Javier García-Bernardo

University of Amsterdam

June 26th, 2019

the role of the Netherlands in TAx avoidance

companies in which country invest more in germany?

companies in which country invest more in brazil?

companies in which country invest more in south africa?

why?

Reurink and Garcia-Bernardo (2018)

companies often use dutch entities in their structure

why?

Reasons

(PwC / EY / DELOITTE / KPMG)

- Logistic:

- Located in the heart of Europe.

- Outstanding infrastructure.

- Highly educated and multilingual workforce.

- Well-developed trust and management services.

- Easy to start and maintain entities in the Netherlands

- Beneficial tax regime:

- No withholding taxes for interest and royalties.

- No real withholding tax for intra-group dividends.

- Participation exemption.

- Large number of tax treaties.

- Advance Tax Rulings (ATR) and Advance Pricing Agreements (APA)

- Investor protection

- Large number of bilateral investment treaties

Answer of E.D. Wiebes (staatssecretaris van Financiën) to Renske Leijten (SP)

Nederland heeft altijd een aantrekkelijk vestigingsklimaat gehad voor ondernemers. Zo hebben we een gunstige ligging, een goede infrastructuur, een goed opgeleide beroepsbevolking, een gunstig leefklimaat, een hoog voorzieningenniveau en een betrouwbare overheid. Ook heeft Nederland een belastingsysteem met sterke elementen, zoals het verdragennetwerk en de deelnemingsvrijstelling, die onze open, op internationale handel gerichte economie ondersteunen. Al deze elementen zijn belangrijk voor het aantrekken en behouden van binnen- en buitenlandse investeerders en daarmee voor economische groei en werkgelegenheid.

Always a front runner in tax competition

-

Favorable legisation:

- Dividendbelasting

- Patent box (7% tax rate)

- Many others:

-

NL intra-group finance activities:

- EU Code of conduct: Harmful (A010 Council 7018/1/03)

- NL group interest box (5% tax rate): Not implemented after complains of the EC

-

NL International financing activities:

- EU Code of Conduct: Harmful (B004 Countil 7018/1/03)

- EU State Aid rules: State Aid (OJ 2003 L180/52)

-

NL informal capital (notional interest deduction):

- EU Code of conduct: Harmful (council 0717/1/03 E004)

-

NL intra-group finance activities:

