Partial Equilibrium

and Welfare Analysis

Christopher Makler

Stanford University Department of Economics

Econ 50: Lectures 20 and 21

Fundamental Economic Questions

What, as a society, do we produce?

Who gets what?

How do we decide?

If you were an omniscient

"social planner" in charge of everything, how would you

make these decisions?

How do billions of people

coordinate their economic activities?

What does it mean to

"let the market decide"

what to produce?

Responding to Prices

Weeks 4-5: Consumer Theory

Firms face prices and

choose how much to produce

Consumers face prices and

choose how much to buy

Weeks 6-7: Theory of the Firm

Competitive Equilibrium

Consumers and producers are small relative to the market

(like an individual firefly)

and make one decision: how much to buy or sell at the market price.

Equilibrium occurs when

the market price is such that

the total quantity demanded

equals the total quantity supplied

Equilibrium in General

Definition 1: a situation which economic forces are "balanced"

Definition 2: a situation which is

self-replicating: \(x = f(x)\)

Transition dynamics: excess demand and supply

Stability of Equilibria

All forces can be in balance in different ways.

Assumptions of

Perfect Competition

Perfect information

Homogeneous good

Lots of buyers and sellers

Free entry and exit

This Week's Agenda

Today: Baseline Example

Friday: A More Complex Example

- Review: Market demand and supply

- Finding the equilibrium price

- Gross and net consumer surplus

- Producer surplus

- How markets maximize surplus

- Finding market demand with non-identical consumers

- Finding market supply with non-identical firms

- Welfare analysis using Lagrangians

- How markets aggregate preferences

Note: I was initially going to do partial equilibrium today (simple and complex)

and welfare analysis on Friday (simple and complex).

I've changed to doing the simple cases of both topics today;

we'll go into more depth on Friday for those who are interested.

Individual and Market Demand

Individual demand curve, \(d^i(p)\): quantity demanded by consumer \(i\) at each possible price

Market demand sums across all consumers:

If all of those consumers are identical and demand the same amount \(d(p)\):

There are \(N_C\) consumers, indexed with superscript \(i \in \{1, 2, 3, ..., N_C\}\).

Market demand curve, \(D(p)\): quantity demanded by all consumers at each possible price

Market demand sums across all consumers:

Individual and Market Supply

Firm supply curve, \(s^j(p)\): quantity supplied by firm \(j\) at each possible price

Market supply sums across all firms:

If all of those firms are identical and supply the same amount \(s(p)\):

There are \(N_F\) competitive firms, indexed with superscript \(j \in \{1, 2, 3, ..., N_F\}\).

Market supply curve, \(S(p)\): quantity supplied by all firms at each possible price

Calculating Partial Equilibrium

Price \(p^*\) is an equilibrium price in a market if:

1. Consumer Optimization: each consumer \(i\) is consuming a quantity \(x_i^*(p^*)\) that solves their utility maximization problem.

2. Firm Optimization: each firm \(j\) is producing a quantity \(q_j^*(p^*)\) that solves their profit maximization problem.

3. Market Clearing: the total quantity demanded by all consumers equals the total quantity supplied by all firms.

"Marginal benefit in dollars per unit of good 1"

\(N_C\) identical consumers, each of whom

has the Cobb-Douglas utility function

\(N_F\) identical firms produce good 1, each of which

has the Cobb-Douglas production function

Week 4: Demand for Good 1

Week 7: Supply of Good 1

and income \(m\)

and capital fixed in the short run at \(\overline K\)

1. Solve for the equilibrium price and quantity if \(\alpha = \frac{1}{4}, m = 100, N_C = 64, w = 4, \overline K = 2, N_F = 16\)

2. Solve for general formula for the equilibrium price and quantity.

Demand

Supply

pollev.com/chrismakler

Suppose that instead of 16 firms, we had only 9 firms.

Then, we would expect the equilibrium price to _____ and the equilibrium quantity to _____.

(Hint: think about what happens to the market demand and supply curves.)

Important Note: Three Kinds of “=" Signs

1. Mathematical Identity: holds by definition

2. Optimization condition: holds when an agent is optimizing

3. Equilibrium condition: holds when a system is in equilibrium

Is this the “right" price?

If you were an omniscient social planner, could you do "better"

than the price the market "chooses"?

Welfare Analysis:

Consumer and Producer Surplus

The Social Planner's Problem

Suppose you were in charge of the economy.

