race to the bottom in corporate taxation

A story of love, passion and jealousy between multinationals and countries in the European Union

Javier Garcia-Bernardo

University of Amsterdam

ISA 2018

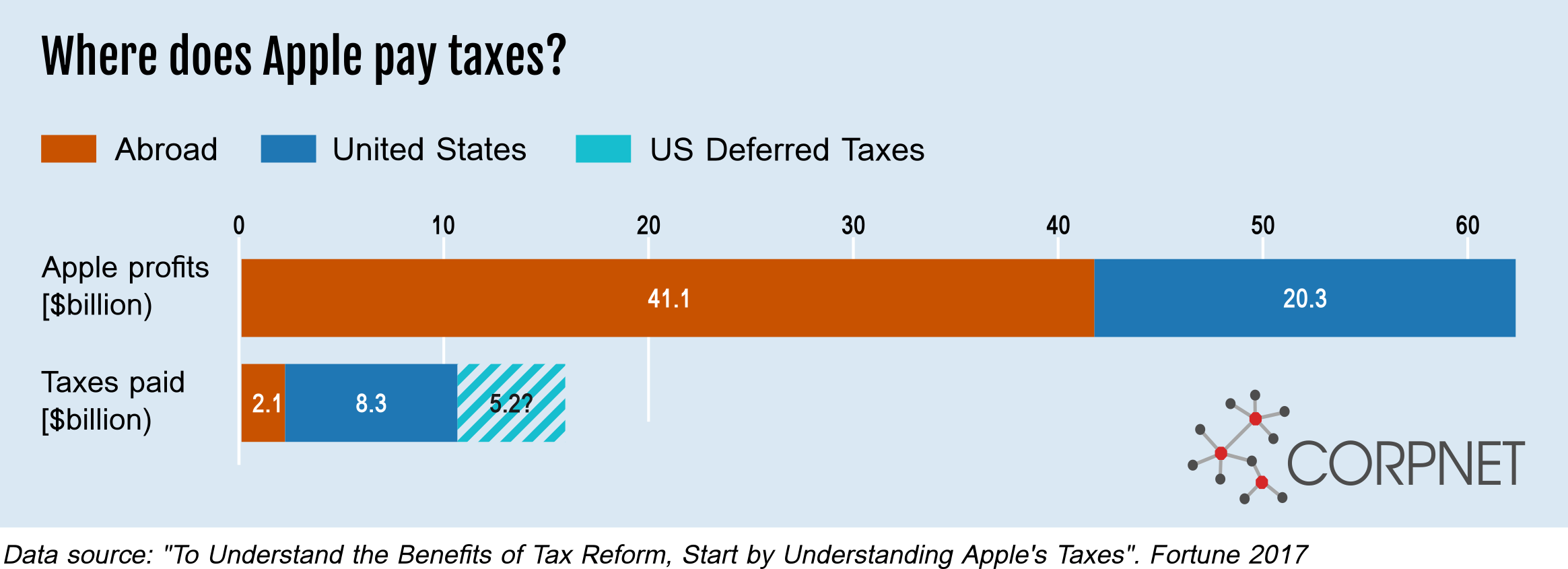

>15k jobs

~€300 million in tax

5% tax rate outside US

6.25% CIT under a new “knowledge development box"

1. LOVE:

benefits for companies and countries

2. the secret(s) of love:

factors affecting investment

3. tax competition:

race to the bottom and who to blame

4. effects

OUTLINE

1. love

Description of who wins what

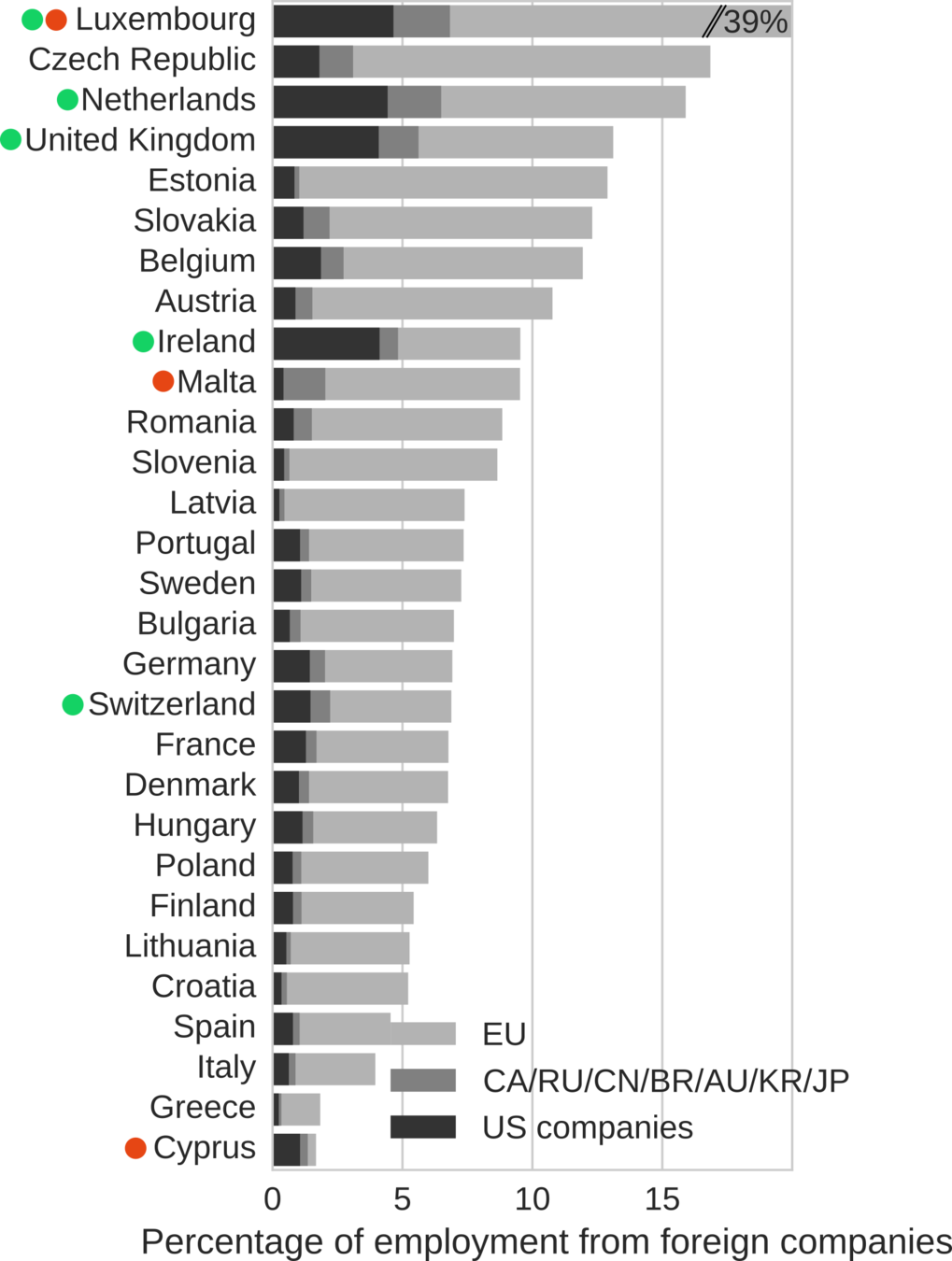

1. benefits for companies

corporations pay less tax

1. benefits for companies

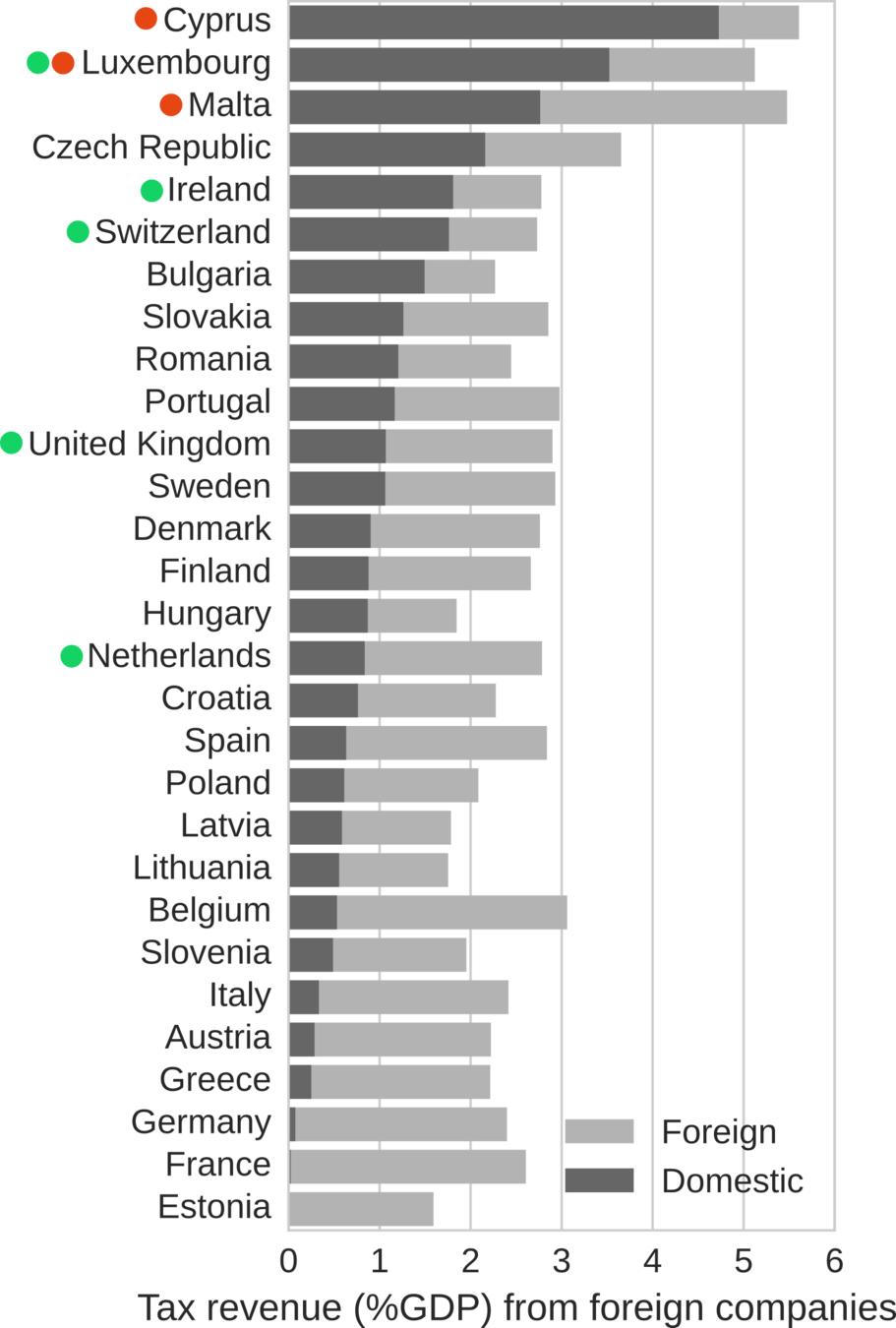

especially for those some countries

1. benefits for companies

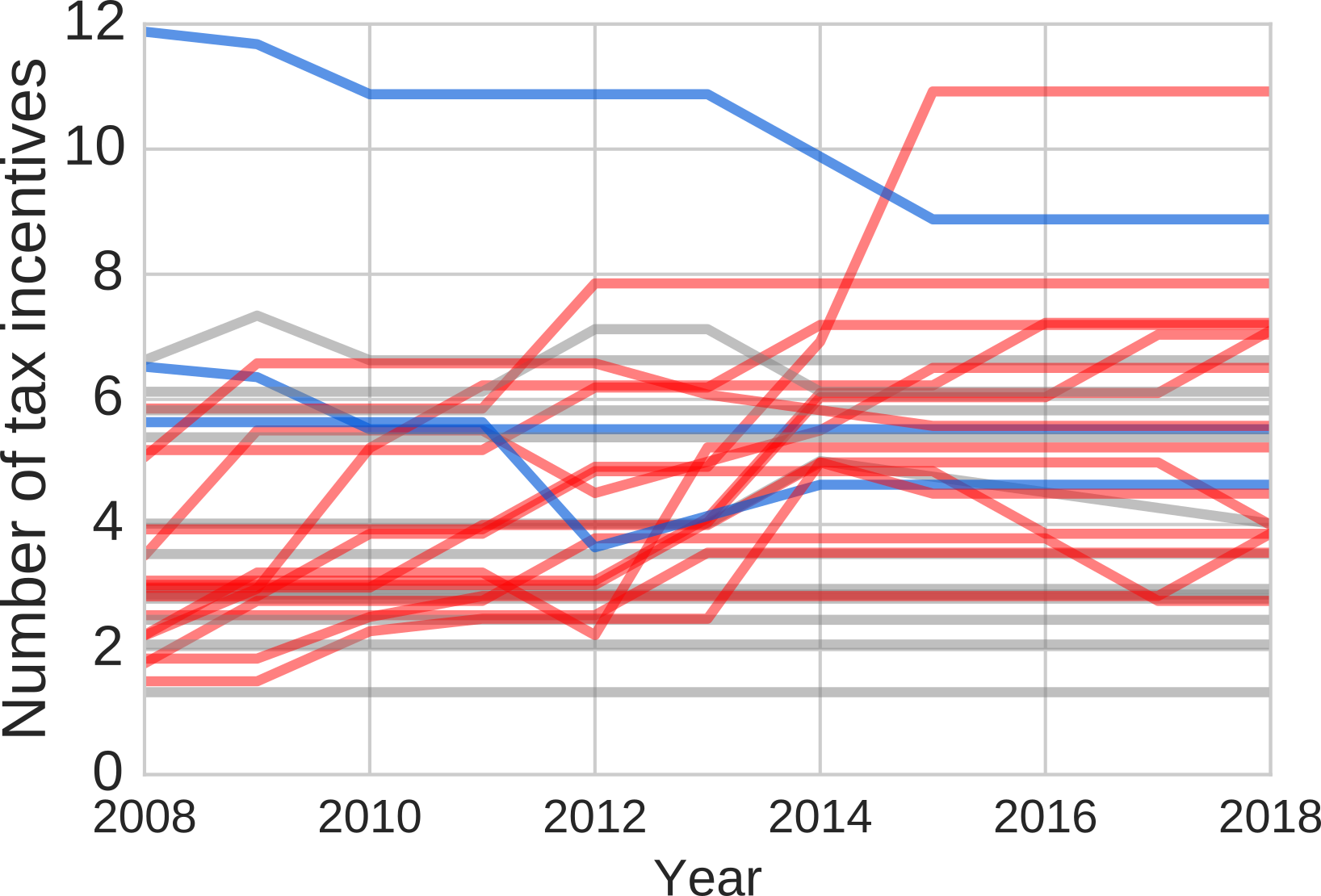

tax incentives are also increasing

1. benefits for countries

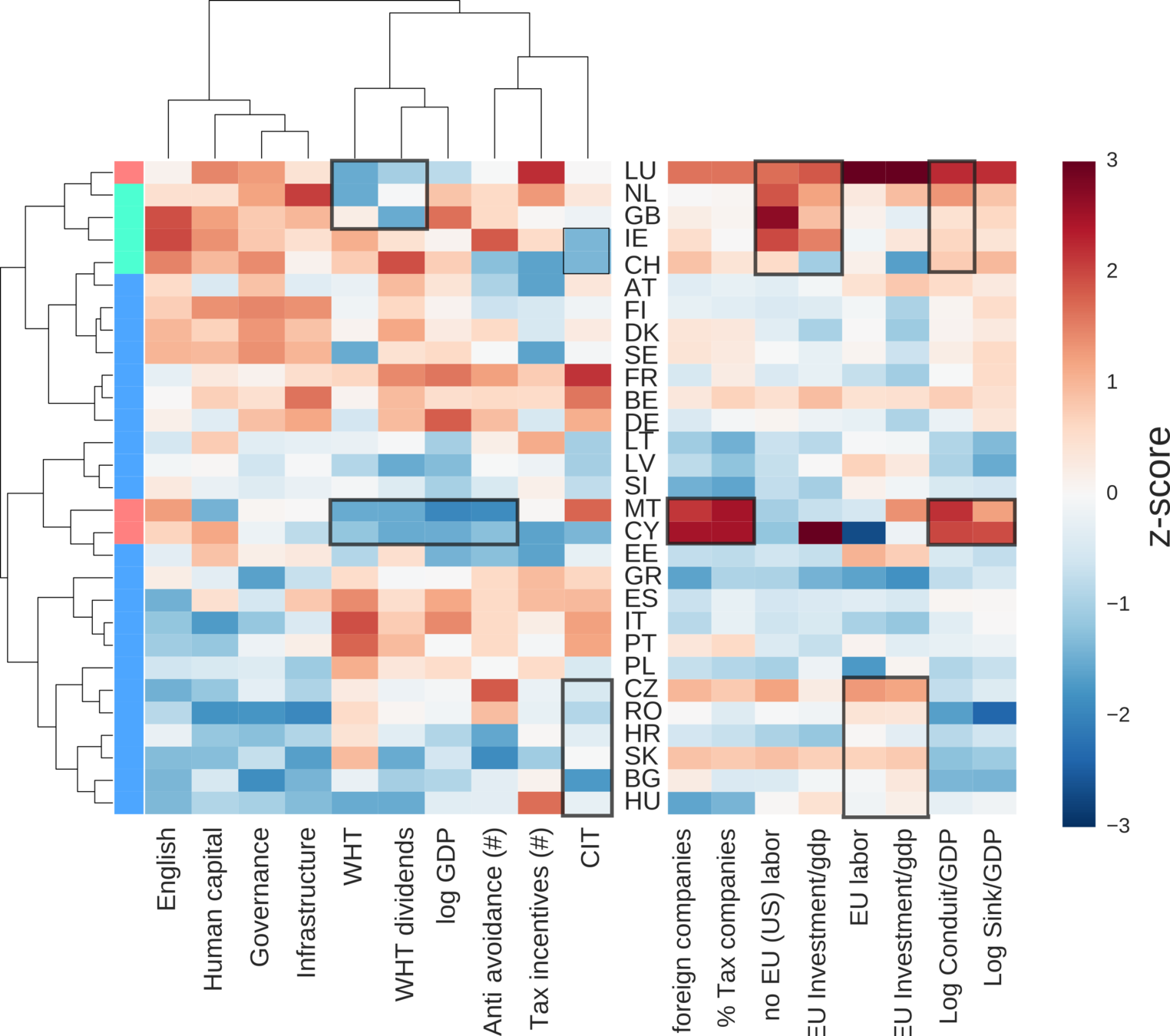

2. the secret(s) of love

Factors affecting investment

2. the effect of tax

CIT:

↓ FDI in 1995-2007: ↑CIT by one unit --> ↓FDI by 3.3%

↑ tax revenue: ↑CIT by one unit --> ↑0.008 GDP in tax revenue

Correlated with: ↑GDP growth and ↓foreign labor force

WHT royalties/interests:

↑ tax revenue: ↑WHT by one unit --> ↑0.002 GDP increase

Correlated with: ↑conduit investment

Anti-avoidance:

↑ GDP growth: ↑1 more anti-avoidance --> ↑0.127 GDP growth rate

↑ tax revenue: ↑1 more anti-avoidance --> ↑0.017 GDP in tax revenue

Correlated with: ↓sink and ↓conduit investment

Tax incentives:

↑ GDP growth: ↑1 more tax incentive --> ↑0.25 GDP growth rate

Correlated with: ↑sink and ↑conduit investment

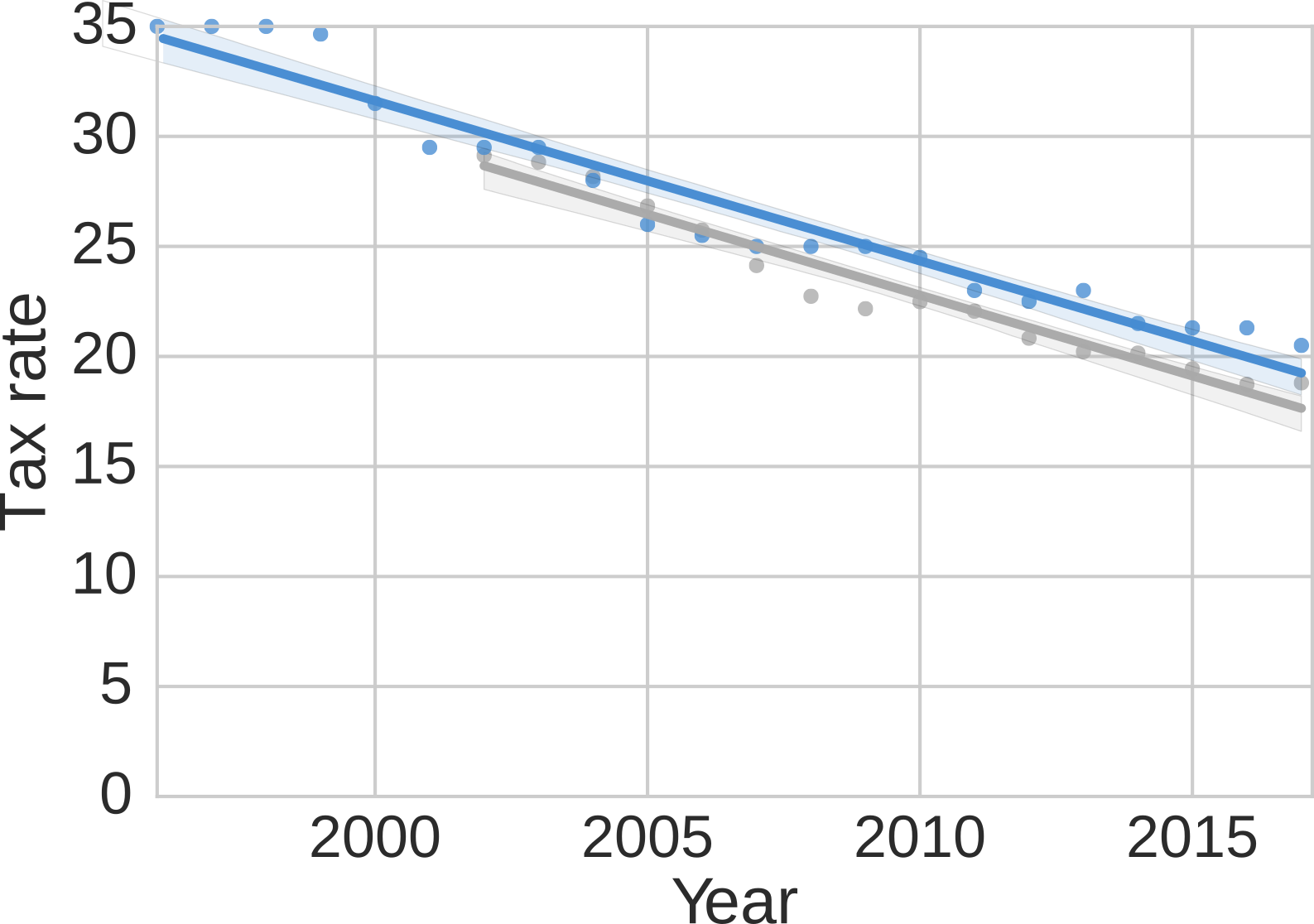

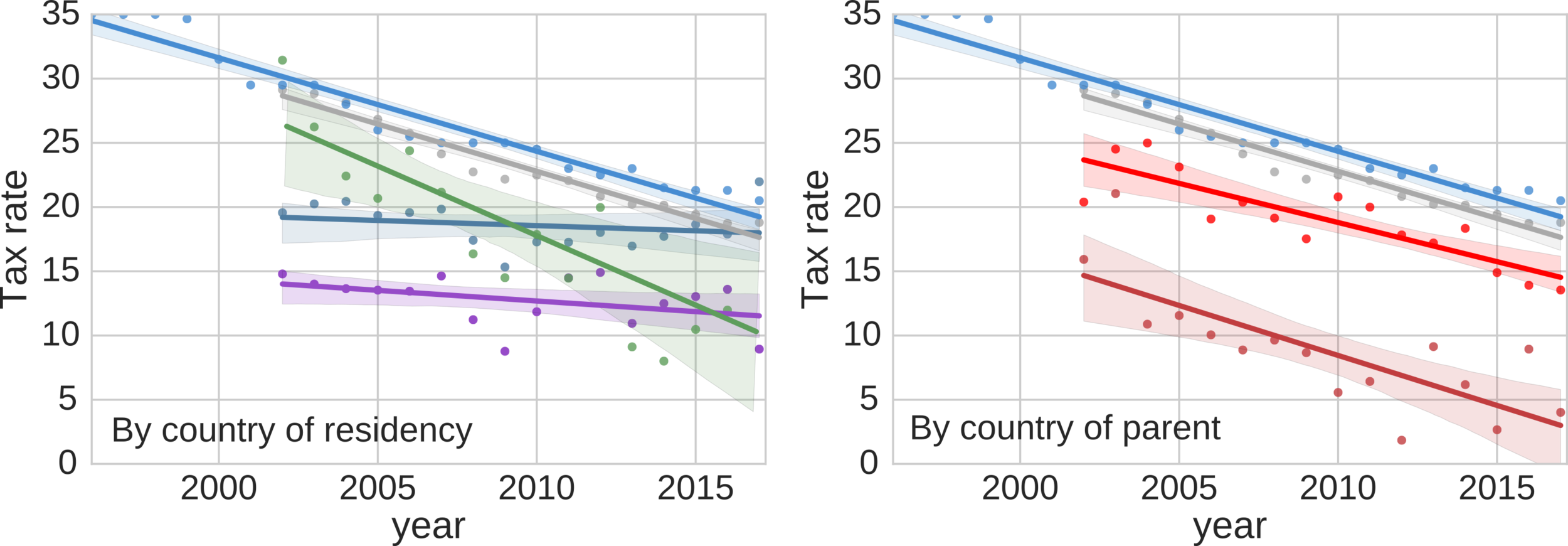

