Elasticity

Market Demand & Supply

Christopher Makler

Stanford University Department of Economics

Econ 50: Lecture 12

Today's Agenda

Part 1: Elasticity

Part 2: Market Demand and Supply

- Why elasticity?

- Degrees of elasticity

- Calculating elasticity

- Demand elasticities

- Supply elasticities

- Aggregating demand and supply

- How market demand aggregates preferences

Elasticity

Why Elasticity?

Notation

"X elasticity of Y"

or "Elasticity of Y with respect to X"

Examples:

"Price elasticity of demand"

"Income elasticity of demand"

"Cross-price elasticity of demand"

"Price elasticity of supply"

Perfectly Inelastic

Inelastic

Unit Elastic

Elastic

Perfectly Elastic

Doesn't change

Changes by less than the change in X

Changes proportionally to the change in X

Changes by more than the change in X

Changes "infinitely" (usually: to/from zero)

How does the endogenous variable Y respond to a

change in the exogenous variable X?

(note: all of these refer to the ratio of the perentage change, not absolute change)

Using Elasticities

- Suppose the price elasticity of demand is -2.

- This means that each % increase in the price

leads to approximately a 2% decrease in the quantity demanded - Example 1: a 3% increase in price would lead to a ~6% decrease in quantity

- Example 2: a 0.5% decrease in price would lead to a ~1% increase in quantity

- These are approximations in the same way as if \(dy/dx = -2\) along a function, increasing \(x\) by 3 would cause \(y\) to decrease by approximately 6.

General formula:

Linear relationship:

Using calculus:

Multiplicative relationship:

Note: the slope of the relationship is \(b\).

Elasticity is related to, but not the same thing as, slope.

This is related to logs, in a way that you can explore in the homework.

This is a super useful trick and one that comes up on midterms all the time!

Demand Elasticities

How much of a good a consumer wants to buy, as a function of:

- the price of that good

- the price of other goods

- their income

We can ask: how much does the amount of this good change, when one of those determinants changes?

Own-Price Elasticity

What is the effect of a 1% change

in the price of good 1 \((p_1)\) on the quantity demanded of good 1 \((x_1^*)\)?

no change

perfectly inelastic

less than 1%

inelastic

exactly 1%

unit elastic

more than 1%

elastic

-

How does \(x_1^*\) change with \(p_1\)?

- Own-price elasticity

- Elastic vs. inelastic

Three Relationships

Price Elasticity of Demand or Supply: \(\epsilon = \frac{\%\Delta Q}{\%\Delta P}\)

[poll question coming up...]

pollev.com/chrismakler

Cross-Price Elasticity

What is the effect of an increase

in the price of good 2 \((p_2)\) on the quantity demanded of good 1 \((x_1^*)\)?

no change

independent

decrease

complements

increase

substitutes

-

How does \(x_1^*\) change with \(p_1\)?

- Own-price elasticity

- Elastic vs. inelastic

-

How does \(x_1^*\) change with \(p_2\)?

- Cross-price elasticity

- Complements vs. substitutes

Three Relationships

Income Elasticity

What is the effect of an increase

in income \((m)\) on the quantity demanded of good 1 \((x_1^*)\)?

decrease

good 1 is inferior

increase

good 1 is normal

-

How does \(x_1^*\) change with \(p_1\)?

- Own-price elasticity

- Elastic vs. inelastic

-

How does \(x_1^*\) change with \(p_2\)?

- Cross-price elasticity

- Complements vs. substitutes

-

How does \(x_1^*\) change with \(m\)?

- Income elasticity

- Normal vs. inferior goods

Three Relationships

Supply Elasticities

Think about all the things we calculated for the function \(f(L,K)=L^{1 \over 4}K^{1 \over 4}\)

LONG RUN

SHORT RUN

LONG RUN

SHORT RUN

What is the output elasticity of conditional labor demand in the short run and long run?

Intuitively, why this difference?

In the long run, the firm uses

both labor and capital to increase output;

in the short run, it only increases labor.

Supply Elasticities

Think about all the things we calculated for the function \(f(L,K)=L^{1 \over 4}K^{1 \over 4}\)

LONG RUN

SHORT RUN

LONG RUN

SHORT RUN

What is the price elasticity of supply

in the long run and short run?

Intuitively, why this difference?

In the long run, the firm can adjust its capital to keep its costs down; so its marginal cost rises less steeply, and its supply curve is flatter.

