Oligopoly, Part II

Christopher Makler

Stanford University Department of Economics

Econ 51: Lecture 8

Review of Last Time

Simple case: linear demand, constant MC, no fixed costs

Baseline Example: Monopoly

14

2

units

$/unit

14

P

Q

Baseline Example: Monopoly

14

2

units

$/unit

14

P

Q

Profit

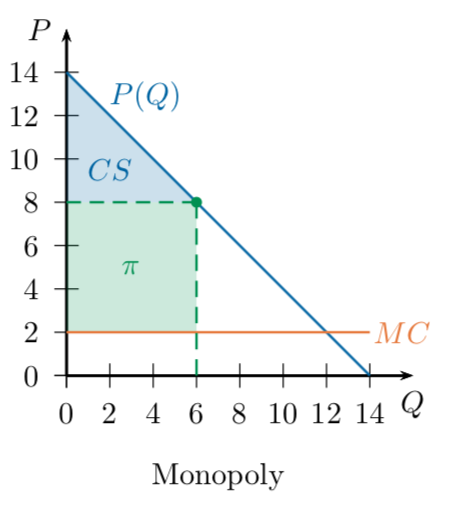

Baseline Example: Monopoly

14

8

2

6

Q

P

36

Quantity Duopoly

- Two firms ("duo" in duopoly)

- Each chooses how much to produce

- Market price depends on

the total amount produced - Each firm faces a residual demand curve

based on the other firm's choice

Quantity Leadership Model

- Firm 1 chooses how much to produce first \(q_1\),

at a cost of $2 per unit - Firm 2 observes firm 1's choice,

and then chooses how much to produce \(q_2\),

also at a cost of $2 per unit - The market price is determined by \(P(q_1,q_2) = 14 - (q_1+q_2)\)

- Profits are realized

- \(\pi_1(q_1,q_2) = (14 - [q_1 + q_2]) \times q_1 - 2q_1\)

- \(\pi_2(q_1,q_2) = (14 - [q_1 + q_2]) \times q_2 - 2q_2\)

How will firm 2 react to firm 1's quantity?

2

P

"Firm 2's Residual Demand Curve"

Firm 2's "reaction function"

Today's Agenda

Part 1: Simultaneous Move (Cournot)

Part 2: Infinitely Repeated Cournot

(cartels and collusion)

Each firm chooses its quantity

simultaneously and independently

Each firm "best responds" to what it believes the other firm will do

In Cournot equilibrium, each firm's beliefs are correct.

Firms are engaged in an ongoing relationship (produce every period)

If they collude by producing less than in Cournot equilibrium, they can raise their joint profits

Can cartel behavior be sustained even if each firm has an incentive to produce just a bit more...?

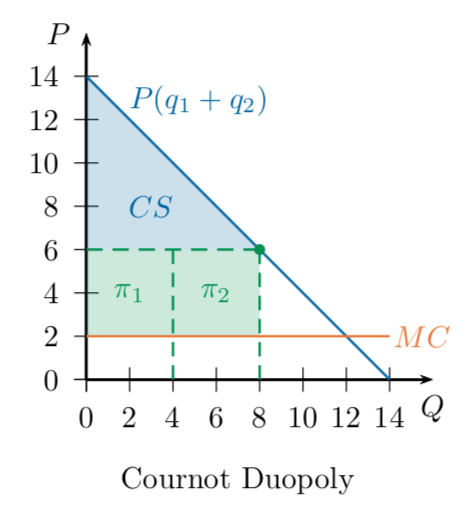

Cournot Duopoly

- Same setup as last time:

- two firms each choose their own quantity

- market price is determined by the total quantity produced

- Difference: timing

- before, firm 1 moved first; firm 2 observed \(q_1\) and chose \(q_2\).

- now: each firm chooses simultaneously and independently,

based on their belief about what the other firm will do - "best response function" says what the firm should do for each possible belief

- In Cournot equilibrium, each firm's belief about what the other firm does is correct.

- neither firm would want to change their output choice

once they learned what the other firm did

- neither firm would want to change their output choice

Before: how does firm 2 react if it observes firm 1 produce \(q_1\) units of output?

Firm 2's

reaction function

Now: what should firm 2 choose if it believes firm 1 will produce \(\hat q_1\)?

Firm 2's

best response function

Before: what should firm 1 choose if it knows that \(q_2 = r_2(q_1) = 6 - {1 \over 2}q_1\)?

