Blockchain Technolgy & Decentralized Finance

Instructors: Andreas Park & Zissis Poulos

Rotman – MBA

5-minute version:

What is a blockchain?

blockchain=

an infrastructure for digital resource transfers

5-minute version:

What is a cryptocurrency?

cryptocurrency =

internal payment mechanism to pay for operation of a blockchain

5-minute version:

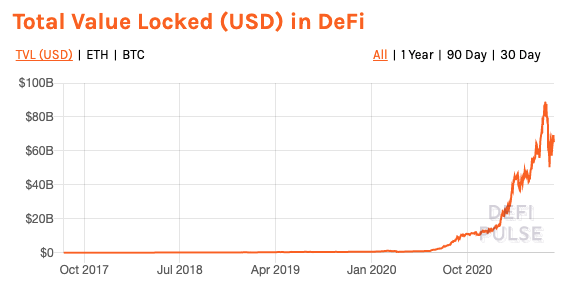

What is Decentralized Finance?

decentralized finance =

provision of financial services without the necessary involvement of a traditional financial intermediary based on blockchain technology

Why should you care?

Verbal Overview: Origins of Financial Institutions

- Money

- Safekeeping

- Deposit certificates and lending

- Trade facilitation & finance

in practice: new financial infrastructure that will be a common resource

payments

stocks, bonds, and options

swaps, CDS, MBS, CDOs

insurance contracts

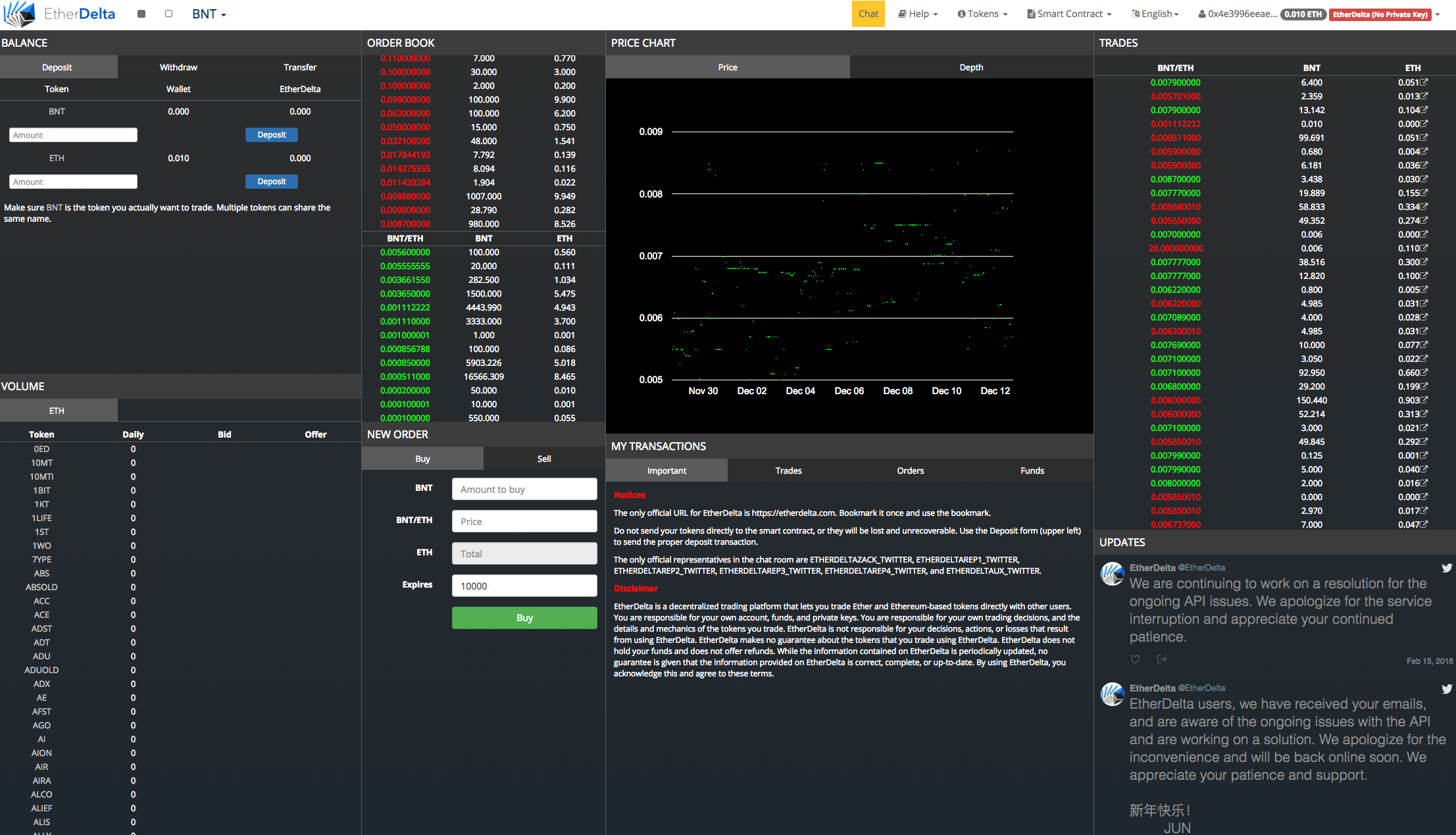

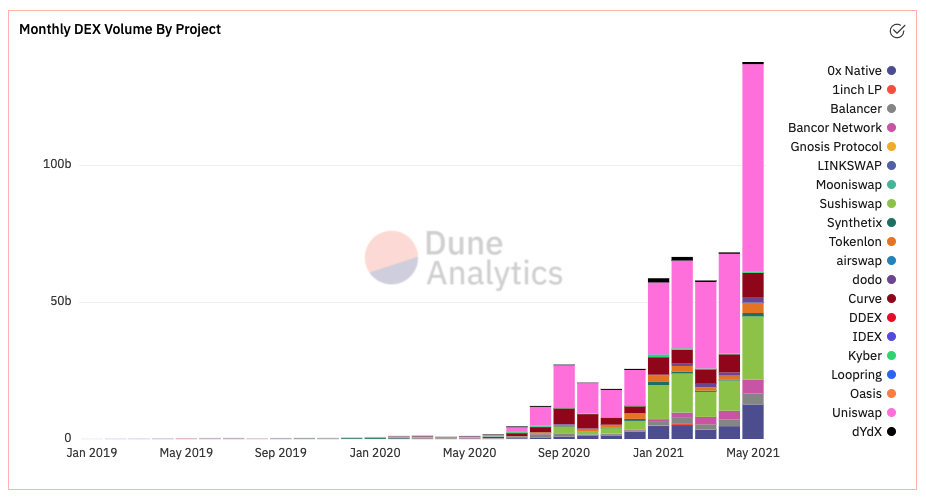

Application: decentralized trading

Application: Decentralized Lending

\(\vdots\)

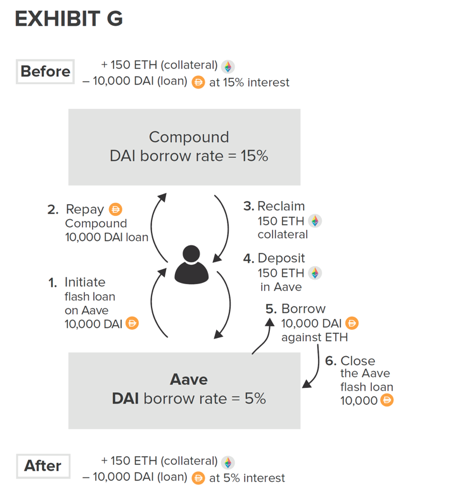

dapp-linking, Defi-Legos and flash loans

Source: Harvey, Ramachandran, and Santoro (2020)

quick comparison

FinTech vs. Defi

FinTech

DeFi

- more user-friendly UX

- more customer-oriented

- less squeezing/rent-extraction

- more competive services

- more innovative services

- currently: horribly user-unfriendly

- "blowing up the banks"

- fundamental re-thinking of financial services

- lots of scams, cowboy-attitude towards laws

innovation vs. salesmanship

main focus

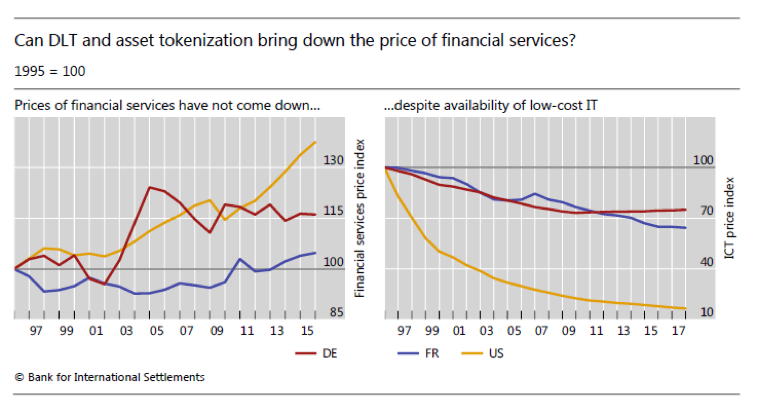

Why should you care?

What questions arise from new tech?

- Do we need banks for safekeeping if AWS/Google/Microsoft hold the data = asset information?

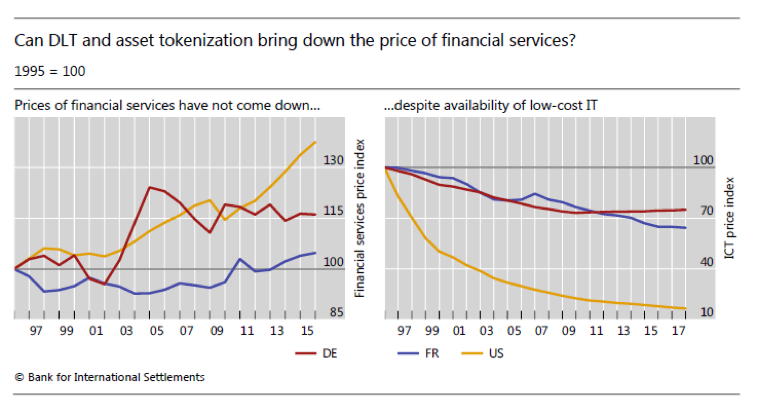

- Why are transfers still hard and costly?

\(\Rightarrow\) Can we decentralize finance?

course content

questions we will address

- How does "decentralized" work?

