Appendix

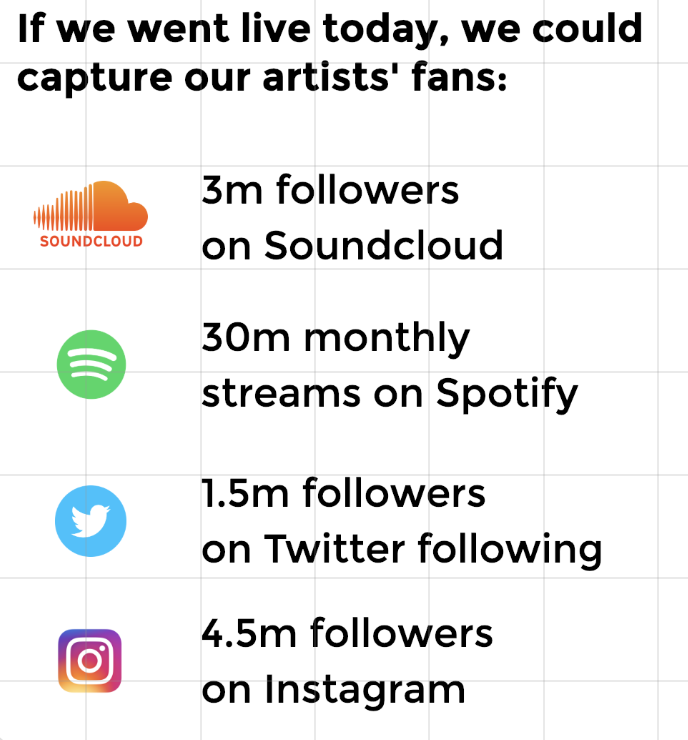

Customer Acquisition

Our average user on a $2.99 monthly subscription plan generates $1.62 in net profits each month

Our median acquisition cost is $.60 per user, requiring just 1 in 30 customers to subscribe to a 1 year plan.

How we do it? We leverage our existing relations with cult-followed creators, and incentivize them to release week long exclusives to the platform.

Here’s why we are defensible

Artists already onboarded support our pricing model

We are addressing an unaddressed and underrepresented market. Forcing incumbents to abandon current business practices to compete on our terms

