Health Care Reform: The Affordable Care Act and Beyond

What was Coverage Like Before the ACA?

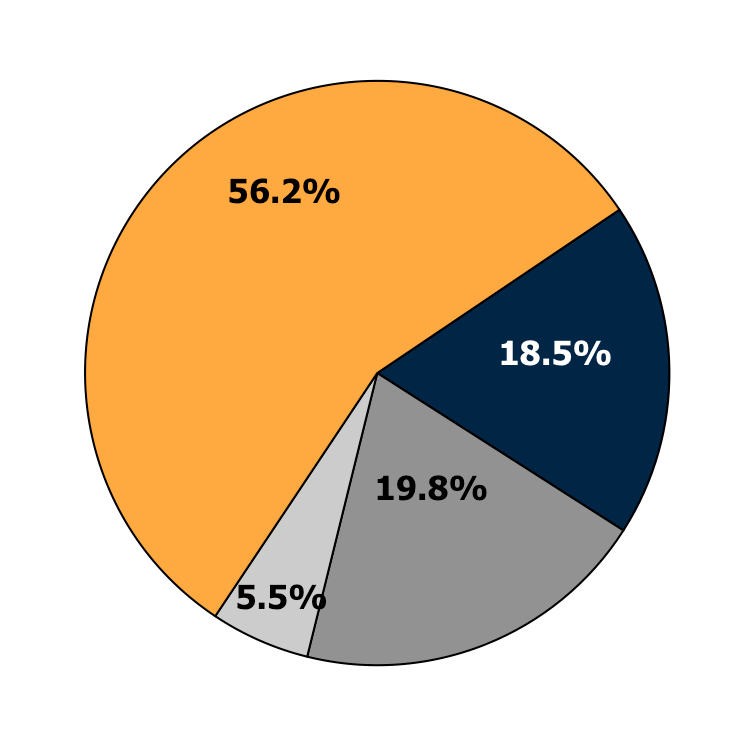

Employer-Sponsored

Health Insurance

Private Non-Group

Medicaid or other

public programs

Uninsured

Source: 2011 CPS ASEC, Non-Elderly Only

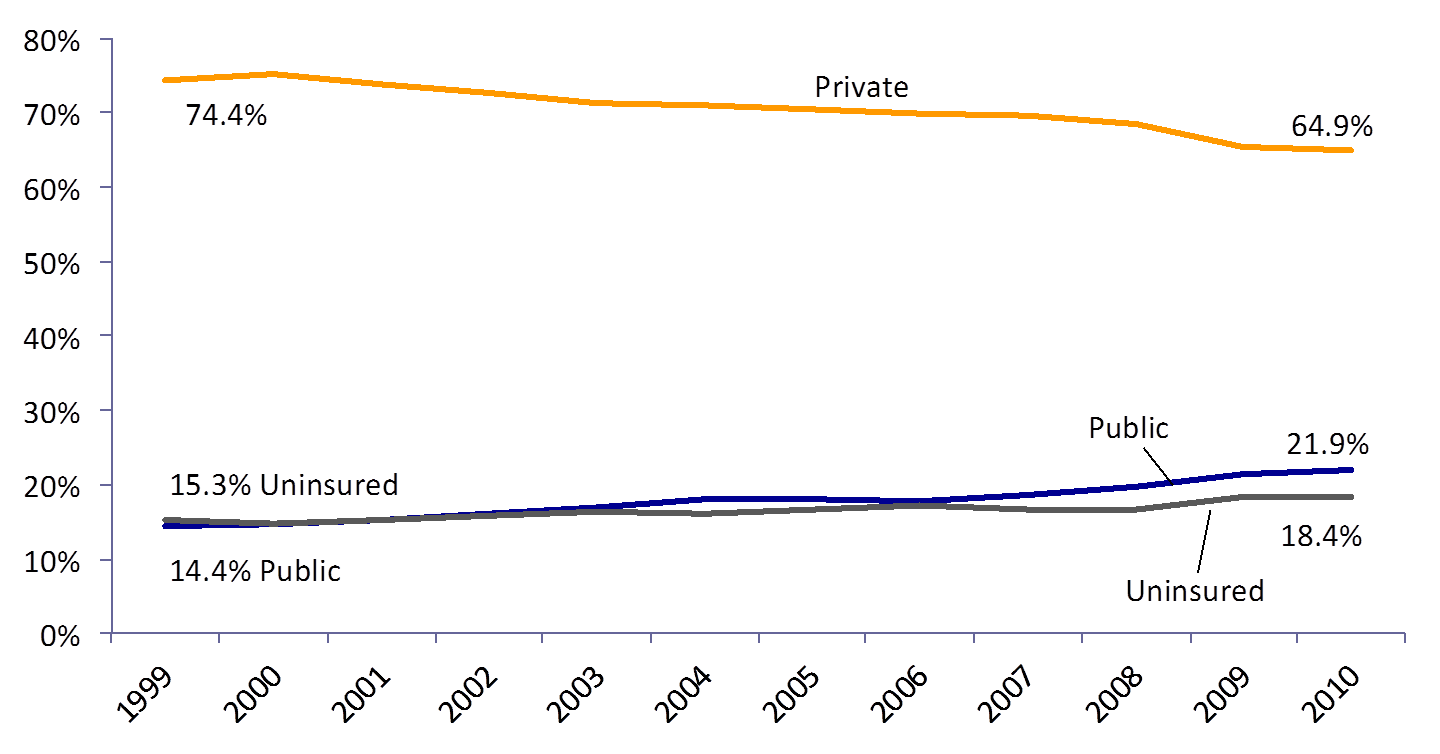

Declines in Coverage

Source: DeNavas-Walt et al. Income, Poverty and Health Insurance Coverage in the United States: 2011, US Census Bureau (2012)

