Execution Algorithms 101

Problem Definition

- Two variables: Time and Price

- Liquidity

- Bid-Ask Spread

A simple algorithm

def buy_sell_logic(self, update):

# Check if the time limit has exceeded

if self.watch.ts >= self.exec_request.end_time:

self._time_exceeded(update)

return

if self.om.num_orders() == 0:

# Send limit order

order_price = self.book.passive_price(self.buysell, num_ticks=0)

order = self.om.create_order('L', self.buysell, self.size, order_price)

self.om.send_order(order)How to check if we did a good job?

Metrics

- Arrival Mid Price

- Arrival Aggressive Price

- VWAP

- TWAP

- Implementation Shortfall

Execution Algorithm Improvements

def divide_orders(self):

self._sub_orders = []

for i in range(self.num_orders):

order_size = max(self.size // self._num_orders, 100)

self._sub_orders.append(order_size)

def buy_sell_logic(self, update):

# Check if the time limit has exceeded

if self.watch.ts >= self.exec_request.end_time:

self._time_exceeded(update)

return

# Get the current bucket number

bucket = self._get_bucket()

if self.om.num_orders() == 0 and bucket > self._current_bucket:

# Send limit order

order_size = self._sub_orders[bucket]

order_price = self.book.passive_price(self.buysell, num_ticks=0)

order = self.om.create_order('L', self.buysell, order_size, order_price)

self.om.send_order(order)More Improvements

Passive TWAP algorithm

def divide_orders(self):

self._sub_orders = []

for i in range(self.num_orders):

order_size = max(self.size // self._num_orders, 100)

self._sub_orders.append(order_size)

def buy_sell_logic(self, update):

# Check if the time limit has exceeded

if self.watch.ts >= self.exec_request.end_time:

self._time_exceeded(update)

return

# Get the latest top price

order_price = self.book.passive_price(self.buysell, 0)

if self.om.num_orders() > 0:

if time_diff >= self._interval:

# Modify to improve/aggressive price

self.om.modify_price(self.buysell, order_price)

# Get the current bucket number

bucket = self._get_bucket()

if self.om.num_orders() == 0 and bucket > self._current_bucket:

# Send limit order

order_size = self._sub_orders[bucket]

order_price = self.book.passive_price(self.buysell, num_ticks=0)

order = self.om.create_order('L', self.buysell, order_size, order_price)

self.om.send_order(order)Production setup

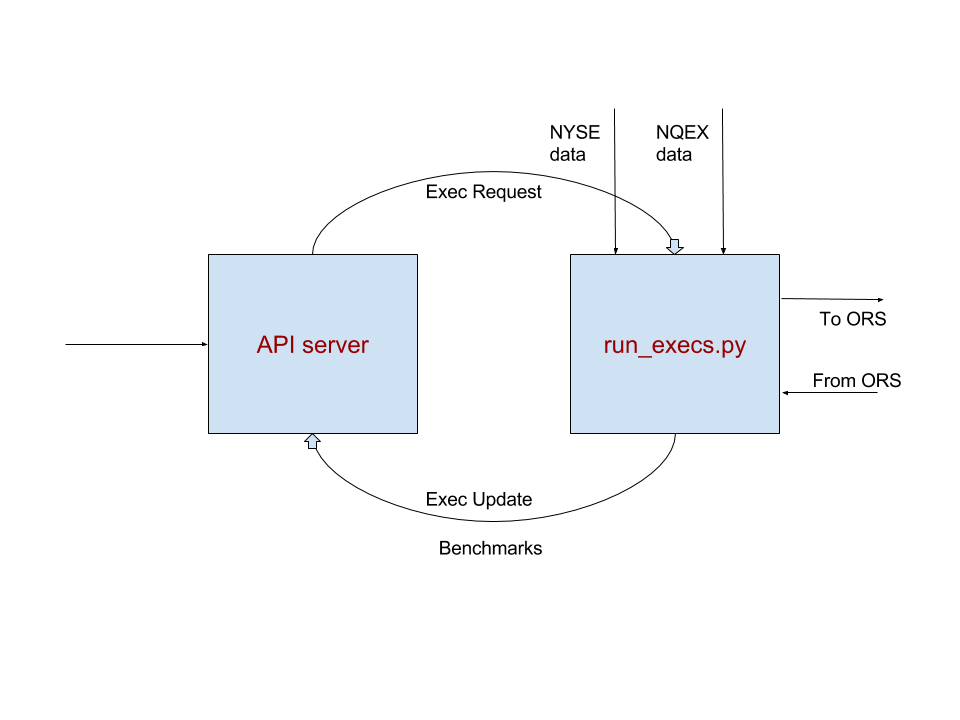

- API server receives the orders and passes them to the run_execs.py process through RabbitMQ.