-

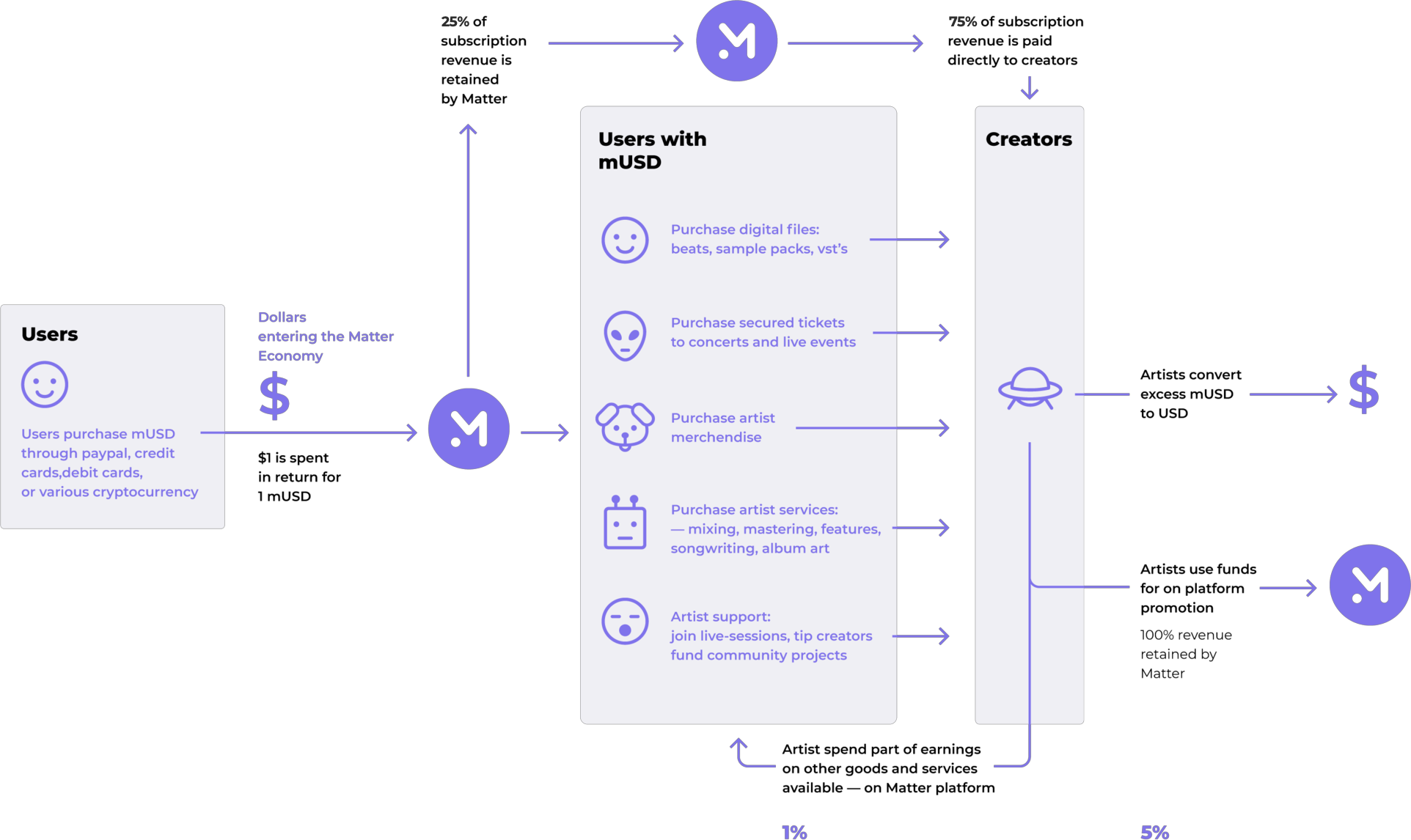

Our pricing model removes the uncontrollable cost of goods problem experienced by all media platforms today

-

Reducing several layers of “middlemen”, allowing us to pay creators more, faster, and transparently

-

Providing the most effective way to monetize impressions

-

Software solutions that turn independent creators into chart-topping artists

Available non-core Growth Strategies

We convert high activity users into fuel for what will be the highest volume music commerce market in the world.

- Finance

- Artist banking

- Project financing

- Data

- b2b analytics for labels

- Technology

- Collaborative production tools

- Merchandise

- Design

- Order Fulfillment

Blockchain driven efficiency

Data Ownership

Transparency

Scalability

Reduced Cost

Servers

Payment Processing

Options

Security

Global Reach

Internet 2.0

Congressional

Support

Our blockchain platform allows best in-class:

The network

enables revenue

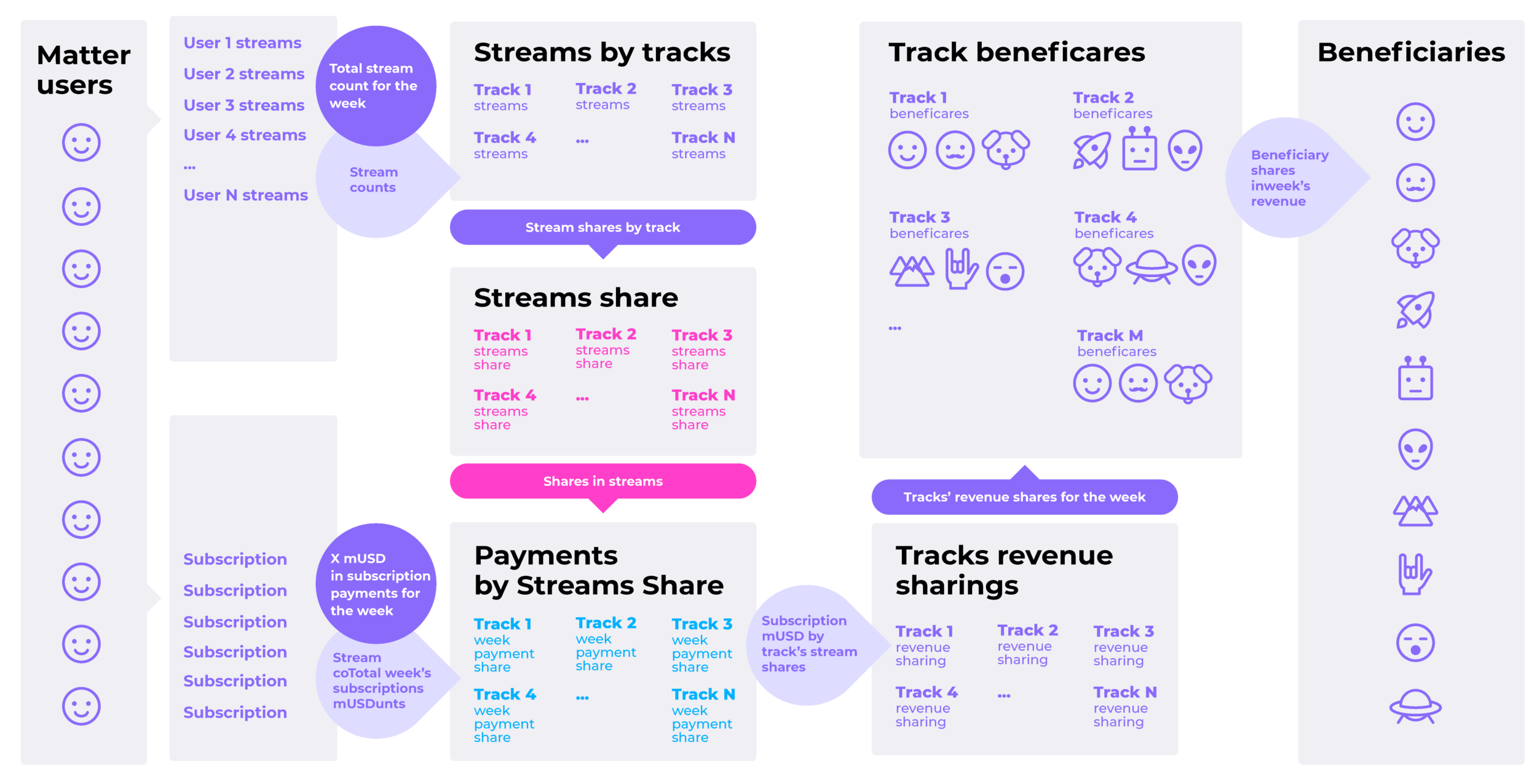

Smart Contract Revenue Distribution (Patent Pending)

