Applications of fractional diffusion in option pricing

Jan Korbel

Slides available at: slides.com/jankorbel

Personal web: jankorbel.eu

VCMF 2025

Option pricing

- Black-Scholes model

- Based on ordinary Brownian motion

-

In financial crises or in complex markets, the model cannot catch realistic market dynamics

- large drops

- sudden shocks

- memory effects

- Finite moment log-stable model (Carr and Wu 2003)

- based on Lévy-stable fractional diffusion

- enables large drops

- We generalize the models by using the space-time fractional diffusion equation

Fractional diffusion

- Black-Scholes model is based on diffusion equation

$$ \left( \partial_t - \mu \partial_{xx}^2 \right) g(x,t) = 0$$

- We extend it to the case of fractional diffusion

$$ \left({}^*_0 \mathcal{D}^\gamma_t - \mu \ {}^\theta \mathcal{D}_x^{\alpha}\right) g(x,t) = 0$$

- Caputo derivative: \( {}^*_{t_0} \mathcal{D}^\gamma_t f(t) = \frac{1}{\Gamma(\lceil \gamma \rceil - \gamma)} \int_{t_0}^t \mathrm{d} \tau \frac{f^{\lceil \gamma \rceil}(\tau)}{(t-\tau)^{\gamma + 1 - \lceil \gamma \rceil}}\)

- Riesz-Feller derivative: \(\mathcal{F}[{}^{\theta} \mathcal{D}^\alpha_x f(x)](k) = -|k|^\alpha e^{i \, \mathrm{sign}(k) \theta \pi/2} \mathcal{F}[f(x)](k) \)

- \(\gamma=1\) - Carr-Wu model

- \(\gamma=1,\alpha=2\) - Black-Scholes model

[1] Physica A 449 (2016) 200-214

Solution of the Fractional diffusion

Solution can be found by taking the Fourier-Laplace transform

$$g_{\alpha,\theta,\gamma}(k,s) = \frac{s^{\gamma-1}} {s^{\gamma} -{|k|}^\alpha e^{i \, \mathrm{sign}(k) \theta \pi/2} }$$

It can be transformed back in terms of Mellin-Barnes transform

$$g_{\alpha,\theta,\gamma}(x,t) = \frac{1}{2 \pi i} \frac{1}{\alpha x} \int_{c-i \infty}^{c+i \infty} \frac{\Gamma(\frac{y}{\alpha}) \Gamma(1-\frac{y}{\alpha})\Gamma(1-y)}{\Gamma(1-\frac{\gamma}{\alpha} y)\Gamma(\frac{\alpha-\theta}{2 \alpha} y) \Gamma(1- \frac{\alpha-\theta}{2 \alpha} y)} \left(\frac{x}{-\mu t}\right)^y \mathrm{d} y$$

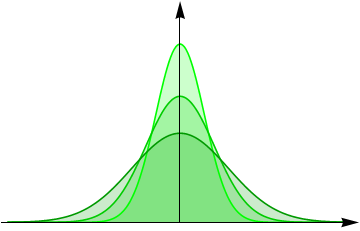

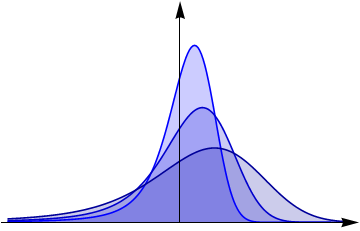

Solution of fractional diffusion

- \(\gamma=1, \alpha=2\) - ordinary Gaussian diffusion

- \(\gamma=1, \alpha<2\) - Lévy-stable diffusion

- \(\gamma \neq 1, \alpha=2\) - diffusion with memory

- \(\gamma \neq 1, \alpha<2\) - space-time fractional diffusion

[6] Mathematics 7 (9) (2019) 796

Space-time fractional option pricing

Price of European call option: $$C(S,K,\tau) = \int_{-\infty}^\infty \max\{S e^{(r+\mu) \tau + x}-K,0\} g_{\alpha,\theta,\gamma}(x,\tau) \mathrm{d} x$$

Interpretation of parameters:

- \(\theta = \max\{-\alpha, \alpha-2\}\)

- maximally asymmetric distribution

- power-law probability of drops (negative Lévy tail)

