Applied Microeconomics

Lecture 8

BE 300

Plan for Today

Market dynamics in a competitive market

Market Simulation

Competitive Markets

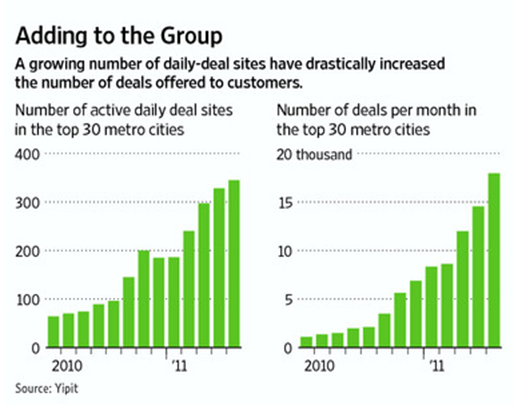

Psyched to Buy, in Groups (New York Times, 9 Feb. 2011)

“Each day, Groupon offers for sale a deep-discount coupon from a business in your town. It might be a $25 coupon that buys you a $50 bike tune-up, or a $40 coupon for a $90 massage…. The coupons aren’t actually distributed until a critical mass of people (50, for example) have clicked “Buy.” After all, shopkeepers can’t afford discounts that steep unless there’s something in it for them.

If not enough people express interest, the deal dies. No coupons are issued, and nobody’s out a cent

Competitive Markets

NYT 2011 (cont.):

…this Internet trend is on fire. Groupon imitators are everywhere… LivingSocial, Groupon’s closest competitor, is in 175 cities …Then there’s BuyWithMe… BloomSpot…CrowdSavings…”

Competitive Markets

What aspects of the market for "Groupon"-type websites make it competitive (in the economic sense)?

In the long run, what are some factors that will determine GroupOn's profitability?

Competitive Markets

Entry is key!

What are some markets that might otherwise be competitive, but do not allow entry?