- API server maintains the status of the order including the benchmarks.

- Benchmarks as well as the order status updates are sent from run_execs.py process.

Production setup

Issues with prices

- Nanex process fetches the live prices. We push the "important" updates in binary format to kafka. (We have not benchmarked this operation.)

- For NASDAQ, the prices are fetched from Google/Yahoo/Robinhood. This affects both the trading and the benchmarking.

- There are often issues with the price APIs - creating more issues in reliably measuring the performance.

- Backtests are likely to have inferior results on average - this is due to the presence of hidden orders in market.

Issues with IB

- BUY orders have to wait till SELL orders get completed.

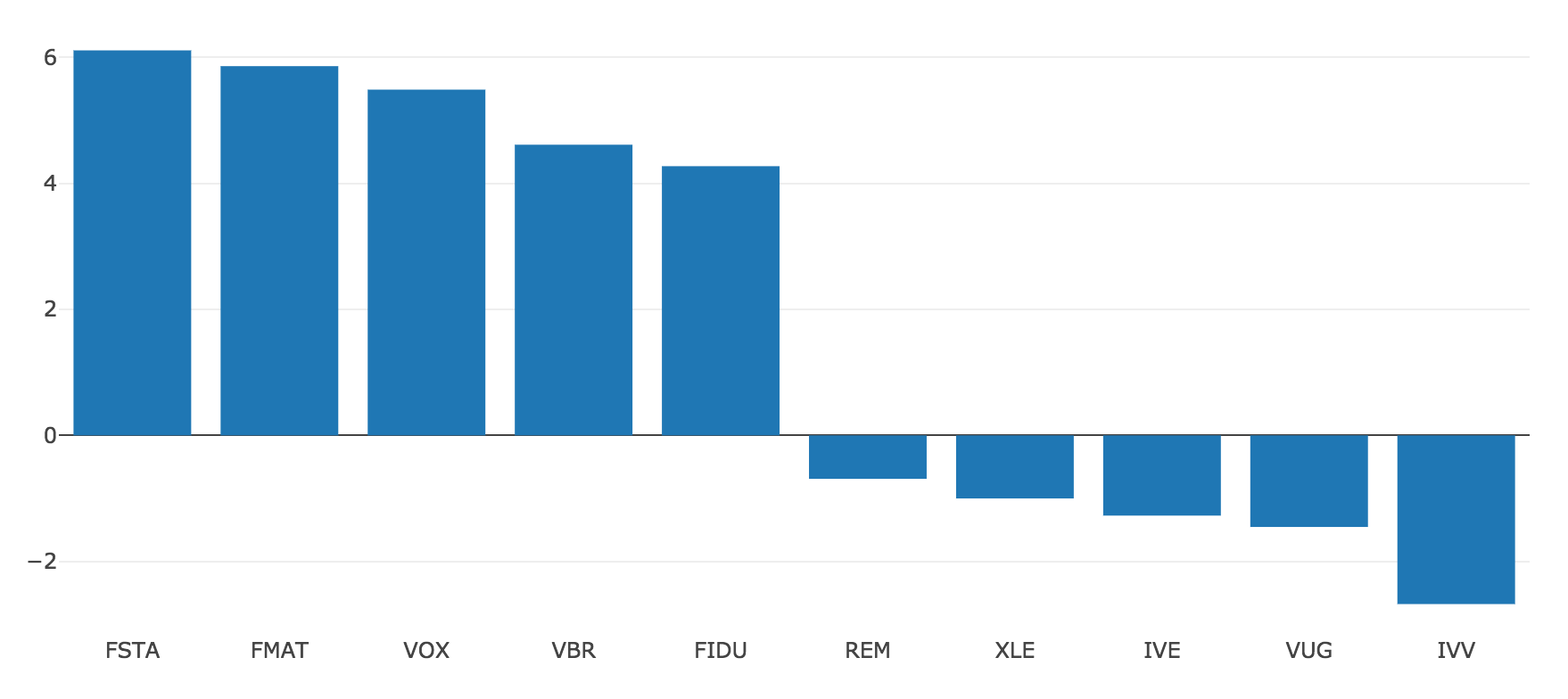

APEX results by securities

APEX results by securities