3. tax competition

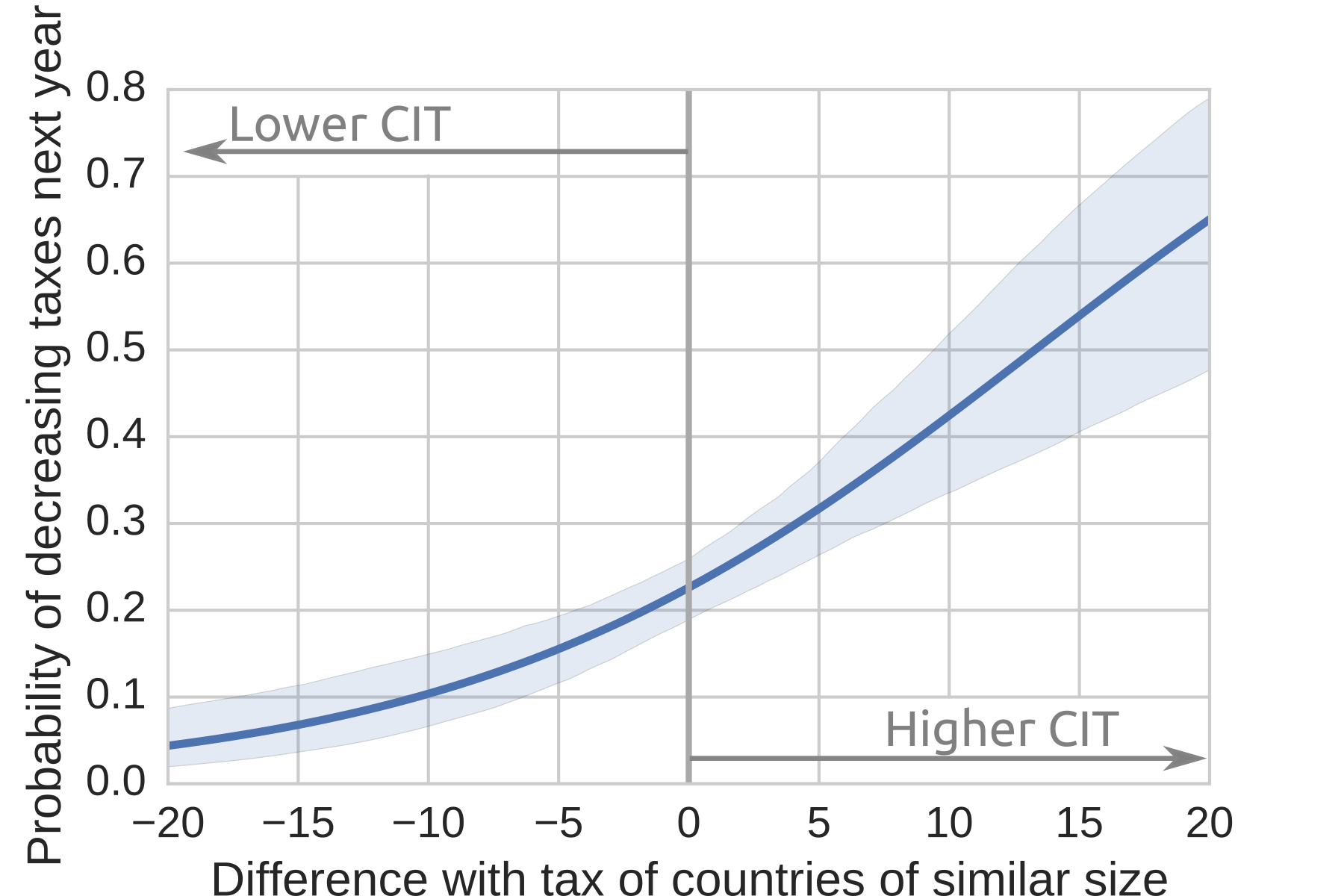

Countries have incentives to reduce tax Does it create a race to the bottom? Who is to blame? Focus on CIT (for now)