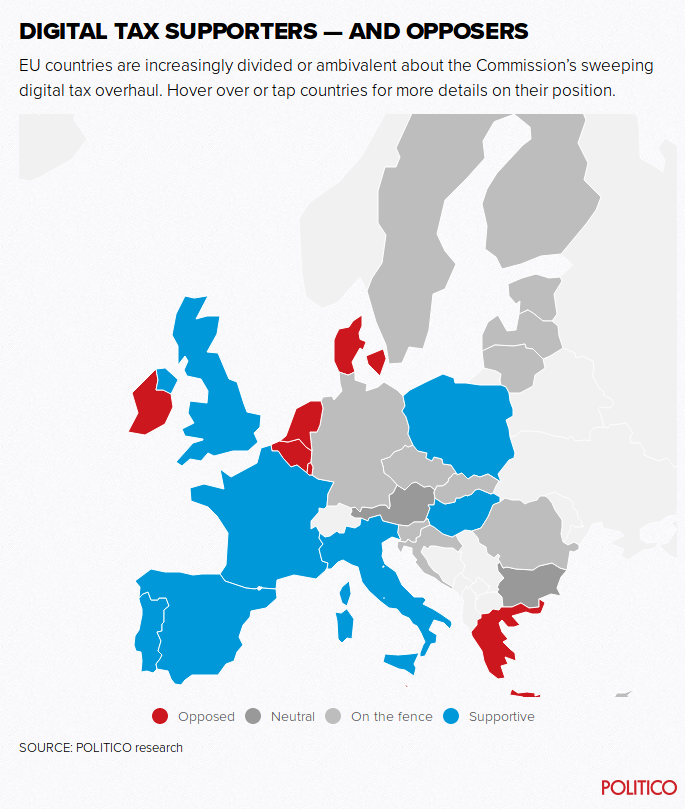

- Blocking EU legislation

onze open, op internationale handel gerichte economie

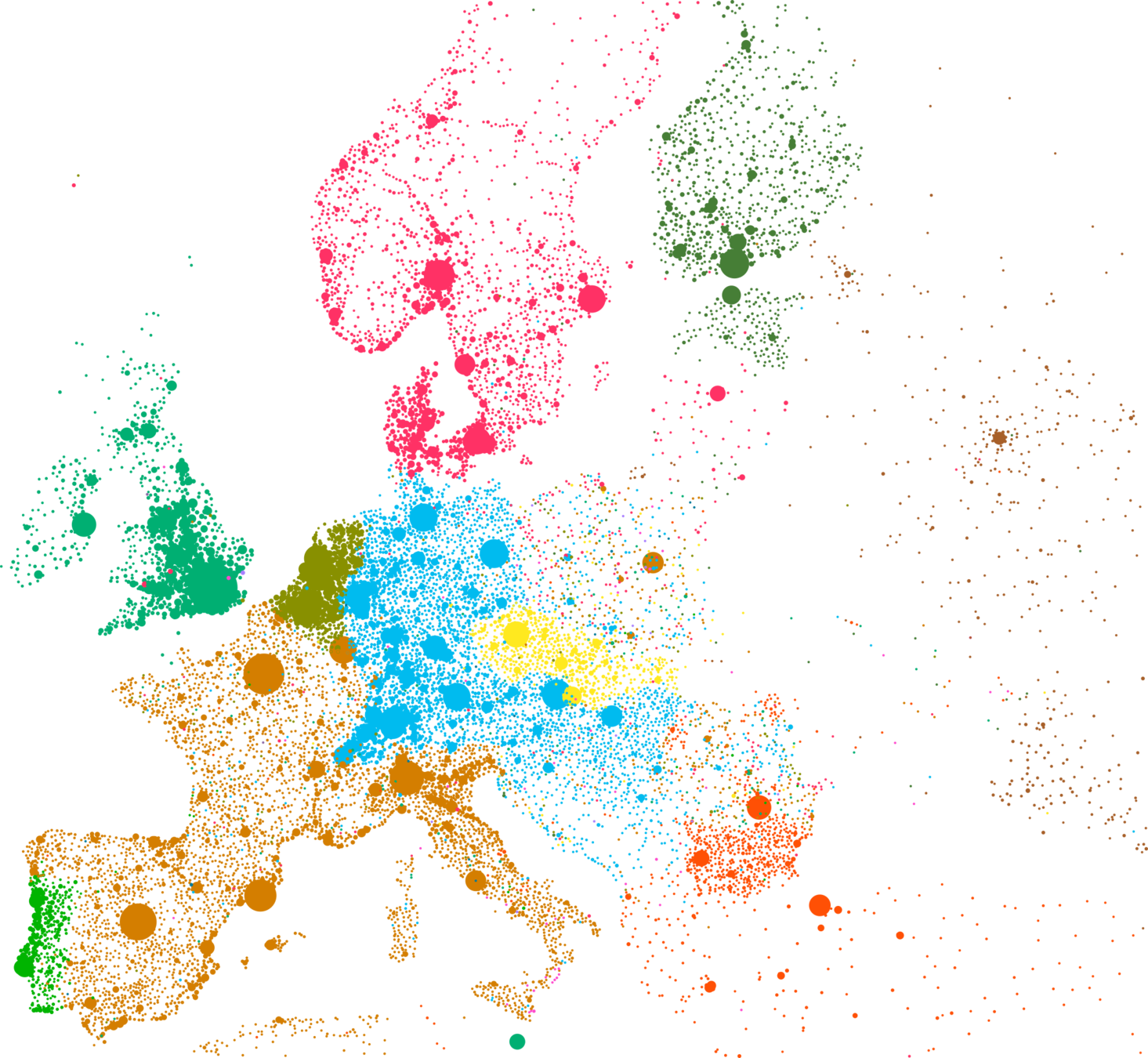

what is exactly the role of the netherlands?