Optimal first move

Now: what should firm 1 choose if it believes firm 2 will produce \(\hat q_2\)?

Best response function

Stackelberg Model:

Firm 1 chooses first,

firm 2 observes \(q_1\) and chooses \(q_2\)

Firm 1's optimal move

Cournot Model:

Both firms choose simultaneously and independently

Firm 1's

best response function

Firm 2's

reaction function

Firm 2's

best response function

Firm 1 makes its choice knowing firm 2 will observe and react to it.

Each firm makes its choice based on its beliefs about what the other firm will do.

(fundamentally asymmetric)

(symmetric)

Cournot Model:

Both firms choose simultaneously and independently

Firm 1's

best response function

Firm 2's

best response function

In equilibrium, each firm is

correct in its beliefs (so \(q_1 = \hat q_1\) and \(q_2 = \hat q_2\) ),

so each firm's quantity is a best response to the other firm's quantity.

Why is this different from Stackelberg?

In Stackelberg, firm 1 produced 6;

firm 2 observed this and produced 3.

If firm 1 believed firm 2 was going to produce 3 (and not observe firm 1's choice, so firm 1 can choose whatever it wants without consequence), what should firm 1 choose?

If firm 1 chose 4.5, what would firm 2 choose?

and on and on...

Another way of thinking about this:

if everyone knows everything about this model (and everyone knows that everyone knows everything about this model), what do each of the firms know about the other firm's beliefs?

Each firm knows the other

will never produce more than 6.

Because \(6 - {1 \over 2}6 = 3\),

this means each firm knows the other

will never produce less than 3.

Because \(6 - {1 \over 2}3 = 4.5\),

this means each firm knows the other

will never produce more than 4.5.

The only set of quantities that survives this is (4,4).

Profits in Cournot Equilibrium

Each firm is producing 4 units, so the market price is \(14 - 4 - 4 = 6\).

Each unit costs $2, so each firm is making

$4 of profit on 4 units = $16.

Remember our monopoly: it produced 6 units,

sold them at a price of 8, and earned a total profit of 36.

If each of these two firms produced 3 units, they could earn 18...

so why don't they?

Collusion

Repeated Games

- Analyze ongoing relationships

- Strategies are based on the history of all actions taken over the course of the relationship

- Agents can make promises or threats about how they will behave in the future

- Model as an "infinitely repeated game"

Evaluating Infinite Payoffs

The present value of a stream of payoffs

(\(\pi_0\) now, \(\pi_1\) in the next period, \(\pi_2\) two periods from now, etc)

may be given by the sum

The present value of a stream of payoffs of \(x\) in every period is

Value of getting payoff \(x\) forever, starting now:

Value of getting payoff \(z\) forever, starting next period:

Value of getting payoff \(y\) now and then payoff \(z\) forever after:

Monopoly: produces 6, profit of 36

Cournot equilibrium: each firm produces 4, receives profit of 16

Possible collusion: each firm produces 3, receives profit of 18

Best possible deviation: if the other firm produces 3,

produce 4.5, receive payoff of 20.25.

Sustaining Collusion

Should you deviate?

Suppose the other player is playing the grim trigger strategy:

"I will collude and play 3 as long as you collude and play 3.

If anyone has ever defected and not played 3, I will play the Cournot quantity of 4 forever."

Payoff from Colluding

Payoff from most profitable defection

Assume the other player is playing the grim trigger strategy:

"I will collude and play 3 as long as you collude and play 3.

If anyone has ever defected and not played 3, I will play the Cournot quantity of 4 forever."

Main Takeaway

- Cooperative (collusive) behavior can be sustained if agents are involved in an ongoing relationship and can make promises/threats about the future

- Their success depends on how much each agent values future payoffs.

- If you value the future a great deal, you're willing to go along with the relationship.

- If you're impatient and want to make a quick buck, you'll stab them in the back.

Section This Week

- Look at similar models in which firms choose price, not quantity

- Hotelling: firms are geographically separated; consumers care both about price and how close they are to the firm

- Bertrand with differentiated products: firms sell "weak substitutes" for one another; the higher your competitor's price is, the greater the demand for your product

Econ 51 | Fall 2022 | 8 | Oligopoly II

By Chris Makler

Econ 51 | Fall 2022 | 8 | Oligopoly II

- 722