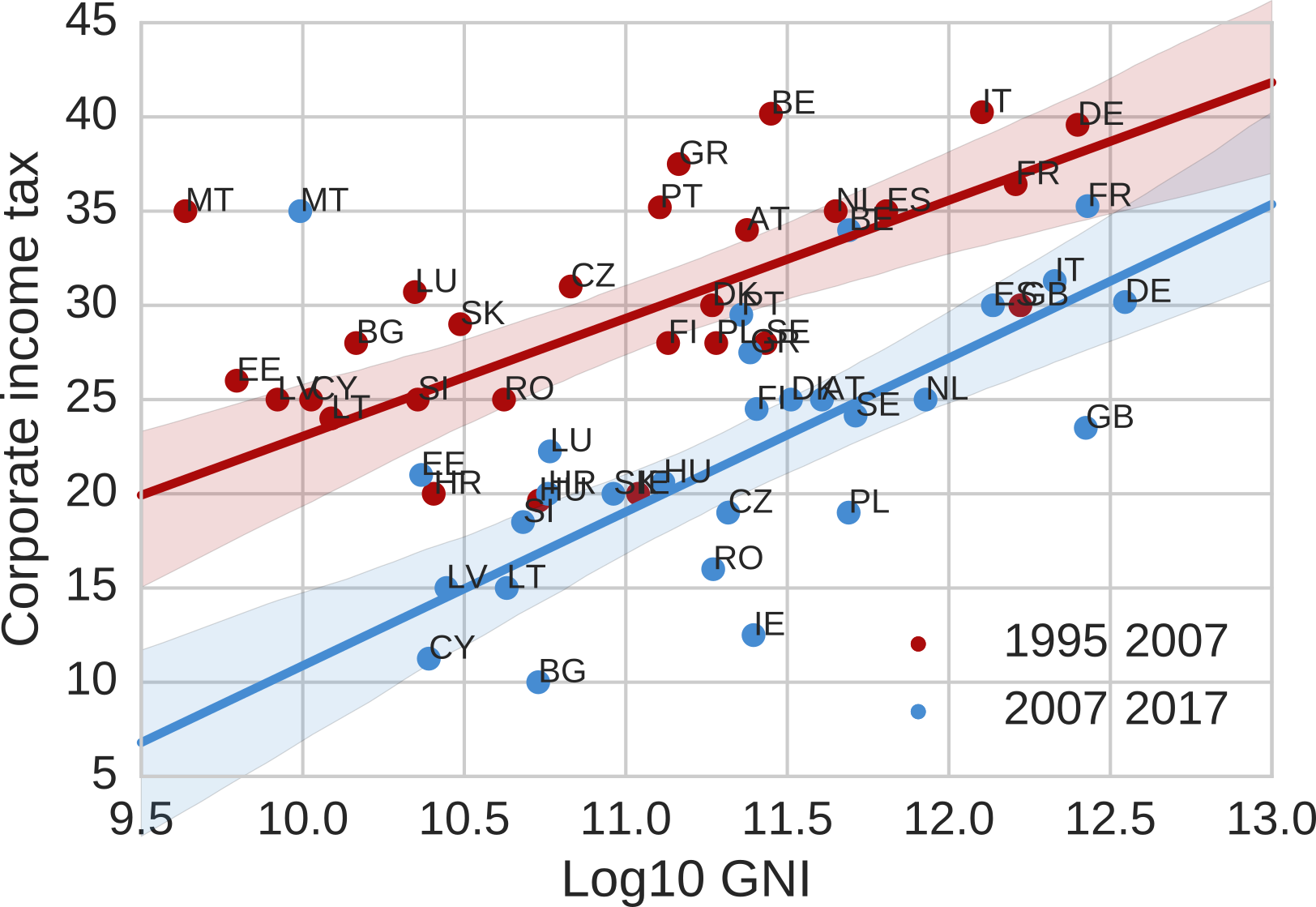

3. `optimal' tax rate

small countries are better with low taxes

different countries reducing taxes

3. who reduces taxes

Pioneers:

- Ireland ('00,'01,'02,'03)

- UK ('97,'12,'14)

- Poland ('00,'03)

- Bulgaria ('05,'07)

- Hungary ('04,'17)

- Romania ('00,'05)

- Lithuania ('02,'08)

- Latvia ('04)

- Poland ('04)

- Slovakia ('04)