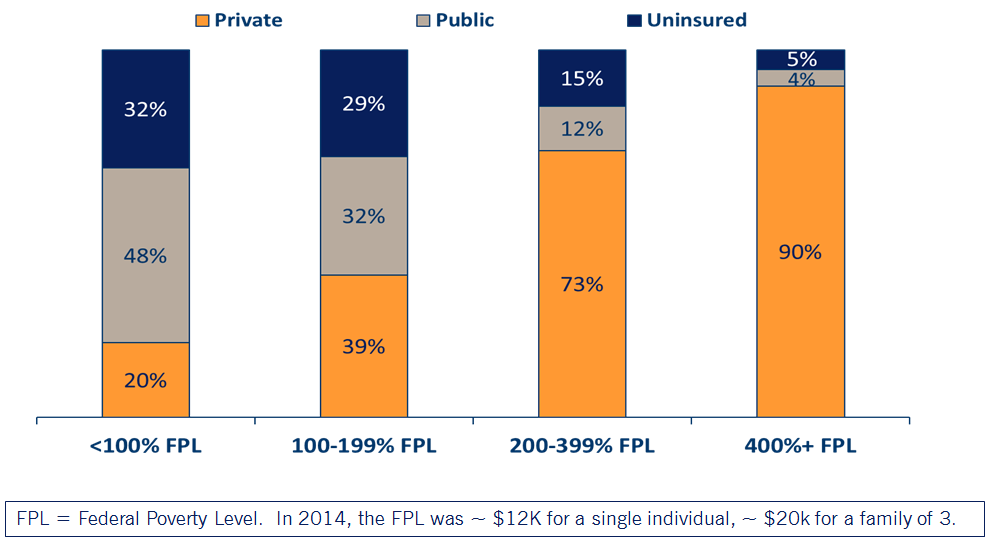

Health Insurance by Income Level

Affordable Care Act Goals

- Increase health insurance coverage

- Reduce health care costs

- Improve quality

ACA Expanded Coverage

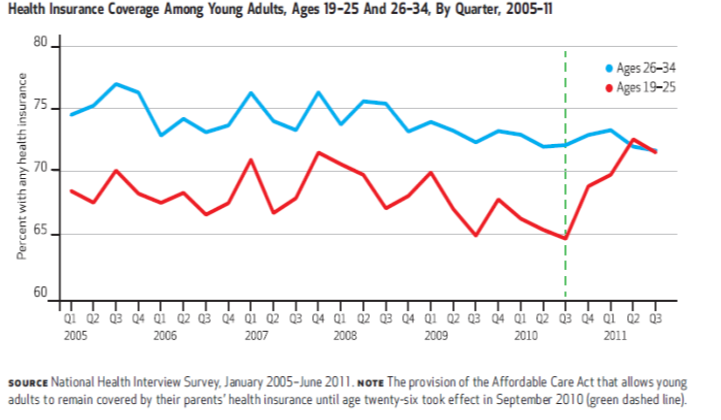

1.Young adults allowed to stay on their parents’ private insurance until age 26 (effective September 2010)

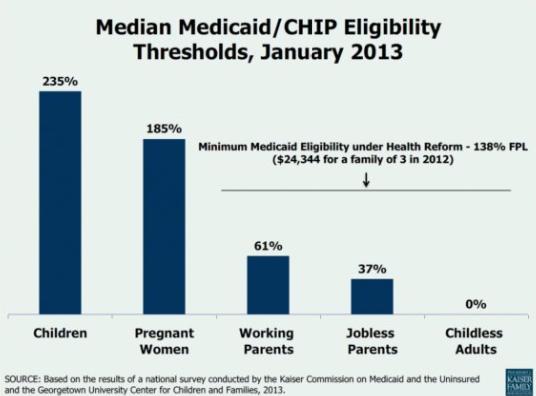

2.Eligibility for Medicaid extended to everyone with incomes below 138% of the Federal Poverty Level (effective Jan 2014*)

3.New tax credits for private insurance for families between 100 and 400% of the Federal Poverty Level (effective Jan 2014)