- Gaussian probability of rises (positive exponential tail

- \(\alpha < 2\) - risk redistribution to large drops

- \(\gamma \) - risk redistribution in time

- \(\gamma < 1\) shorter contracts are more risky

- \(\gamma > 1\) longer contracts are more risky

[1] Physica A 449 (2016) 200-214; [3] Fractal Fract. 2 (1) (2018) 15

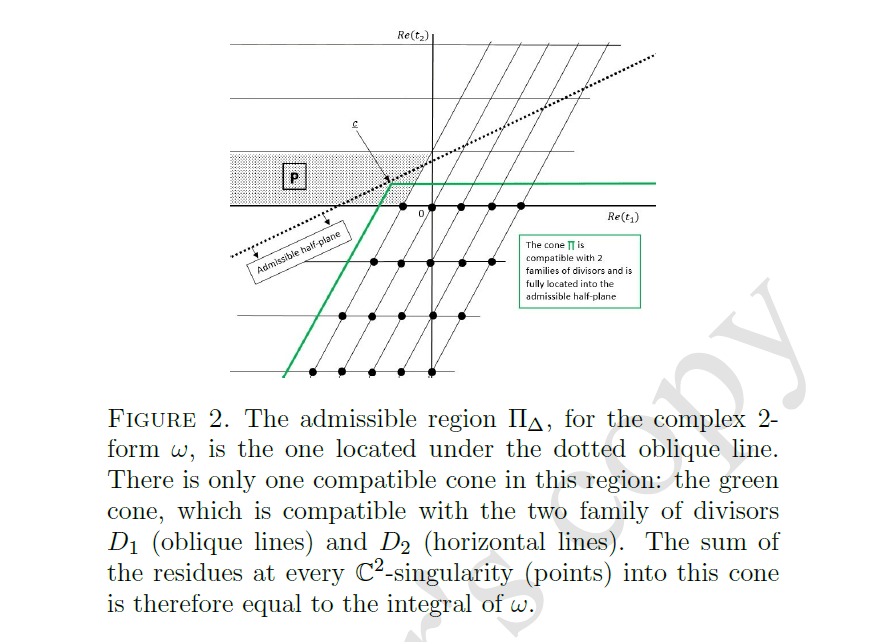

Differential 2-form representation

We can rewrite the option price via Mellin-Barnes representation: $$C(S,K,\tau) = \frac{K e^{-r \tau}}{\alpha} \int_{c_1 - i \infty}^{c_1 + i \infty} \int_{c_2 - i \infty}^{c_2 + i \infty} (-1)^{t_2} \frac{\Gamma(t_2)\Gamma(1-t_2)\Gamma(-1-t_1+t_2)}{\Gamma(1-\frac{\gamma}{\alpha}t_1)}$$

$$\times\left(- \log\frac{S}{K}-(r+\mu) \tau\right)^{1+t_1-t_2}(-\mu\tau)^{-t_1/\alpha} \frac{\mathrm{d}t_1}{2\pi i}\wedge \frac{\mathrm{d} t_2}{2 \pi i}$$

This can be compactly represented as an integral over a complex differential 2-form:

$$C(S,K,\tau) = \frac{K e^{-r \tau}}{\alpha} \int_{\vec{c} + i \mathbb{R}^2} \omega$$

Its characteristic vector is \(\Delta = (-1+\frac{\gamma}{\alpha},1)\)

As a result, the integral can be expressed as a sum of residues, which can be simply written as a double sum