- not cloud compution, but blockchain

- How does centralized work?

- What roles do intermediaries play?

- Can intermediation be decentralized?

- How do platforms work economically?

- What DeFi solutions are there?

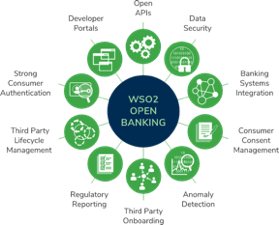

The World of Banking is Opening

Is this a distant future?

Will there be banks in the future?

Is this a distant future?

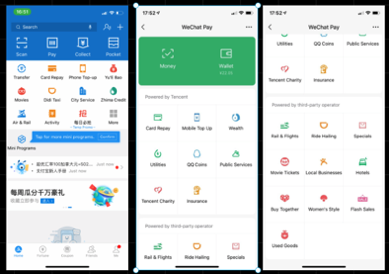

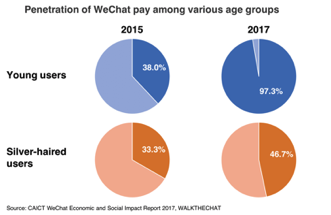

- 900M WeChat Pay Users

- 84% market penetration

- >150K WeChat Pay users @GTA

Partnerships

Meanwhile, in the traditional world of finance

Business as usual?

Some Examples of (Past) Industry Leaders

Why worry about the distant future?

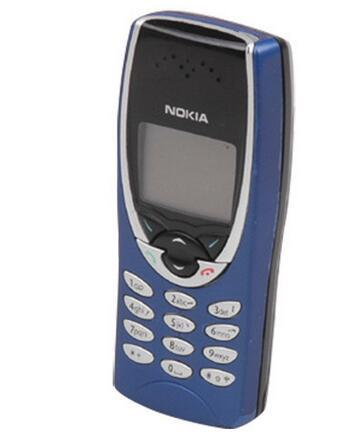

Nokia's market shares for devices:

- 2007: 49.4%

- 2012: 3%

What happened and can it happen to banks?

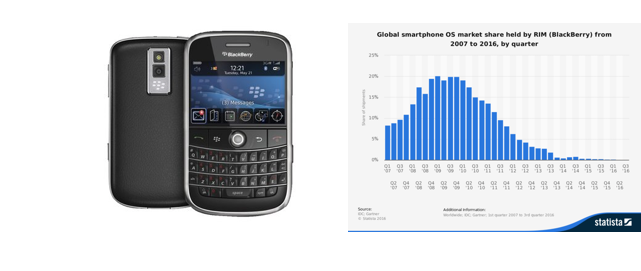

Examples: Blackberry and a generic bank

Paid-for vs. valued

- Keyboard

- Security

- Being businessy

- Cool and cutting edge

- Being Canadian

- Independence from desk

What did they pay for?

What do people value?

- Mobile email

- Brand name

- Easy access to branch

- Great product range

- Fair prices

- Great advice

- Latest tech

- Friendly tellers

- Safe-keeping of assets

If banks move all data into "the cloud," why do we need banks?

What took the place of Blackberry?

Major Lesson: Platforms provide value

What took the place of Blackberry? The App-Phone

Past, Present, and Future

Who will provide the next gen banking platform?

Siloed banks

Cloud computing and cloud storage

Open banking and open data

The past (and the present?)

The present and near future

3-5 years in the future

5-10 years in the future

Platforms?

Banks?

Tech firms?

- Each bank has a separate data center

- high costs

- no scaling

- little network externalities

- AWS etc

- Use specialized IT providers

- Network with external providers (FinTechs)

- Share data with external parties at customer request

- Platforms will emerge

- Customers can switch at the drop of a hat

- How will basic banking work?

- Who will run the platform and how will you survive on a platform?

- What will a platform work in financial services look like?

- What roles will current banks play?

- How will a bank earn money in a platform world and with which services?

Silos vs Common Infrastructures

Illustration of Infrastructure Frictions: money transfers

Version 1: They use the same bank

Change ledger entry locally

Version 2: They use different banks but the banks have a direct relationship

Sue's bank transfers from Sue's account to Bob's bank's account

Bob's bank transfers from its account to Bob's account

Version 3: They use different banks that have no direct relationship

Sue's bank transfers from Sue's account to its own account

Bob's bank transfers from its account to Bob's account

Central Bank

Central bank transfers from Sue's bank's account to Bob's bank's account

International transfers

Sue's bank transfers from Sue's account to its own account

Bob's bank transfers from its account to Bob's account

use the Swift network of correspondent banks

Bottom Line

very complex

many parties

lots of frictions and points of failure

very expensive

Crazy thought: Wouldn't it be nice if there was a single ledger?

Existing solutions

Problem:

power concentration/Monopoly

Distributed Ledger/Blockchain Technology

- A "joint, single system"

- Features:

- secure storage of information and transfer of value

- guaranteed execution of code

- Promise

- open platform

- global reach

- frictionless finance

How does it all work and why?

How do we establish trust in commerce?

trustworthy People

long-term Relationships

reputation

contract law

institutions

What's needed for trust in anonymous deals?

Authority

Execution

Continuity

Authority

Do you have the item?

Do you have power over it?

Tool: "key" cryptography

Execution

Can we agree that it happened?

Tool:

consensus algorithm

Security and Continuity

Are the records immutable?

restricted permissions

really difficult to hack

premise of blockchain

no trusted parties needed

everything

in code

open to

anyone

platform or network

commerce thrives

How?

A deep dive into the "How?"

Cryptography: only Sue can spend her money

Authority

Execution

Problem: double-spending

How can we trust that

- sale happened and

- $$ only spent once?

Execution

Security

B3

B1

B2

B4

B5

Contains transaction from Sue to Bob

Question: Can Sue rewrite history?

immutability

No! Because: Economics!

Incentive to support longest Chain

B3

B1

B2

B4

B5

B6

Where to add a new block B7?

- Add to B3?

- => people after still more likely to add to B6

- lose "coinbase" reward

Altering the past?

B3

B1

B2

B4

B5

- needs to be faster than anyone after who adds to B5 and build a longer chain

- or needs to be able to mine repeatedly

B8

B7

B9

B10

B6

Contains transaction from Sue to Bob

Sue wants to undo the transaction by rewriting history with B6

Alice's objective

- Wants to undo this trade and cheat Bob by building alternative chain from B6

What does it take?

- needs to be predictably able to add several blocks to the chain without interference, or

- needs to be faster than anyone after who adds to B5 and build a longer chain, or

- needs to ability to reject new blocks that are added to B5 .

How does Proof of Work prevent this?

- mining success is random subject to resources spend:

- computers/GPUs

- electricity

- you need faster/more computers than 51% of the network

- current network power: 800 million tera-hashes per second (blockchain.info)

Back of the envelope calculation

- hashrate: 25,000,000 TH/s

- best GPUs have 2.5GH/s per card=0.0025 TH/s

- => need 25,000,000 x 400 x 0.5 = 5,000,000,000 GPUs

- 1 GPU costs around $200

- =>Cost = $1,000,000,000,000

Economic Analysis, Part II

Double spend attack prevention

- Validation rewards are taken as given, but they are crucial in

- determining incentives to participate,

- to support the chain, and

- to expense electricity and computing power

Basic idea of competitive equilibrium

aggregate mining cost = aggregate reward

Double spending attack

- expense resources but:

- win N block rewards until "confirmation" block

- ability to double-spend

condition that prevents it

(Chiu & Koeppl RFS 2018)

How do you agree though that something happened, or, what is consensus?

How can we reach consensus? The Byzantine Generals' problem

How can we reach consensus? The Byzantine Generals' problem

Blockchain proof of work establishes consensus

Byzantine Generals' Problem

\(t\)

\(t\)

\(t\)

\(t\)

\(t\)

\(t\)

\(t\)

\(t\)

\(t\)

\(t\)

\(t\)

\(x\)

\(t\)

\(t\)

\(t\)

\(t\)

\(t\)

\(x\)

\(t,t,x\)

\(t,t,x\)

\(t,t,t\)

Byzantine Generals' Problem

\(x\)

\(y\)

\(z\)

\(y\)

\(x\)

\(z\)

\(y\)

\(x\)

\(z\)

\(x,y.z\)

\(x,y,z\)

\(x,y,z\)

Byzantine Generals' Problem

Equilibrium

- generals pick majority message

- successful consensus as long as no more than 1/3 cheats

Blockchain requirement

- reach Byzantine Fault Tolerant consensus

- trick: messages are hard to forge

Byzantine Generals' Problem

Proof of Work Protocol

A Byzantine Fault Tolerant Algorithm

This Hash starts with a pre-specified number of zeros!

Blockchain BFT

= 00000xd4we...

= 00000xd4we...

= 00000xd4we...

consensus is reached if hash starts with right number of leading zeros

PoW does two things

- selects a leader

- makes messages hard to forge

Blockchain BFT

What can it for finance, what are problems and obstacles?

Obvious application: trading

Sue wants to sell ABX

Bob wants to buy ABX

sell order

buy order

Clearing House

Stock Exchange

Broker

Broker

3rd party tech

custodian

custodian

record beneficial ownership

central bank for payment

Evolution

With Blockchain: single ledger for money and securities

0xA69958C146C18C1A015FDFdC85DF20Ee1BB312Bc

0x91C44E74EbF75bAA81A45dC589443194d2EBa84B

0xA65D00Eda4eEB020754C18e021b1bF4E66C9Ed90

- blockchain 1.0

- first solution to double spending

- clunky, slow, expensive

- huge following and computing power

vs

- blockchain 2.0

- smart contract platform

- highly flexible

- foundation for many private initiatives

"Let me just say how impressed I am with Ethereum...If Bitcoin is email ––a one-trick pony, so to speak, but obviously revolutionary–– Ethereum goes far beyond that; it's more like the Internet...The whole idea of DeFi really is, number one, it’s obviously revolutionary, and I think at the end of the day could lead to a massive disintermediation of the financial system and the traditional players."

Heath P. Tarbert, CFTC Chairman, October 2020

Usage of blockchain in financial industry

Areas of applications

moving value (remittances)

digital money: real-time settlement, reduced reserves

tokenization of assets

automization of contract payments

securitization

systems and infrastructure reorganization

digital identity

new forms of financial contracts, assets, and forms of financing

What Changes in Business Models can Blockchain Technology bring?