How would you answer the fundamental economic questions about a particular good?

How to produce it?

Want to produce any given quantity Q

at the lowest possible cost

Who gets to consume it?

How much to produce?

Want to distribute any given quantity Q

to the people who value it the most

Want to choose the quantity Q*

to maximize total surplus

(benefit to consumers minus costs of production)

Example: One Consumer, One Firm

FIRM

CONSUMER

Quasilinear utility function:

Good 2 is "dollars spent on other goods"

Total benefit (in dollars)

from \(x_1\) units of good 1:

Total cost function:

Note: variable costs only

GROSS CONSUMER'S SURPLUS

(total benefit, in dollars)

Marginal benefit,

in dollars per unit:

(also MRS, marginal willingness to pay)

TOTAL VARIABLE COST

(dollars)

Marginal cost,

in dollars per unit:

What is the optimal quantity \(Q^*\) to produce and consume?

FIRM

CONSUMER

Total benefit:

Total cost:

Total welfare:

Marginal welfare from producing another unit:

TOTAL WELFARE

(dollars)

Marginal welfare,

in dollars per unit:

Total benefit to consumers minus total cost to firms

Marginal benefit to consumers minus marginal cost to firms

How do competitive markets

solve this problem?

FIRM

CONSUMER

Maximize net consumer surplus

Maximize profits

FIRM

CONSUMER

Net benefit from buying \(Q\) units at price \(P\):

Net benefit from selling \(Q\) units at price \(P\):

Total welfare:

Marginal welfare from producing another unit:

profit-maximizing

firms set P = MC

utility-maximizing consumers set P = MB

as long as consumers and firms face the same price, markets set MB = MC and maximize total welfare!

"Individual ambition serves the common good." - Adam Smith

If there is a single price in the market that all consumers pay, and all producers receive, and all consumers and producers are “price takers,” then:

Every consumer sets MB = p:

- Everyone’s MB from the last unit bought is the same.

- Cannot increase total benefit by reallocating the good from one consumer to another

Every firm set MC = p:

-

Every firm’s MC from the last unit produced is the same.

-

Cannot reduce total costs by reallocating production from one firm to another

The MB of the last unit consumed by some person

equals the MC of the last unit produced by some firm

Endogenizing the Price

Previously: agents took the price

"as given" (exogenous) - it was determined outside the model

Today: we endogenized

the market price by analyzing the model where it's determined

What happens if not everyone is identical?

Two consumers:

Consumer Optimization: Each consumer sets MRS = price ratio

Market Demand: Sum up individual demands for all people:

This leads to the individual demand functions:

pollev.com/chrismakler

Two firms: Subway's has \(\overline K = 2\), Togo's has \(\overline K =1\), both pay wage rate \(w = 4\).

Firm Optimization: Each firm sets P = MC

Market Supply: Sum up individual supply for all firms:

Solving for \(q_S\) and \(q_T\) gives us the firms' individual supply functions:

Let's bring our consumers and firms together!

1. Consumer Optimization: each consumer \(i\) is consuming a quantity \(x_i^*(p^*)\) that solves their utility maximization problem.

2. Firm Optimization: each firm \(j\) is producing a quantity \(q_j^*(p^*)\) that solves their profit maximization problem.

3. Market Clearing: the total quantity demanded by all consumers equals the total quantity supplied by all firms.

Note: if we go back to the individual demand

and supply functions, we get:

Welfare Analysis

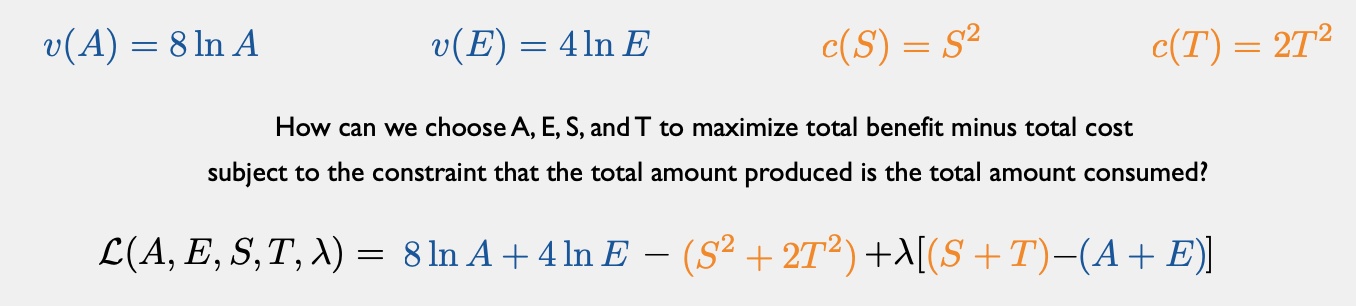

FIRMS: SUBWAY AND TOGO'S

CONSUMERS: ADAM AND EVE

A = number of sandwiches for Adam

S = number of sandwiches produced by Subway

E = number of sandwiches for Eve

T = number of sandwiches produced by Togo's

How can we choose A, E, S, and T to maximize total benefit minus total cost

subject to the constraint that the total amount produced is the total amount consumed?

How Demand

Aggregates Preferences

NOTATION AHEAD

STAY FOCUSED ON

ACTUAL ECONOMICS

Special Case: Cobb-Douglas

Suppose each consumer has the utility function

where the \(\alpha\)'s all sum to 1.

We've shown before that if consumer \(i\)'s income is \(m\), their demand for good \(k\) is

quantity demanded of good \(k\) by consumer \(i\)

consumer \(i\)'s preference weighting of good \(k\)

consumer \(i\)'s income

price of good \(k\)

There are 200 people, and they each have \(\alpha = \frac{1}{2}, m = 30\)

Suppose there are only two goods, and each consumer has the utility function

So consumer \(i\) will spend fraction \(\alpha_i\) of their income \(m_i\) on good 1:

Market demand:

number of consumers

quantity demanded by each consumer

Note: total income is \(200 \times 30 = 6000\), so this means the demand is the same "as if" there were one "representative agent" with \(\alpha = \frac{1}{2}, m = 6000\)

Individual demand:

Now suppose there are two types of consumers:

Again there are only two goods, and each consumer has the utility function

100 low-income consumers who don't like this good: \(\alpha_L = \frac{1}{4}, m_L = 20\)

100 high-income consumers who do like this good:\(\alpha_H = \frac{3}{4}, m_H = 40\)

(demand from

low-income)

(demand from

high-income)

Market demand:

Individual demand:

Note: total income is \(100 \times 20 + 100 \times 40 = 6000\), so this means the demand is the same "as if" there were one "representative agent" with \(\alpha = \frac{7}{12}, m = 6000\)

Conundrum

In both cases, average income was 30 and average preference parameter \(\alpha\) was \(\frac{1}{2}\).

When everyone was identical, it was "as if"

there was a representative agent with all the money

with preference parameter \(\alpha = \frac{1}{2}\).

When rich people had a higher \(\alpha\), it was "as if"

there was a representative agent with all the money

with preference parameter \(\alpha = \frac{7}{12} > \frac{1}{2}\).

Feel free to tune out the intermediate steps, but hang on to the econ...

How market demand aggregates preferences

If consumer \(i\)'s demand for good \(k\) is

then the market demand for good \(k\) is

where \(M = \sum m_i\) is the total income of all consumers

and \(\alpha_k\) is an "aggregate preference" parameter.

Conclusion: we can model demand from \(N_C\) consumers with Cobb-Douglas preferences

"as if" they were a single consumer with "average" Cobb-Douglas preferences.

so what is \(\alpha_K\)?

If everyone has the same income (\(m_i = \overline m\) for all \(i\)), then demand simply aggregates preferences:

Let \( \overline m = M/N_C\) be the average income. Then we can rewrite market demand as:

\(\alpha_K\)

But if there is income inequality, \(\alpha_k\) gives more weight to the prefs of those with higher income.

\(=1\)

Example: consider an economy in which rich consumers like a good more:

100 low-income people with \(\alpha_L = \frac{1}{4}, m_L = 20\),

100 high-income people with \(\alpha_H = \frac{3}{4}, m_H = 40\)

Average income is \(\overline m = 30\), total income is \(M = 6000\)

So, market demand is

closer to \(\alpha_H\) than \(\alpha_L\)

Example, revisited

Source: zillow.com, 5/26/23

Conclusion: Aggregating Preferences

You can model market demand as reflecting the preferences of a single representative agent.

But...know that you're weighting the preferences of richer people more.

Econ 50 | Spring 2023 | Lectures 20 and 21

By Chris Makler

Econ 50 | Spring 2023 | Lectures 20 and 21

Bringing supply and demand together

- 373