Digital Branch Transformation

Digital branch transformation requires a holistic approach to customer interaction, not simply a dying physical high street presence complemented by remote online alternatives. The most effective branch transformations consider the customer journey as a single continuum, from online to offline. This article will cover Relationship-driven branch transformation, Self-service zones, and BI tools. Ultimately, we will look at Human less branches, becoming the most popular branch type.

Relationship-Driven Branch Transformation

Bank branches are on the verge of a radical transformation, and it is a pivotal moment for the industry. Customers demand more services and convenience than ever before, and traditional branch designs are not conducive to this. Banks can accommodate these new customer expectations by integrating technology and retail banking spaces. Relationship-driven branch transformation is one such solution, integrating banking technology with retail environments, creating an enhanced customer experience.

To achieve this goal, banks need to rethink their branch strategy regarding digital engagement. For example, one large European bank is retooling its employee interaction with customers. Routine transactions have been moved to self-service, and employees have been trained to focus on building customer relationships instead of on routine tasks. This digital transformation is necessary for today's Omni channel environment. A customer experience strategy must be in place to make branches more profitable and valuable.

Self-Service Zone

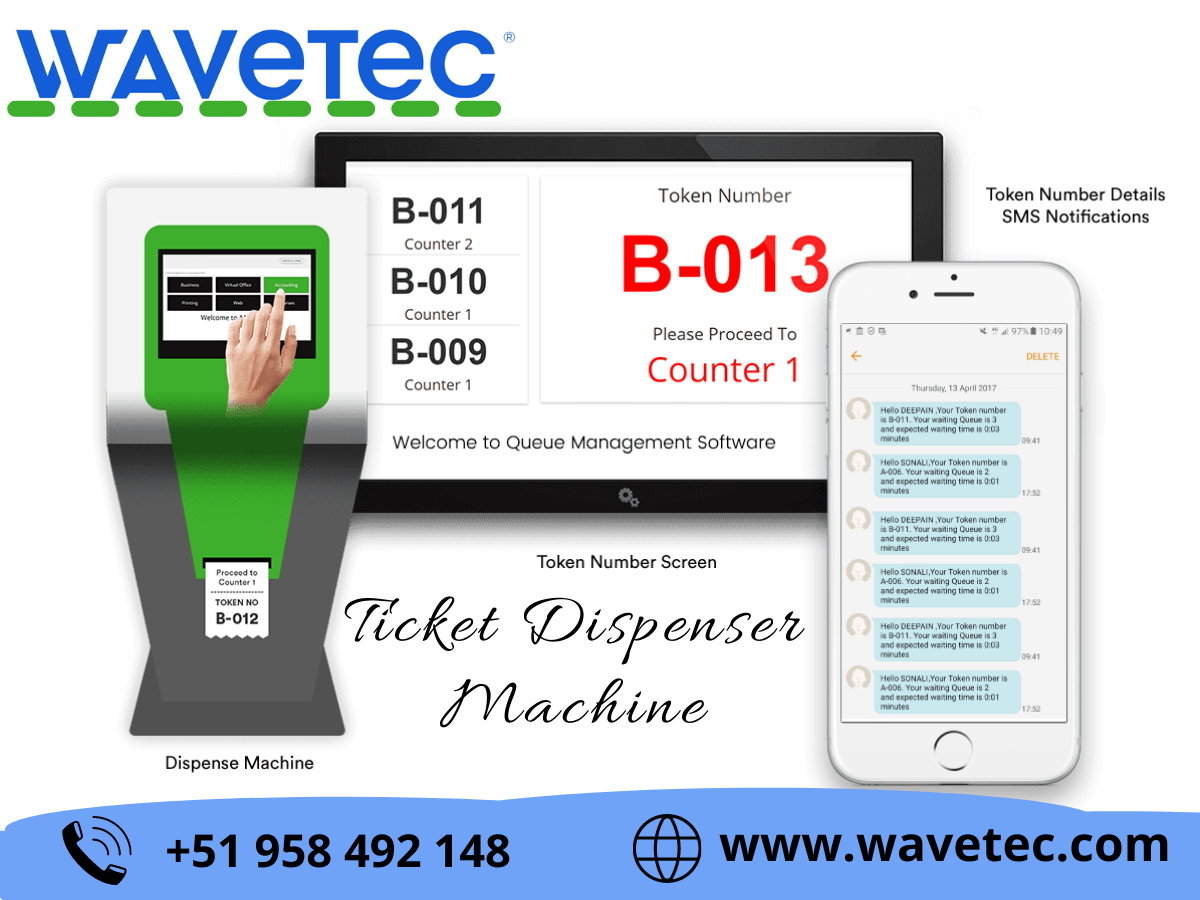

A self-service zone is an essential component of a modern branch, especially if a bank plans to operate with minimal staff. It allows customers to perform routine banking transactions and reduces staffing requirements, including real estate and operating costs. In addition, self-service zones offer an enhanced customer experience since customers can get any banking transaction done with minimal human interaction. For example, they can use mobile devices to check-in at the branch or fill out e-forms.

In addition to embracing the self-service zone, businesses must also consider the overall customer journey transformation. This process must be customer-centric and drive operational costs while maintaining a personalized customer experience. By using self-service technology in branch locations, businesses can extend their hours, increase sales, and reduce operational costs by 50%. In addition, self-service zones can effectively convert leakage from digital-only channels to brick-and-mortar stores. Research shows that branch conversion rates are higher than those achieved through other engagement channels such as contact centers and digital.

BI Tools

BI tools are becoming more critical for modern business. They help organizations gather competitive intelligence and track business projects. They can help companies understand their data better and make decisions based on it. With data warehouses and data lakes, businesses can organize and analyze large volumes of data. BI tools are ideal for this because they allow users to access and analyze the data quickly and provide a user-friendly interface.