What does blockchain do?

peer to peer value transfers

self-powered platforms

contract execution

disintermediation

Who do you dis-intermediate, and then who is your customer?

issuer

investor

broker-dealer

The Business challenge of dis-intermediation

investment advisor

Challenges

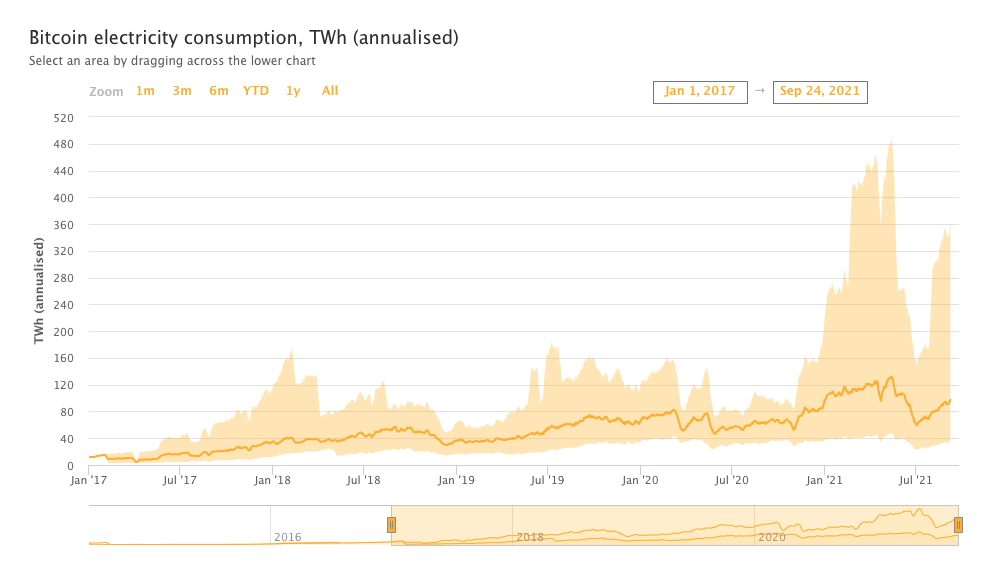

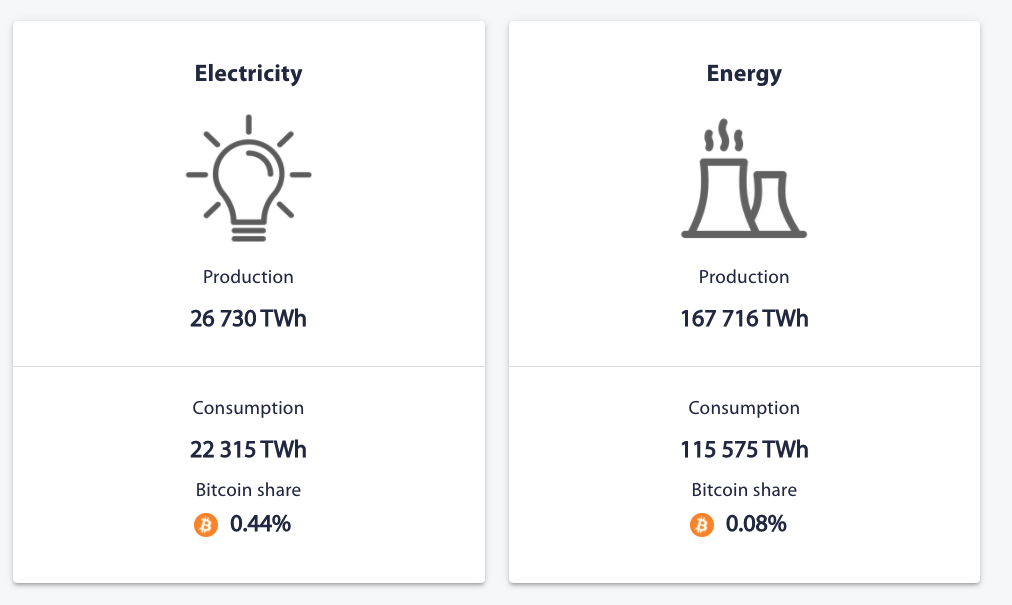

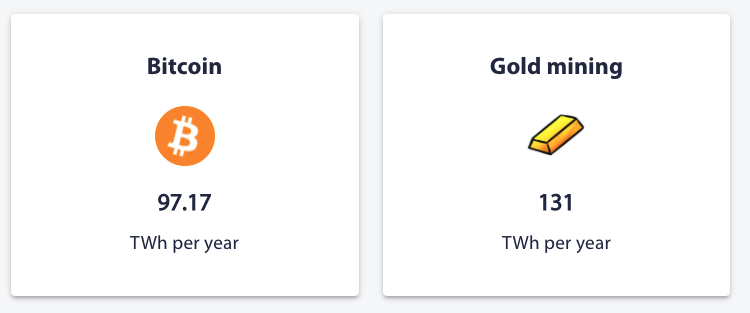

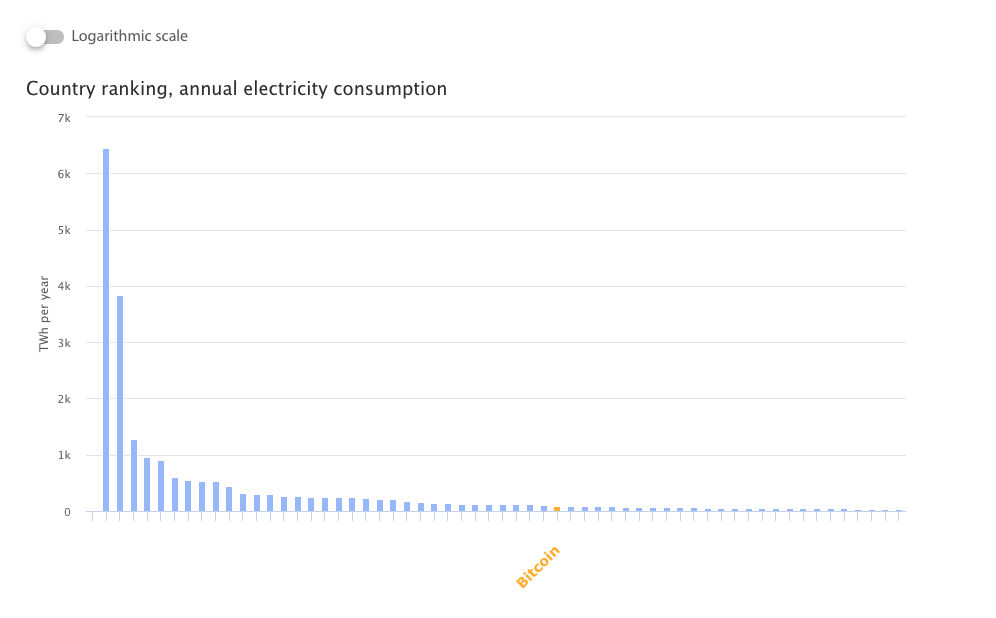

Proof of Work uses unsustainable amounts of energy

Source: Cambridge Bitcoin Energy Consumption Index https://cbeci.org/

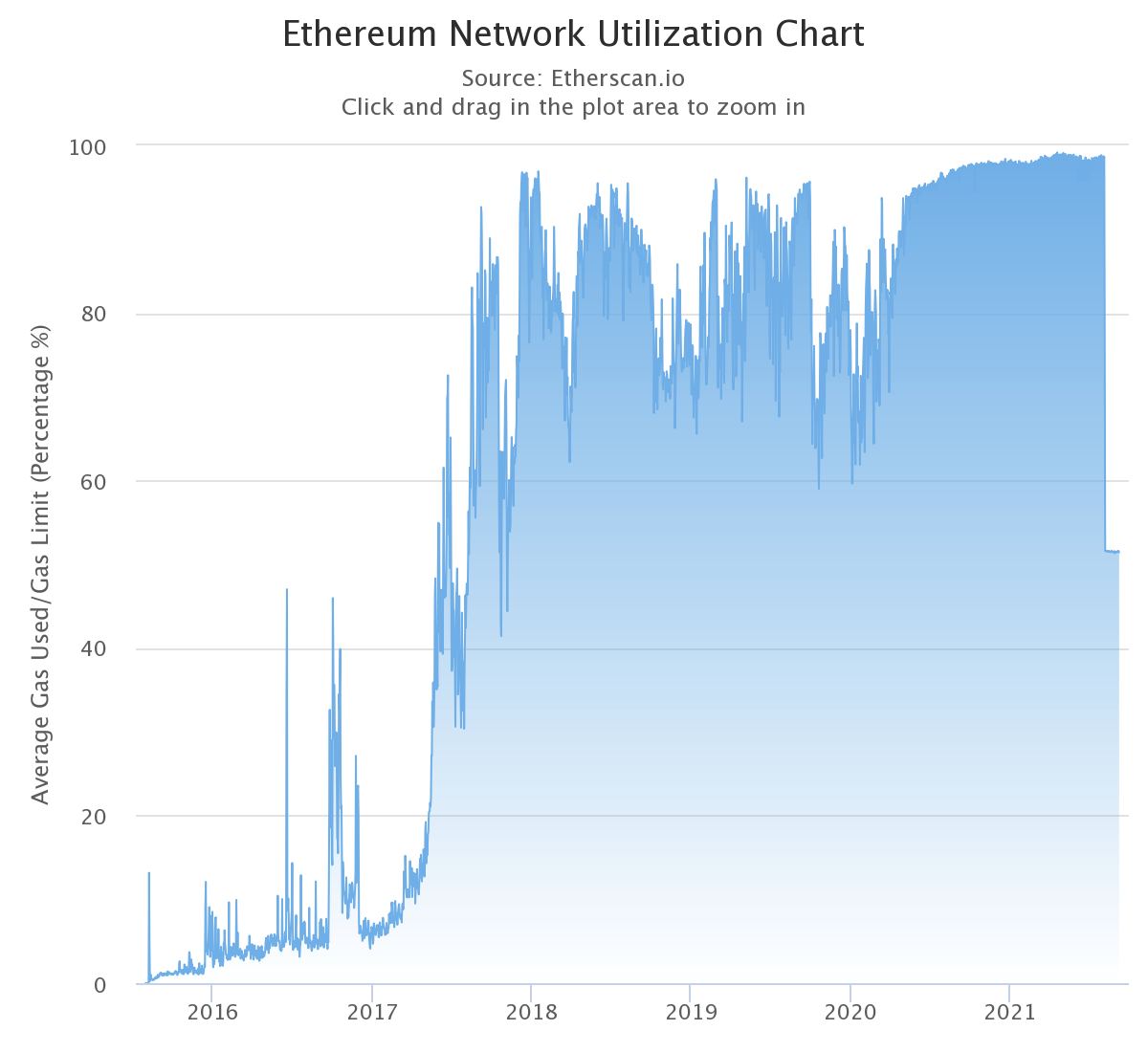

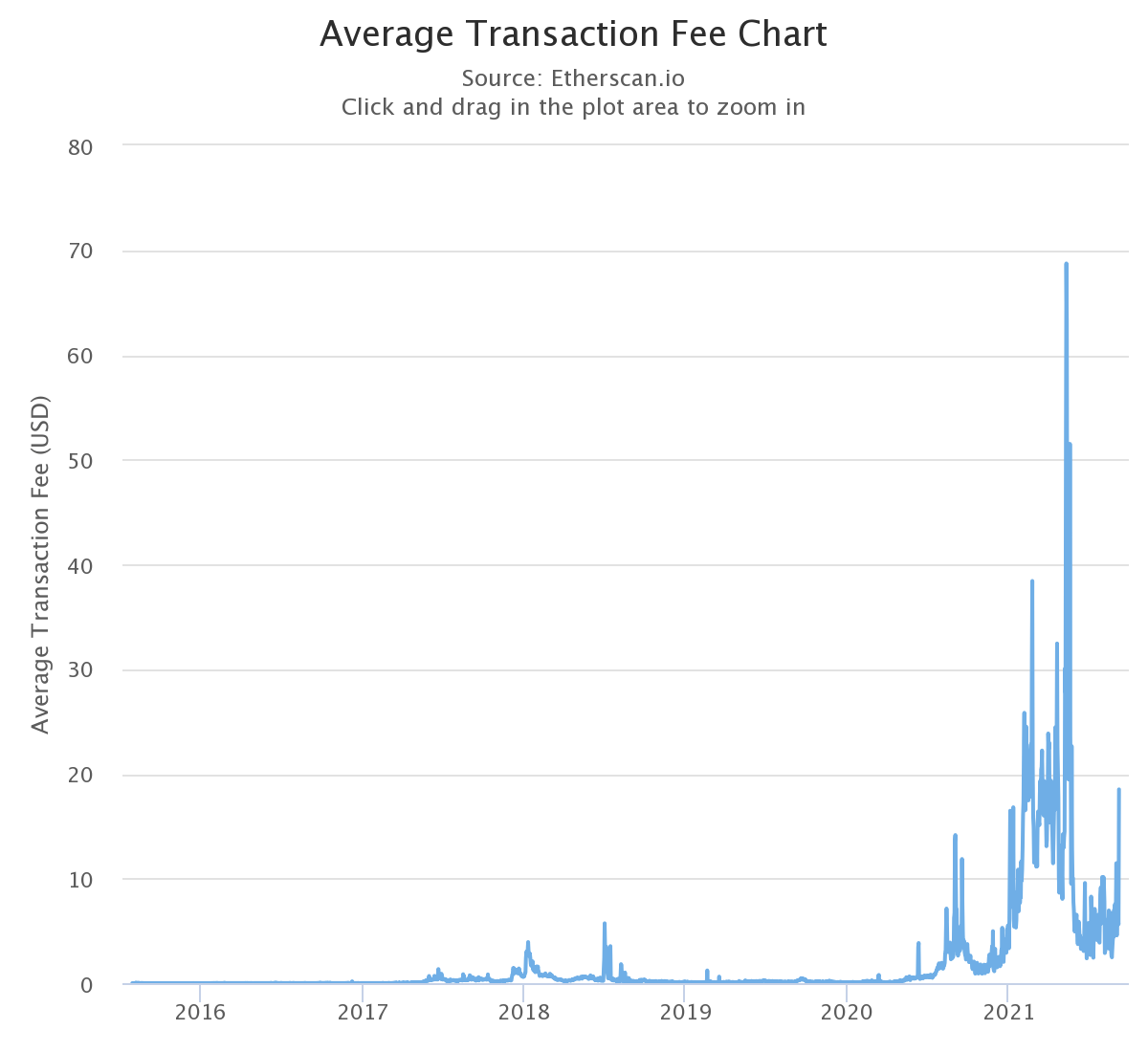

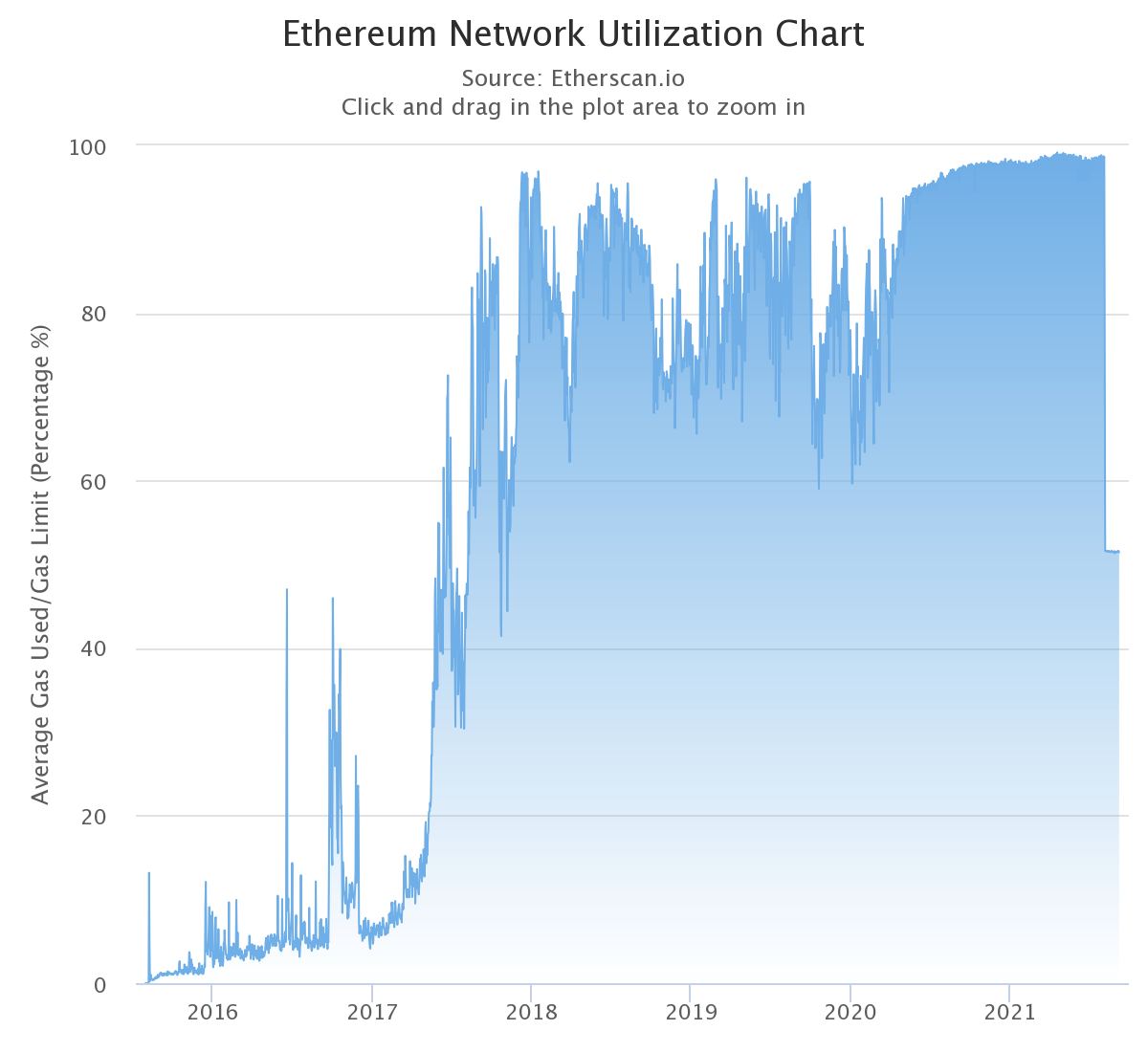

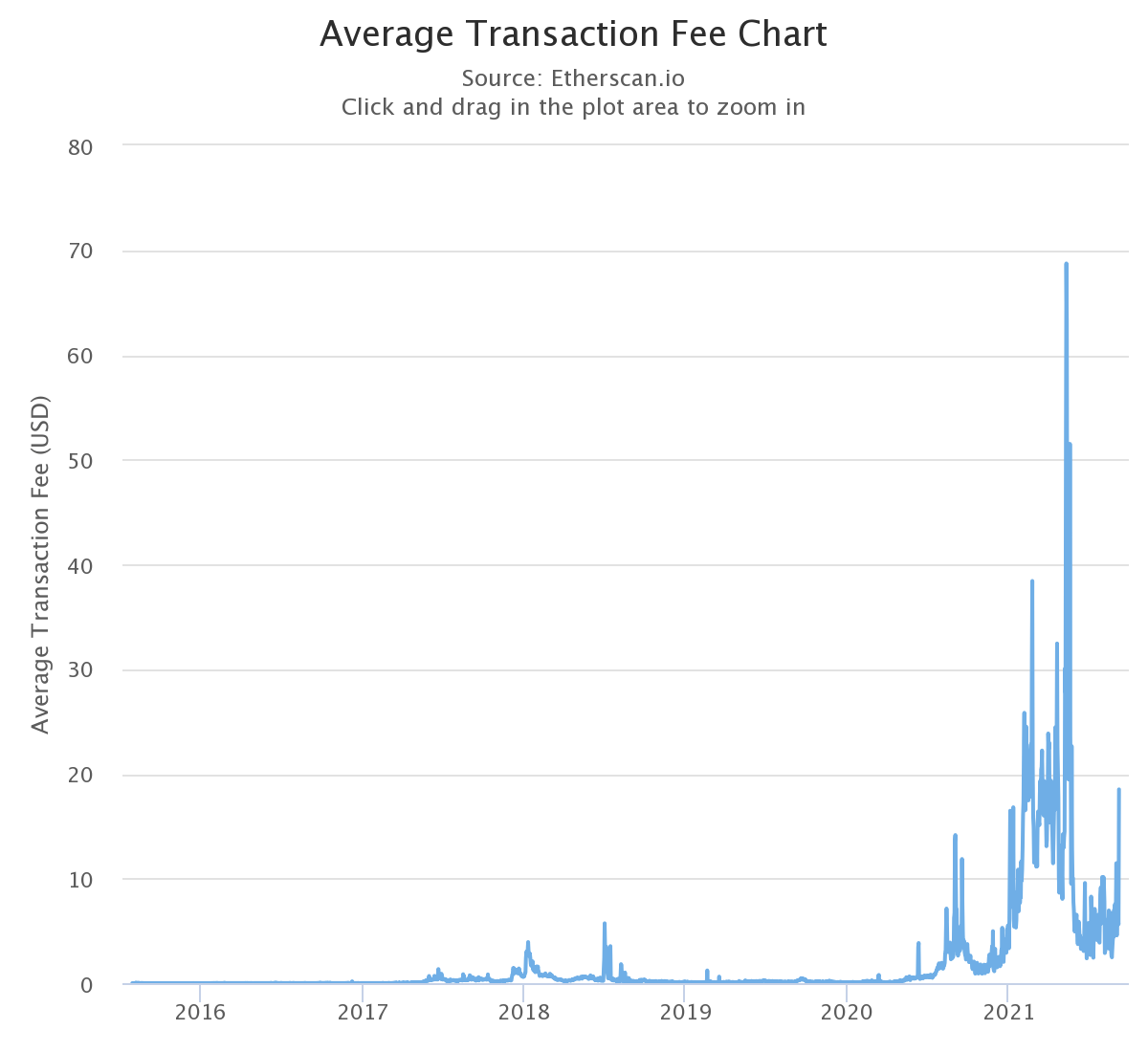

Ethereum is full and using it is expensive

Scalability projects for Ethereum