4. Individual mandate to purchase health insurance (now repealed)

* Several states elected to expand Medicaid at different times, or not at all!

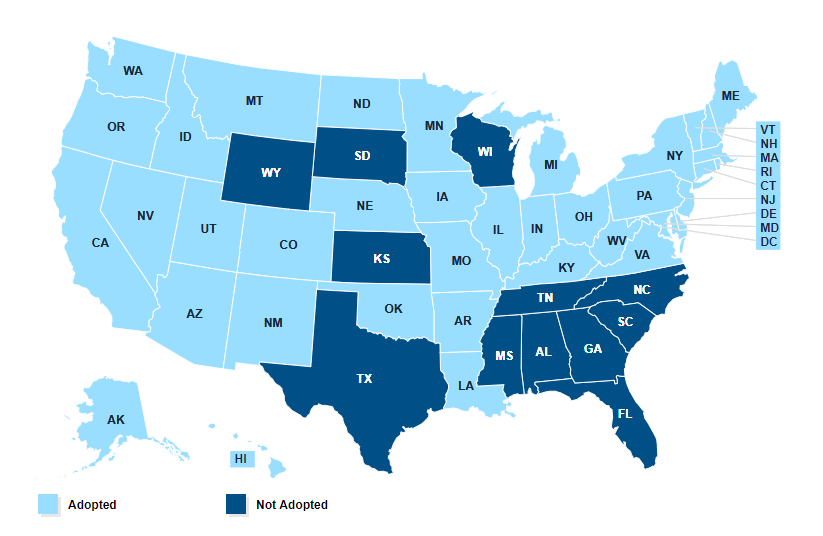

Medicaid Expansion

NFIB v Sibelius 2012

High profile supreme court case challenging constitutionality of the ACA:

SCOTUS ruled the threat of losing all Medicaid funding was unconstitutionally coercive, a "gun to the head" as Roberts wrote in his majority opinion.

Because of this ruling, states could opt not to expand Medicaid without risking losing additional funding.

