Politics through the Lens of Economics

Lecture 9: Presidential vs. Parliamentary Systems

Masayuki Kudamatsu

29 November, 2017

Discussion Time

What evidence do we need to say

the legislative bargaining model (assumptions / predictions)

explains Japan's immigration policy?

Background information #1

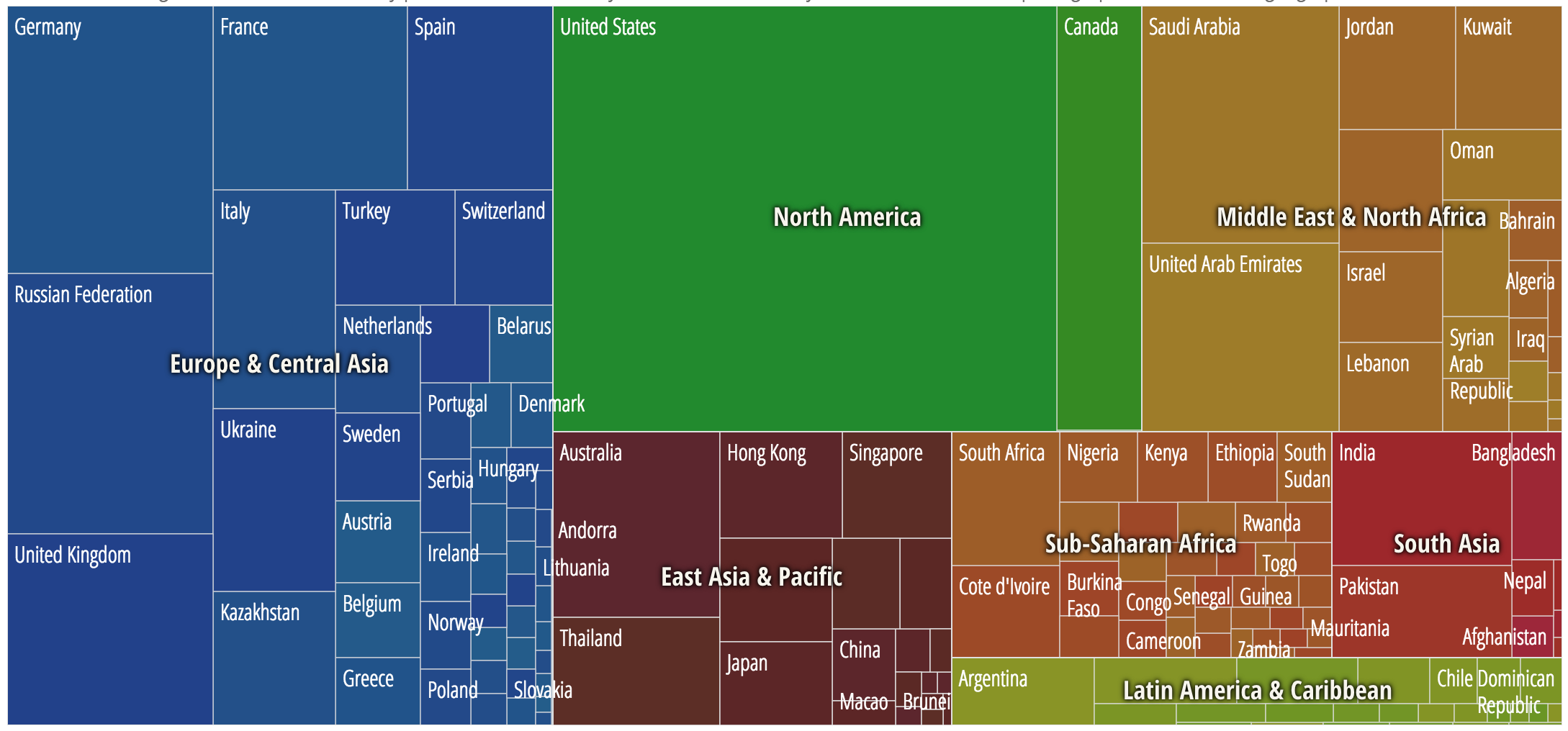

Image source: Figure 1 of Nguyen (2016)