Residues of the differential 2-form

Slide title

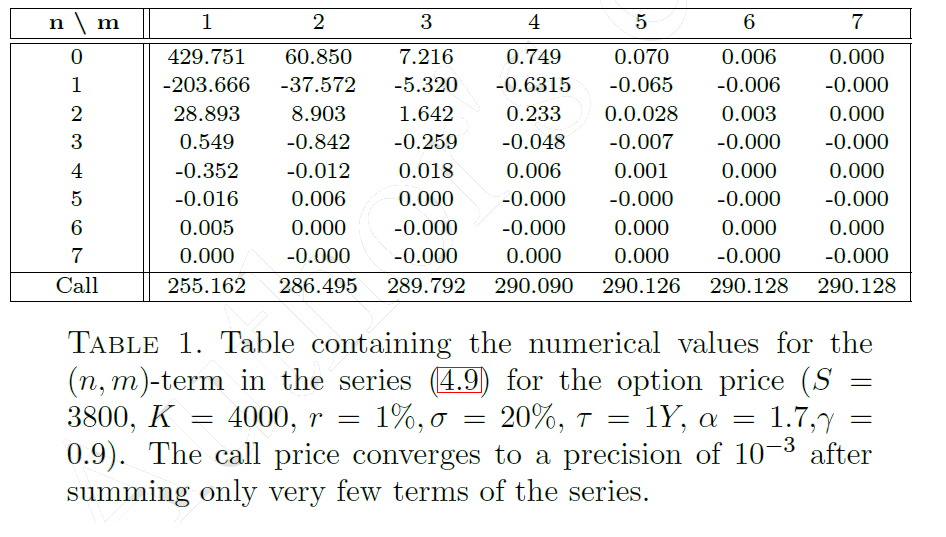

By using residue summation in \(\mathbb{C}^2\) it is possible to express the price in terms of rapidly-convergent double series ( \(\mathcal{L} = \log \frac{S}{K} + r \tau\) )

$$C(S,K,\tau) = \frac{K e^{-r \tau}}{\alpha} \sum_{n=0}^\infty \sum_{m=1}^\infty \frac{1}{n! \Gamma\left(1 + \frac{m-n}{\alpha}\right)}(\mathcal{L}+\mu \tau)^{n}(-\mu \tau)^{\frac{m-n}{2}}$$

[4] Fract. Calc. Appl. Anal. 21 (4) (2018) 981-1004

Applications to exotic options and the Greeks

- Analogous results can be applied to exotic types of options

- Cash-or-nothing \(C(S,K,0) = \Theta(S-K)\)

- Asset-or-nothing \(C(S,K,0) = S \times \Theta(S-K)\)

- Additionally, similar formulas can be derived for risk sensitivities (the Greeks), including

- Delta \(\Delta = \frac{\partial C}{\partial S}\)

- Rho \(\rho = \frac{\partial C}{\partial r}\)

- Gamma \(\Gamma = \frac{\partial^2 C}{\partial S^2}\)

- Specific results can be found in

- [5] Risks 7 (2) (2019) 36; 10.3390/risks7020036

- [6] Mathematics 7 (9) (2019) 796; 10.3390/math7090796

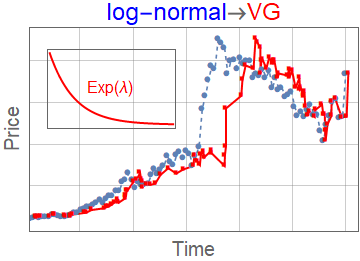

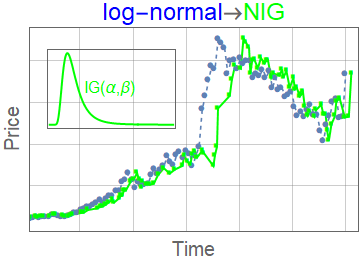

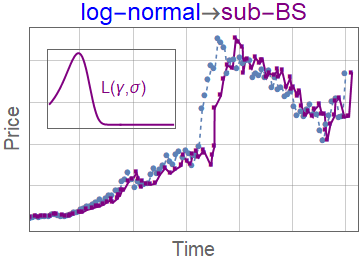

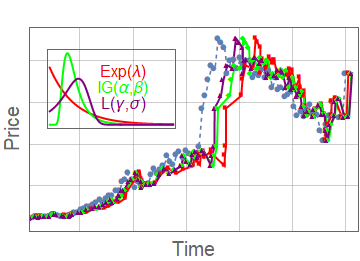

Subordinator representation

\(g_{\alpha,\theta,\gamma}(x,t)\) can be represented as a subordinated process

$$g_{\alpha,\theta,\gamma}(x,t) = \int_0^\infty \mathrm{d} l K_\gamma(t,l) L_{\alpha}^\theta(l,x)$$

- \(L_{\alpha}^\theta(l,x)\) - Lévy-stable distribution with scaling parameter \(l\)

- \(K_\gamma(t,l\) - subordinator (smearing kernel)

- \(K_\gamma(t,l) = \frac{t}{l^{1+1/\gamma} \gamma} L_\gamma^{\gamma}\left(\frac{t}{l^{1/\gamma}}\right)\)

