includes forking!

Governance vs LPs with arbitrary commitments

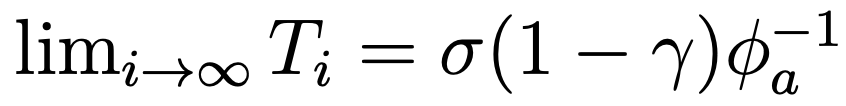

Grim Forker contract

New equilibrium

- "Mere LPs" should participate in Grim Forker (interim rational)

- Induces a threat => upper bound on protocol fee

🧈 forking & smart contracts influence governance

🧈 grim trigger on UNI tokenholders

Internalize externalities

🧈

🧈 XV is the present value extracted by UNI tokenholders out of the protocol

🧈 XV is limited by the attack:

- either ρ > 0 is fixed: volume will be reduced ultimately to 0

- either ρ is modulated to limit liquidity flight

Upper limit on Governance Extractible Value

🧈

👋 🧈

twitter.com/butterymoney

twitter.com/lajarre

🧈

buttery.money

Copy of Cost of Fee Switch

By lajarre

Copy of Cost of Fee Switch

- 24