A "Big Data" approach

Data provider: Orbis

~300 million companies

~100 million ownership links

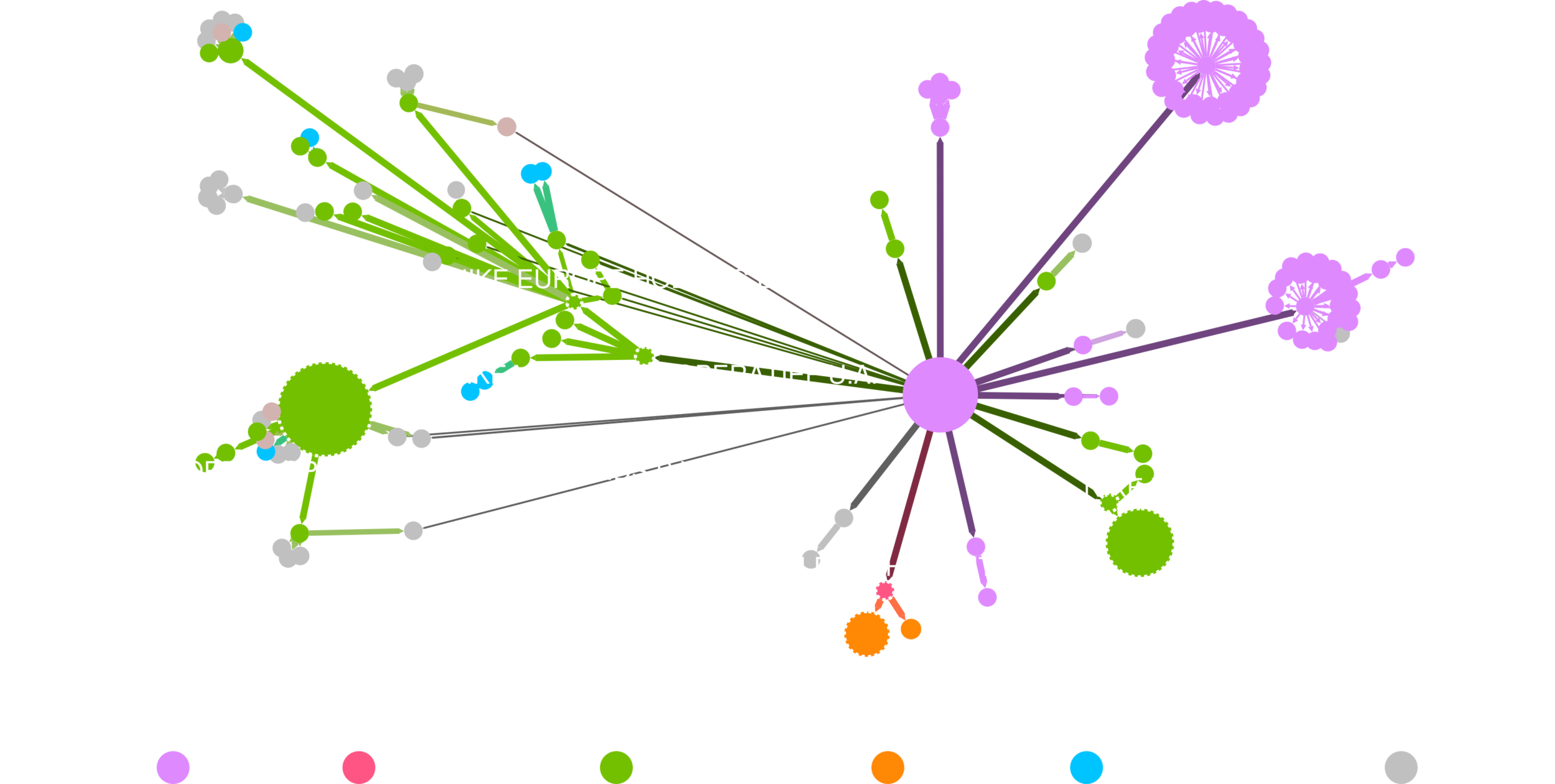

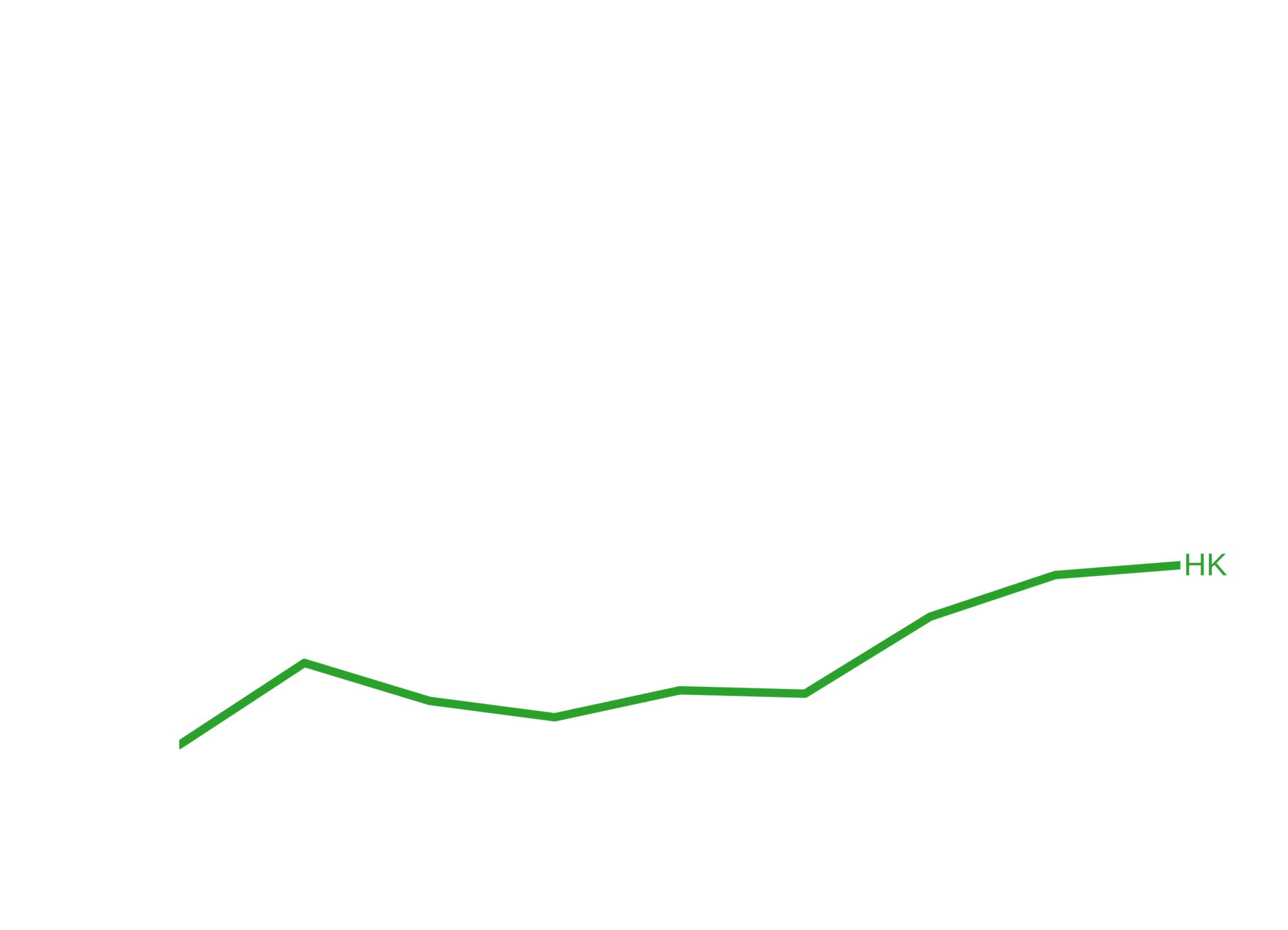

