Javier García-Bernardo

The University of Amsterdam

Nov 12th, 2017

Nature, origins and political consequences of corporate networks in modern economic life?

corporate networks

Nodes:

- Companies

Links:

- Shared directors

E.M. Heemskerk, F.W. Takes, J. Garcia-Bernardo and M.J. Huijzer ‘Where is the global corporate elite? A large-scale network study of local and nonlocal interlocking directorates‘, Sociologica 2016(2): 1-31, 2016.

Mr. Jorge Paulo Lemann - Heinz - 3G Capital - AB Inbev - And another 70 positions

corporate networks

Nodes:

- Companies

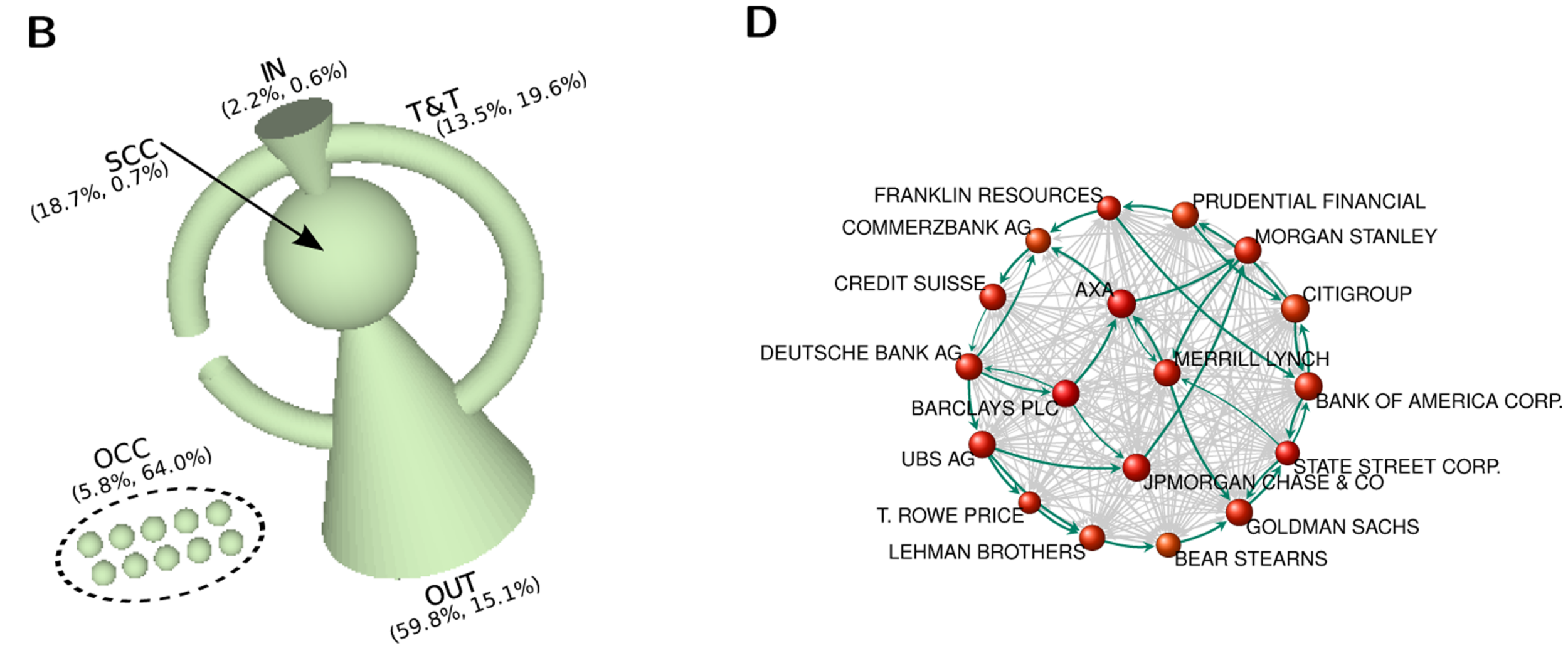

Vitali, Glattfelder and Battiston, The network of global corporate control, PloS one, 2011.