Profit

Potential

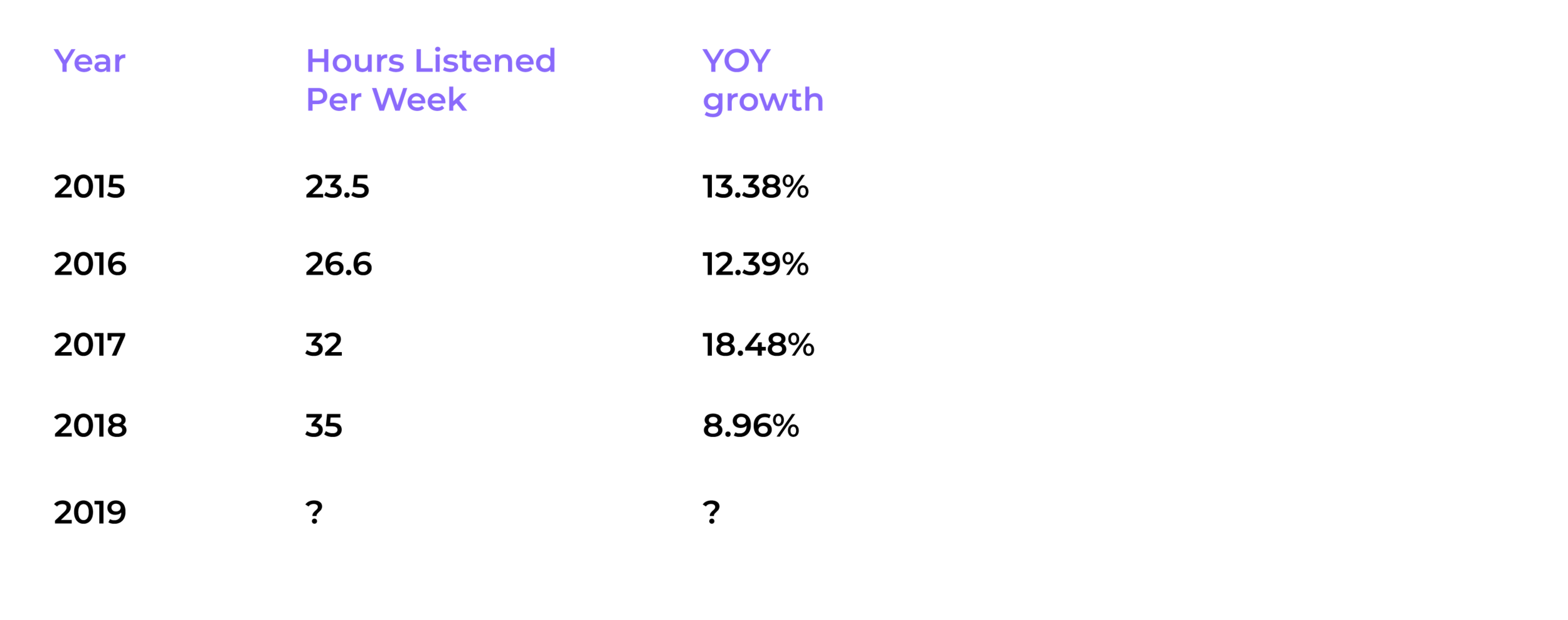

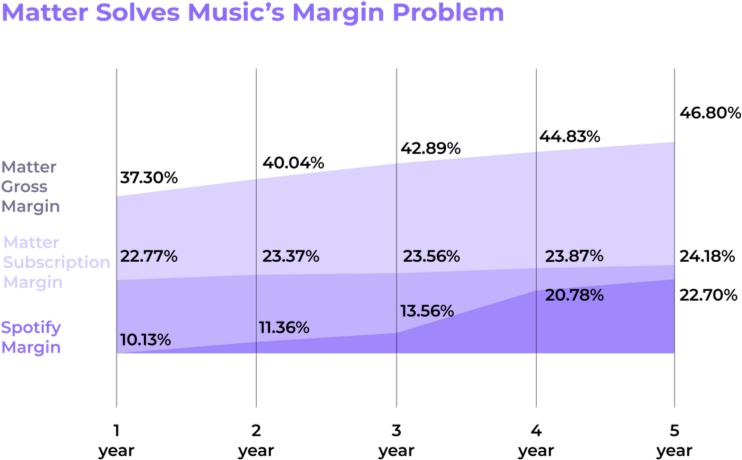

As streaming consumption increases, incumbents are unable to absorb increasing licensing costs.

If music consumption trends continue (8.96%+ YOY), current industry leaders will be vulnerable to a company that can offer a more expansive product with lower price points.

Because we provide more value than just streaming, we can effectively double the margin's of industry leaders, regardless of product pricing.

Of the 71% of Americans who do not use music streaming, 55% cited high subscription costs as the number one reason.