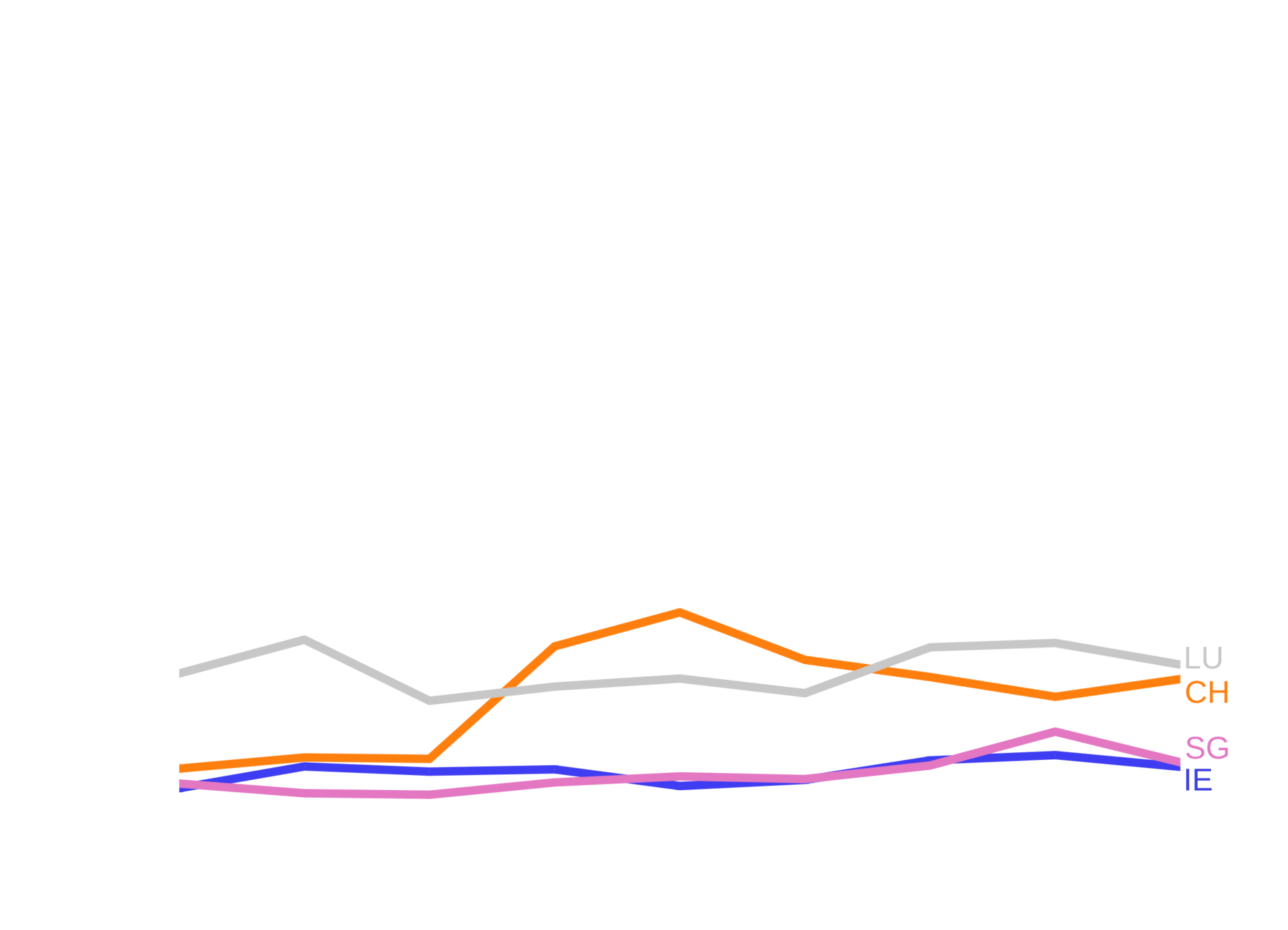

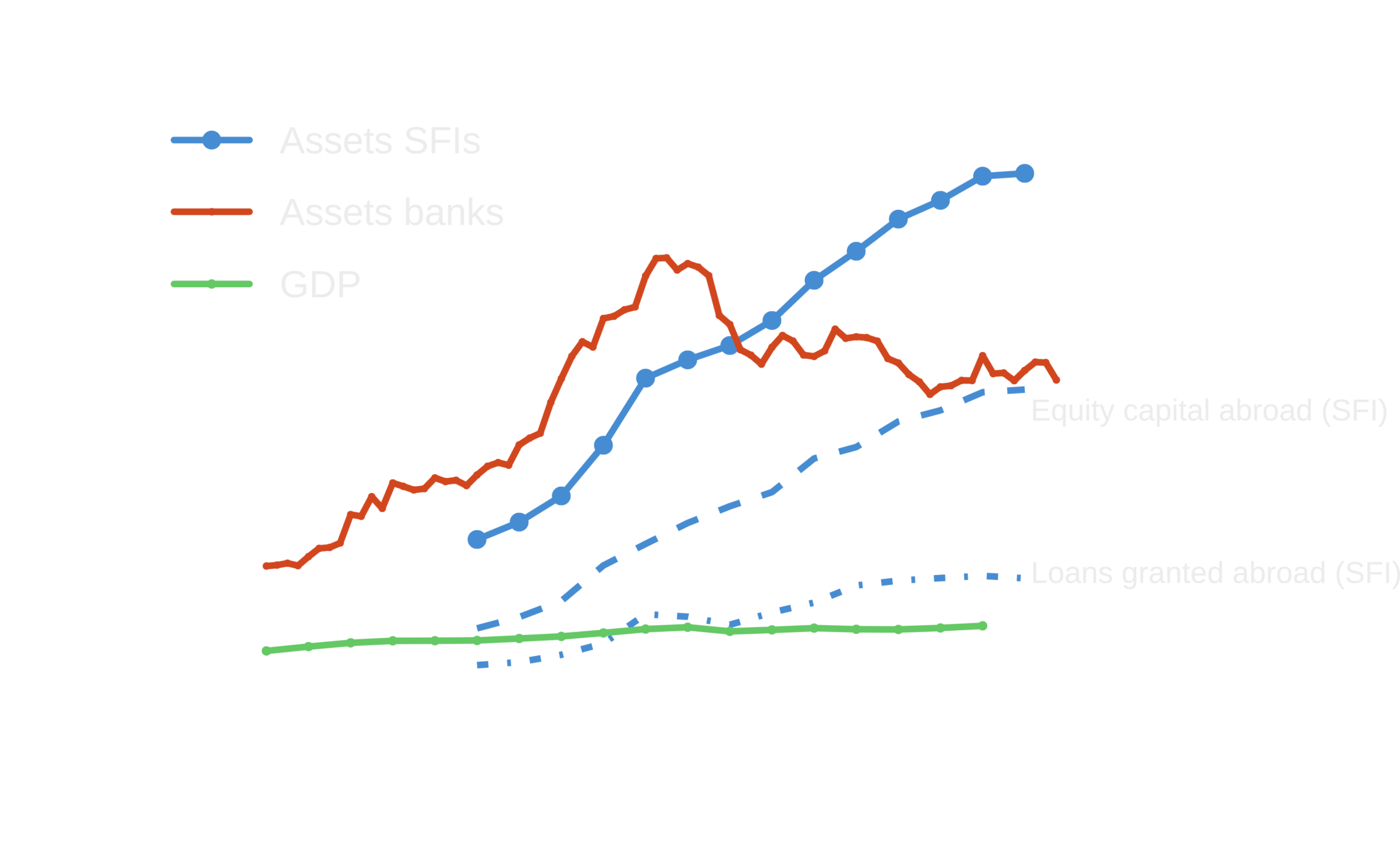

sink-OFFshore financial centers

Garcia-Bernardo, Fichtner, Takes, Heemskerk (2017)