Distribution of 244 million migrants

across countries in 2015

Background information #2

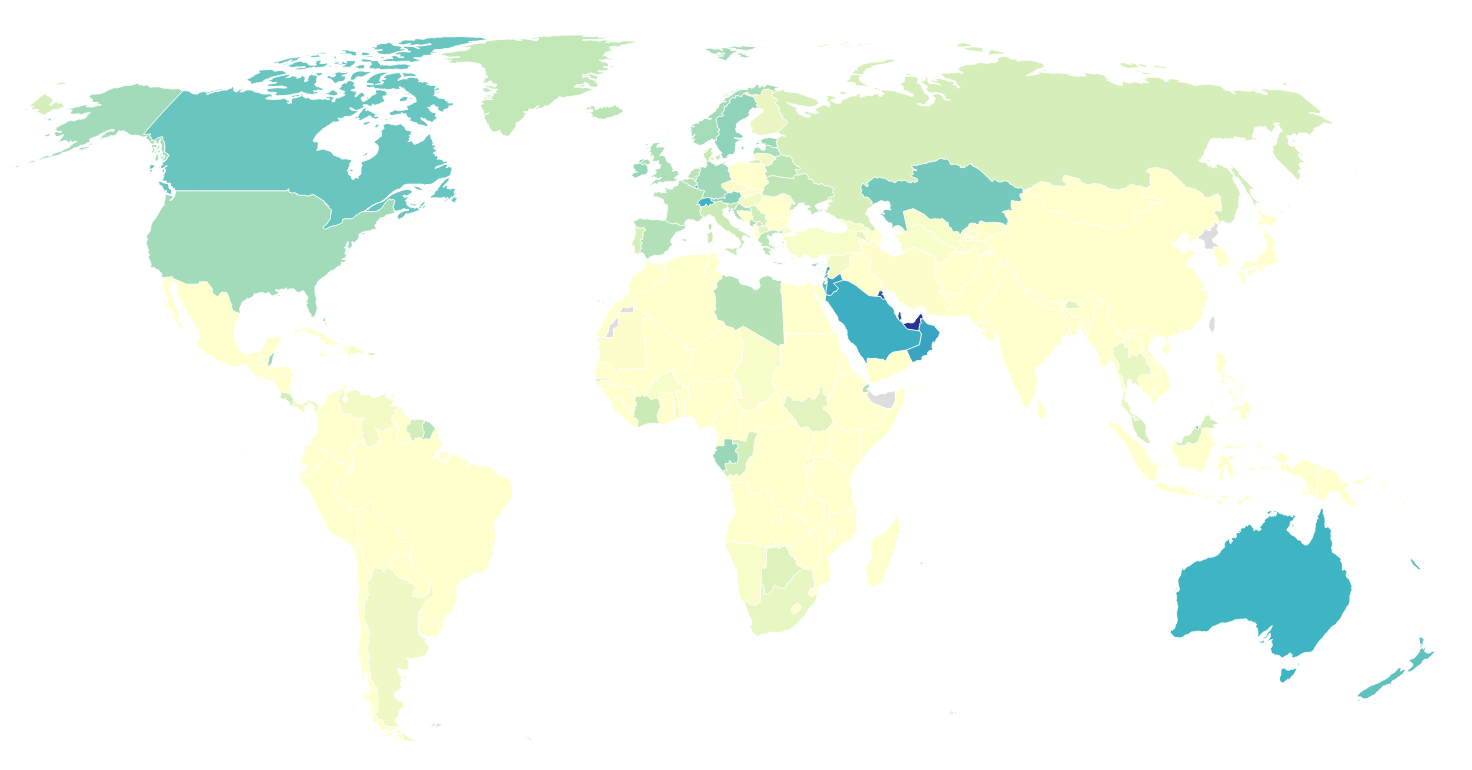

Image source: Figure 2 of Nguyen (2016)