- Cyprus ('03)

pioneers and followers

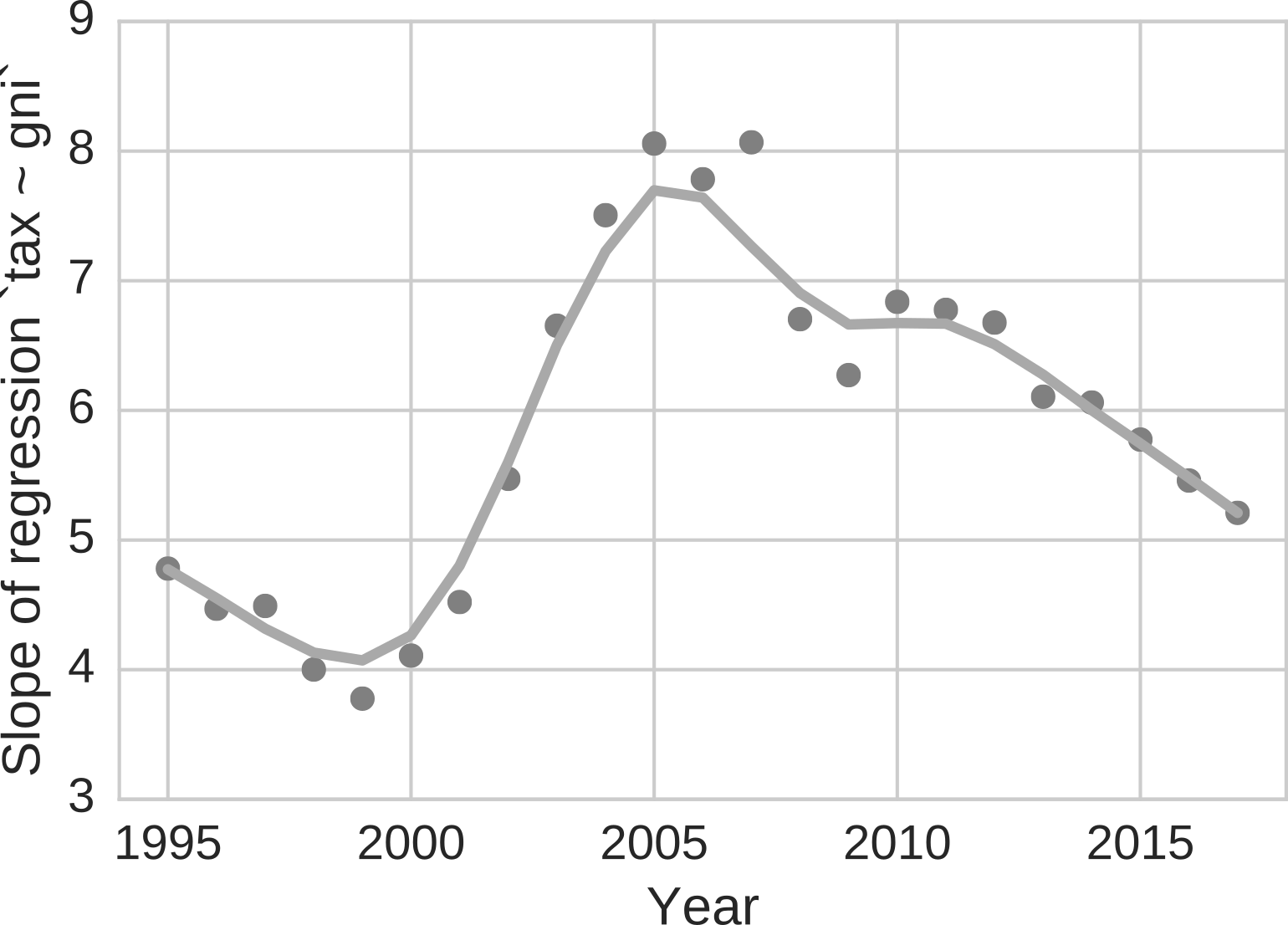

3. race to the bottom

4. effects

Pioneers reduce taxes to attract/retain competitive advantage

Followers follow to keep their companies from leaving

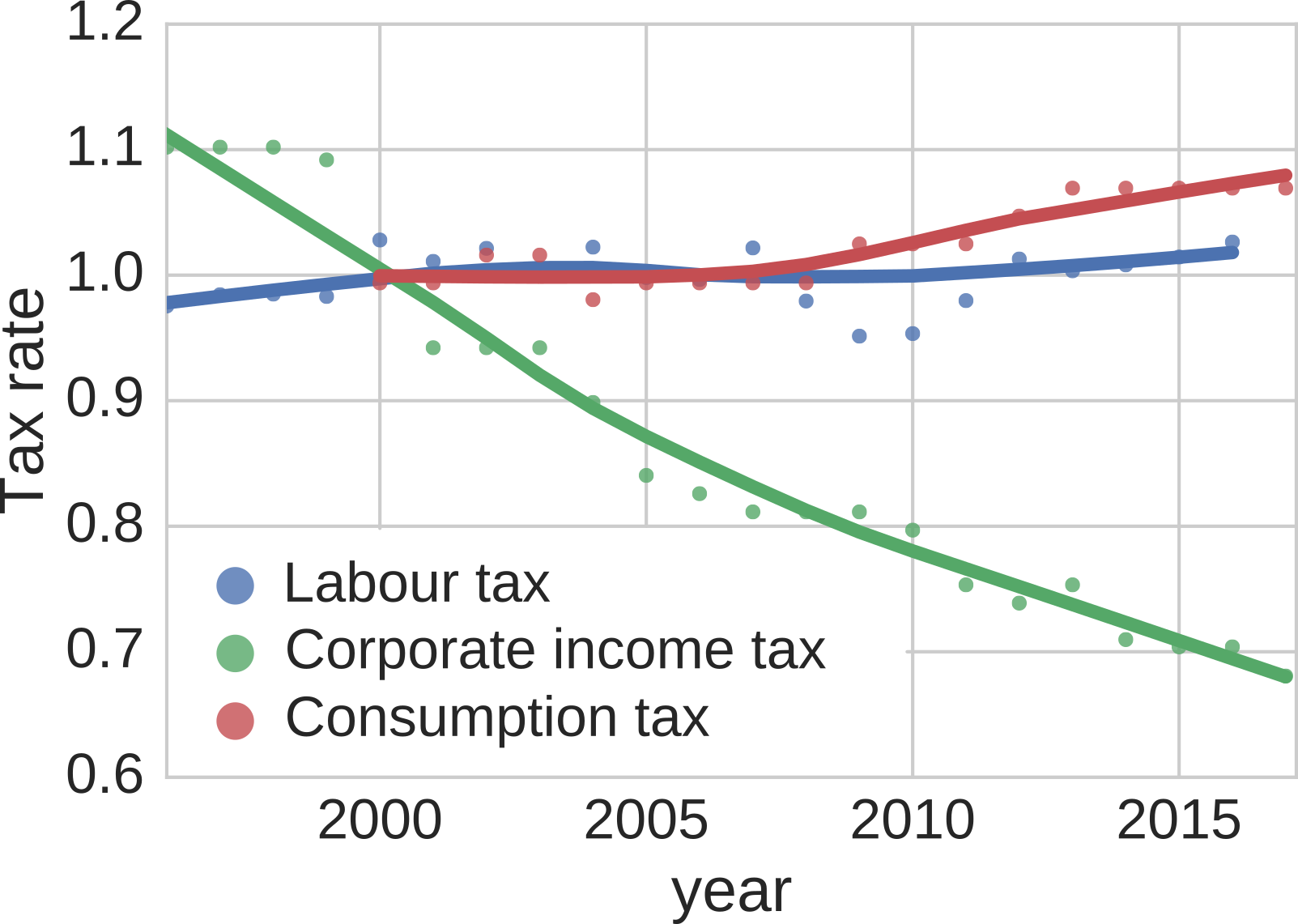

4. effects

burden transferred to consumption

4. effects

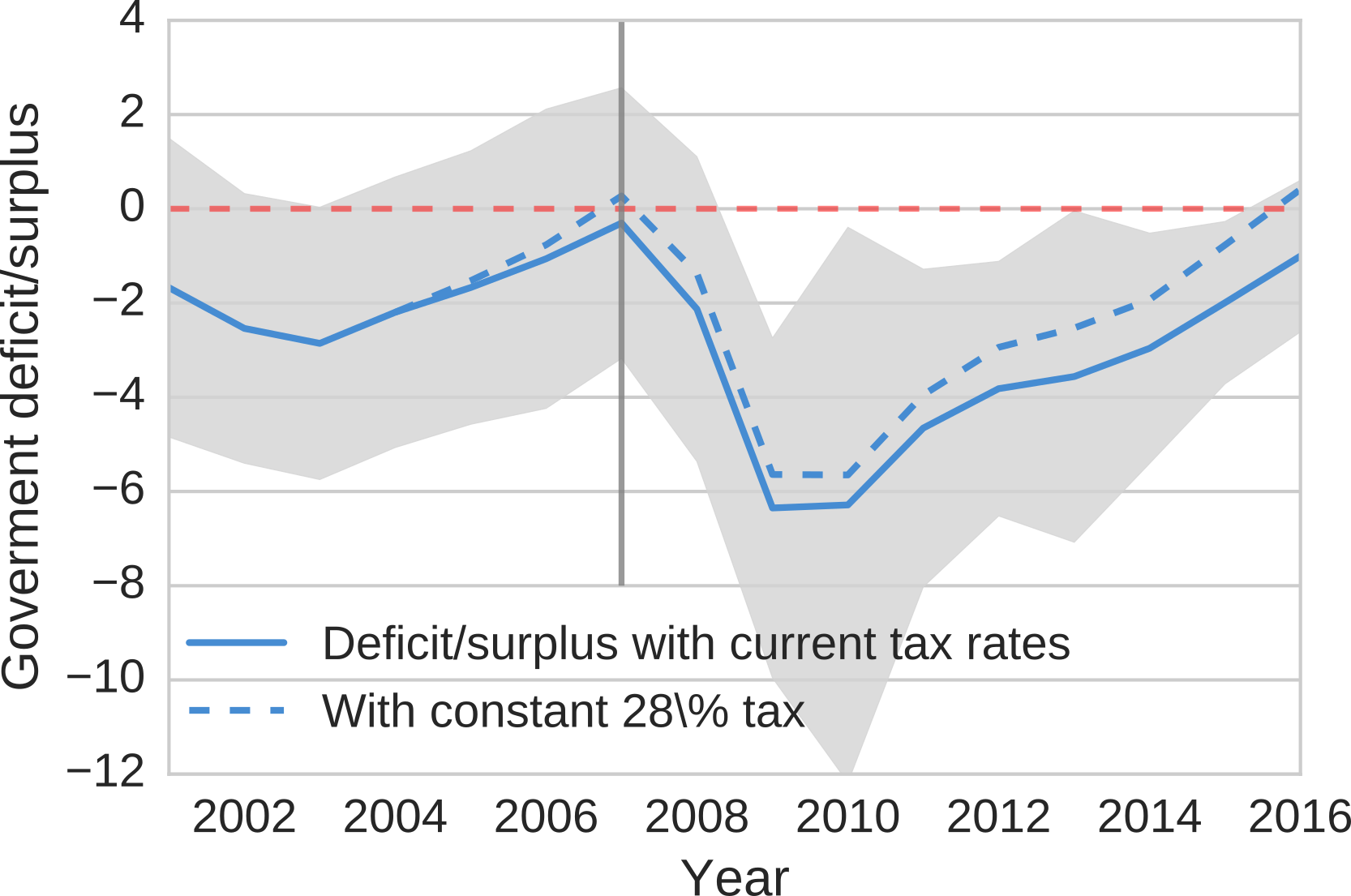

government deficit

4. recap

- LOVE:

- Countries have incentives to attract multinationals (jobs/revenue)

- MNEs have incentives to invest in countries with low tax rates.

- TAX COMPETITION:

- Small countries have higher incentives, but also some other countries can gain a comparative advantage from reducing taxes. For the case of CIT:

- Eastern Europe: Attract real investment from Europe

- Ireland / UK: Attract mainly US multinationals

- Other taxes/incentives: CY/MT/LU --> Low regulations. NL --> WHT

- Small countries have higher incentives, but also some other countries can gain a comparative advantage from reducing taxes. For the case of CIT:

- EFFECTS:

- They drag the rest of the countries in a race to the bottom.

- Increasingly lower CIT rates (e.g. cuts in NL and UK).

Javier Garcia-Bernardo

garcia@uva.nl / @javiergb_com

thanks!

deck

By Javier GB

deck

- 1,448