conduit-OFFshore financial centers

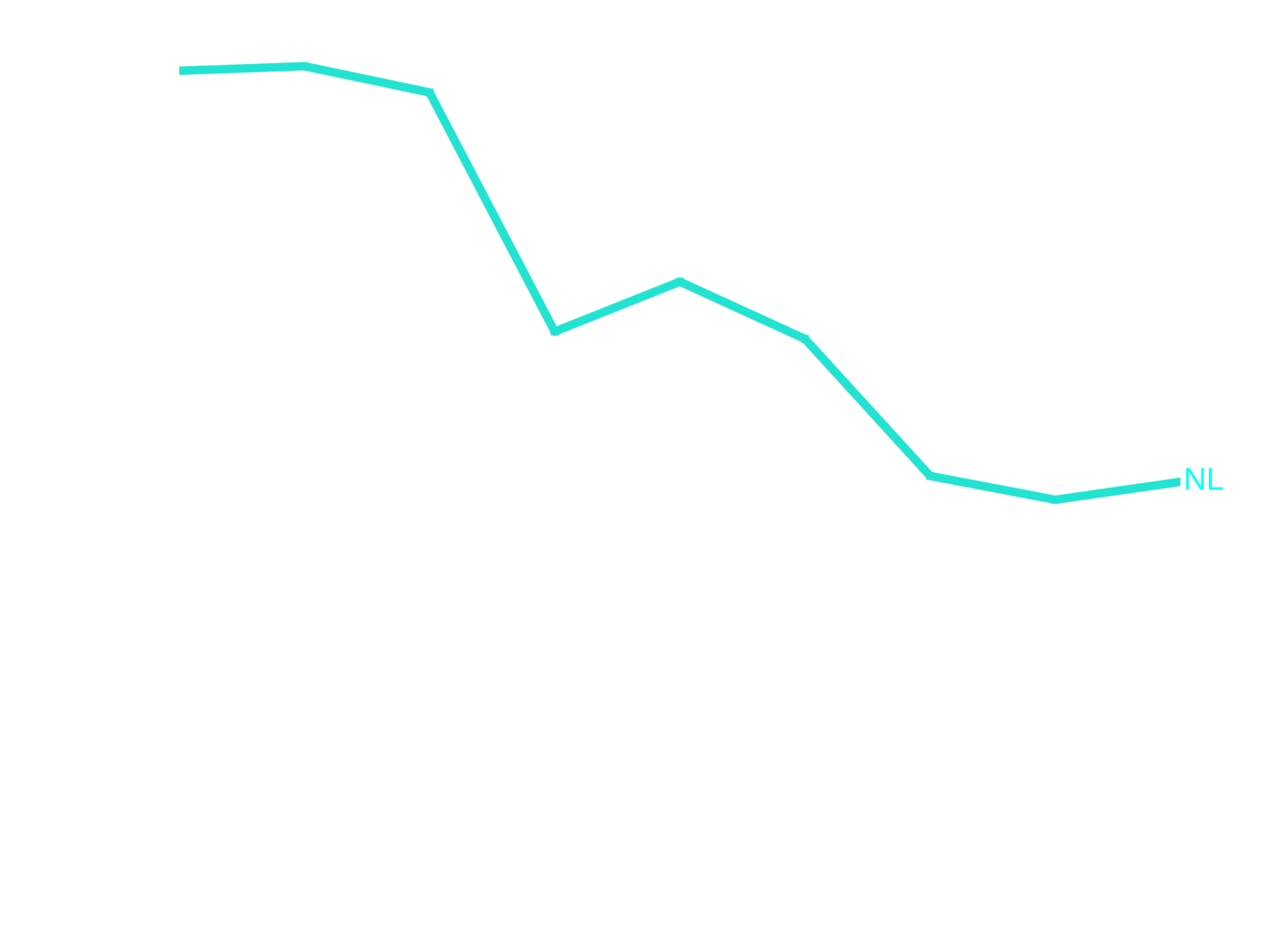

23% of all the value flowing to a sink-OFC flows through a Dutch Special Financial Institutions (BFI)

role as equity and interest conduit:

The Nederlandsche Bank

role as royalty conduit:

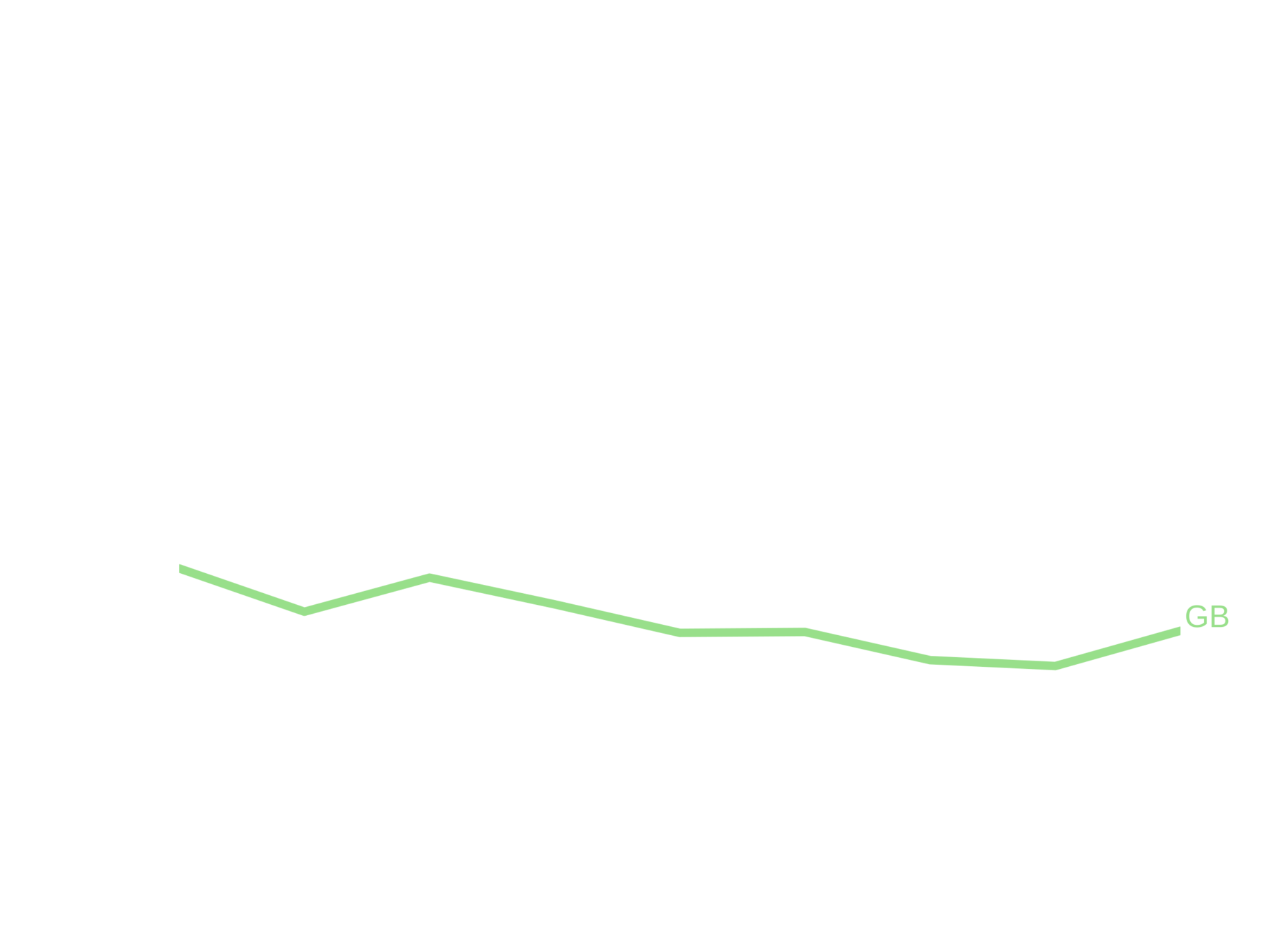

what does the netherlands gain?

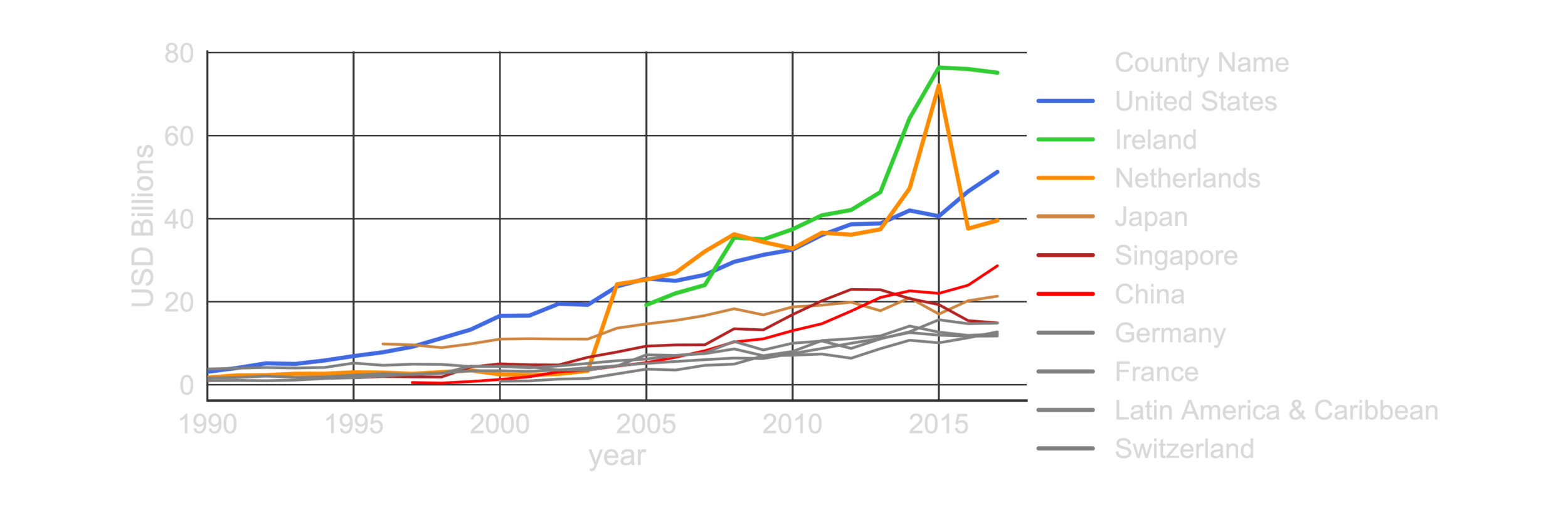

The Netherlands is extremely successful at attracting holding companies (assets ~8 times GDP).

Taxes

- 1.5-3 billion / year (1% of total revenue)

Employment

- 3000 of business service professionals

- Some other thousands in headquarters and shared service centers

The benefits are expected to increase in the post-BEPS era

Garcia-Bernardo, Janský and Tørsløv (forthcoming)

The Netherlands is the largest player because corporations organize their internal structure using Dutch conduits

CONCLUSIONS:

Corporations use the NL because it provides all the macro-institutional requirements AND many tax incentives

- Taxing financial revenue differently

- Secrecy/certainty in deals with corporations

CONSEQUENCES

- As the largest player in corporate structures, the NL enables companies to shift profits away from the place where economic activity happens - The NL diminishes tax sovereignty of other countries

- Contributes to inequality (domestic firms, rising power of capital)