- Ethereum blocks have no size limit

- but: gas limit imposes computation limit and thus transaction limit

- note: in contrast to Bitcoin, Ethererum always announced that it would eliminate proof-of-work eventually

Root Problem

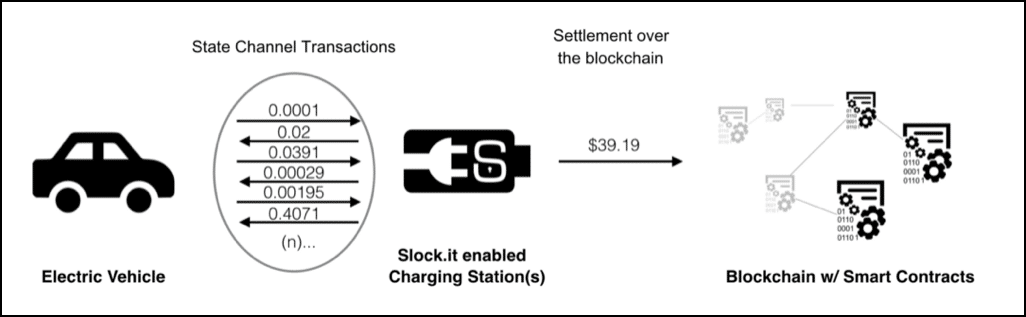

- Side Channels:

- Keep two-party interactions off the main chain and use chain only for terminal settlement

- Sharding

- instead of storing all info on all nodes, break up the blockchain into shards

- \(\to\) hard problem!

Solutions

https://blog.stephantual.com/what-are-state-channels-32a81f7accab

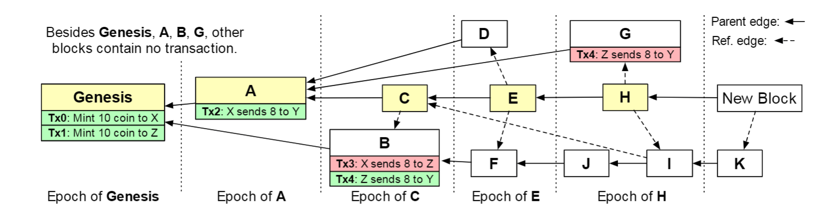

a better blockchain: Conflux

Greedy Heaviest Adaptive SubTree (GHAST) algorithm

- Blocks are assigned a weight according to the topologies

- Exists a deterministically heaviest chain called pivot chain

