the card COMMANDMENTS of 2020

discuss the following with each proposal

- What are our goals, specifically, to attract, engage, and retain? Do they consider our new reality?

- Feasibility: Marketing and Card & Lending Services time and effort.

- Marketing channels needed

- Data needed to fulfill campaign

- Target audiences

- Historical data/performance

#1: ACTIVATE YOUR DAMN CARD

- The Issue: We have 700-some non-activated cards since 2017. These cards are costing us $$ to sit on the books

- Understand: Why are members not activating? Are they paying down their balance? Nonchalance?

Scoville Effort Scale: Minimal

Scoville Effort Scale: Minimal

ACTIVATE YOUR DAMN CARD (cont'd)

Proposal:

- At 30 days, send an activation letter reminding them of the benefits they signed up for and say they have an additional 30 days to activate their card or we may close it.

- Customize current activation sticker to say they have 30 days to activate their card or we may close it.

- Marketing to examine letter and language. Is this the best format?

- If no response after 30 days (60 total), call them. If no response after call, wait [XX] days to close.

- Monthly report should be reviewed and worked monthly to minimize fraud, database expenses and potential unnecessary reissues in the future

#2: QUARTERLY CARD NEWSLETTER & WELCOME EMAILs

- The Issue: Members aren't aware of the features of their card. They aren't aware of their cash back or rewards points. This leads to less engagement over time.

- Understand: What features, besides cash back and rewards, are members most interested in? What would they like to see in a newsletter, besides card features? Can this help them on a path to upgrade?

Scoville Effort Scale: Intense

Proposal--Newsletter:

- Send quarterly newsletter to Platinum Rewards and Inspire cardholders. Ideas (if we have the data):

- Spend data: Total purchases, top spending category

- Cash back and rewards points earned YTD

- Upcoming calendar dates to earn points/cash back (if Valentine's Day, for instance, link to Resy.com Chicago to find restaurants)

- Cardmember since date

- Benefits of using in mobile wallets

- Links to blogs about saving money and how to earn the most cash back

QUARTERLY NEWSLETTER & WELCOME EMAILs (Cont'd)

Proposal--Welcome Emails:

- Create just 1 welcome email for each card type.

- We don't have time to create an entire "welcome series" for each card, but an email thanking them, reminding them of any bonuses and benefits, is a good start

QUARTERLY NEWSLETTER & WELCOME EMAILs (Cont'd)

#3: BENEFIT POSTCARDS TO PLATINUM REWARDS

- The Issue: Older members who still mainly rely on paper communication may not be aware of the features and benefits of their card, and they are still our heavy spenders. If they aren't paying attention to email, how can we encourage card usage?

- Understand: What entices certain demographics to use their card, and is it different? For older members, is it a sense of loyalty? Is there any way to measure the success of such a campaign? Any incentive, however small?

Scoville Effort Scale: Spicy

Sales by Age Range: This proves that the older older generation is loyal and loves our cards.

- How do we continue to engage and strengthen the relationship?

- Focus on winning back business from long time cardholders as they become inactive.

BENEFIT POSTCARDS TO PLATINUM REWARDS (cont'd)

Proposal:

- Use SmartGrowth to send out quarterly (bi-annual?) postcards. Each quarter will highlight/remind members of their benefits, especially as it pertains to rewards points options. Q1-Earn unlimited points, Q2 -The perks of cash back, Q3-Refer your friends and family and earn 2,500, 4Q - Gift yourself with gift cards and cash back.

- Get testimonials from members. Show the tangible benefits of rewards points.

- Goal: To generate cardholder loyalty & awareness of Choice Rewards points program.

#4: DIGITAL/mobile WALLET incentive

- The Issue: Credit card spend is plummeting because of the virus, and especially for cards like our which reward travel.

- Understand: Can concern over the virus help people to see that mobile wallets like Apple Pay, Samsung Pay, and Google Pay are more safe and secure? Can an incentive for usage push our cards top of wallet for future purchases?

Scoville Effort Scale: Minimal

Scoville Effort Scale: Minimal

mobile wallet incentive (cont'd)

Proposal:

- Use SmartGrowth to send out an email to eligible cardholders

- $2 for every transaction made with a DCU credit card up to $10 total.

- Show why it is the safer and more secure option

- Encourage folks to activate their cards to earn the incentive

- Congratulations email to follow

#5: streaming services & groceries

- The Issue: COVID-19 is changing spending and it's difficult to determine how significantly card usage will change. But what we can say with certainty is that people still need to eat and the last thing they want to give up is their streaming services. We already canceled the spend and get for May/June, but is this worth prioritizing over another promotion?