@javiergb_com

javiergb.com

garcia@uva.nl

This presentation: slides.com/jgarciab/dag_fin19

jgarciab

@uvaCORPNET

corpnet.uva.nl

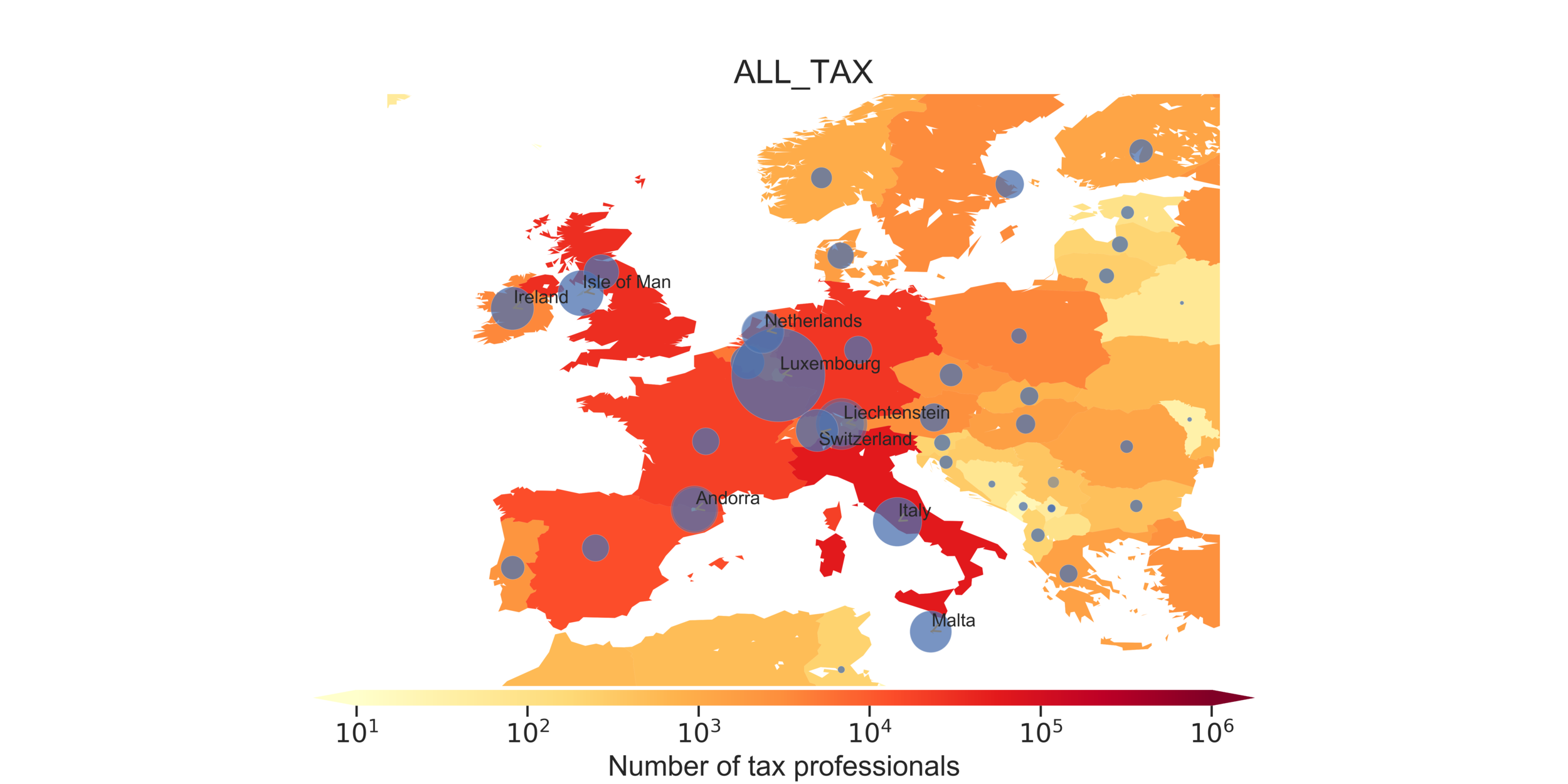

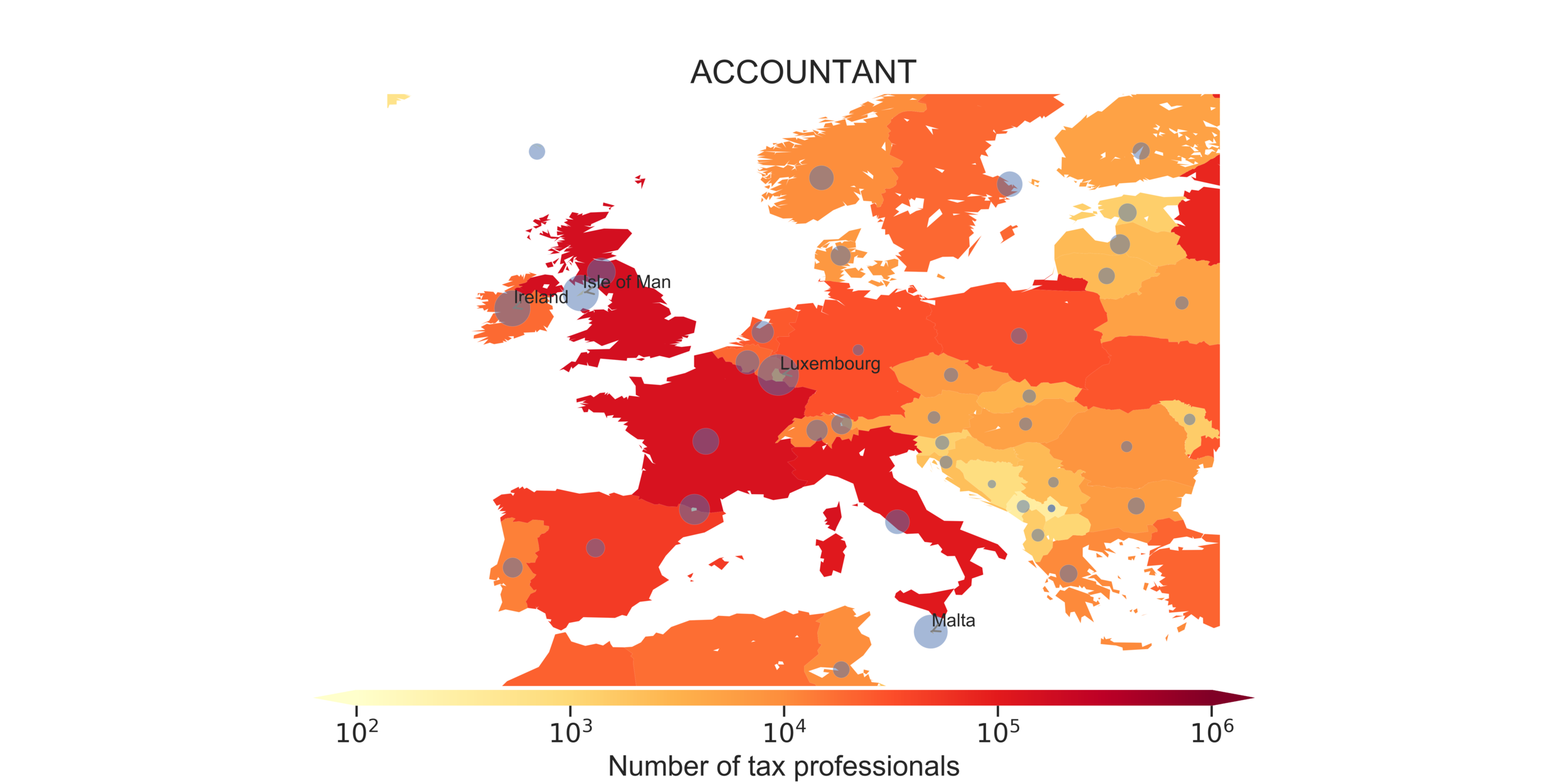

