Options Basics &

Using Options as Stock Insurance

Background

- How I got interested in Options

- Motivation

- Disclaimers

- Not good at Stock Picking

- Have not traded options (yet)

Options

- Options are contracts

- Tradable like stock (have value apart from the underling)

- Optional for the buyer

- Obligatory for the seller (there are ways out)

- Contract terms (1w, 1m, 3m, 6m, 1y, 1y+)

- Can be exercised at any time

- Sold in 100 stock units

Terms

- The Underlying

- Optionable

- Premium

- Exercising (American vs European)

- Strike (At-the-money, In-the-money, Out-of-the-money)

- Bullish / Bearish

- Long / Short

- Covered / Naked

- Assignment

What is Stock

- Ownership of a share in profits

- Bullish Investment

- Risky (Can lose entire investment)

Option Types

Call & Puts

Buyers (long) & Sellers (short)

Calls

-

The right to buy stock (Call away)

-

Makes money when the stock price goes up

-

Typically a Bullish position

-

Mimics buying stocks (synthetic stock)

-

As a seller you must have the stock (covered) or a margin account

At-the-money call (40 Strike): $2

Puts

-

The right to sell stock

-

Makes money when the stock price goes down

-

Functions like insurance

-

Typically a Bearish position

-

Mimics shorting stocks

-

Sellers require a margin account

At-the-money put (40 Strike): $2

Functions like Shorting Stock without the risk

Question

What kind of options are company options?

(Calls or Puts)

Advanced Options Strategies

- Combine 2 or more options trades

- Make money any way a stock moves (up, down, stagnant)

- Common Strategies

- Spreads

- Condors

- Straddles

- Strangle

- Butterfly

Option Pricing Components

- Intrinsic Value (amount in-the-money)

- Time Value

Stock: $100

Option (110 Strike): $11

Intrinsic Value: $10

Time Value: $1

Problems with Stocks & Options

- Always expire worthless

- Overleveraging

- Possible to have unlimited loss

- Covered Calls effectively sort out winning stocks

- Can become worthless

- Impossible to time highs and lows

- Limit orders are vulnerable to price gaps

Options:

Stock:

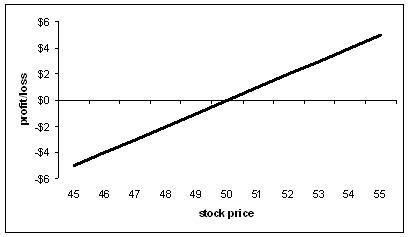

The Solution: Married Puts

- Stock married to a Put Option (2 Leg investment)

- a.k.a Protective Put

- This create insurance on the stock price

- Far out expirations loose Time Value slowly

- Trade the option to capture gains (Rolling the Put)

- This strategy works in IRAs

- No margin account needed

Stock: $52 x 100 = $5200

Option (52 Strike): $4 x 100 = $400

Total Investment: $5600

At Risk: $400 (7.14%) at Expiration

More reasons to do this:

- Prevent loss of already winning stocks

- Lock in gains now and sell later (next year)

- Trade stock knowing maximum loss

- Potentially have a year to make sell desisions

1. "Rule No.1: Never lose money. Rule No.2: Never forget rule No.1" - Warren Buffet

Next Step

- Find Married Puts

- Find position adjustments

- Make the trade riskless

- Notifications

lets build the App!

Additional Strategies

- Sell Puts then Sell Calls

Options Basics

By Tim Santeford

Options Basics

- 2,022