Hands-on: Measuring the intangible

By Thomas Ploch

Hands-on: Measuring the intangible

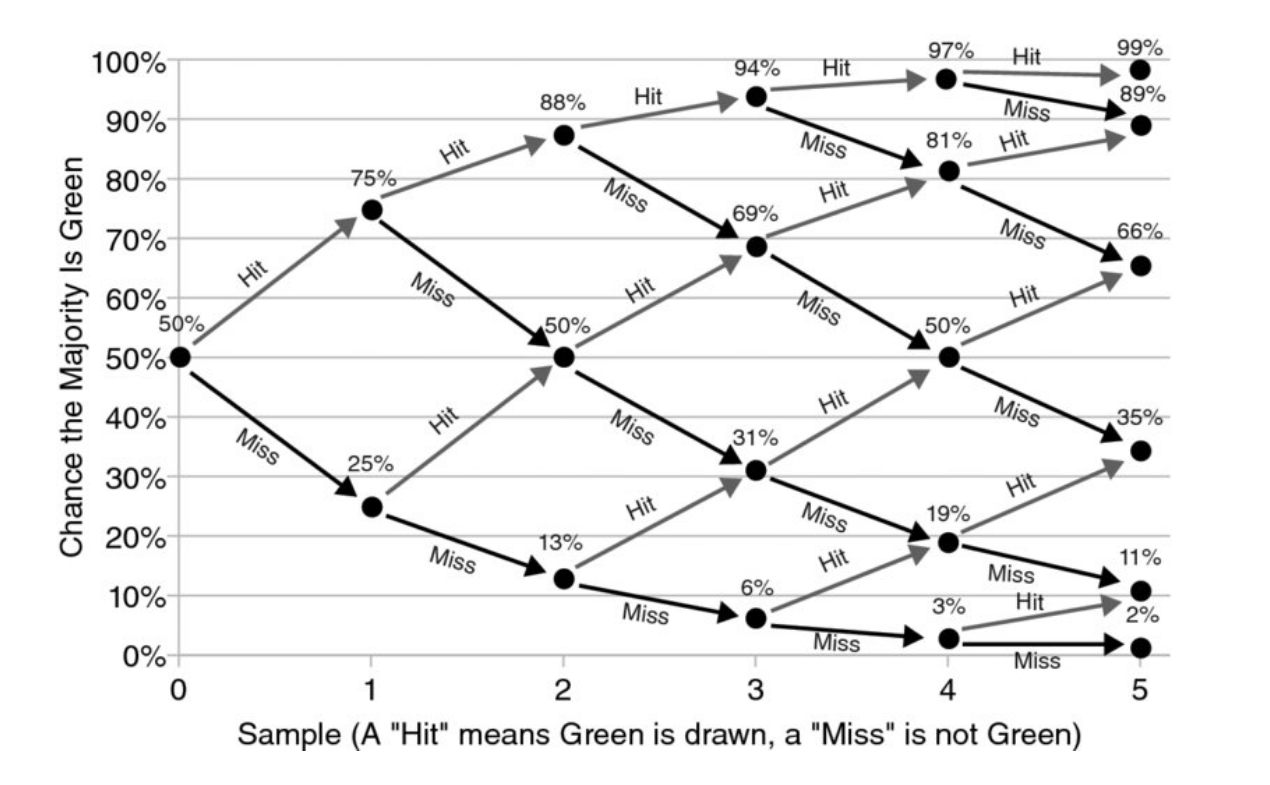

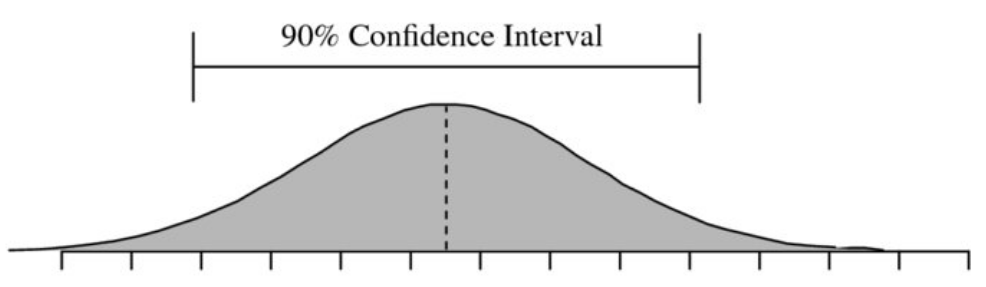

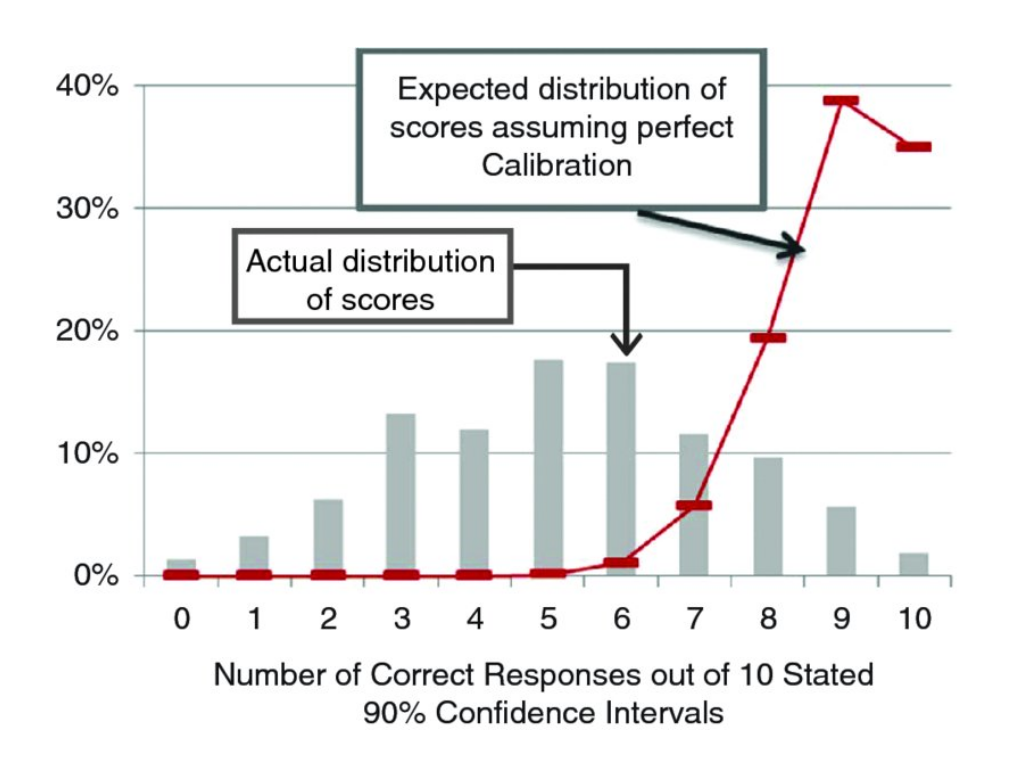

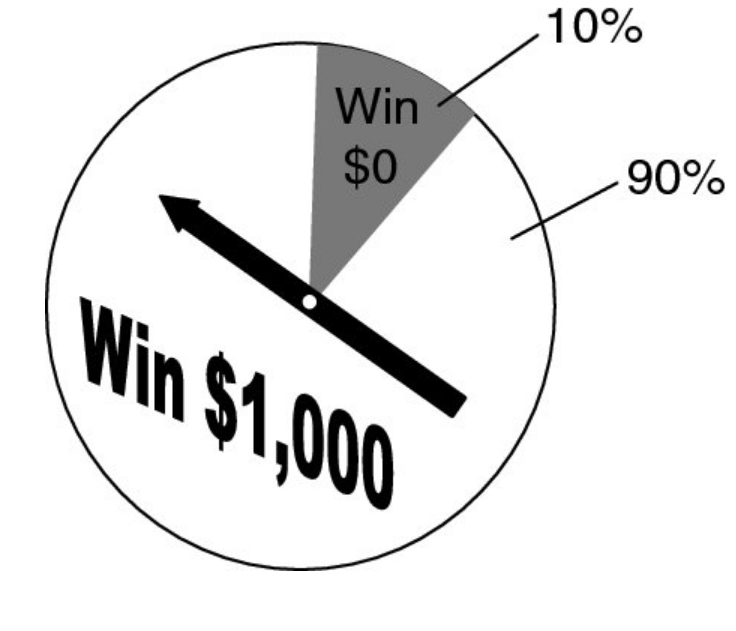

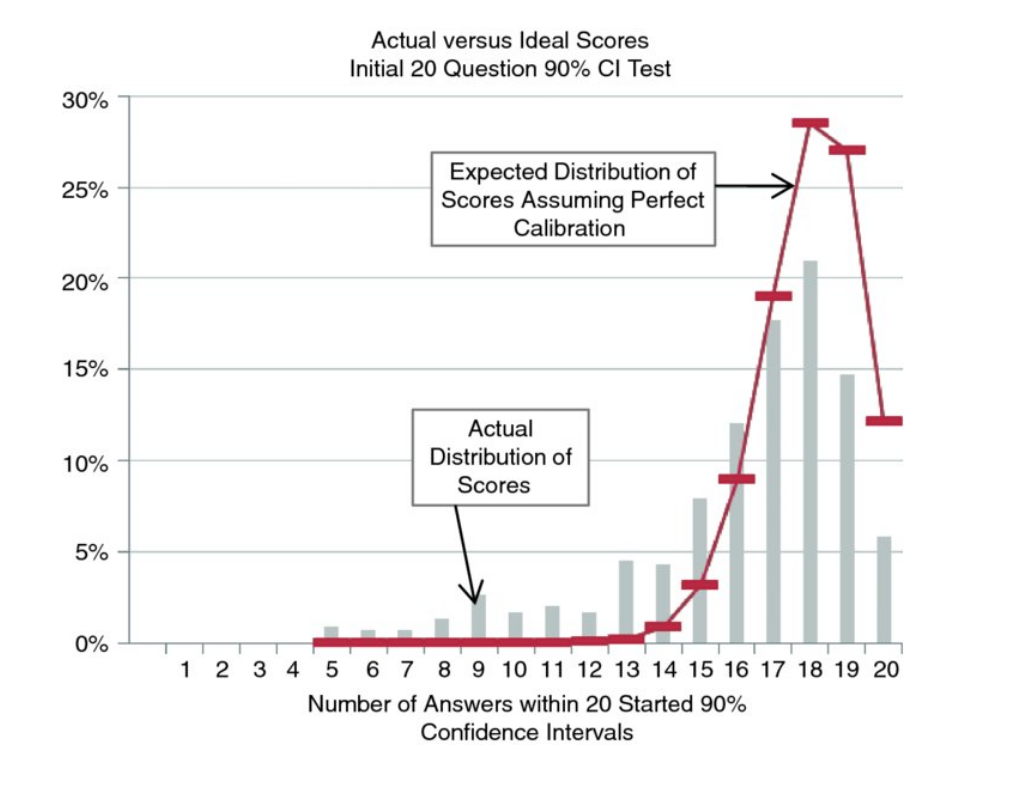

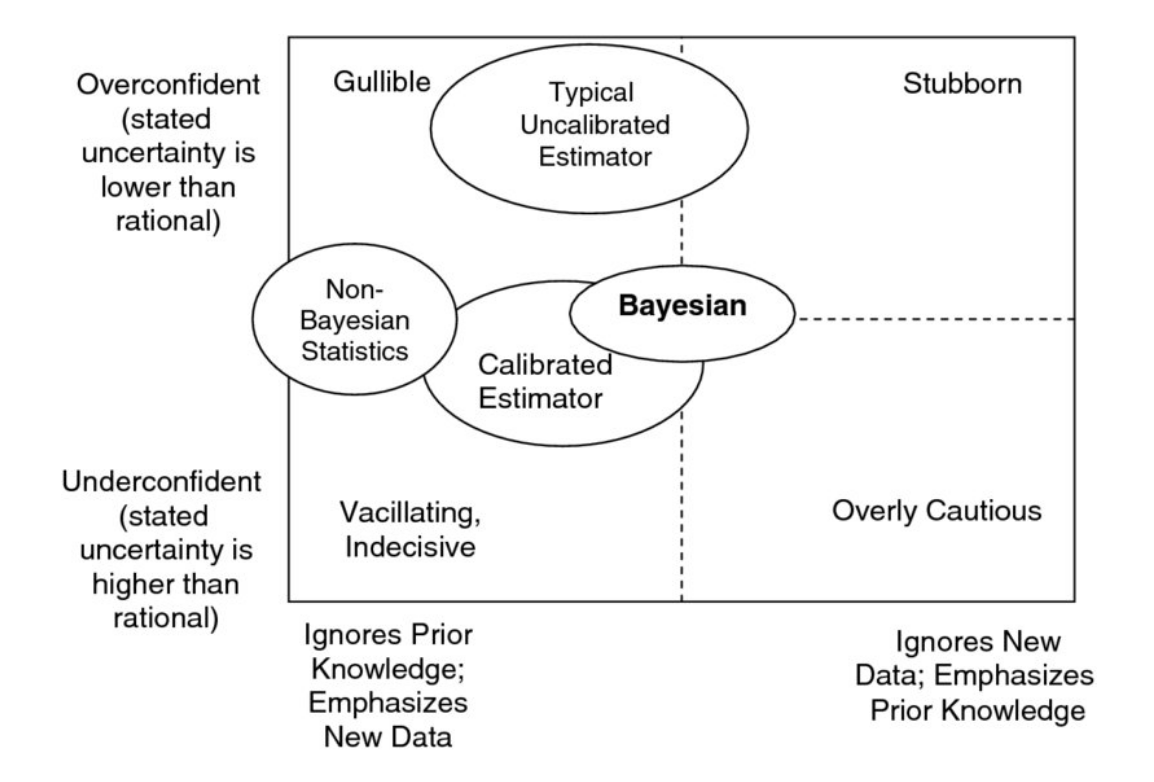

A repeating pattern I have discovered during discussions with participants of DDDEU over the last years was always that people are not able to calculate risk and potential value for intangible assets like "organisational flexibility" in the presence of uncertainty for adopting the modern organisational patterns and principles that the DDD community embraces. Senior managers in larger organisations are seldomly convinced to board such an endeavour just by opinions and subjective assessments. During these conversations I regularly ask if people have thought about creating a business case that would enable senior management to make a risk vs. value potential decision. And most of the time people do not know how to create such a case, because these "intangibles" seem impossible to measure. But they are! It is possible by employing statistical methods to derive probabilities for ranges of possible outcomes that are built from various sources of information, i.e. calibrated expert knowledge. Said information can be annotated with an "expected value" when discovered, and other quantitative and qualitative data that doesn't seem obvious in the beginning. This workshop would teach the basics of bayesian probabilities, how to calibrate people to better estimate ranges of possible outcomes (50% confidence, 70% confidence, 90% confidence), how to weigh results by the expected value of