Status of State Expansions

Source: KFF

Private Coverage Provisions

Underwriting reforms:

- "Guaranteed issue": no denials or exclusions for pre-existing conditions

•Adjusted community rating: premiums vary by age, smoking status, but nothing else

-Results in higher premiums for those who are younger, men; lower premiums for older, women

Health Insurance "Marketplaces"

The goal: make it easier to shop for health insurance if you don't have coverage through an employer

•Consumers choose from a menu of private plans

•All plans must offer 10 “essential health benefits” and conform to one of four actuarial value “metal levels.”

•Tax credits are based on consumer income and the premium for the 2nd lowest cost silver plan.

- 100-133 % of FPL: premiums are capped at 2% of income

- 300-400% of FPL: premiums are capped at 9.7% of income

•Low-income enrollees also qualify for cost-sharing reductions.

Other policies:

Employer mandate: large employers penalized if they don't offer coverage and their employees end up receiving a subsidy for health insurance

Experimenting with new ways of paying providers: "Accountable care organizations" trying to incentivize quality over quantity

Variety of other policies like requiring calorie posting, tanning bed tax etc

What were the results?

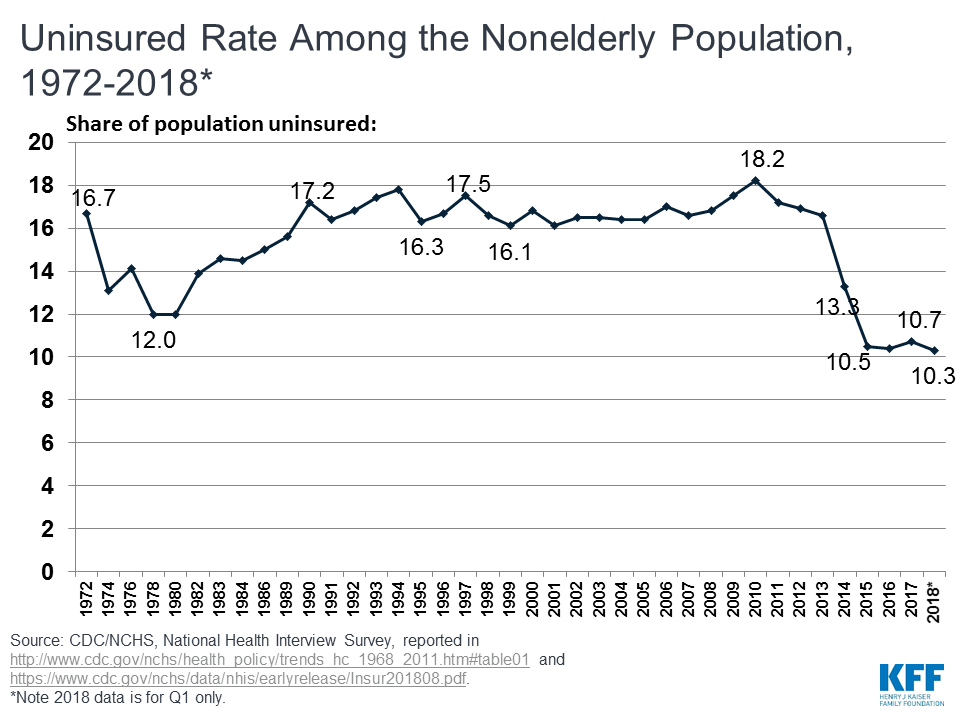

Overall Coverage Gains (Non-elderly adults)

The number of people with insurance increased by 20 million between 2010 and 2015