Competitive Market

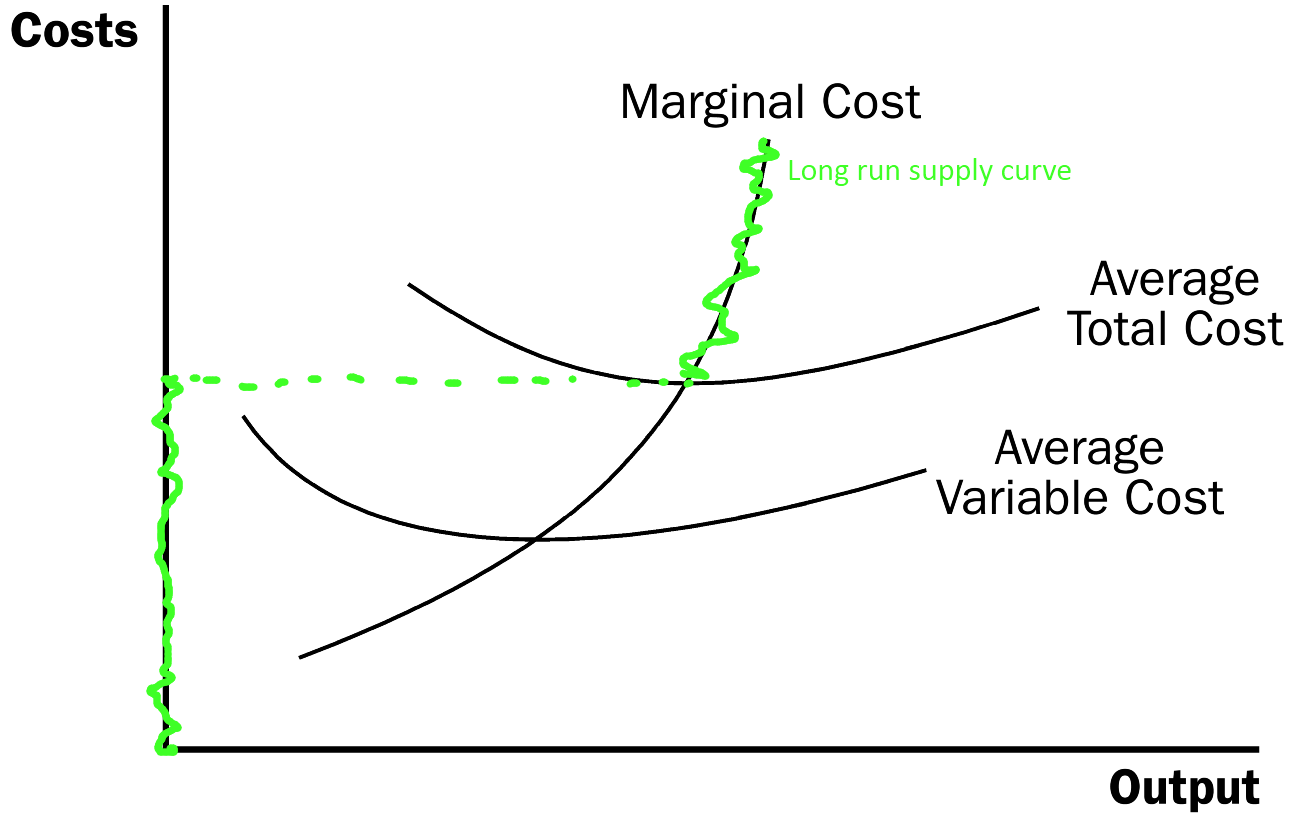

What will happen in the long run if a firm in a competitive market is earning a loss? How is this different from the short run?

If price stays below average total cost, eventually the firm will be able to sell its factories/machines and close down.

Competitive Markets

Competitive Market

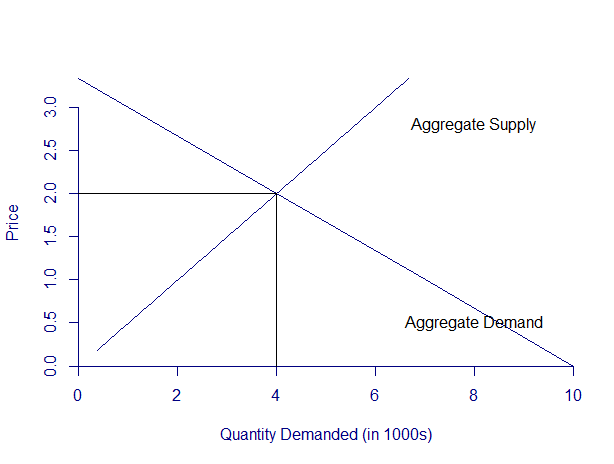

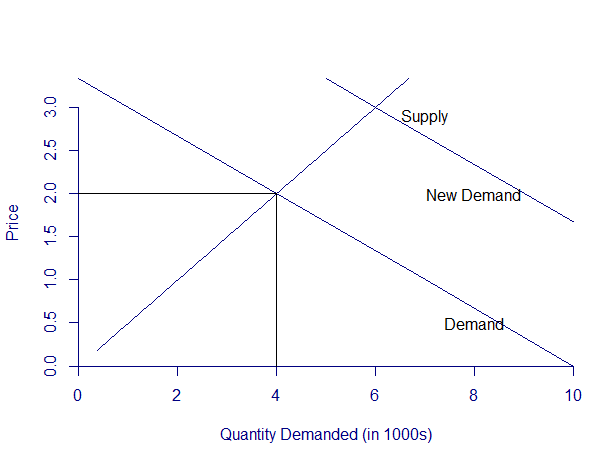

What will happen in the long run if $2 < min ATC?

Competitive Market

When will firm's stop exiting?

Competitive Market

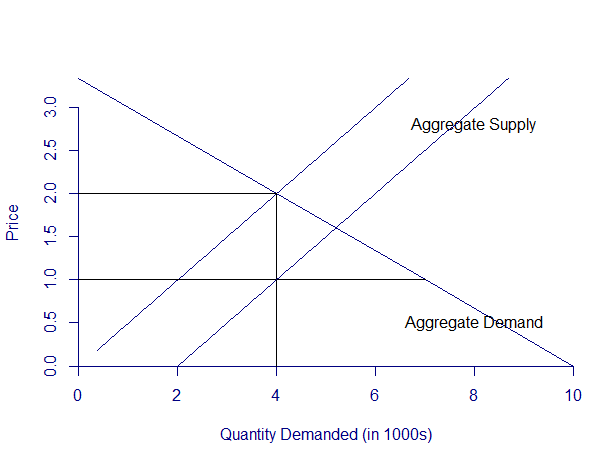

Will firms make profit if $2 > ATC? What will happen?