- An epoch contains one pivot chain block and its reachable blocks

Transaction Processing

- Blocks are processed sequentially ordered by epoch, topological order and id

- Only the first occurrence of the transaction is processed

- up to 4,000 tps for simple payment transactions

- Note: runs Solidity \(\to\) 100\% compatible with all Ethereum smart contracts

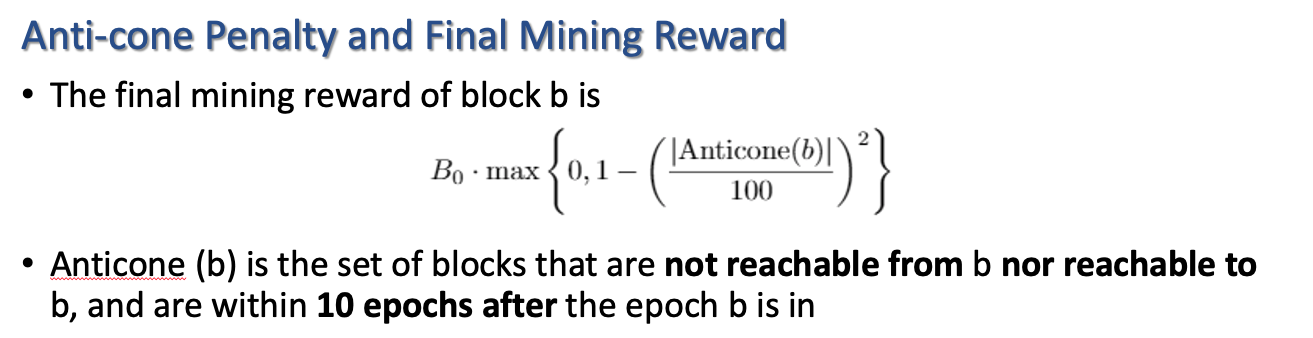

Disclaimer: token design strongly influenced by yours truly

going back to Budish (2018)

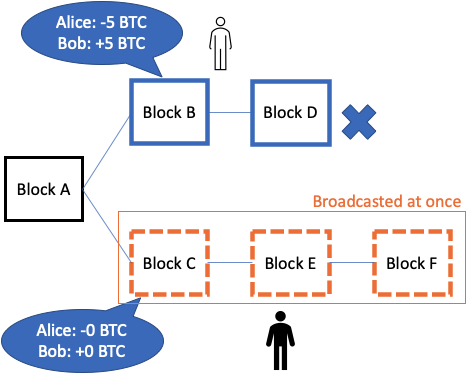

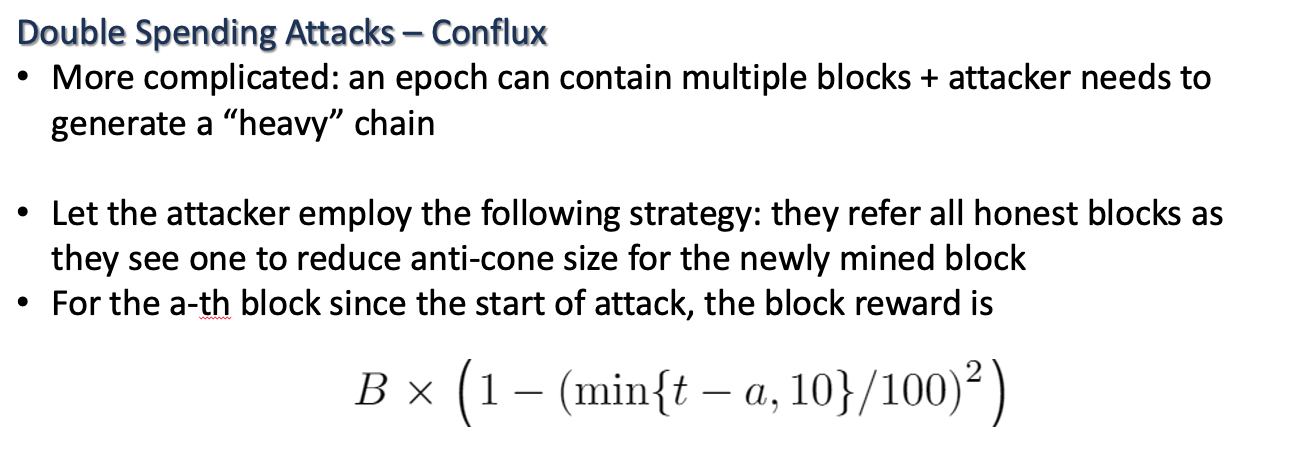

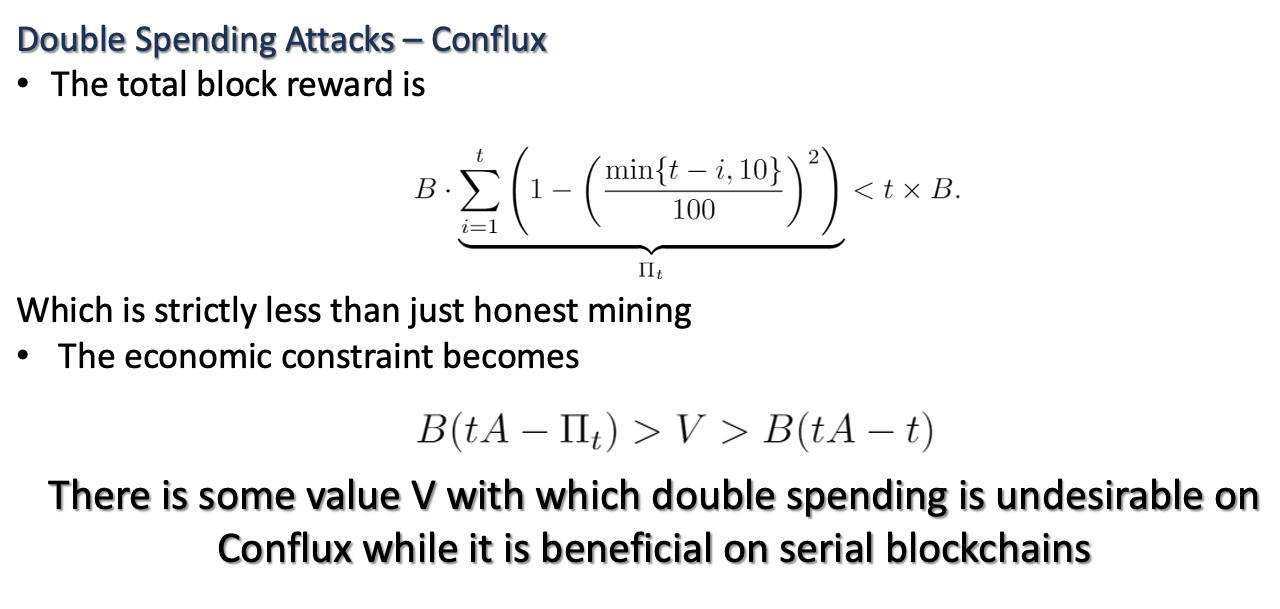

Selfish Mining Attack in CONFLUX

Serial Chain

Conflux Chain

In Conflux, withholding a block leads to greater anti-cone size

Intuition: Anticone = blocks created without properly referencing others blocks in its vicinity

