Game Theory and Managerial Decision Making

A case study on Taurus Packaging Pvt Ltd

Taurus Packaging

Text

What do they want?

Expansion

-

Geographically

- Product Lines

How can we help them?

Maybe...

Yes! Why not apply game theory?

What is game theory?

Study of Strategy

Study of Decisions

Study of Games

Output

Optimal Strategy

Players

Actions

Payoffs

Game

Game Tree

-

Sequential games

-

Nodes = Actions

- Same player at alternate levels

Backward Induction

Used to solve the game tree and come up with the optimal solution of the game

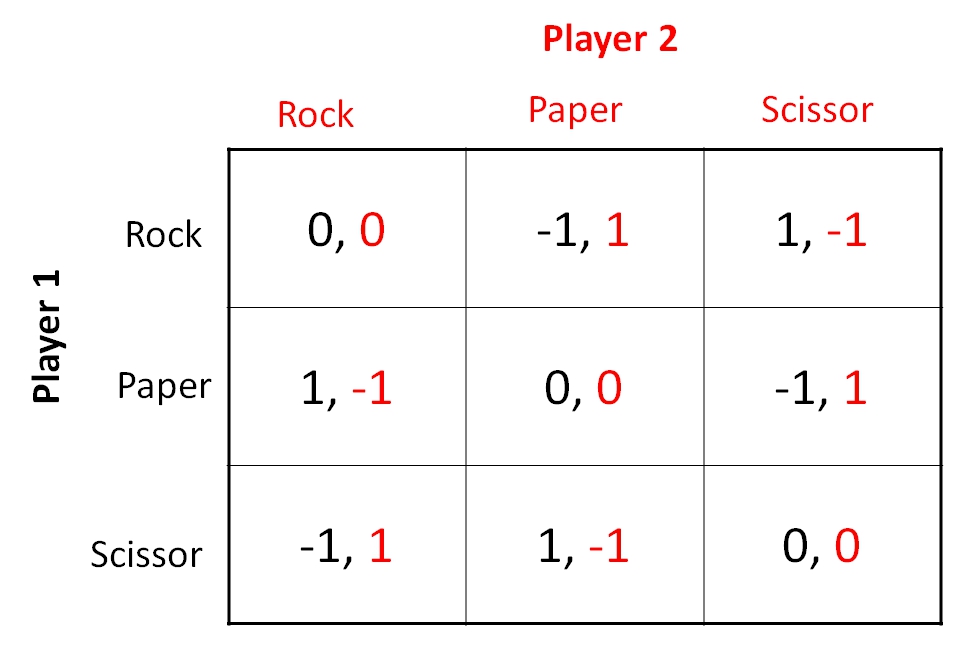

Payoff Matrix

Simultaneous Games

Matrix structure

Rows & Columns = Actions of the players

Elements = Payoffs

Model

Entry in Market

Advertising

Compensation of employees

Entry in Market

Porter's Five Forces

- Competition within the industry

- Suppliers

- Buyers

- Substitutes

- Potential new entrants

Entry in Market

Tanzania

Kenya

South Africa

Entry in Market

Assumptions

- Manufacturing firm

- Well defined and rigid supply chain

- Quality of products very important

- Competitive pricing

- Perfect Information

- Rational firms

Entry in Market

Parameters

Market Structure

Perfect Competition

Monopolistic Competition

Marginal Cost

High

Low

Technology

Normal

Advanced

Products

Homogeneous

Heterogeneous

Entry in Market

Parameters

Price War Threat

Non-credible

Credible

Information

Complete

Incomplete

Sensitiveness of customers

To quality

To price

Price of product

High

Low

Heterogeneity of products

Firms want to set their product apart

Go for differentiation strategy

Based on location, quality, customer service, durability

Generic Strategies

Entry in Market

Symmetric costs of both firms

Same technology used by both firms

Homogeneous products

If price set by both firms is same, the demand gets equally divided. Hence the profit of each firm is half the total profits in the market

Entry in Market

New Technology

Higher Marginal Cost

Quality-sensitive customers

Entry in Market

New Technology

Lower Marginal Cost

Price-sensitive customers

Price war credible threat by other seller

Entry in Market

From the incumbent's side

Marketing

Advertising

Trade Expo/Fair

Compensation of employees

Principal-Agent problem

- Adverse selection

- Signalling

- Moral hazard

Moral Hazard

How to ensure that employee works hard when he is given a fixed salary?

Agent takes action

Principal observes outcome

Favourable for principal

Unfavourable for principal

Solving Moral Hazard

Fixed wage contract based on reservation utility of agent

Wage rates based on effort level = wH, wL

Wage rates based on outcome achieved by agent

Outcome-based contract

Wages corresponding to no order, small order and large order

Principal wants to maximize =

Constraints =

Solution

= 118

= 117

= 1

Solved using linear programming

Thank You!

Shreya Khurana

Shubham Goel

deck

By Shreya Khurana

deck

- 1,073