*Spotify data from previous 5 years

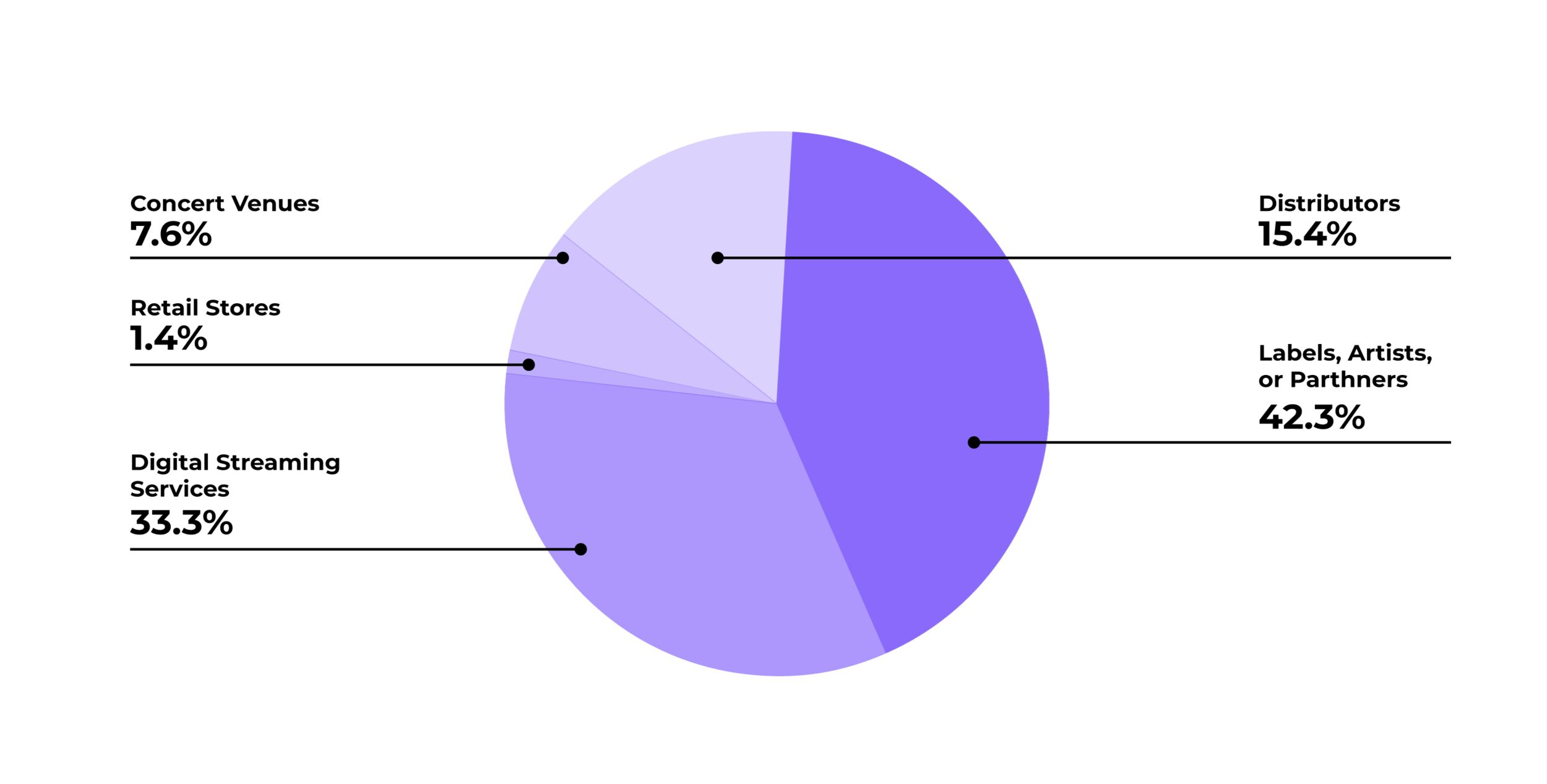

The Breakdown

$43,000,000,000 of revenue was generated in 2018,

with over $29b going to non-content creators