Supply Elasticities

Think about all the things we calculated for the function \(f(L,K)=L^{1 \over 4}K^{1 \over 4}\)

LONG RUN

SHORT RUN

Work with a partner:

How would the firm respond to a

6% increase in the wage rate in the long run?

pollev.com/chrismakler

How would the firm respond to a

6% increase in the wage rate in the long run?

A 6% increase in w decreases y by 3%.

and decreases by 6% (due to the -3% change in y),

for a total decrease of 9%.

K increases by 3% (due to the +6% change in w)

L decreases by 3% (due to the +6% change in w)

and decreases by 6% (due to the -3% change in y),

for a total decrease of 3%.

How would the firm respond to a

6% increase in the wage rate in the long run?

A 6% increase in w decreases y by 3%.

and decreases by 6% (due to the -3% change in y),

for a total decrease of 9%.

L decreases by 3% (due to the +6% change in w)

Note: we can calculate the LR profit-maximizing demand for labor:

What did we just show?

- If there is a direct causality \(X \rightarrow Y\), elasticity measures how Y responds to X.

- If there is a chain of causality \(X \rightarrow Y \rightarrow Z\), the elasticity composes just like a function does (like the chain rule for elasticity)

Market Demand and Supply

Individual and Market Demand

Individual demand curve, \(d^i(p)\): quantity demanded by consumer \(i\) at each possible price

Market demand sums across all consumers:

If all of those consumers are identical and demand the same amount \(d(p)\):

There are \(N_C\) consumers, indexed with superscript \(i \in \{1, 2, 3, ..., N_C\}\).

Market demand curve, \(D(p)\): quantity demanded by all consumers at each possible price

Market demand sums across all consumers:

Individual and Market Supply

Firm supply curve, \(s^j(p)\): quantity supplied by firm \(j\) at each possible price

Market supply sums across all firms:

If all of those firms are identical and supply the same amount \(s(p)\):

There are \(N_F\) competitive firms, indexed with superscript \(j \in \{1, 2, 3, ..., N_F\}\).

Market supply curve, \(S(p)\): quantity supplied by all firms at each possible price

How Demand

Aggregates Preferences

NOTATION AHEAD

STAY FOCUSED ON

ACTUAL ECONOMICS

Special Case: Cobb-Douglas

Suppose each consumer has the utility function

where the \(\alpha\)'s all sum to 1.

We've shown before that if consumer \(i\)'s income is \(m\), their demand for good \(k\) is

quantity demanded of good \(k\) by consumer \(i\)

consumer \(i\)'s preference weighting of good \(k\)

consumer \(i\)'s income

price of good \(k\)

There are 200 people, and they each have \(\alpha = \frac{1}{2}, m = 30\)

Suppose there are only two goods, and each consumer has the utility function

So consumer \(i\) will spend fraction \(\alpha_i\) of their income \(m_i\) on good 1:

Market demand:

number of consumers

quantity demanded by each consumer

Note: total income is \(200 \times 30 = 6000\), so this means the demand is the same "as if" there were one "representative agent" with \(\alpha = \frac{1}{2}, m = 6000\)

Individual demand:

Now suppose there are two types of consumers:

Again there are only two goods, and each consumer has the utility function

100 low-income consumers who don't like this good: \(\alpha_L = \frac{1}{4}, m_L = 20\)

100 high-income consumers who do like this good:\(\alpha_H = \frac{3}{4}, m_H = 40\)

(demand from

low-income)

(demand from

high-income)

Market demand:

Individual demand:

Note: total income is \(100 \times 20 + 100 \times 40 = 6000\), so this means the demand is the same "as if" there were one "representative agent" with \(\alpha = \frac{7}{12}, m = 6000\)

Conundrum

In both cases, average income was 30 and average preference parameter \(\alpha\) was \(\frac{1}{2}\).

When everyone was identical, it was "as if"

there was a representative agent with all the money

with preference parameter \(\alpha = \frac{1}{2}\).

When rich people had a higher \(\alpha\), it was "as if"

there was a representative agent with all the money

with preference parameter \(\alpha = \frac{7}{12} > \frac{1}{2}\).

Feel free to tune out the intermediate steps, but hang on to the econ...

How market demand aggregates preferences

If consumer \(i\)'s demand for good \(k\) is

then the market demand for good \(k\) is

where \(M = \sum m_i\) is the total income of all consumers

and \(\alpha_k\) is an "aggregate preference" parameter.