Competitive Market

When will firms stop entering the market?

Competitive Market

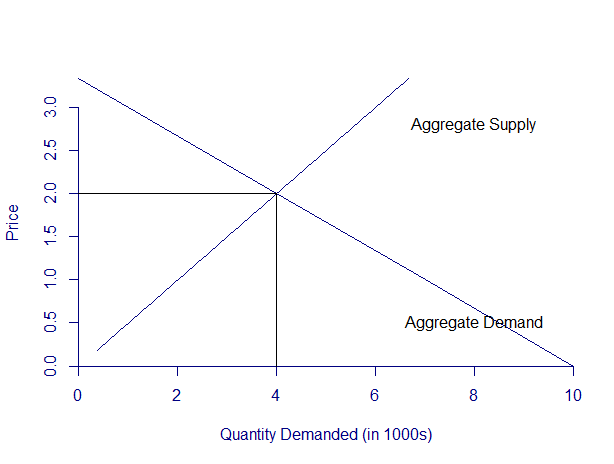

Market forces drive price towards the minimum of average total cost.

What is profit when price equals the minimum of ATC?

Competitive Market

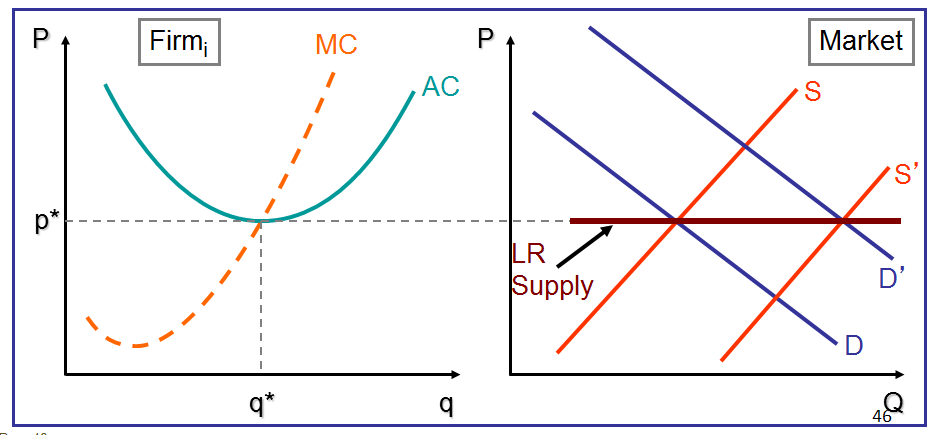

In a competitive market, in the long run, firms make zero economic profits.

Competitive Markets

-

In long-run equilibrium, economic profits must be zero.

-

Firms are not trying to earn zero economic profit: competition is pushing them there

-

But firms are not failing – efficient ones cover all their economic costs, including opportunity costs!

- Owners do as well using their capital and effort here as in their next best alternative

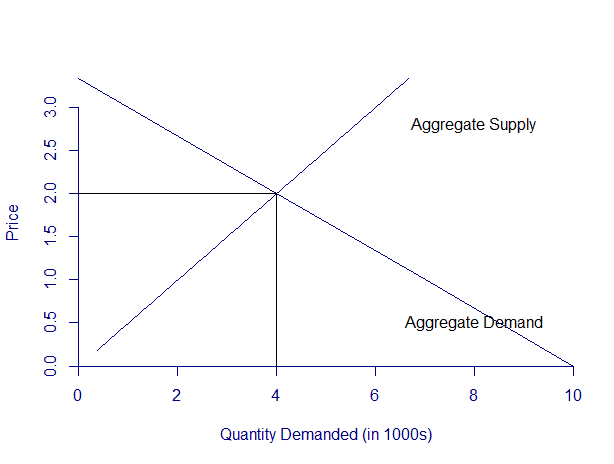

Competitive Market

Competitive Market

Let's say this is a long-run equilibrium and there are 100 firms with identical cost functions. What is ATC at q=4? What is TC per firm?

Competitive Market

Demand shifts up. What happens to profits?