Selfish Mining/Double-Spent Attack in CONFLUX

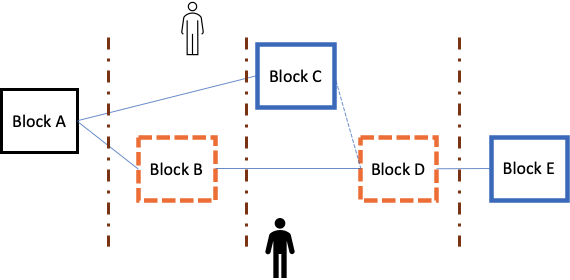

Key problem of Proof-of-Stake:

How to incentivize support of longest chain?

B3

B1

B2

B4

B5

B6

Where to add a new block B7?

- PoW: only longest chain

- PoS: could add both at B3 and B6 (nothing-at-stake)

- solution: punish deviations!

My personal problem: I have not yet seen a convincing theoretical model of PoS

economic result: Fahad Saleh (2021) Review of Financial Studies, "Blockchain Without Waste: Proof-of-Stake" shows that PoS is an equilibrium

current state:

- promised since 2014

- secondary PoS chain in operation

- merger of chains expected in late 2021

Reality Check: Capacity

| transactions per second | T per 12 hours (business day) | |

|---|---|---|

| Bitcoin | 7 | 302,400 |

| Ethereum | 30 | 1,296,000 |

| Algorand | 2000 | 86,400,000 |

| Conflux | 4000 | 172,800,000 |

| Athereum | 5000 | 216,000,000 |

| Payments Canada ACSS | 648 | 28,000,000 |

| US retail | 7639 | 330,000,000 |

| Canada number of equity trades | 46 | 2,000,000 |

| Orders on Canadian equity markets | 3588 | 155,000,000 |

-

Tweaks: lighting network (BTC) or side chains, SegWit, blocksize possible, but there are limits

-

microtransactions, IoT, and other smart contract use cases place very high demands

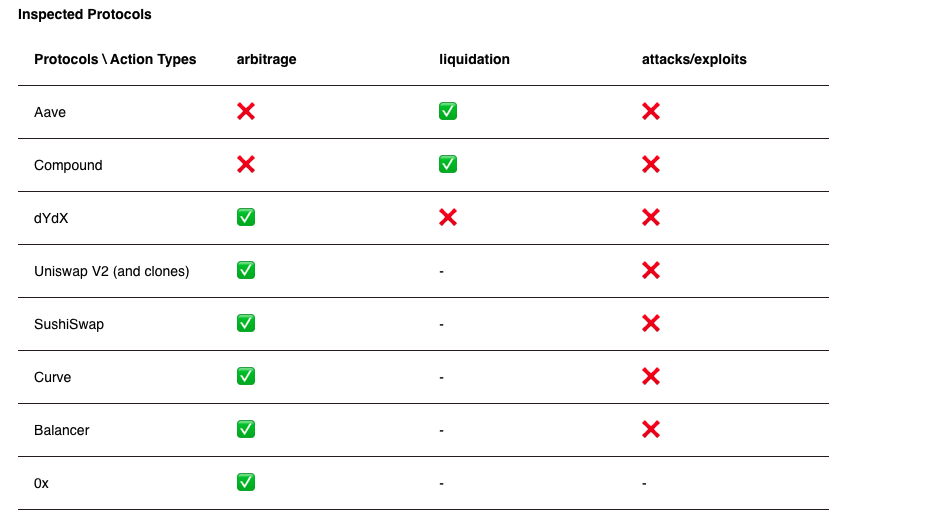

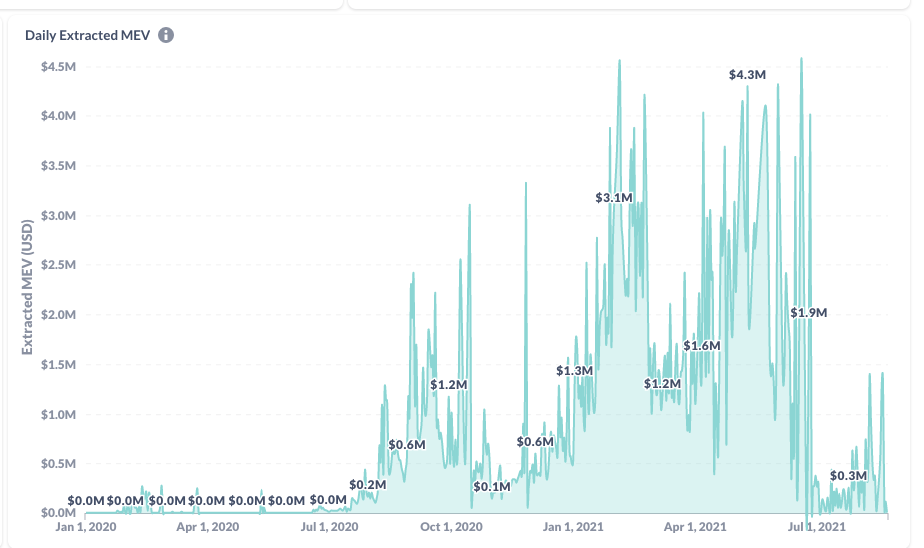

Miner extractable value and High Priority Gas Auctions

Private Sector Solutions

Private vs. public

some key questions

Who gets to update?

Can a higher body prevent

transactions?

Can the past be altered?

consensus

immutability

censorship resistence

Public Blockchains provide

Main private blockchain systems

Features of Private vs. public blockchains

open to anyone

no one can be excluded

past cannot be changed

Public Blockchains

private Blockchains

high visibility of transactions

open-access eco-system

slow governance

privacy only at a cost

joint control and governance

straightforward KYC and AML

tech support

transaction secrecy simpler

rely on corporate development

compliance with law (reversion)

can keep competition out

Enter BigTech

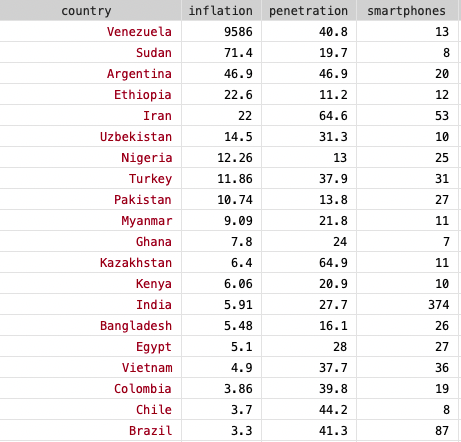

cellphone data from 2018 (NewZoo), inflation from 2020 (World Population Review)

Evolution

DIEM = "new financial infrastructure"

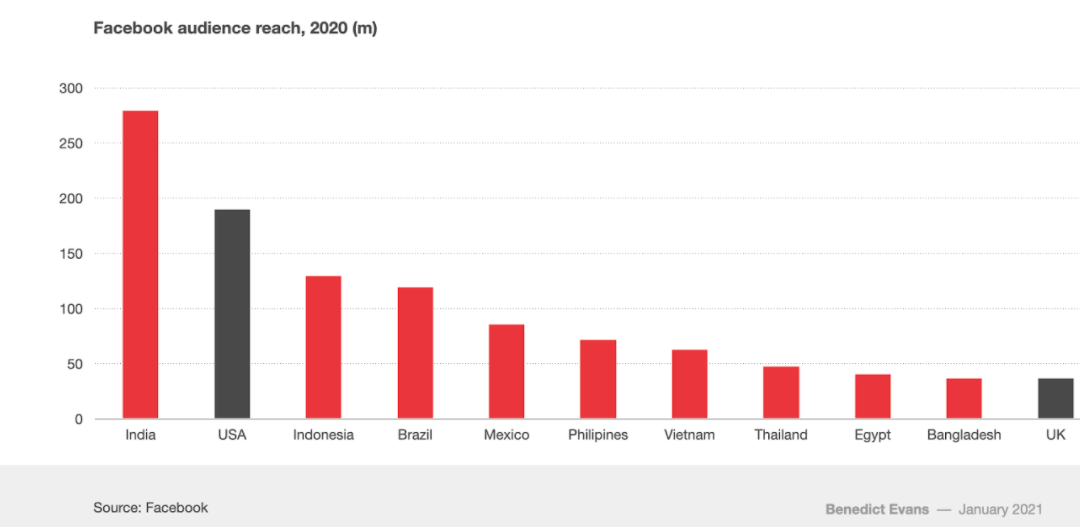

Why does BigTech enter the finance game?

