riskval financial solutions

Over a decade of providing premium analytics to the most sophisticated players in the financial services industry

RV PORTFOLIO PRODUCT OVERVIEW

- 55 employees

- 24/6 support

- 220 trading strategies

- 50 institutional clients

RV Portfolio

RiskVal's pretrade analytics with integrated real-time P&L and risk are used at many of the world's top hedge funds

Portfolio Management

P&L Explanation

Scenario Analysis

Value-at-Risk

Graphs & Charts

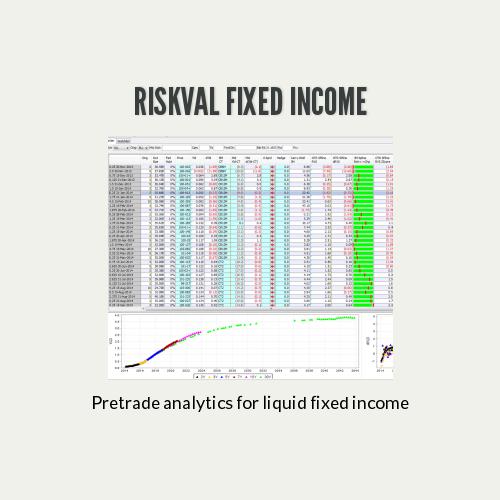

pretrade analytics

portfolio management

p&l explanation

scenario analysis

value-at-risk

graphs & Charts

key benefits

-

RV Portfolio is a comprehensive suite of tools that help advisers manage and report on risk. Within a single platform, advisers can monitor real-time P&L across multiple portfolios, run scenario analyses, calculate value-at-risk, and feed downstream reporting systems.

-

RV Portfolio offers real-time spot and forward bucket risk analysis, as well as real-time P&L with respect to each bucket.

-

Emerging regulation such as the Dodd-Frank Act and the Alternative Investment Fund Managers Directive require hedge funds to report more information to regulators than ever before. RV Portfolio calculates many of the risk measures required by reports such as Form PF.

- RV Portfolio is deployed as a hosted platform-as-a-service with integrated market data.

managed services

Follow-the-sun support from New York, London and Taipei.

RiskVal products are supported by a global team of analysts, quants and developers who are directly available 24/6.

The quality of RiskVal's support is so high that our clients frequently see us as an extension of their own teams.

coverage

-

Treasuries

-

Swaps

-

Basis swaps

-

Swaptions

-

Caps/Floors

-

FX spots & forwards

-

FX options

-

Listed Options

-

Agencies

-

Mortgage TBA

-

CMBS

-

Inflation-linked bonds

-

Repos

-

Bond futures

contact

info@riskval.com

212-631-0808

Request a demo or trial of RV Portfolio today.

RV HF Overview

By mb

RV HF Overview

Hedge fund overview.

- 142