Competitive Market

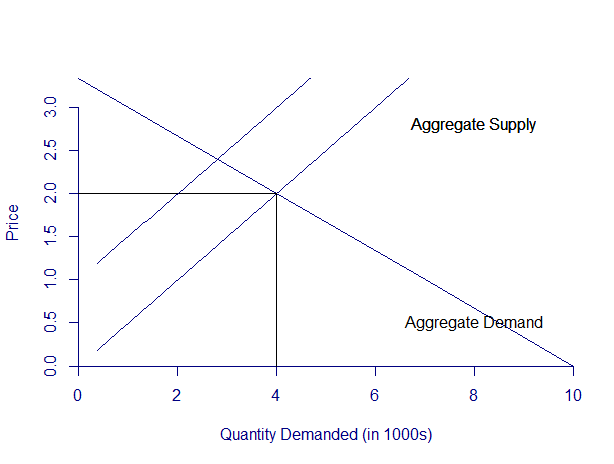

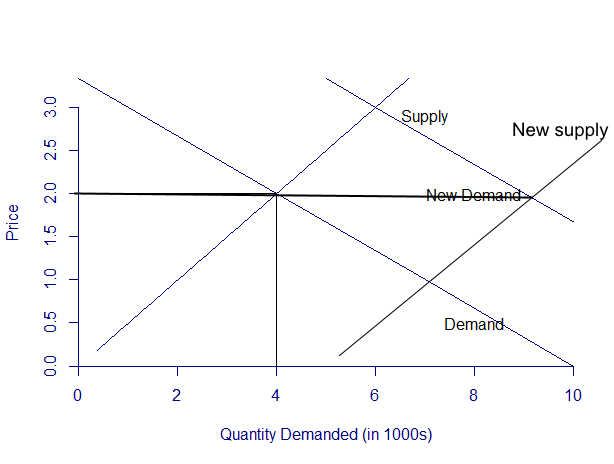

What will happen in the long run?

Competitive Market

In the long run, as demand shifts around, equilibrium will always settle with price at the minimum of ATC (in this case, $2). But, firms are still setting MC=$2 and each producing the same amount. So how is it possible that total quantity increased?

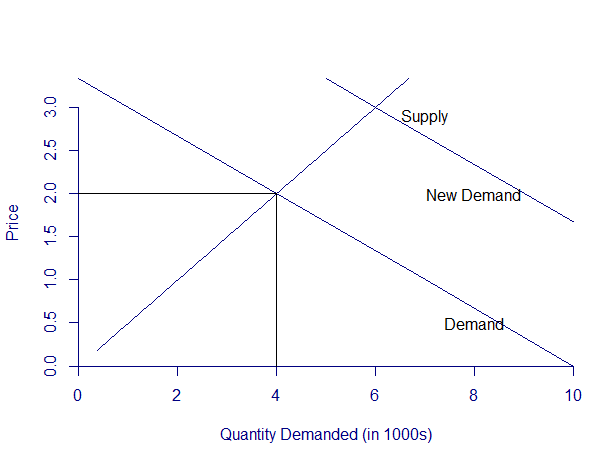

Competitive Markets

In a constant cost industry, the long run supply curve will be flat as "clones" enter to compete away profits.

Competitive Markets

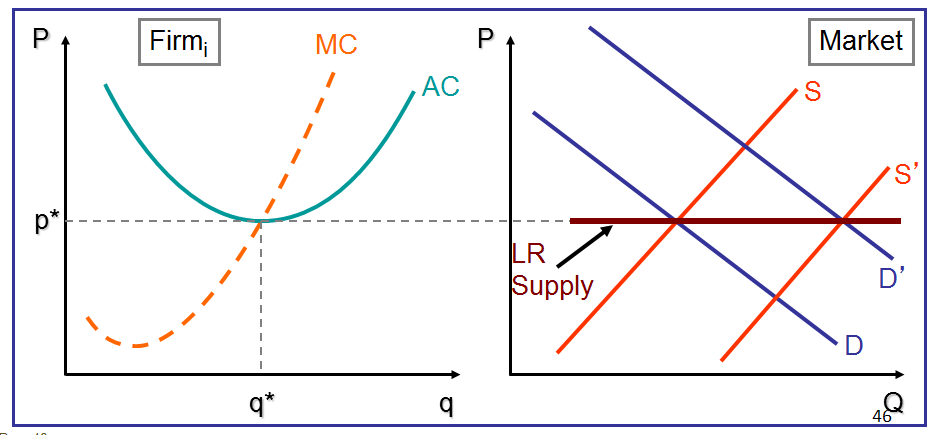

What if costs increase as the industry grows? (I.e., ATC curves shift up as market Q increases?)