Population share of foreign-born people in 2015

Background information #3

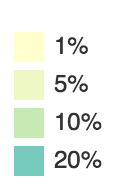

% of foreigners among Japanese population

Image source: Figure 1 of Migration Policy Institute (2017)

Background information #4

History of immigration policy of Japan

1952

Immigration Control and Refugee Act (出入国管理及び難民認定法)

To discourage long-term settlement of foreign workers

1980s

Increase in illegal unskilled migrants for "3K" jobs

1990

Revised Immigration Control and Refugee Act

Allow unskilled migrants if they are of Japanese descent

e.g. Japanese Brazilians, Japanese Peruvians

2012

Launch a new Highly Skilled Foreign Professional (HSFP) visa

Discussion Time

What evidence do we need to say

the legislative bargaining model (assumptions / predictions)

explains Japan's immigration policy?

Aim to come up with a wrong answer

Motivation: Forms of Government

Parliamentary system

Presidential system

Two major forms of democracy

Major difference: how the chief executive is elected

But the legislative policy-making process differs, too

Presidential system

Different congressional committees hold proposal power over different policy issues

Separation of Power

=

Taxation

Spending

Parliamentary system

Ruling party legislators propose almost all bills

A disagreement within ruling party members leads to a government crisis: vote of no confidence (内閣不信任決議)

June 1993: Vote of no confidence against Prime Minister Miyazawa was approved after the ruling LDP members couldn't agree on electoral reform

Legislative cohesion

=

Today's Road Map

Model of Presidential vs. Parliamentary Systems

Fiscal Policies in Presidential System

Fiscal Policies in Parliamentary System

Evidence on Model Predictions

Region 1

Region 2

Region 3

Legislator 1

Legislator 2

Legislator 3

A country of 3 regions, each represented by one legislator

Model ingredient #1: Legislators

Amount of tax to be collected

(tax burden is equally shared by 3 regions)

Model ingredient #2: Policies

Amount of

public goods

to be provided

Transfer

to

Region 1

Transfer

to

Region 2

Transfer

to

Region 3

No budget deficit allowed (for simplicity)

Model ingredient #3: Default policies

If tax proposal is rejected, no tax is collected

(i.e. government shutdown)

If spending proposal is rejected,

No public good or transfer to any region is provided

The approved tax proposal is annulled.

Model ingredient #4: Legislators' objective

Assume each legislator perfectly represents their region's citizens

(as in the citizen-candidate model)

Each legislator prefers:

Less tax

More public goods

More transfer to their own region

Doesn't care about:

Transfer to other regions

Extra benefit/loss from each policy

Extra benefit from public goods declines (cf. Lecture 3)

Public goods

Extra benefit from public goods

But extra benefit from transfer does not decline

Transfer

Extra benefit from transfer

Transfer can be used for anything (while public goods are specified)

Extra benefit/loss from each policy (cont.)

Similarly, extra loss from paying tax does not change, either

Tax

Tax money could have been used for anything

Extra cost from being taxed

Extra benefit/loss from each policy (cont.)

Finally, extra benefit from transfer = extra loss from tax

If tax money comes back to your region, you're indifferent

Extra cost from being taxed

Extra benefit from transfer

Transfer

Tax

Extra benefit/loss from each policy (cont.)

Presidential system: separation of power

Legislator 1 proposes tax

Legislator 2 proposes spending allocation

Parliamentary system: no separation of power

Legislators 1 & 2 (ruling party members)

jointly propose tax and spending allocation

Model ingredient #5: Agenda setters

Presidential system: no legislative cohesion

Each bill requires a (potentially different) majority to pass

e.g. 1 & 2 approve tax and 2 & 3 approve spending

Parliamentary system: legislative cohesion

Ruling party legislators can veto each other

i.e. 1 & 2 need to approve both tax and spending

Model ingredient #6: Winning coalition

Timing of Events in Presidential System

1

2

3

4

Legislator 1 proposes tax

Legislators vote on the tax proposal

Legislator 2 proposes spending allocation

Legislators vote on the spending proposal

If rejected, the default tax rate is implemented

If rejected, the default allocation is implemented

Timing of Events in Parliamentary Systems

Legislators 1 & 2 negotiate tax & spending

If the agreement is reached,

The policies are proposed to the legislature

and approved by majority voting

If either disagrees,

The vote of no confidence is approved

and the government collapses.