They have ZERO interest in becoming a financial institution/bank

\(\rightarrow\) no expertise

\(\rightarrow\) competitive market

\(\rightarrow\) one of the most regulated business environments

My take

They are trying to deal with frictions that impede their business

They aim to collect data which will vastly improve their business

Lay the groundwork for the next step of the digital evolution: the "Metaverse"

5-minute version:

Finance, Metaverse, and Non-Fungible Tokens

metaverse =

marriage of the digital and physical world

sale price: $69,000,000

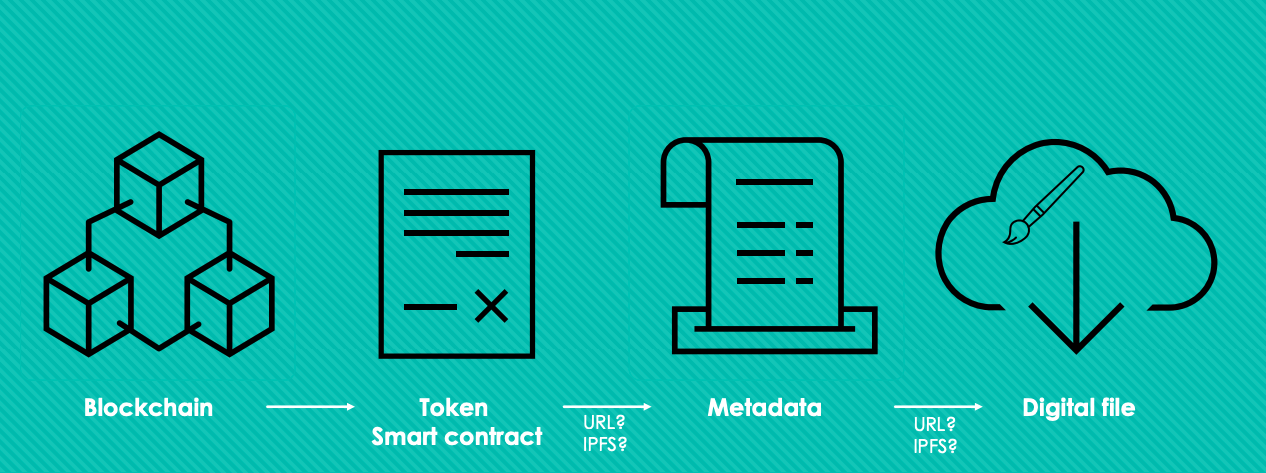

What is an NFT?

- "unique" token

- digital ownership certificate

- ERC-721 standard (also ERC-1155)

Why bother with an NFT?

- difficult legal question: what do you actually own?

- allows royalty payments

- could be used in other tools (e-book readers)

- NFTs can be tokenized (partial ownership)

- used as collateral in DeFi

Metaverse application

- ownership in the digital world

- payment for digital experiences

Related Development: Central Bank-Issued Digital Currencies

Evolution

CBDCs

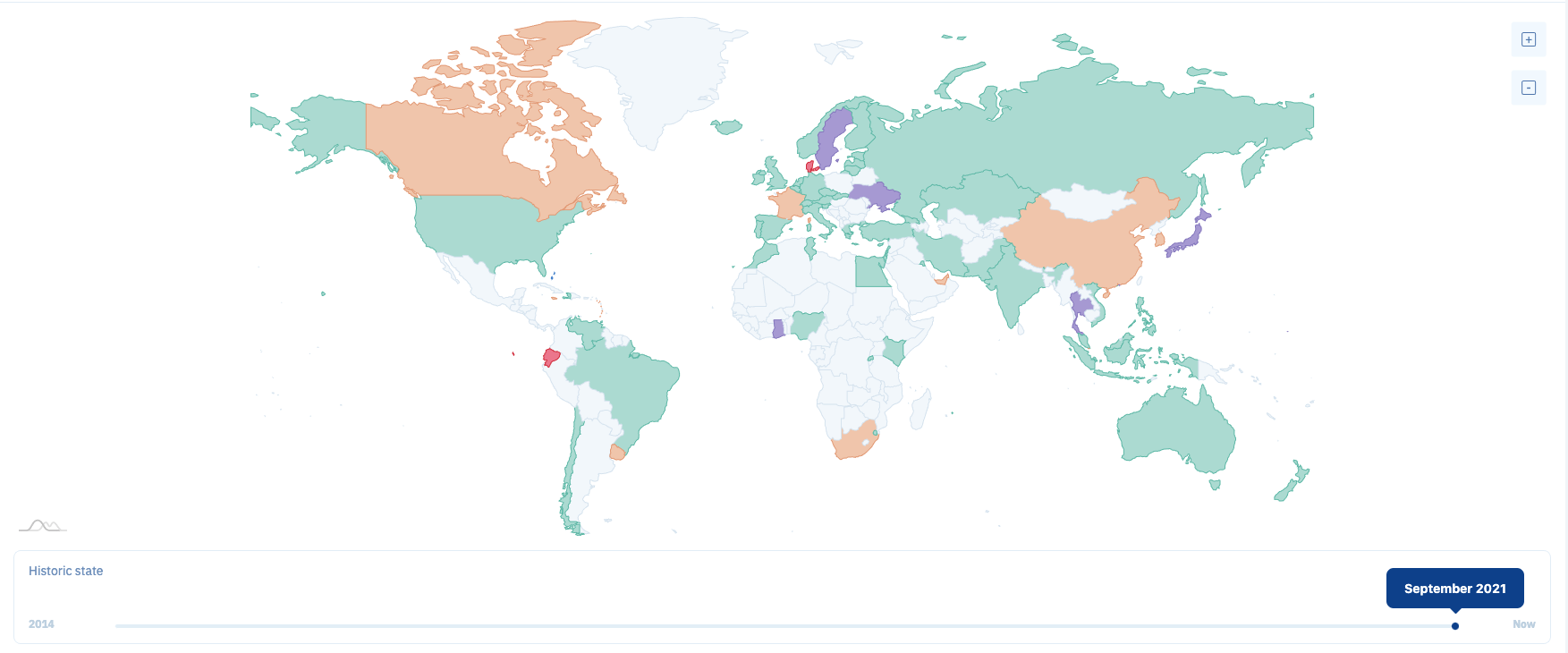

Newest Developments: CBDC

CBDC = Central Bank issued Digital Currency

not a cryptocurrency \(\to\) just a "normal" liability on central banks balance sheets

-

BIS Jan 2019: "Proceed with caution"

-

BIS Jan 2020: "Impeding Arrival"

Is it coming?

players (inter alia)

-

China: in test mode; provinces prep own initiatives, coming next year

-

U.S.: has bigger problems and is always a last mover

-

UK: preparing

-

Canada: contingency planning (it'll happen within two years)

players (inter alia)

Source: CBDCTracker.org

Risks and open problems

- many apps are still experimental, many kinks need ironing, and tech progress is needed

- smart contract risk:

- detecting problems with code

- detecting problems with economic incentives

- foreseeing unforeseen contract contingencies

- contract contagion risks

- governance of decentralized organizations

- role of regulators

The Ugly Truth: token trading and token markets are different from securities trading and markets

Investor

Broker

Venue

Settlement

Exchange

Traditional

Wholeseller

Darkpool

Internalizer

Venue

Settlement

Investor

On chain

Crypto

Key Challenges for the blockchain Community for 2019

Technology

Legal/Regulation

Economic functions

What is the right governance structure for systems?

How should we design tokens as contracts?

How do platform payment means interact with outside world

How much do we have to pay operators to maintain the chain?

Key Economic Questions for Blockchain Design

Key Technology Questions for Blockchain Design

interoperability

cybersecurity and privacy

functionality

scalability

smart contract features and verification

space constraints

Solution projects to Key Technology Questions

interoperability

scalability

space constraints:

Does the law have to change to accommodate new tech? If so, how? What's dated, what's not?

Key Legal Questions for Blockchain Design

Legal setup of a platform: what rules can, should, and must a platform establish? What regulations are necessary?

How can token design and the law be married?

Questions for the future

What is the economic impact of "tokenizing everything"?

How will it affect investments and investment banking?

Which business opportunities will it enable?

What do tokens and "alternative money" mean for payments?

Private vs. public

some key questions

Who gets to update?

Can a higher body prevent

transactions?

Can the past be altered?

consensus

immutability

censorship resistence

Public Blockchains provide

Main private blockchain systems

Features of Private vs. public blockchains

open to anyone

no one can be excluded

past cannot be changed

Public Blockchains

private Blockchains

high visibility of transactions

open-access eco-system

slow governance

privacy only at a cost

joint control and governance

straightforward KYC and AML

tech support

transaction secrecy simpler

rely on corporate development

compliance with law (reversion)

can keep competition out

Crypto vs Money

Cryptocurrency = money?

Can bitcoin or ether replace "fiat" MONEY?

store of value?

unit of account?

method of exchange?

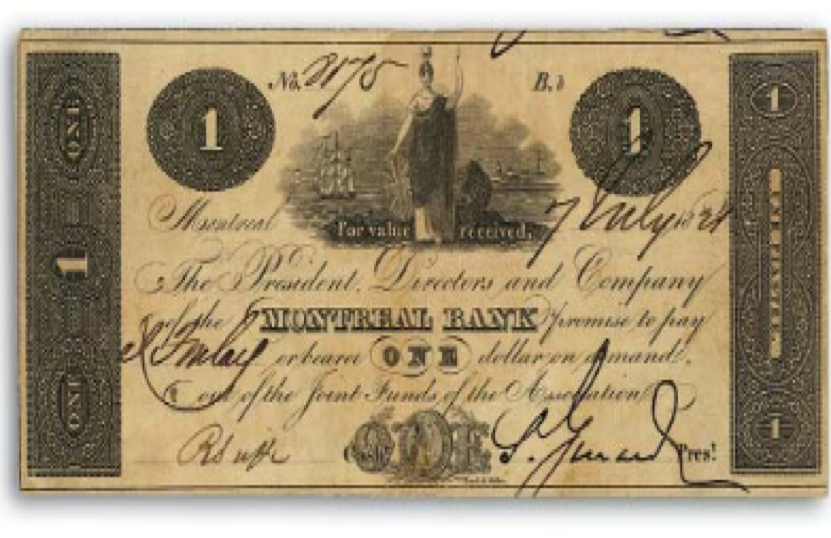

A short history of Money

A short history of Money

A short history of Money

A short history of Money

A short history of Money

Cryptocurrencies vs USD

Cryptocurrency = money

Can bitcoin or ether replace "fiat" MONEY?

store of value?

unit of account?

method of exchange?