| Security | Average PNL (bps) |

|---|---|

| FSTA | 6.11 |

| FMAT | 5.86 |

| VOX | 5.49 |

| VBR | 4.61 |

| FIDU | 4.27 |

APEX results by securities

| Security | Average PNL (bps) |

|---|---|

| IVV | -2.68 |

| VUG | -1.45 |

| IVE | -1.27 |

| XLE | -1.00 |

| REM | -0.69 |

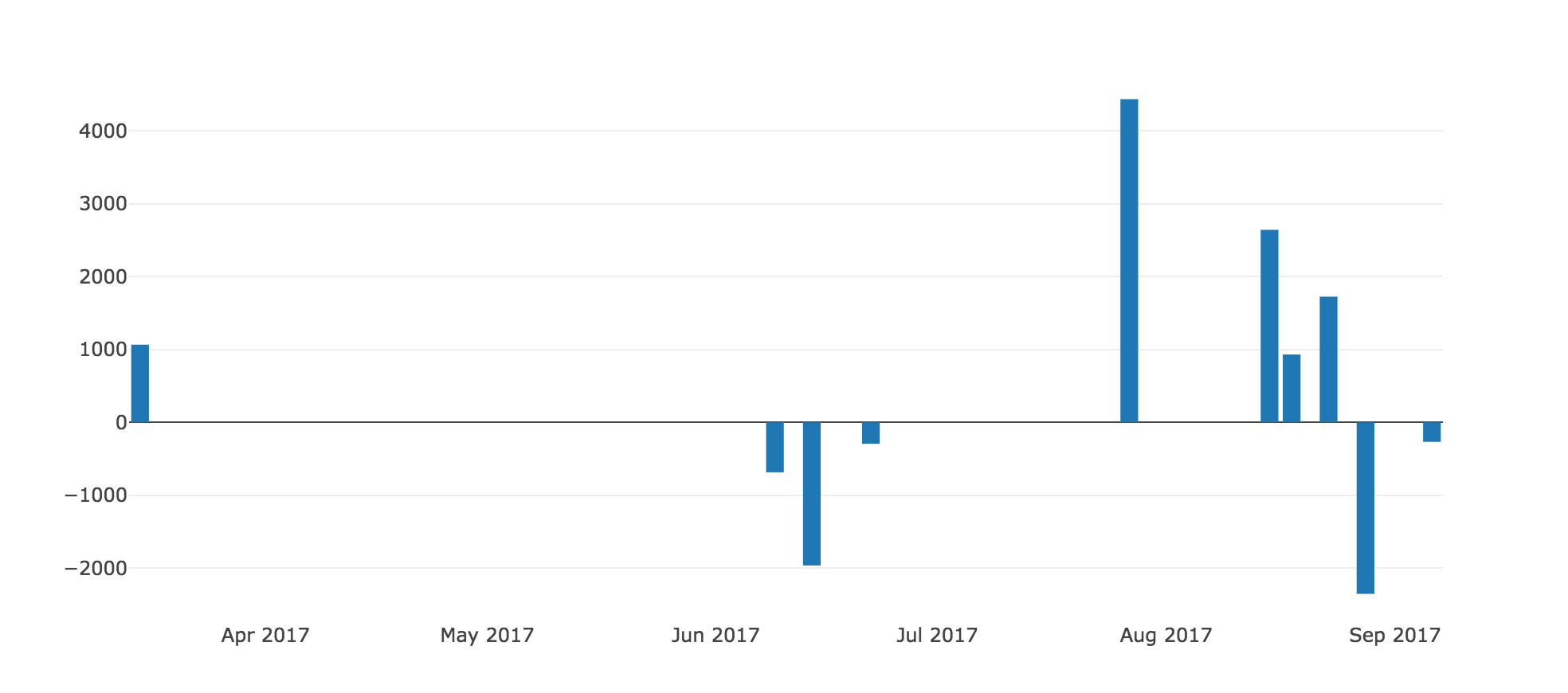

APEX results by date

APEX results by date

| Date | Total PNL ($) |

|---|---|

| 2017-07-27 | 4435 |

| 2017-08-15 | 2642 |

| 2017-08-23 | 1725 |

| 2017-03-15 | 1066 |

| 2017-08-18 | 932 |

APEX results by date

| Date | Total PNL ($) |

|---|---|

| 2017-08-28 | -2353 |

| 2017-06-14 | -1964 |

| 2017-06-09 | -685 |

| 2017-06-22 | -293 |

| 2017-09-06 | -267 |

APEX results by size

| Size | Average PNL (bps) |

|---|---|

| <500 | 1.20 |

| >=500 | 1.05 |

Next steps

Execution Algorithms 101

By Hardik Patel

Execution Algorithms 101

- 1,133