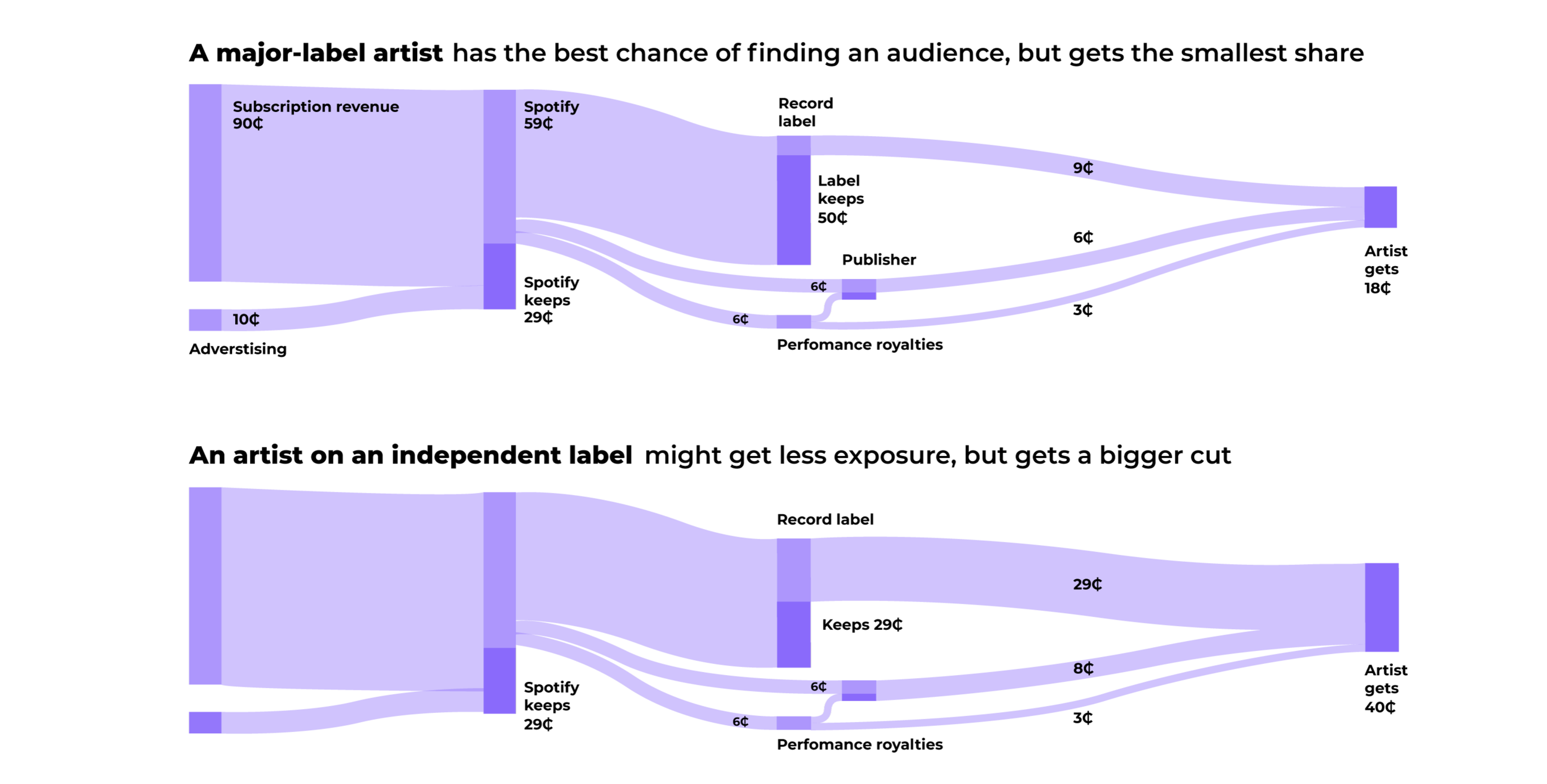

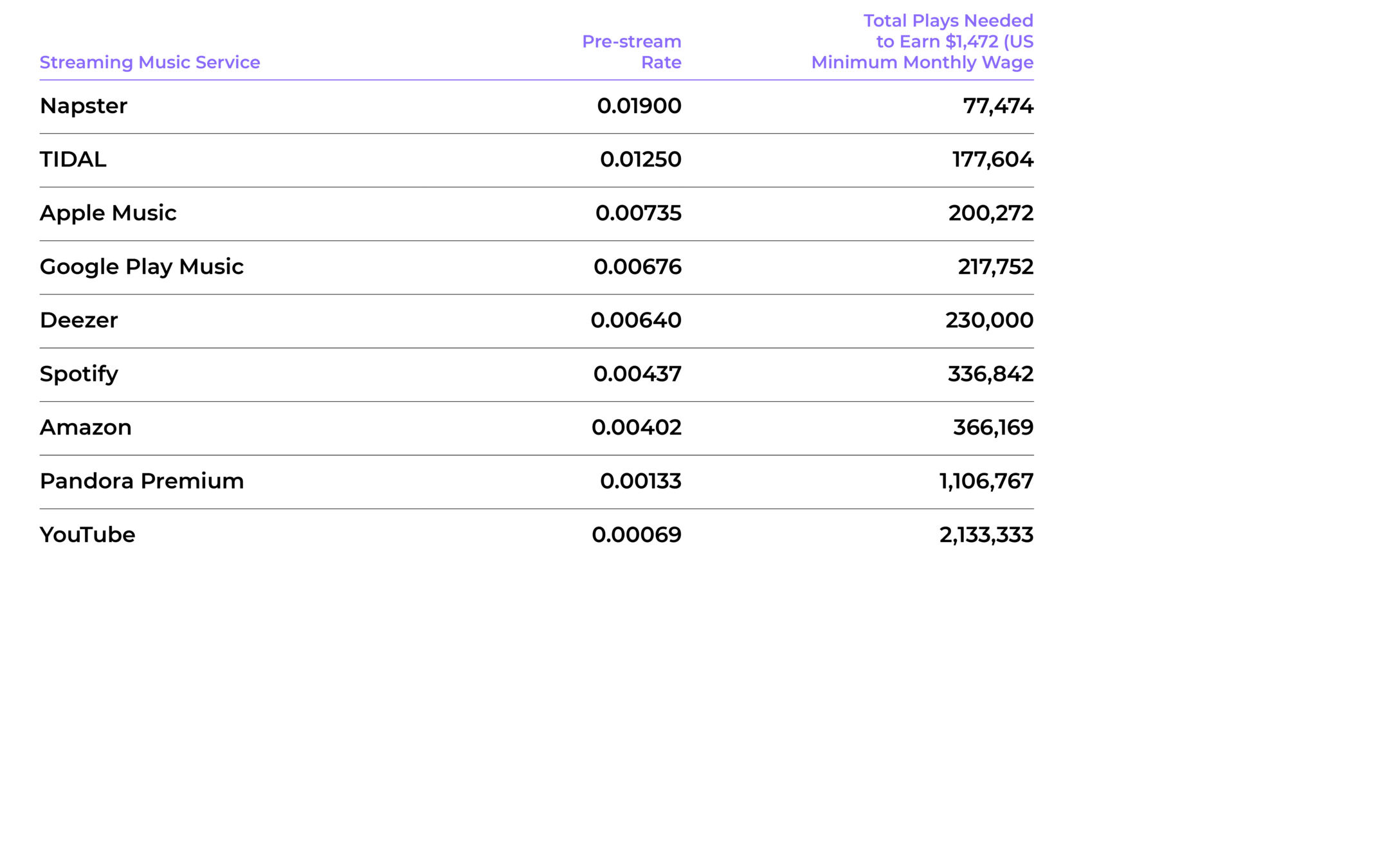

Artist Streaming Payouts

Are you able to earn minimum wage?

With the advent of the digital age, artists have been unable to monetize their work. Forcing them to come up with other ways to make ends meet. Such as performing live shows and selling merchandise.