The default policy is implemented

1

2a

2b

(The ruling party forms a majority in parliament)

Legislative cohesion in Parliamentary Systems

Why won't legislator 1 try to make legislator 3 as a coalition partner if legislator 2 disagrees to 1's proposal?

Remember the agenda setter chooses as coalition partners

legislators with a worse default outcome (Lecture 8)

Also remember the agenda-setter gets a lot (Lecture 8)

Legislative cohesion in Parliamentary Systems

Why won't legislator 1 try to make legislator 3 as a coalition partner if legislator 2 disagrees to 1's proposal?

If the government collapses

Opposition (3) has a chance to become the agenda-setter

Ruling party (2) has a chance to lose the agenda setting power

Default outcome is worse for legislator 2

Legislator 1 chooses 2 as a coalition partner

Today's Road Map

Model of Presidential vs. Parliamentary Systems

Fiscal Policies in Presidential System

Fiscal Policies in Parliamentary System

Evidence on Model Predictions

Backward induction #1

1

2

Legislator 1 proposes tax

Legislators vote on the tax proposal

If rejected, the default tax rate is implemented

3

4

Legislator 2 proposes spending allocation

Legislators vote on the spending proposal

If rejected, the default allocation is implemented

Optimal voting on spending for legislators 1 & 3

Vote yes as long as the proposal is better than the default policy

Backward induction #2

1

2

Legislator 1 proposes tax

Legislators vote on the tax proposal

If rejected, the default tax rate is implemented

3

4

Legislator 2 proposes spending allocation

Legislators vote on the spending proposal

If rejected, the default allocation is implemented

Transfer to non-proposers' regions

Both legislators 1 & 3 will accept the offer better than the default

Legislator 2 has no reason to offer more than zero

Legislator 2's optimal proposal on

Public good vs transfer to proposer's region

Legislator 2's optimal proposal on

Public good vs transfer to proposer's region

Legislator 2 maximizes his region's benefit

Transfer

Tax revenue

Extra benefit from transfer

Extra benefit from public goods

Legislator 2's optimal proposal on

Public goods

Public good vs transfer to proposer's region

Legislator 2 maximizes his region's benefit

Transfer

Tax revenue

Extra benefit from transfer

Extra benefit from public goods

Legislator 2's optimal proposal on

Public goods

Optimal allocation

Backward induction #3

1

2

Legislator 1 proposes tax

Legislators vote on the tax proposal

If rejected, the default tax rate is implemented

3

4

Legislator 2 proposes spending allocation

Legislators vote on the spending proposal

If rejected, the default allocation is implemented

Optimal voting on tax for legislators 2 & 3

If voting no,

No public good is provided

If voting yes to a proposal to collect non-zero taxes,

Legislator 2 will propose a non-zero amount of public good.

Public goods / Tax

Extra benefit from public goods

Optimal voting on tax for legislators 2 & 3 (cont.)

Extra cost from being taxed

Public goods / Tax

Extra benefit from public goods

Optimal voting on tax for legislators 2 & 3 (cont.)

Extra cost from being taxed

You gain by this much

compared to no tax collection at all

Optimal voting on tax for legislators 2 & 3

If voting no,

No public good is provided

If voting yes to a proposal to collect non-zero taxes,

Legislator 2 will propose a non-zero amount of public good.

Both legislators vote yes to a proposal of non-zero tax

Backward induction #4

1

2

Legislator 1 proposes tax

Legislators vote on the tax proposal

If rejected, the default tax rate is implemented

3

4

Legislator 2 proposes spending allocation

Legislators vote on the spending proposal

If rejected, the default allocation is implemented

Tax revenue

Legislator 1 expects legislator 2 will

Legislator 1's optimal proposal on

(1) Transfer zero to region 1

(2) Provide public goods first if tax revenue is small

Transfer

Public goods

Tax

revenue

Extra benefit from transfer

Extra benefit from public goods

If tax revenue is small...