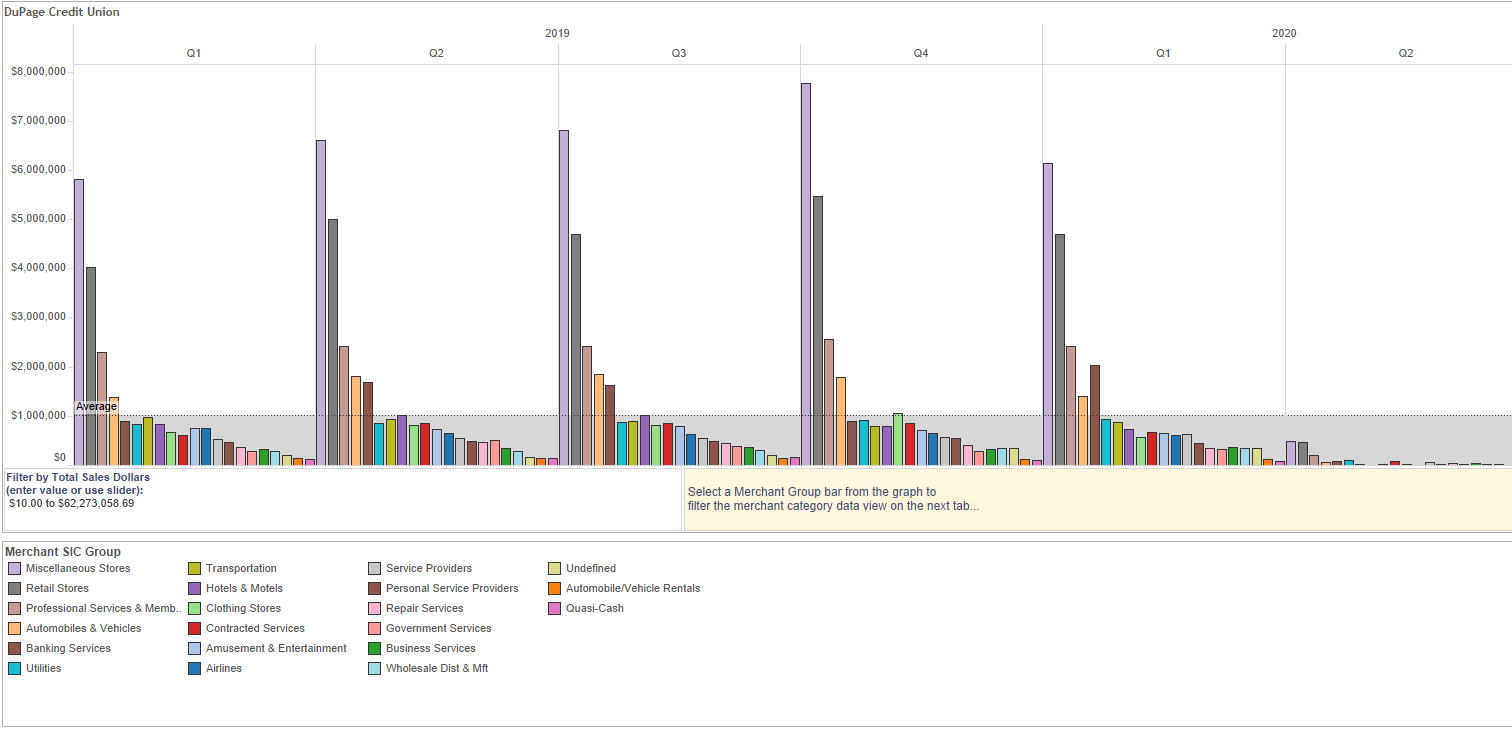

- Understand: How is the pandemic changing card merchant spend?

- Utilize the SmartLook tool to gauge the change.

Scoville Effort Scale: Spicy

Text

Text

Text

Text

Q2-Top Miscellaneous Merchants-Book Stores (Amazon) and Eating places (Uber Eats and Doordash)

Q2-Top Retail Merchants-Grocery/Supermarkets (Jewel and Wal-Mart) and Home Supply (Home Depot and Menards)

#5: streaming services & groceries (cont'd)

The Proposal

- Spend ($XX) in combined streaming services and groceries for June-August, earn ($XX) statement credit.

- Encourage cardholders to switch over their DCU card for streaming services to ensure they hit their spend. In many instances, having our card-on-file, would make our card top-of-wallet for this category in the future.

- Target all current cardholders--existing and *new*, too?

- Prime Days: Cardholders will receive a $25 statement credit after $350 of combined spend for using their card during Amazon Prime Day, Target Deal Days, eBay Crash Sale and Walmart’s Big Sale. TBD for Amazon Prime Day date...

- 3x Rewards: Platinum Rewards cardholders get 3x rewards points during Labor Day weekend in September

- Credit limit increase: November

- Skip-A-Pay reminder: November

- Holiday Spend & Get: In 2019, we gave Rewards cardholders at least 2 rewards points on every purchase, and at least 2% cash back to Inspire cardholders. This year, mid-November to December, proposing a targeted spend and get for each card that could be tier-based. Need to come to consensus.

- Nov-Dec: Redeem your points for a Visa Gift card

- Balance Transfer promotion with Convenience checks: December - February

PLANNED CAMPAIGNS FOR THE REST OF 2020

The Card Commandments 2020

By Alexander J

The Card Commandments 2020

2020 credit card promo ideas

- 682