Advanced dashboards and business intelligence tools help bank management track real-time workloads and sales results, allowing them to shift resources based on facts and figures. SEDCO's digital branch solutions can assist banks with their transformation to thoughtful digital branches. Its tools allow them to integrate self-service machines, advanced central management, and virtual queueing systems. Once a branch has the latest BI tools and analytics, it can use the data to improve its customer experience.

Human less Branches

Some banks are moving toward a more human less environment. Banks that have gone fully digital are experimenting with the idea of a human less branch. In an attempt to make banking easier for customers, introduced the Pepper robot in a Manhattan branch. Pepper is programmed to answer basic questions and direct customers to the appropriate adviser or personnel in the branch. Another bank, NatWest, recently introduced the AI-powered bot Cora, which can be used for online and mobile banking.

The human aspect of branches cannot be neglected in the face of digitalization. Research shows that most digital customers are acquired within five miles of a branch. This trend is reflected in the number of branches within markets. However, a digital transformation can be efficient and effective without sacrificing the human aspect of branches. Despite the potential for a human less branch, banks must consider the risks and rewards of a digital-only branch.

Costs

One of the most challenging projects for banks today is the transformation of their branches. Transforming branches involves digitization, premises, people, and processes. Banks must consider the impact of digital technologies, balance the pace of digital branch transformation with capital management, and how customers will accept the changes. For example, banks may view the decline in branch transaction volume as an opportunity to reduce costs and increase revenues while improving the customer experience.

A retail bank's operating expenses are primarily devoted to branch expenses. On average, branches account for one-third of the bank's expenses. Branch-related costs are becoming an even more significant concern with the trend toward digital channels. Changing how customers make financial transactions has become a top priority for bank executives, who need to decide what to do with existing branch staff and which to retrain. Understanding the exit strategy for employees is essential as well. Organizations need to create a strategy and plan for the digital channel.

Digital Branch Transformation

By Alexander William

Digital Branch Transformation

Digital branch transformation requires a holistic approach to customer interaction, not simply a dying physical high street presence complemented by remote online alternatives. The most effective branch transformations consider the customer journey as a single continuum, from online to offline.

- 330