Public goods

Tax

revenue

Extra benefit from transfer

Extra benefit from public goods

Optimal allocation

Legislator 1 will spend all tax revenue on public goods

Tax revenue

Legislator 1 expects legislator 2 will

Legislator 1's optimal proposal on

(1) Transfer zero to region 1

(2) Provide public goods first if tax revenue is small

(3) Transfer any extra tax to region 2

once public goods are provided enough

Public goods

Tax

revenue

Extra benefit from transfer

Extra benefit from public goods

Optimal allocation

Once tax revenue is large enough for legislator 2 to spend transfer...

Transfer to region 2

Tax revenue

Extra benefit from transfer

Extra benefit from public goods

Any extra tax revenue will be spent on transfer to region 2

Optimal allocation

Public goods

Tax revenue

Legislator 1 expects legislator 2 will

Legislator 1's optimal proposal on

(1) Transfer zero to region 1

(2) Provide public goods first if tax revenue is small

(3) Transfer any extra tax to region 2

once public goods are provided enough

Public goods

or Tax

Extra benefit from public goods

Extra cost from being taxed

Legislator 1 benefits from public goods

as long as not paying taxes too much

Extra benefit from public goods

Extra cost from being taxed

Optimal level of public goods

Legislator 1 benefits from public goods

as long as not paying taxes too much

Transfer to region 2

Tax revenue

Extra benefit from transfer

Extra benefit from public goods

Which coincides with public good level chosen by legislator 2

Optimal allocation

Public goods

because extra benefit from transfer = extra cost of taxes

Transfer

Public goods

Optimal tax revenue

Extra benefit from transfer

Extra benefit from public goods

Therefore, legislator 1 proposes to collect tax just enough to finance optimal level of public goods

Then legislator 2 will spend all tax revenue on public goods

Policies chosen by the presidential system

Public goods

Tax revenue

& No transfer to any region

i.e. A small government as in U.S.

Today's Road Map

Model of Presidential vs. Parliamentary Systems

Fiscal Policies in Presidential System

Fiscal Policies in Parliamentary System

Evidence on Model Predictions

Timing of Events in Parliamentary Systems (recap)

Legislators 1 & 2 negotiate tax & spending

If the agreement is reached,

The policies are proposed to the legislature

and approved by majority voting

If either disagrees,

The vote of no confidence is approved

and the government collapses.

The default policy is implemented

1

2a

2b

(The ruling party forms a majority in parliament)

Timing of Events in Parliamentary Systems (recap)

Legislators 1 & 2 negotiate tax & spending

If the agreement is reached,

The policies are proposed to the legislature

and approved by majority voting

If either disagrees,

The vote of no confidence is approved

and the government collapses.

The default policy is implemented

1

2a

2b

(The ruling party forms a majority in parliament)

Transfer to legislator 3's region

No support is needed from legislator 3 to pass the bill

Transfer to region 3 = Zero

Legislators 1 & 2's optimal

Public goods & Transfer to ruling party's regions

Legislators 1 & 2 jointly maximize their benefits

The allocation of the maximized joint benefit

depends on their bargaining power

We're interested in the size of government

So we assume legislators 1 & 2 split the joint benefit in half

Legislators 1 & 2's optimal

Public goods

Extra benefit from public goods

Legislators 1 & 2 jointly maximize their benefits

Extra benefit from public goods doubles

Transfer to 1 & 2

Extra benefit from transfer

Legislators 1 & 2 jointly maximize their benefits

Extra benefit from the sum of transfer

does not change

Public goods

Tax revenue

Extra benefit from transfer

Extra benefit from public goods

Optimal allocation

Transfer to 1 & 2

Public goods & Transfer to regions 1 & 2

Legislators 1 & 2's optimal

Tax revenue

Legislators 1 & 2 jointly maximize their benefits

Every additional tax revenue (from all regions including 3)

will be used as transfer to regions 1 & 2

Collect tax as much as possible

Legislators 1 & 2's optimal

Public goods

Tax revenue

Optimal allocation

Transfer to regions 1 & 2

Extra joint benefit from public goods

Extra joint benefit from transfer

Summary 1: Public goods

Under-provided in presidential system

Public goods

Presidential

system

Extra benefit from public goods

Parliamentary

system

Public goods

Summary 1: Public goods

Under-provided in presidential system

Extra joint benefit from public goods

Summary 2: Transfer

Opposition region exploited

Presidential system

Equal allocation (zero to all)