About ~2 million gain coverage

through dependent mandate

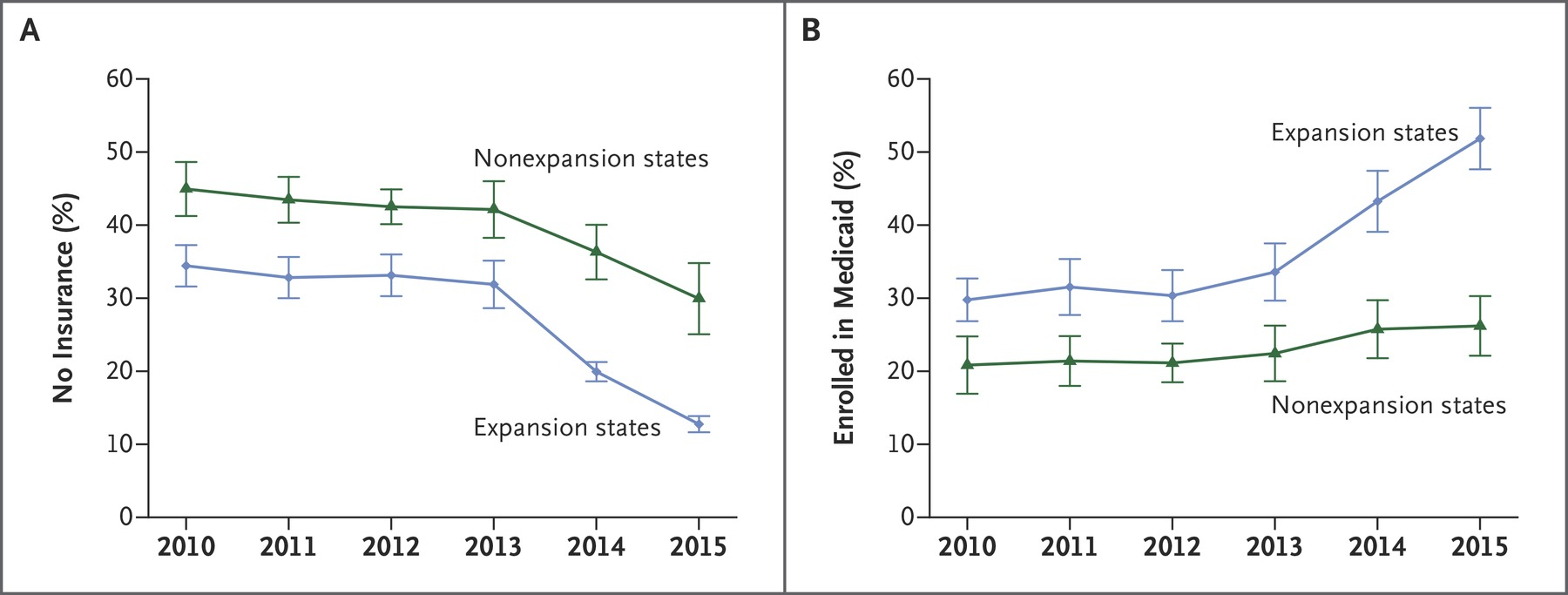

Coverage Gains Largest in states that expanded Medicaid

Sample among low income adults, Miller and Wherry 2016 New England Journal of Medicine