Cryptocurrencies are (currently) useless as money

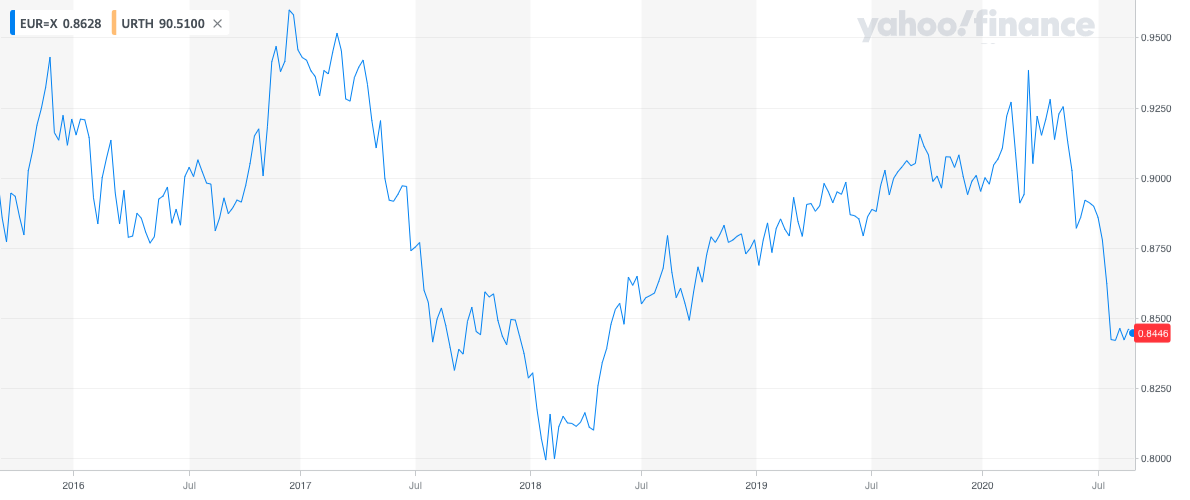

cryptocurrencies' volatility?

Cryptocurrencies are (currently) useless as

money

fiat money cannot be used in smart contracts on the blockchain

solutions:

stablecoins

central bank digital currency

BTC, ETH

fiat: USD, EUR

asset (gold)

fee-backed

Seigniorage

Crypto

Traditional

Algorithmic

Collateral-Backed

Taxonomy of Stablecoins

$174M

$33M

$144M

funding figures from Nov 2018; source: blockchain.com

The One the world is talking about

What is Libra and how does it work?

issued by a consortium of firms (e.g., Facebook, Mastercard) and not for profits (Creative Destruction Lab)

each coin will be backed by a basket of SIX fiat currencies

idea is conceptually similar to IMF Special Drawing Rights (pegged to USD, EUR, YEN, GBP, YUAN)

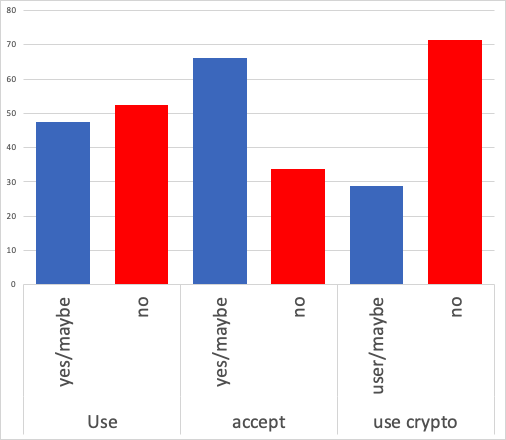

Survey Info on Libra

Would you use Libra/Money issue by Tech Firm?

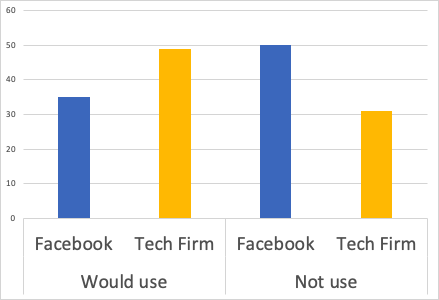

If we ask explicitly for Facebook vs Tech Firm

Scaled to yes/maybe/no. About 20% say: "Need more info"

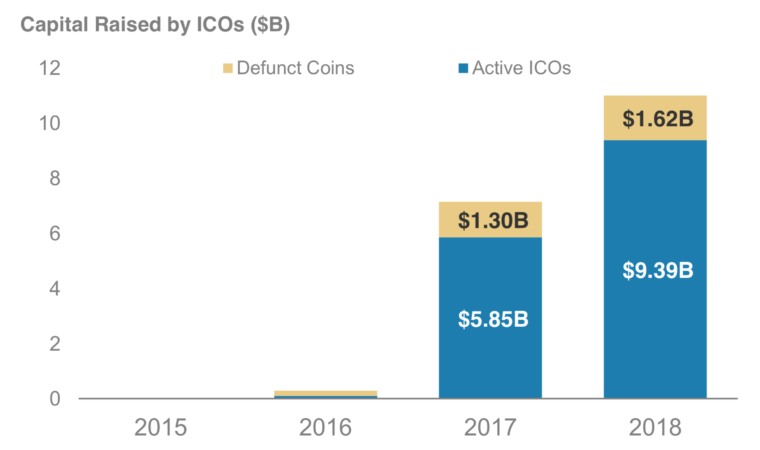

Cumulative Token sales since Jan 2016

Data: coinschedule

$25B total

$21B in 2018

for comparison: total size of

-

Toronto Stock Exchange: $2,200B

-

Toronto Venture Exchange: $41B

Some spectacular returns

Source: Tokendata

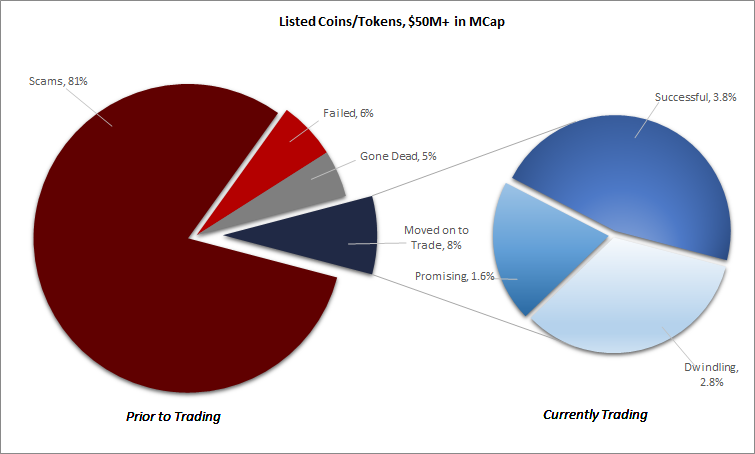

The Ugly Truth: Scams

Source: Satis Group LLC

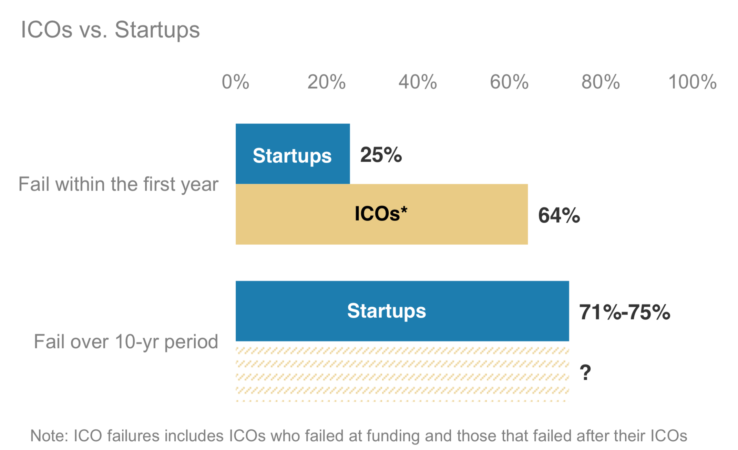

The Ugly Truth: Failure Rate

Source: Morgan Stanley (Nov 2018) “Update: Bitcoin, Cryptocurrencies and Blockchain”

Source: Tokendata

Also: a real horrow show

Key: you cannot collect money from just anybody!

The Ugly Truth: Many tokens are securities

Blockchain Tokens and Coins as Payments: a New Financing Tool?

- Since Jan 2016: $31 billion for 1,700+ early start-ups

- TMX Venture (successful, since 1999, for junior firms)

- $42 billion market cap (since 1999!)

- In 2018: 52 IPOs, $2.2 billion

- Private markets in Ontario: raised $70 billion in 2017

Lessons?

- Significant interest in FinTech

- Appetite by retail investors for risk/early-stage firms

- Possible to raise funds directly from investors

- VCs and intermediaries do provide a service

- money does not substitute for business plan/advice

- "wisdom of the crowd" is non-existent (?)

Tokens as Payments: a New Financing Tool?

Preliminary (academic) Research insights: What can (utility) tokens finance that traditional securities cannot?

can finance projects that otherwise would find no debt or equity funding

enable network effects and new business opportunities

allows entrepreneurs to extract more surplus

can finance projects that otherwise would find no debt or equity funding

Blockchain Tech Stack: Tokens vs Cryptocurrencies

Infrastructure

reward

and

internal currency

usage fee

or

incentive

usage fee

Service

Application

Tech Stack Layer

Role of Token

cryptocurrency

Token

Token

What Changes in Business Models can Blockchain Technology bring?

What does blockchain do?

peer to peer value transfers

self-powered platforms

contract execution

disintermediation

Who do you dis-intermediate, and then who is your customer?

issuer

investor

broker-dealer

The Business challenge of dis-intermediation

investment advisor

economics of Platforms are tricky

-

is it worth it for me to engage at all?

-

is the desired action of the platform the best for me?

Not everything that can be measured matters and not everything that matters can be measured

-

must be aligned with long-run goal of platform

-

must be under the control of platform participant

What does the platform need people to do?

Is there a suitable performance metric?

Utility tokens fail \(\Rightarrow\) not good platform tokens

Equity tokens fail too!

Observation: many Decentralized Apps = platform for two-sided, dis-intermediated market

Question 3: Do you need to incentivize the establishment of trust?

Question 2: What kind of incentives can you provide?

Question 1: What role does the intermediary play, what service does it provide?

-

Trust

-

Matchmaking

-

Time/size intermediation

-

marketing

Conclusion and final thoughts

blockchain is a transformative technology, but won't be used in practice overnight

many conceptual and technological challenges remain, but there are already various areas of application

legal, regulatory, and competitive changes are needed and then the opportunities are endless ...

it will open up the banking world further, foster international competition, and change how we pay and exchange value

My view: business development will happen in private/semi-public space; strong increase in recent activity; no more testing but re-engineering of processes.

@financeUTM

andreas.park@rotman.utoronto.ca

slides.com/ap248

sites.google.com/site/parkandreas/

youtube.com/user/andreaspark2812/

Copy of Decentralized Finance: Introduction (MBA)

By zpoulos

Copy of Decentralized Finance: Introduction (MBA)

This is the slide deck that I use for a quick introduction to the Decentralized Finance class.

- 876