DataSpace

from

Drake Howell Ltd

What to

expect

Slide #

3

4

5

6

7-10

11

12

13

14

Who are we?

The problem

The solution and from it new ideas

The story

Demo videos

Development path

The investment opportunity

More information links

Covid 19 - the effects

2

Who we are

- A team of 5 led by Richard Edwards, a trader, economist and mathematician, trained at 3 major banks and IBM

- The team core has worked together for 30 years with over 100 years collective experience in markets

- The team has designed complete exchanges, financial instruments, and forecasting methods

- All have 'STEM' backgrounds and front line experience in financial and commodity markets

3

The Problem

-

Everyone in financial markets shares a common desire – to see them clearly through the fog of events

- This can be the whole landscape or,

- Pieces of it, in greater detail

- The data is multi-dimensional so it is a difficult task and current tools are not up to the job

- Much time and effort is wasted trying to gain insights from sifting through raw data or a series of 2D displays

4

The Solution

- 3D & 4D Market visualizations are the answer

- 30 years of R&D have led to three unique viewers

- These allow analysts and traders to see many different variables ‘live’ at the same time

- Which makes the whole market visible ‘at a glance’ and much easier to compare and trade

- Many more products and services stem from this, such as a new commodity market

5

Drake Howell will launch these, one at a time

The story

Problem:

Too much to see

Solved by:

New 3D displays

Which combine to make:

A 3D virtual market

6

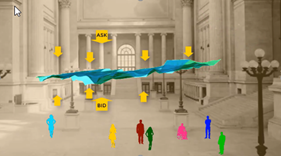

This video plays for 10 seconds

This ribbon is made of six delivery months of Crude Oil futures, updated 'live' together

All move up-and-down, roughly in sync but differences between them build up over time

These differences can easily be seen in animated 3D through the Glass Wall as the ribbon twists.

This is a strong predictor of imminent change in the market and is vital for traders

7

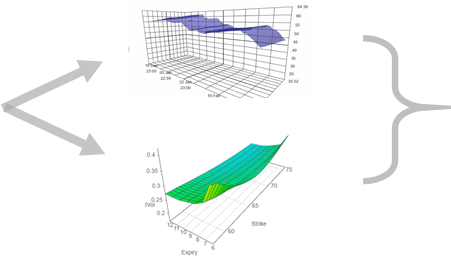

This video plays for 19 seconds

This surface is made from crude oil call options for different strikes & expiries, also updated 'live'

They move as a group, up and down mostly together but there are ripples and rhythms.

These patterns are important to traders and can only be seen in 3D, when animated to make 4D

8

As a result…

- 3D & 4D Market displays create many more possibilities

- Seeing markets better makes comparison easy

- Adding a variety of data sources means side-by-side derivatives valuation possible

- Price comparisons leads directly to trading, if a marketplace is available

- This new comparison portal will provide that and should attract a large share of trade in commodity derivatives

9

This video plays for 36 seconds

The Mercantile Exchange meets Zoom

This is a virtual space

Where traders gather

View basic blocks to build custom derivatives

Make offers & bids for these complex products

Which will bring tighter prices

And a great increase in trading

10

Covid brings fear of close contact, so we will accelerate the launch of this portal to provide 'distanced' trading sooner

Development

- The 'Glass Wall' 3D & 4D viewer is ready to launch soon

- The option viewer will launch a few months later

- The comparison portal can launch after 12-18 months

11

All these products will allow trading. It is the main purpose of the comparison portal and the viewers will add it after a few months.

Revenues from trading fees will be higher than from subscriptions

Revenues will come at each stage - see document links in slide 13

Further planned products are:

AI training ecosystem for hedge fund trading algorithms and 3D & 4D data visualisation for other activities such as medicine and logistics

The Opportunity

Invest £1.5m equity

for working capital

(equivalent to $1.85m)

The 'pre-money'

valuation is £4m,

so £1.5m = 27.3%

Multiple revenue streams from large available markets

Aim for >$1bn valuation

after 4 years with

potential for >$10bn

12

Links for a closer look

1. A plan to make and grow the business

2. Potential market and revenue analysis

3. Cost and revenue forecast spreadsheet

For video passwords & more info contact:

13

Covid consequences

1. We cannot see any negative effects to our plans from the pandemic

2. Costs have fallen as work for developers has declined - cheaper for us now

3. The need for a virtual market place for commodity derivatives has increased

4. We will accelerate portal development and so create the marketplace sooner

14

DataSpace

from

Drake Howell Ltd

www.drakehowell.com

Main DataSpace Slideshow

By Richard Edwards

Main DataSpace Slideshow

- 209