**artists typically only receive distributions every 3-6 months.

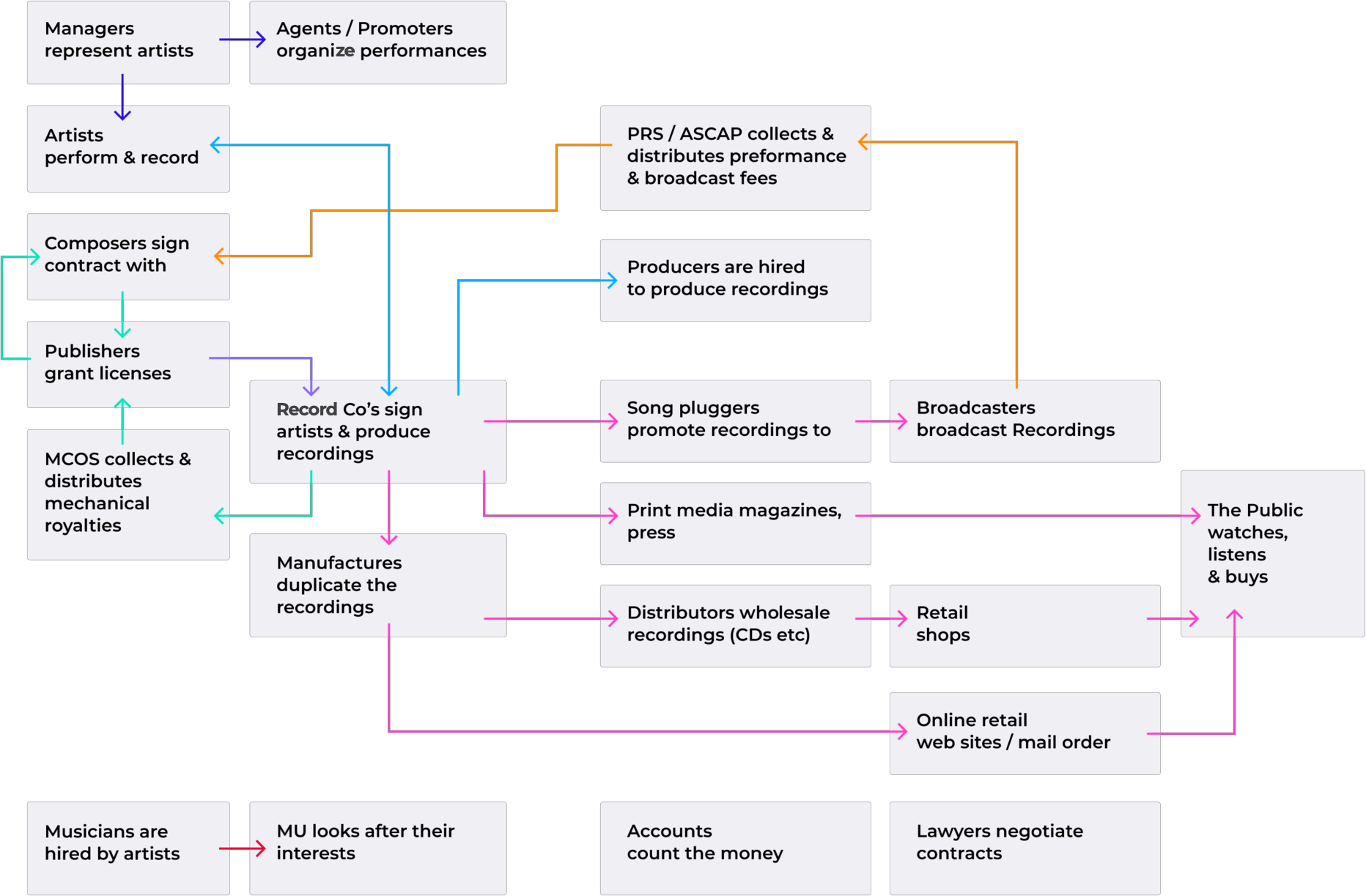

Structure

of the

Industry

The present internal structure of the music industry was born when the radio was king, the record store was queen, and the labels were small and independent.

Principal Organisational

Structures of the Music

Industry

Strong results with only $350k spent

5,180 hours of development

3 platform designs and iterations

1 re-brand

Unprecedented NAL submission

Initial Artists with over 31,000,000 monthly streams

Core functionality with highly scalable codebase

Surpassing of the competitions user behavioral analytics

Patentable IP

Investors and Advisors

Sonic Ark Publishing

TXV Partners

Alan Loudermilk

Curated Capital Group

Next Stage Partners

Edison Ventures

The Recording Academy

Keyworld

Patrick McQuown

Investors

Advisors

Citations

1. Winberg, Sampo. “Constantly Evolving Music Business: Stay Independent vs. Sign to a Label: Artist’s Point of View,” n.d., 68.

2. “The Average Person Spends Less Than $15 Per Year on Streaming Music | Digital Trends.” Accessed February 2, 2019. https://www.digitaltrends.com/music/nielsen-streaming-music-spending-news/.

3. “Spotify Just Turned the First Net Profit in Its History (but It’s Not Particularly Happy about It).” Music Business Worldwide, November 1, 2018. https://www.musicbusinessworldwide.com/spotify-just-turned-the-first-net-profit-in-its-history-and-its-not-particularly-happy-about-it/.

4. “Here’s Exactly How Many Shares the Major Labels and Merlin Bought in Spotify - and What Those Stakes Are Worth Now.” Music Business Worldwide, May 14, 2018. https://www.musicbusinessworldwide.com/heres-exactly-how-many-shares-the-major-labels-and-merlin-bought-in-spotify-and-what-we-think-those-stakes-are-worth-now/.

5. “The SoundCloud You Loved Is Doomed | Pitchfork.” Accessed February 2, 2019. https://pitchfork.com/thepitch/the-soundcloud-you-loved-is-doomed/.

7. “Declining Audience, Rising Revenue For Pandora.” Insideradio.com. Accessed February 2, 2019. http://www.insideradio.com/free/declining-audience-rising-revenue-for-pandora/article_f0f129be-9556-11e8-b009-5fa5684f0ca0.html.

8. Kafka, Peter. “Spotify Has Guaranteed to Pay Big Music Labels Billions over the next Two Years.” Recode, June 15, 2017. https://www.recode.net/2017/6/15/15807382/spotify-revenue-2016-financials-guarantee-payment-universal-merlin.

appendix

By Fairy Mymyu

appendix

- 156