Brazilian economic uncertainty and its impact on investments

Why do we have a big data problem?

Is economic uncertainty an important issue?

Why do we have a big data problem?

- web-scraping technique [we are crawling the most important Brazilian media sources];

- Over 6 million news items collected in our database;

- Hadoop, elasticsearch, SparklyR package, Media API;

- Machine learning [supervised and unsupervised methods];

- Uncertainty app to classify the news

Is economic uncertainty an important issue?

-

“The Dog that Barked” - Steven J. Davis

Is economic uncertainty an important issue in the USA?

Is economic uncertainty an important issue for us?

Historical periods that have affected the economic uncertainty indicator

Is economic uncertainty an issue?

Lula advocating for the non payment of the fiscal external debt

Lula criticizing the monetary stability plan (Real)

"No one needs to teach me the importance of controlling inflation."

"We will preserve the primary surplus to prevent domestic debt from rising and destroying confidence in the government's ability to honor its commitments."

Is economic uncertainty an issue?

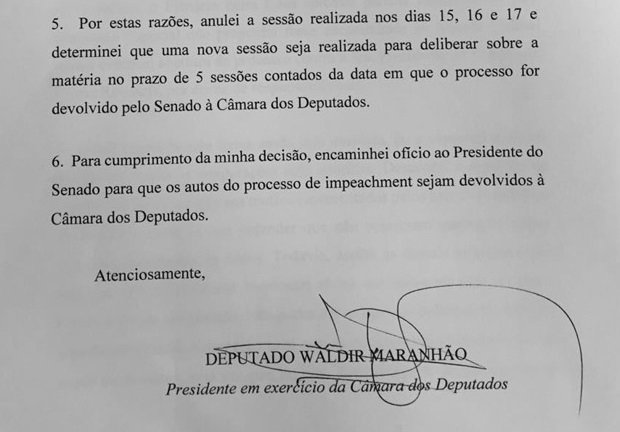

April 15th and 17th

Impeachment proceedings is initiated against Dilma

Dilma is Impeached

May 9th

Waldir Maranhão [interim president of the chamber of deputies] tries to annul the impeachment

May 10th

August 31th

Waldir Maranhão revokes his cancelation

Is economic uncertainty an issue?

Is economic uncertainty an issue?

Brazil in the uncertainty

Is economic uncertainty an issue?

Temer is recorded giving approval to the purchase of Cunha's silence [this is an opinion of O Globo]

Is economic uncertainty an issue?

Partial before JBS audio was leaked

Partial after JBS audio was leaked

17

this is the number of times that the Central Bank has cited the word uncertainty in the minutes of the Meeting of the Monetary Policy Committee [May 2017]

"If sustained over a long period, high levels of uncertainty regarding the evolution of reforms and adjustments in the economy can have detrimental effects on economic activity."

source: O Globo (https://goo.gl/E1yd1v).

8

17

24

26

27

35

1989

1995

2000

2005

2010

2017

Total of parties in Brazil

Is economic uncertainty an issue?

How the economic uncertainty impacts the economy?

- Uncertainty is the people's inability to forecast the likelihood of events happening. In contrast, risk is people's known probability distribution over known events [Frank Knight, 1921];

- Bernanke states that under uncertainty, the firms prefer "wait and see" to get more information and, then, to make the investments;

- Uncertainty is damaging for short-run growth, reducing firms’ willingness to hire and invest, and consumers’ willingness to spend [Bloom, 2013]

How we are measuring the economic uncertainty

Brazilian Economic Uncertainty Indicator

IIE-Br

In adherence with the international literature, our indicator is composed by:

IIE-Br = 0.7 x Media + 0.2 x Expectation + 0.1 x Market

compound indicator

IIE-Br

Media

IIE-Br

Expectation

IIE-Br

Market

Maximizing the negative effect of IIE-Br on industrial production (via IRF)

IIE-Br Media

IIE-Br Media

Mention of uncertainty

- Term related to the economy: econ

- Terms related to the uncertainty: incert, crise, instab

Basically, the indicator is measuring the economic uncertainty taking into account the frequency of the news related to the theme;

IIE-Br Media

Online

Printed

| Medias | Type | Total of the news |

|---|---|---|

| Folha de São Paulo | Printed | 178750 |

| Folha de São Paulo | Online | 864741 |

| Valor Econômico | Printed | 245910 |

| Valor Econômico | Online | 424947 |

| Jornal O Globo | Online | 409638 |

| Estadão de São Paulo | Online | 225320 |

| Correio Braziliense | Online | 33255 |

| Zero Hora | Online | 184782 |

Printed media

Online media

IIE-Br Media

IIE-br Media - compound indicator

IIE-Br Expectation

IIE-Br Expectation

Assumptions

- Coefficient of variation [to correct the difference of scale]