- We compare with other subordinated models

- Variance gamma \(K_\lambda(t,l) = \lambda e^{\lambda (-t/l)}\)

- Negative inverse-gamma \(K_{\alpha,\beta}(t,l) = \frac{e^{-\frac{\beta }{t/l}} \left(\frac{\beta }{t/l}\right)^{\alpha }}{t/l \Gamma (\alpha )}\)

[1] Physica A 449 (2016) 200-214; [8] Risks 8 (4) (2020) 124

Slide title

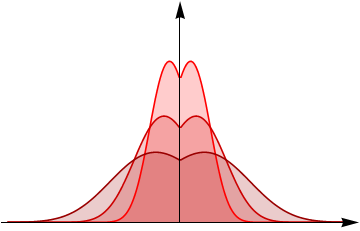

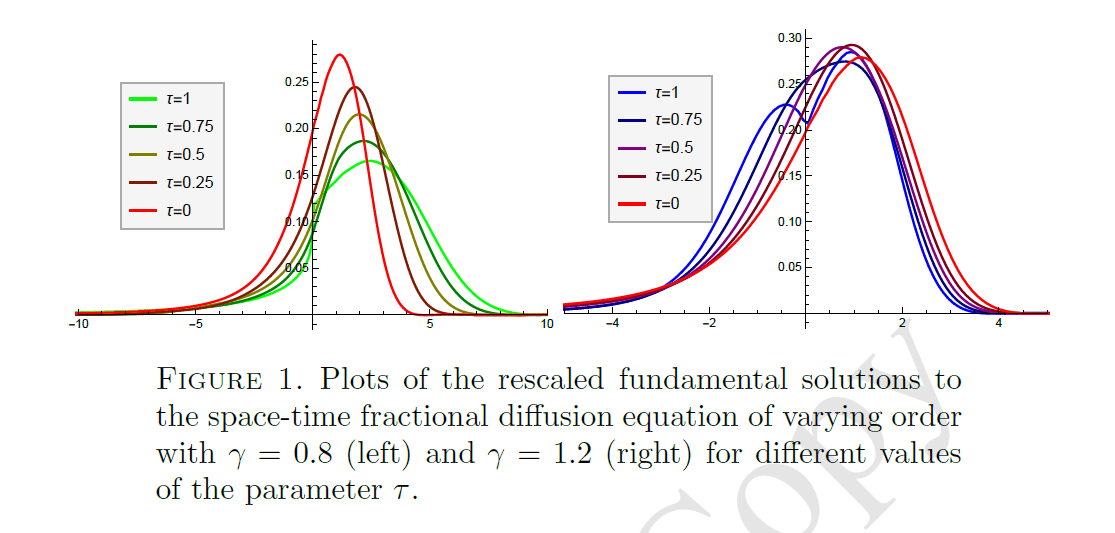

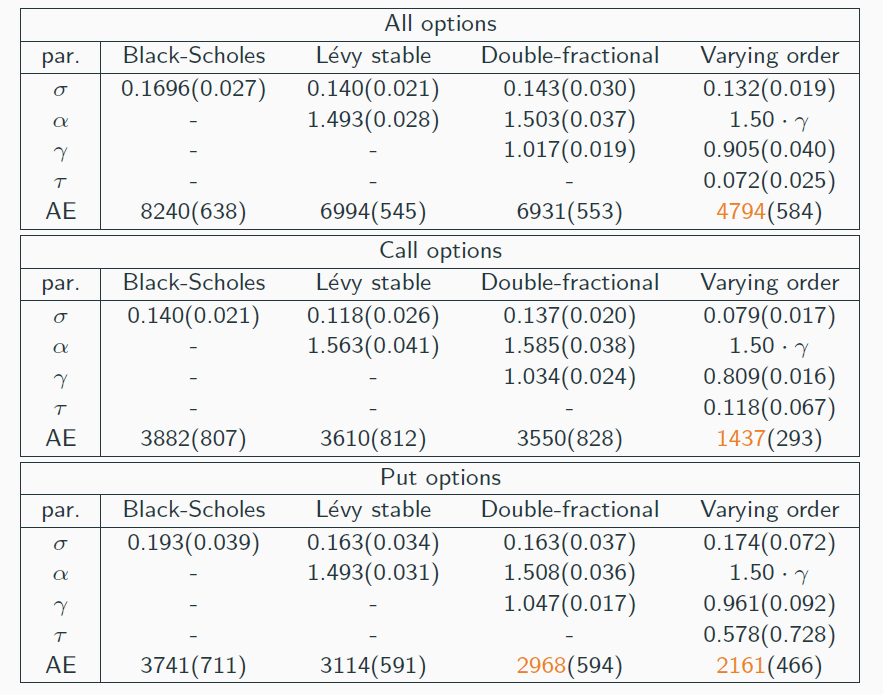

Space-time fractional option pricing with derivatives of varying order

- One of the important aspects of financial markets is switching between different regimes - boom vs crisis

- Long-term scaling properties remain stable for each stock.

- This requires a time-dependent description by fractional diffusion of varying order.

- For each time period, we estimate the parameters

[2] FCAA 19 (6) (2016) 1414-1433

- Let us define intervals \(T_i = (t_i ; t_{i+1})\)

- Dynamics described by a space-time fractional diffusion in each interval $$ \left({}^*_{t_i} \mathcal{D}^{\gamma_i}_t - \mu \ {}^\theta \mathcal{D}_x^{\Omega \gamma_i}\right) g(x,t) = 0$$ with initial conditions: \(g_i(x,t_i) := g_{i-1}(x,t_i)\), \(g_0(x,0) := f(x)\)

- For \(\gamma_i > 1\) we add \(\frac{\partial g_i(x,t)}{\partial t} |_{t=t_i} = 0\)

- The overall solution is given as a convolution $$g(x,t) = f(x) \star g_0(x,t_1-t_0) \star \dots \star g_i(x,t-t_i) \qquad \mathrm{for} \ t \in T_i$$

Space-time fractional option pricing with derivatives of varying order

- The stable parameter is defined as \(\alpha_i = \Omega \gamma_i\) so that \(\Omega = \frac{\alpha_i}{\gamma_i}\) remains the same among all intervals \(T_i\) and characterizes the scaliung of \(g(x,t) \mathrm{d}{x} = \frac{1}{t^{\Omega}} g\left(\frac{x}{t^{\Omega}}\right) \mathrm{d}{x}\)