Competitive Markets

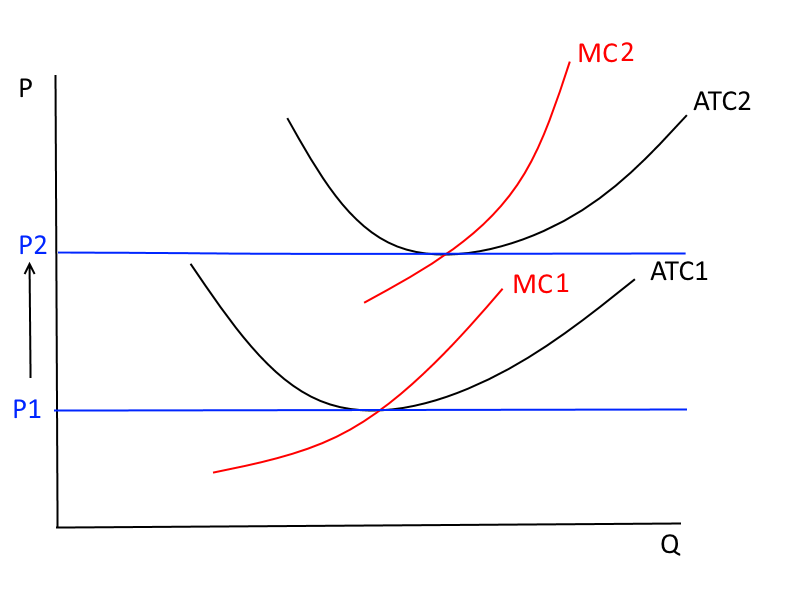

Supply shock can happen, too!

For example, a permanent increase to the price of diesel permanently increases the ATC and MC curves of the trucking industry.

Competitive Markets

New long run supply curve at P2.

Competitive Market

Competitive Markets

Pit Market Trading

Simulation

The Rules:

The goal is to get the most possible surplus. Record your surplus in each round on your sheets.

- The seller's surplus is the price s/he receives minus the marginal cost (written on the index card).

- The buyer's surplus is his/her personal willingness to pay/value (written on the card) minus the price he/she actually pays.

- You are either a seller or a buyer. You remain a seller or buyer in every round.

Do not show other people your private value/private cost!

The Rules:

Once you've found a buyer/seller to trade with, come up to me so I can check the trade and have Veena or Stephanie record the price.

If you don't manage to find a trade, you get 0 surplus for that round.

You are not allowed to get negative surplus (be rational people!). So you must sell for above your marginal cost and buy for below your private willingness to pay.

Exercise Solutions

Exercise 2:

TC = 100 + 300q + 5q2 so MC = dTC/dq = 300 + 10q

P = minATC determines the long-run equilibrium, and minATC occurs where MC=ATC (or dATC/dq = 0)

ATC=MC implies 100/q + 300 + 5q = 300 + 10q

implies q* = 4.5 (rounding)

Plug q* = 4.5 into ATC (or MC) to find long-run eq. price:

min ATC= P* = 100/4.5 + 300 + 5(4.5) = $345 (rounding)

Exercise Solutions

Exercise 2 (cont):

TC = 100 + 300q + 5q2 so MC = dTC/dq = 300 + 10q

Plug P = 345 into demand equation to find LR eq. quantity:

345 = 1000 – 0.25Q implies Q* = 2,620

# firms = Q/q = 2620/4.5 = 582 (rounding)

The short-run price created positive economic profits. In the long-run, this attracted entry, driving down the price. The long-run (zero economic profit) price is lower than the short-run equilibrium price, so quantity produced by each firm is lower in the long-run. But total market quantity demanded is higher (because of the lower prices) so the number of firms must be higher too.

Lecture 8

By umich

Lecture 8

- 399