Parliamentary system

Summary 3: Tax revenue (= Total spending)

Public goods

Tax revenue

Presidential

system

Tax revenue

Transfer to regions 1 & 2

Public goods

Parliamentary

system

Summary 3: Tax revenue (= Total spending)

Extra joint benefit from public goods

Extra joint benefit from transfer

Today's Road Map

Model of Presidential vs. Parliamentary Systems

Fiscal Policies in Presidential System

Fiscal Policies in Parliamentary System

Evidence on Model Predictions

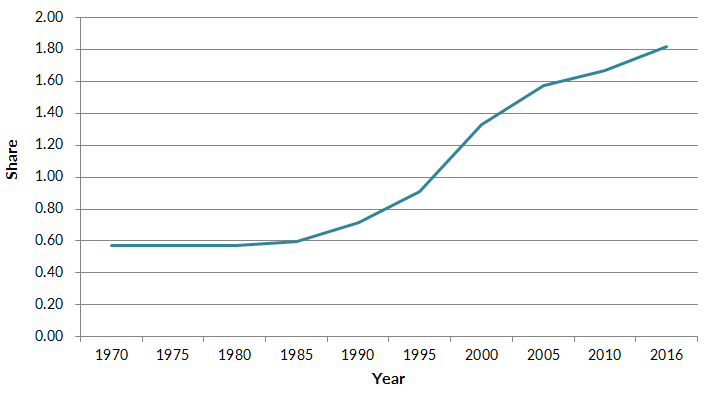

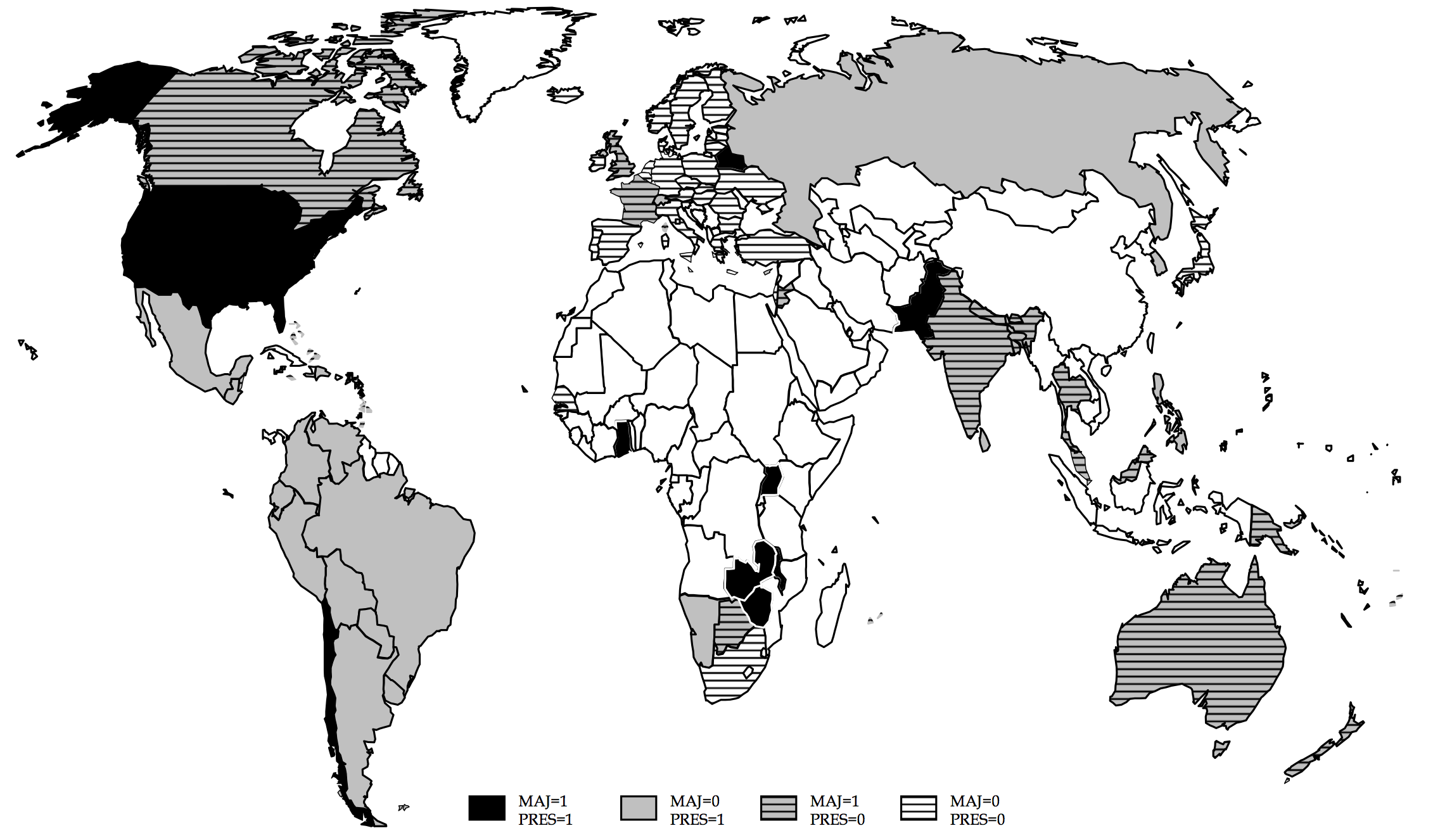

Forms of government across the world in 1998

Source: Figure 4.1 of Persson and Tabellini (2003)

Presidential

Parliamentary

Not democratic

Caveat: same as for electoral rules (lecture 7)

Central govt spending as % of GDP

22.2%

33.3%

vs.

Presidential

Parliamentary

Source: Tables 1-2 of Persson and Tabellini (2004)

The difference is not driven by:

Electoral rules

Income per capita

Trade openness

Total population

% of population aged 16-54 / 65+

Years since democratization

Degree of democracy

Federal system

OECD member countries

Continents

Former colonizers

Social service and welfare spending as % of GDP

4.8%

9.9%

vs.

Presidential

Parliamentary

Source: Tables 1 and 4 of Persson and Tabellini (2004)

The difference is not driven by:

Electoral rules