- Omega can be estimated e.g., from diffusion entropy analysis \(S(t) = - \int g(x,t) \ln g(x,t) = S(1) + \Omega \ln t\)

- This can be used, e.g., to model diffusion in a temporally abnormal period (crisis)

- We distinguish two intervals

- short-term behavior affected by immediate dynamics

- long-term behavior characterized by scaling properties

Space-time fractional option pricing with derivatives of varying order

- This regime switch can be described by \(g(x, t)\) as an overlap between space-time fractional

diffusion (\(t \leq \tau\) ) and Lévy flight (\tau \leq t). - Considering \(\Omega\) as a system-characterized scaling exponent we obtain $$g(x,t) = \left\{ \begin{array}{ll} g^{\theta}_{\Omega \gamma,\gamma}(x,t) & t \leq \tau \\ \left[ g^{\theta}_{\Omega \gamma,\gamma}(\tau) \star L_\Omega^\theta(t-\tau) \right](x) & t > \tau \end{array}\right.$$

Space-time fractional option pricing with derivatives of varying order

Space-time fractional option pricing with derivatives of varying order

Extensions to more sophisticated fractional derivatives

[7] FCAA 23 (4) (2020) 996-1012

- We also generalize the time-fractional derivative to a more generalized operator - Hilfer-Prabhakar derivative.

- We define the following functions:

- Generalized Mittag-Leffler function $$E^{\gamma}_{\rho,\mu}(t) := \sum_{k=0}^{\infty} \frac{\Gamma(\gamma+k)}{\Gamma(\gamma)\Gamma(\rho k + \mu)}t^k$$

- Rescaled GML function $$e^\gamma_{\rho,\mu,\omega}(t) := t^{\mu-1} E^{\gamma}_{\rho,\mu}(\omega t^\rho) $$

- Prabhakar integral $$(I^{\gamma}_{\rho,\mu,\omega,0+} f)(t) := \int_0^t (t-y)^{\mu-1} E^{\gamma}_{\rho,\mu}[\omega(t-y)^\rho]f(y) \mathrm{d} y$$