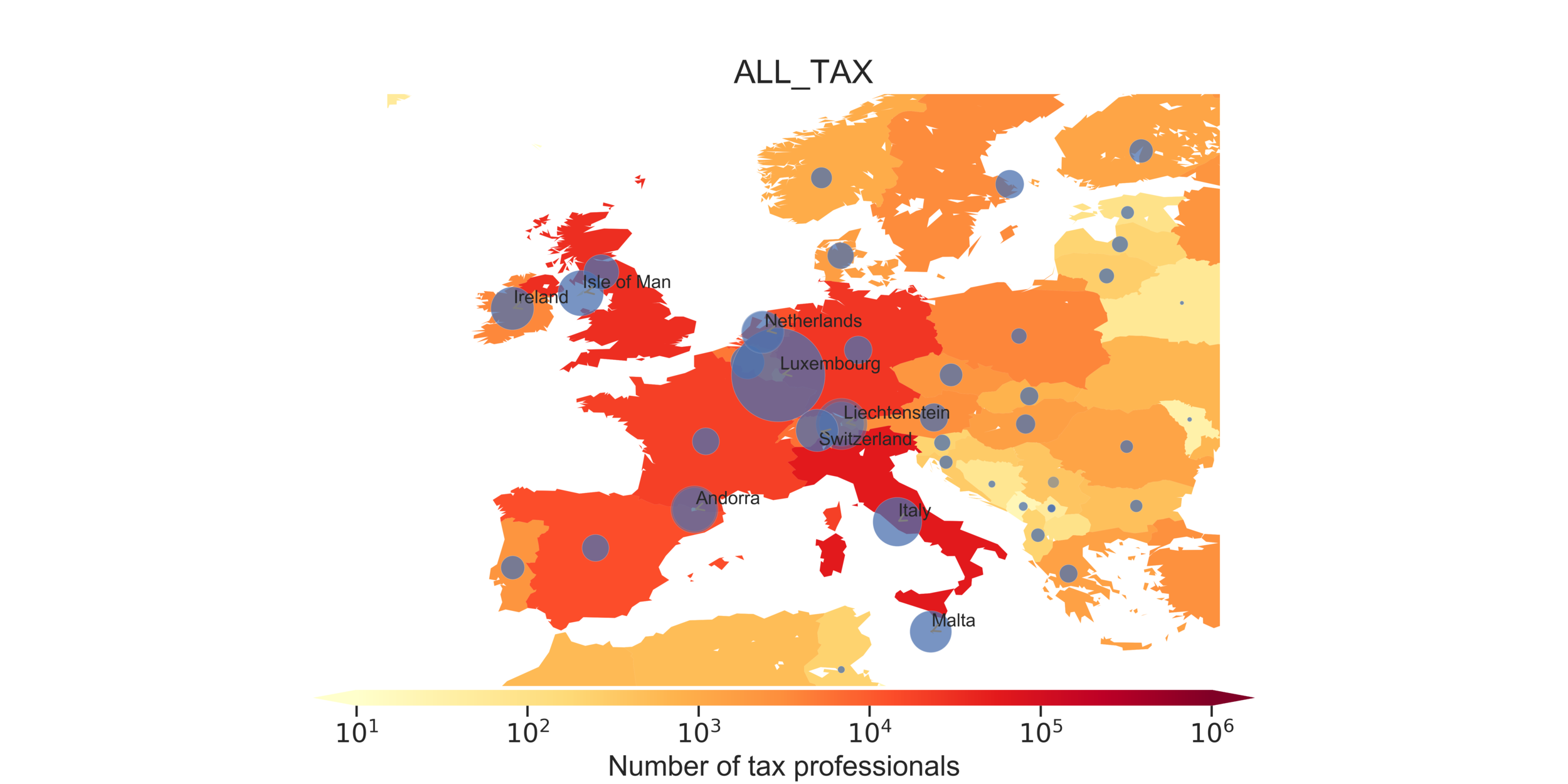

accountants

tax professionals

Dag van de Financial

By Javier GB

Dag van de Financial

sink and conduits in Corporate Structures

- 1,416