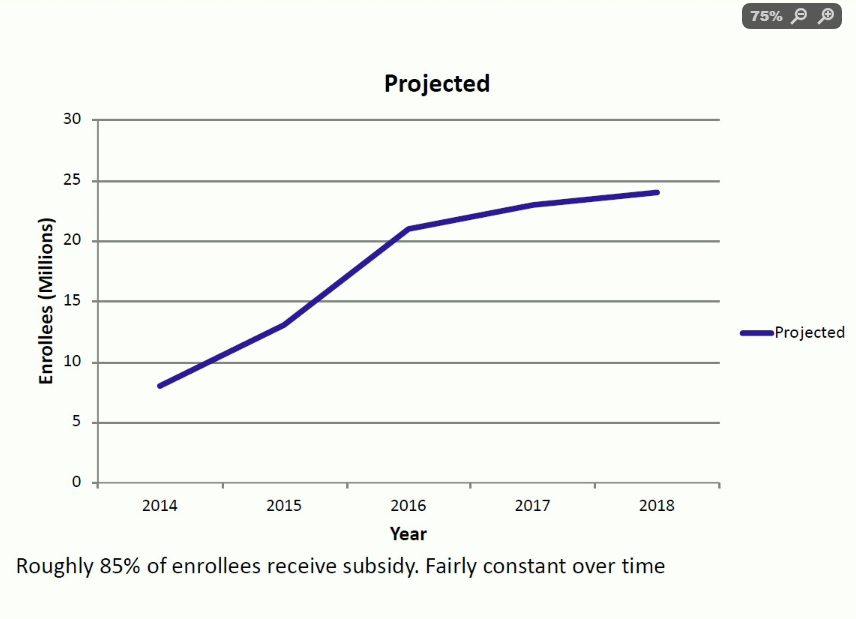

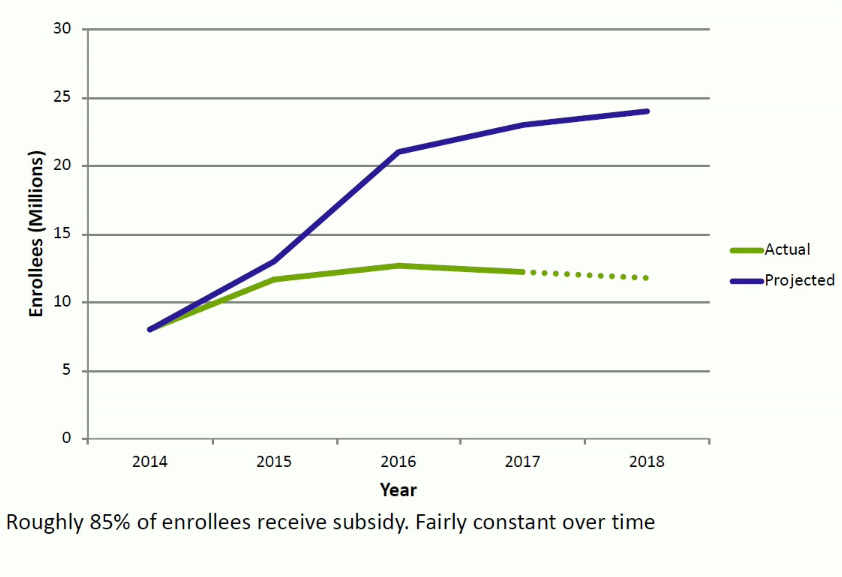

Marketplace Enrollments

Marketplace Enrollments

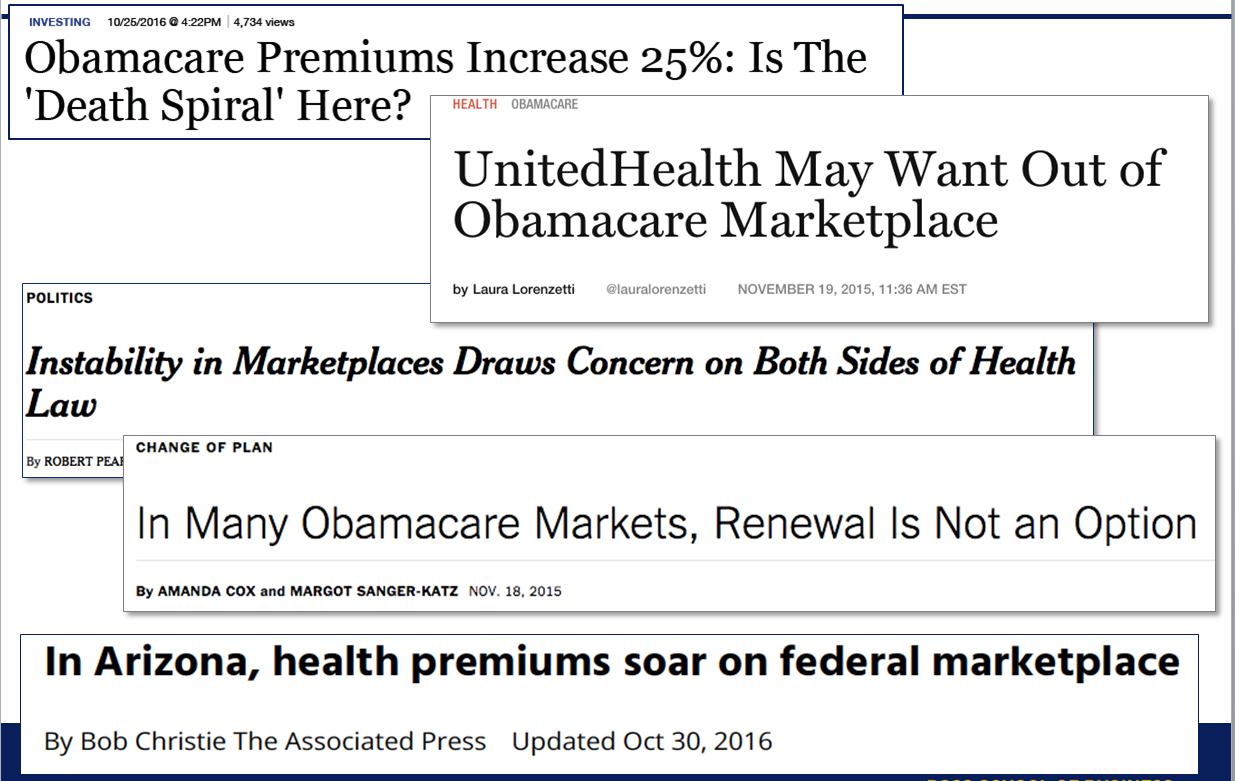

Significant Premium Volatility