Extensions to more sophisticated fractional derivatives

- Prabhakar derivative $$(D^{\gamma}_{\rho,\mu,\omega,0+} f)(x) := \frac{d^m}{d x^m}(I^{-\gamma}_{\rho,m-\mu,\omega,0+}f)(x)$$

- Generalized Hilfer-Prabhakar derivative $$(D^{\gamma,\mu,\nu}_{\rho,\omega,0+} f)(x):= (I^{-\gamma \nu}_{\rho,\nu(n-\mu),\omega,0+} \frac{\mathrm{d}^n}{\mathrm{d} x^n} I^{-(\gamma)(1-\nu)}_{\rho,(1-\nu)(n-\mu),\omega,0+} f)(x)$$

- The log-price evolution is then driven by the fractional diffusion equation $$D^{\gamma}_{\rho,\mu,\omega,0+} g(x,t) = \kappa \frac{\mathrm{d}^2}{\mathrm{d} x^2} g(x,t)$$

- The initial conditions are: \(g(x,0) = f(x)\), \(\frac{\partial g(x,t)}{\partial t} |_{t=0} = h(x)\)

- We can then calculate the value of the European call option if the underlying stock is driven by the aforementioned FDE

Extensions to more sophisticated fractional derivatives

$$g(x,t) =c^+ g^+(x,t) \xi_{x\geq 0}(x)+c^- g^-(x,t) \xi_{x<0}(x)$$

$$g^+(x,t)=\sum_{n=0}^\infty \Phi_{-2n}(x) (-\kappa)^n e^{\gamma n}_{\rho,\mu n+1,\omega}(t)$$

$$g^-(x,t)=\sum_{n=0}^{\infty}\frac{|x|^{2n+1}}{(2n+1)!\kappa^{n+1}}{e}^{-\gamma(n+1)}_{\rho,-\mu(n +1)+1,\omega}(t)$$

The fundamental solution of the FDE:

Thus, the option price can be expressed as

$$C(S,K,\tau) = c^+ C^+(S,K,\tau) + c^- C^-(S,K,\tau)$$

Extensions to more sophisticated fractional derivatives

$$ C^+(S,K,\tau) = \max\{S e^{(r+q)\tau}-K,0\} + \phi_K(S e^{(r+q)\tau}) \sum_{n=1}^\infty (-\kappa)^n e^{\gamma n}_{\rho,\mu n+1,\omega}(\tau)$$

$$C^-(S,K,\tau) = \sum_{n=0}^{\infty}\frac{1}{(2n+1)!\kappa^{n+1}} {e}^{-\gamma(n+1)}_{\rho,-\mu(n+1)+1,\omega}(\tau)$$ $$ \times \left(e^{(r+q) \tau} \gamma(2(n+1),\log(Se^{(r+q)\tau}/K)) \frac{K \ (\log(S e^{(r+q)\tau}/K))^{2(n+1)}}{2(n+1)} \right)$$

where \(\phi_K(x) = x\) if \(x > K\) and \(\phi_K(x) =0\) if \(x< K\), and \(\gamma\) is the incomplete gamma function. One can similarly express the negative part.

The positive part of the call price is

csh.ac.at

References:

[1] Physica A 449 (2016) 200-214; 10.1016/j.physa.2015.12.125

[2] Fract. Calc. Appl. Anal. 19 (6) (2016) 1414-1433; 10.1515/fca-2016-0073

[3] Fractal Fract. 2 (1) (2018) 15; 10.3390/fractalfract2010015

[4] Fract. Calc. Appl. Anal. 21 (4) (2018) 981-1004; 10.1515/fca-2018-0054

[5] Risks 7 (2) (2019) 36; 10.3390/risks7020036

[6] Mathematics 7 (9) (2019) 796; 10.3390/math7090796

[7] Fract. Calc. Appl. Anal. 23 (4) (2020) 996-1012; 10.1515/fca-2020-0052

[8] Risks 8 (4) (2020) 124; 10.3390/risks8040124

[9] Mathematics 9(24), 3198;10.3390/math9243198

Applications of fractional diffusion in option pricing - VCMF 2025

By Jan Korbel

Applications of fractional diffusion in option pricing - VCMF 2025

- 108