Income per capita

Trade openness

Total population

% of population aged 16-54 / 65+

Years since democratization

Degree of democracy

Federal system

OECD member countries

Continents

Former colonizers

Next lecture

Model of politics #5

Political Agency Model

Task of running the country is delegated

Citizens reward well-behaving politicians with re-election

Politicians are the agent of citizens

Conflict of interests between citizens and politicians (e.g. corruption)

This lecture is based on the following academic articles and books:

Persson, Torsten, Gérard Roland, and Guido Tabellini. 2000. “Comparative Politics and Public Finance.” Journal of Political Economy 108(6): 1121–61.

See also Chapter 10 of Persson, Torsten, and Guido Tabellini. 2000. Political Economics: Explaining Economic Policy. Cambridge, Massachusetts: MIT Press.

Persson, Torsten, and Guido Tabellini. 2004. “Constitutional Rules and Fiscal Policy Outcomes.” American Economic Review 94(1): 25–45.

See also chapters 4 & 6 of Persson, Torsten, and Guido Enrico Tabellini. 2003. The Economic Effects of Constitutions. MIT Press.

Politics through the Lens of Economics (2017): Lecture 9 Presidential vs. Parliamentary Systems

By Masayuki Kudamatsu

Politics through the Lens of Economics (2017): Lecture 9 Presidential vs. Parliamentary Systems

- 2,048