- Market experts forecast 12 steps ahead

- Top 5 Award [better sample and most commitment with the forecasts]

Dates

Basically, the indicator is measuring the differences among the market forecasts, that is, if all the forecasts are different we have economic uncertainty

| Critical date | Date of collection | |

|---|---|---|

| IPCA | IPCA 15 disclosure | Day prior to IPCA-15 disclosure |

| Câmbio | First business day of the month | Last business day of previous month |

Brazilian official CPI

Exchange rate [US/BRL]

IIE-Br Expectation

IIE-Br Expectation - compound indicator

IIE-Br Market

The indicator estimates the uncertainty based on the variability of the Brazilian stock market

Used data

- Daily Closed price of IBOVESPA

- Monthly volatility [coefficient of variation]

IIE-Br Market

Economic uncertainty - Brazil and World

Brazilian Economic Uncertainty and Global Economic Policy Uncertainty [Bloom, Baker and Davis]

Out/02

Presidential Election

Out/08

Collapse of the Lehman Brothers

Ago/11

U.S.A credit-rating was downgraded

Ago/15

Brazilian credit-rating was downgraded

111,0

IRF - IIE-Br and GEPU

Time series of Brazilian Private Investment

This work follows the same methodology applied by Manoel Pires et. al. (2007) and José Roberto Afonso et. al. (2015) in which private investment was calculated in a residual way, e.g:

Private

Investments

Total Investments (GFCF)

Public Investment

=

-

Public Investment

Federal Gov. Inv.

=

+

State Gov. Inv.

+

City Halls' Inv.

State-owned Enterprises Inv.

+

Private investment vs Inverted Economic uncertainty

VAR model

the impact of uncertainty shocks

In order to investigate the effects of uncertainty on private investments, the exercise proposed by Bloom (2009) was replicated.

The use of a VAR model is suggested in order to investigate the impact of uncertainty shocks on the other variables of the model.

The variables introduced were the ones as follows:

- Dummy of the Brazilian Uncertainty Indicator indicating level higher than 110.

- Ex Ante Real interest rate

- Unit Labor Cost

- Index of Economic Activity of the Central Bank (IBC-Br),

- Level of Capacity Utilization (NUCI)

- Private Investments’ time series

- Commodities Index (exogenous variable)

IRF (private investment and IIE-Br)

The challenges continue...

The challenges continue ...

Partnership with EMAp

Development of the historical time series

Classify the news using Machine Learning techniques

Crawlers maintenance

New historical time series starting in 1985

Machine Learning techniques to classify the news

Challenges faced day by day: constant maintenance of the crawlers, try to increase the sample, construct a new data bank, get financing, develop partnerships, etc.

IIE-BR Team

Nowcasting

Nowcasting package

CRAN

install.packages('nowcasting')

Github

devtools::install_github('nmecsys/nowcasting')

What it does

Estimate nowcasting using Dynamic Factor Models as in:

•Bańbura, M., & Rünstler, G. (2011). A look into the factor model box: publication lags and the role of hard and soft data in forecasting GDP

•Bańbura, M., & Giannone, D & Reichlin, L. (2011). Nowcasting.

•Giannone, D., Reichlin, L., & Small, D. (2008). Nowcasting: the real-time informational content of macroeconomic data.

•Mariano, R. S., & Murasawa, Y. (2003). A new coincident index of business cycles based on monthly and quartely series.

•Stock, J. H., & Watson, M. (2011). Dynamic factor models.

Create Brazilian real-time data base

•Get in real-time the data available in Brazilian Central Bank Time Series Management System v2.1

•Re-create a subset of the information set available on specific date

To do list

Translate functions from Matlab to R

Create routine to extract information in real-time

Create data bank in SQL to store the past vintages

Write a R package to facilitate the replication and studies of these methodologies

Amplify the data bank available from different sources (IBGE & IPEA)

Extend the available vintages to a recent past

Create functions to estimate the importance of the news

Optimize the estimation using other Kalman Filter packages as fkf for instance

Final remarks

- We are making strong efforts to follow the macroeconomic variables using big data techniques;

- Economic uncertainty indicator;

- Time series of private investments;

- Nowcasting;

- Other researches: Brazilian CPI with web prices; Partnership with Superintendence of Private Insurance (SUSEP) [more than 30 GB of data]; new methods of core inflation; BETS (Brazilian Economic Time Series) package, etc.

THANK YOU!

Pedro Costa Fereira - pedro.guilherme@fgv.br

[+55 21 971054843]

workshop BACEN 2017-11-09 - short version

By Pedro Ferreira

workshop BACEN 2017-11-09 - short version

apresentação sobre o indicador de incerteza da economia para o BCB

- 1,214