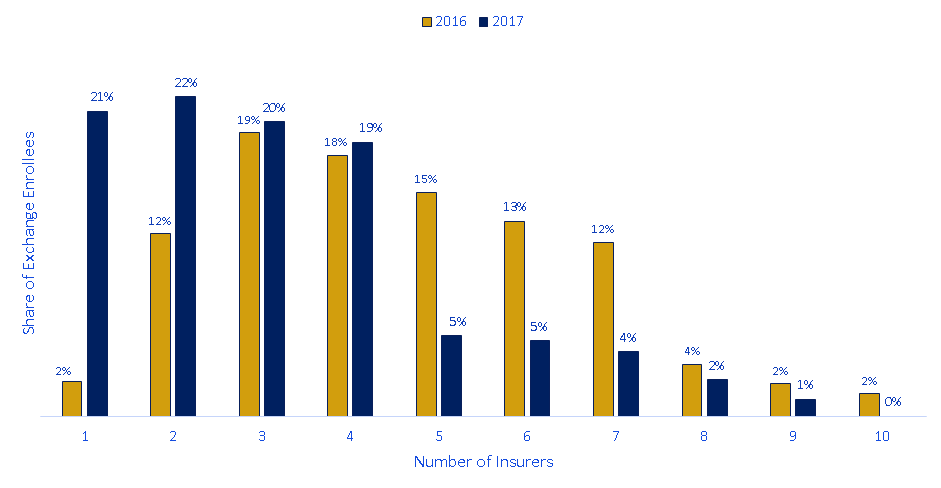

Competition on the Exchanges

About 20% of enrollees have only one insurance company offering plans--far from the "perfect competition" ideal