Conclusion: we can model demand from \(N_C\) consumers with Cobb-Douglas preferences

"as if" they were a single consumer with "average" Cobb-Douglas preferences.

so what is \(\alpha_K\)?

If everyone has the same income (\(m_i = \overline m\) for all \(i\)), then demand simply aggregates preferences:

Let \( \overline m = M/N_C\) be the average income. Then we can rewrite market demand as:

\(\alpha_K\)

But if there is income inequality, \(\alpha_k\) gives more weight to the prefs of those with higher income.

\(=1\)

Example: consider an economy in which rich consumers like a good more:

100 low-income people with \(\alpha_L = \frac{1}{4}, m_L = 20\),

100 high-income people with \(\alpha_H = \frac{3}{4}, m_H = 40\)

Average income is \(\overline m = 30\), total income is \(M = 6000\)

So, market demand is

closer to \(\alpha_H\) than \(\alpha_L\)

Example, revisited

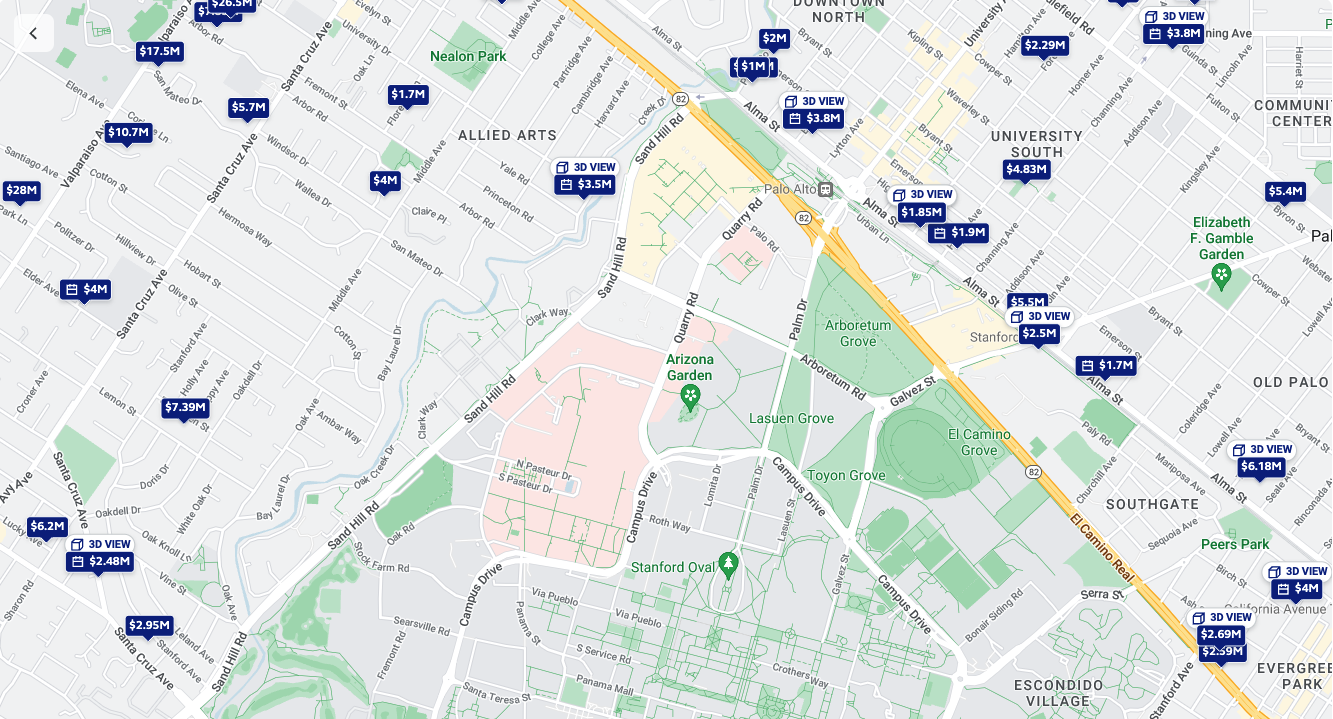

Source: trulia.com, 5/12/22

Conclusion: Aggregating Preferences

You can model market demand as reflecting the preferences of a single representative agent.

But...know that you're weighting the preferences of richer people more.

Econ 50 | Fall 2022 | 12 | Market Demand

By Chris Makler

Econ 50 | Fall 2022 | 12 | Market Demand

- 869