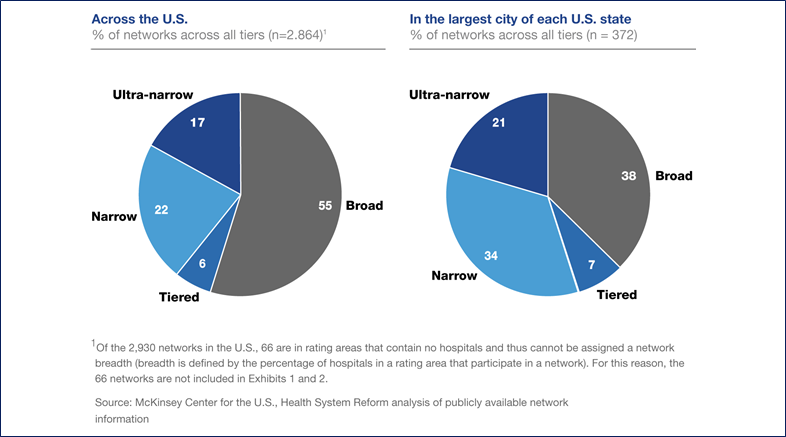

Rise of Narrow Network Plans

•Ultra narrow plans contract with < 30% of hospitals in the market

•Narrow plans contract 30% to 70% of hospitals in the market

•Broad plans contract with > 70% of hospitals in the market

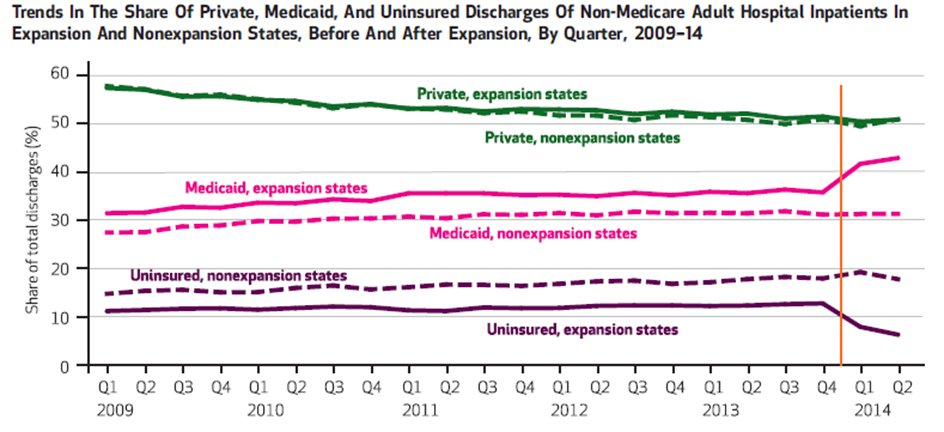

Effect on Providers

Because hospitals must accept all patients regardless of ability to pay, they are “insurers of last resort.”

- Each uninsured person generates an average of $900 in uncompensated care per year.

- 2013: hospitals provided ~$45 billion in uncompensated care

(~6% of expenditures)

Hospitals were advocates for reform and for continued Medicaid expansion.

Summary

- Clear evidence that a large number of people gained coverage.

- However, many people are still without! This is not "universal coverage"

- Dependent coverage mandate very popular, increased coverage

- Only benefits you if your parents can add you to their plan!

- Medicaid expansion a successful way to get low-income people covered--popular with strong evidence of improved health, access to care among the poorest.

- Exchanges seem to work okay if you are lower income and receiving a subsidy--in this case you are shielded from high premiums.

- Exchanges were not as popular as some analysts predicted.

Change to the ACA under the Trump Administration

Continued growth in Medicaid coverage

- During the Trump administration, 6 states (VA, ID, LA, NE, UT and ME) have elected to expand Medicaid.

- Federal government was also much more permissive in issuing waivers:

- Work requirements for Medicaid--but these have been struck down by the courts

- Allow "short term" health plans that don't follow ACA regulations

Mandate Repeal

To reduce adverse selection, the ACA included an individual mandate to purchase insurance with a penalty if you did not purchase it. This was repealed for tax year 2017.

Appears to not have had that big of an effect:

- Relatively few tax filers paid the penalty: about 12m were "exempted," 6.7 paid penalty

- Some confusion about whether mandate was repealed (about 40% did not know in latest Gallup poll)

- Many enrollees are subsidized, which is larger than the penalty

American Rescue Plan

Biden administration included many health policies in the COVID relief bill, although most of them are temporary.

Make exchange coverage subsidies more generous and allow everyone to use them, regardless of income

- Subsidies scale with income but do not "cut off" sharply at a certain income level.

Incentives to states who have not expanded Medicaid coverage

State option to cover new mothers for 12 months post partum (vs 60 days).

Cover COBRA premiums for unemployed

Questions

Affordable Care Act

By umich

Affordable Care Act

- 640