Links:

- Ownership

IDENTIFYING OFFSHORE FINANCIAL CENTERS

``Uncovering Offshore Financial Centers: Conduits and Sinks in the Global Corporate Ownership Network''

https://www.nature.com/articles/s41598-017-06322-9

Javier Garcia-Bernardo, Jan Fichtner, Frank Takes, Eelke Heemskerk

OFFSHORE FINANCIAL CENTERS

Offshore Financial Center (OFC): jurisdiction (country) that attracts financial activities from abroad through low taxation and lenient regulation.

- So, which countries are OFCs?

- Definitions differ

- Highly contested and politicized

- FDI/GDP ratio approach: substantially more Foreign Direct Investment than expected based on GDP

- Problematic because:

- No exact investment flows, just dyadic relationships

- OFC homogeneity assumption

- Large countries hard to detect

- No difference in roles

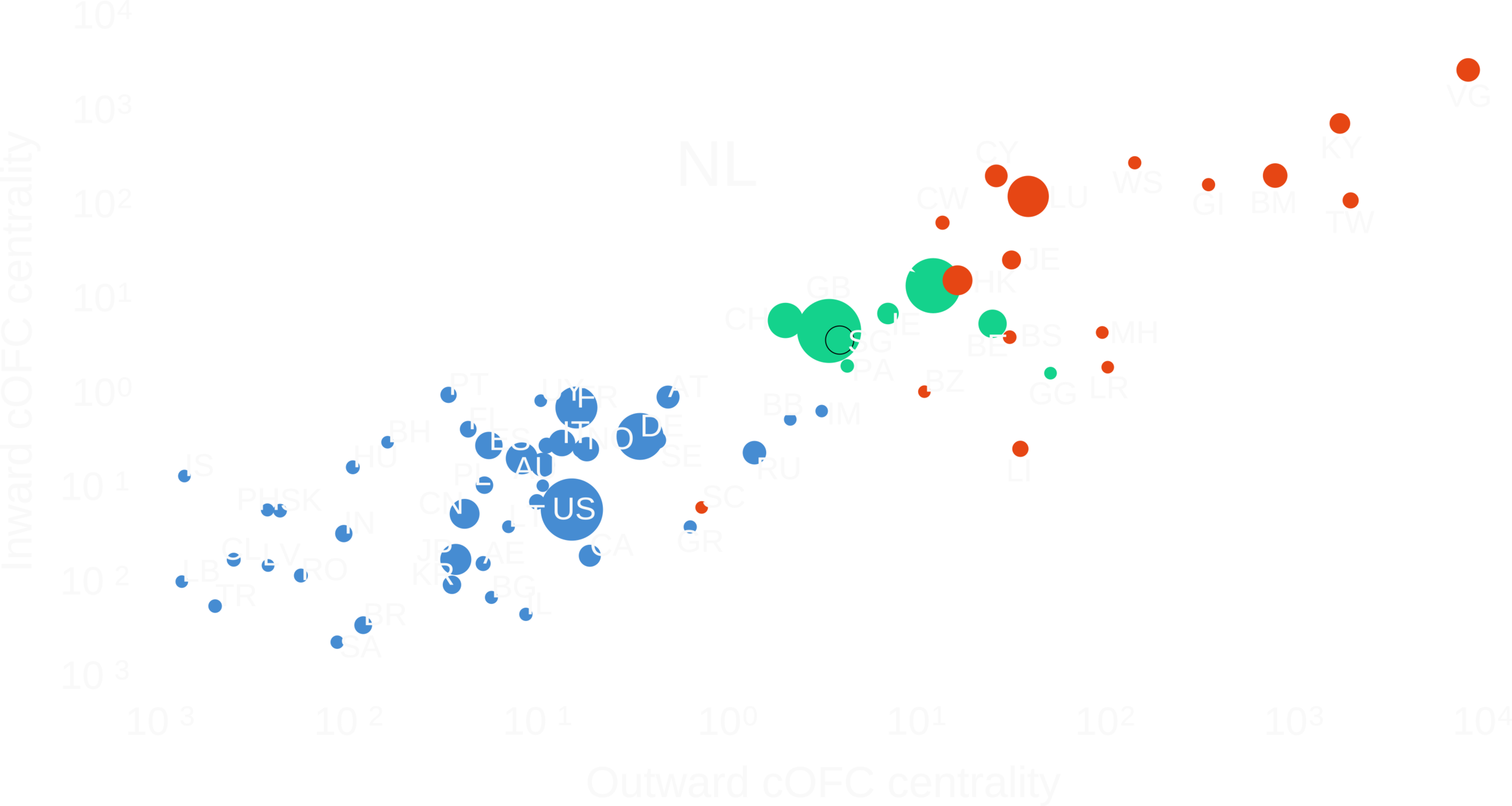

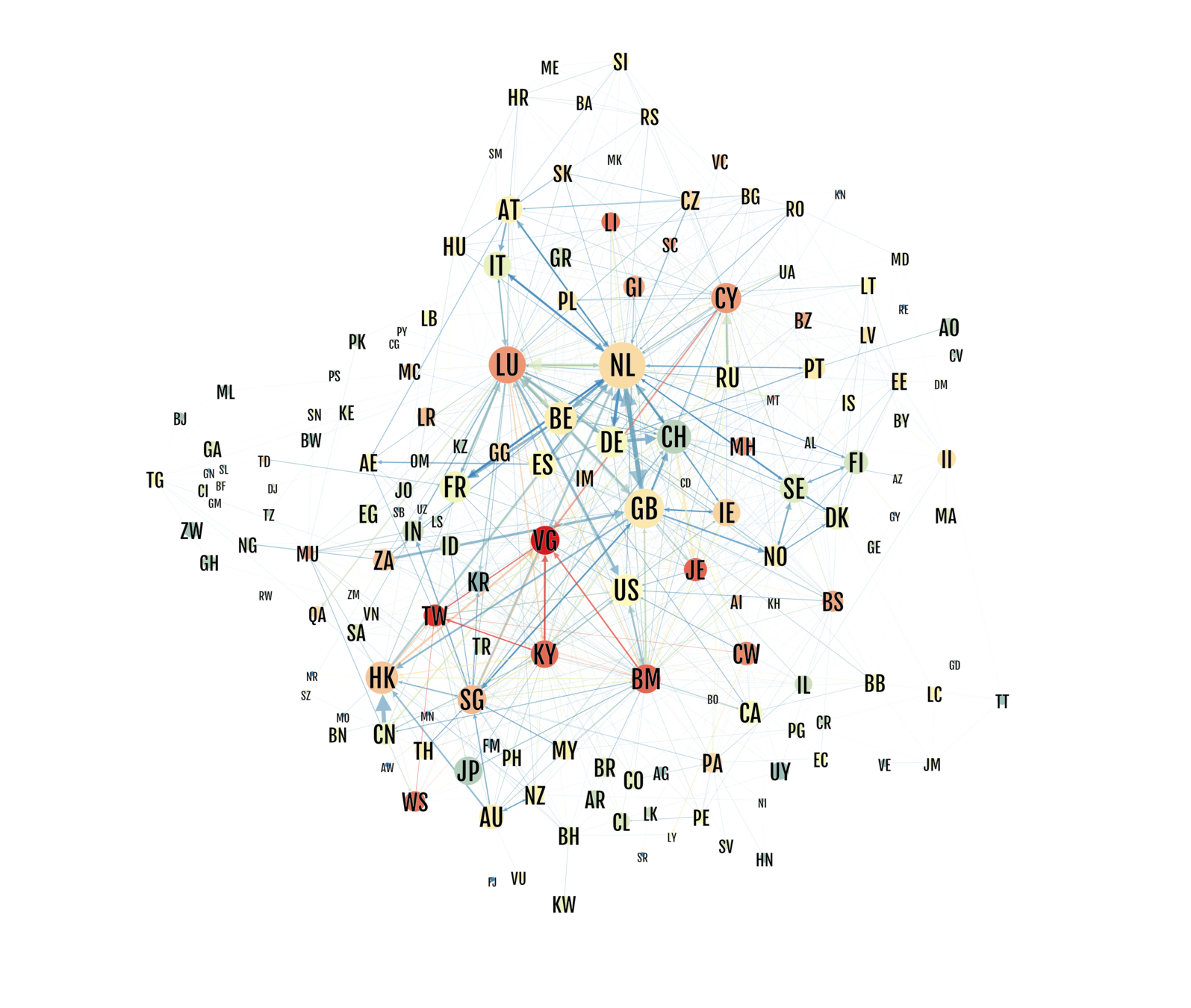

sinks and conduits

We look at which countries are used disproportionally in transnational ownership chains.

ORBIS

- 200 million companies

- 70 million ownership relationships

- 10 million transnational chains

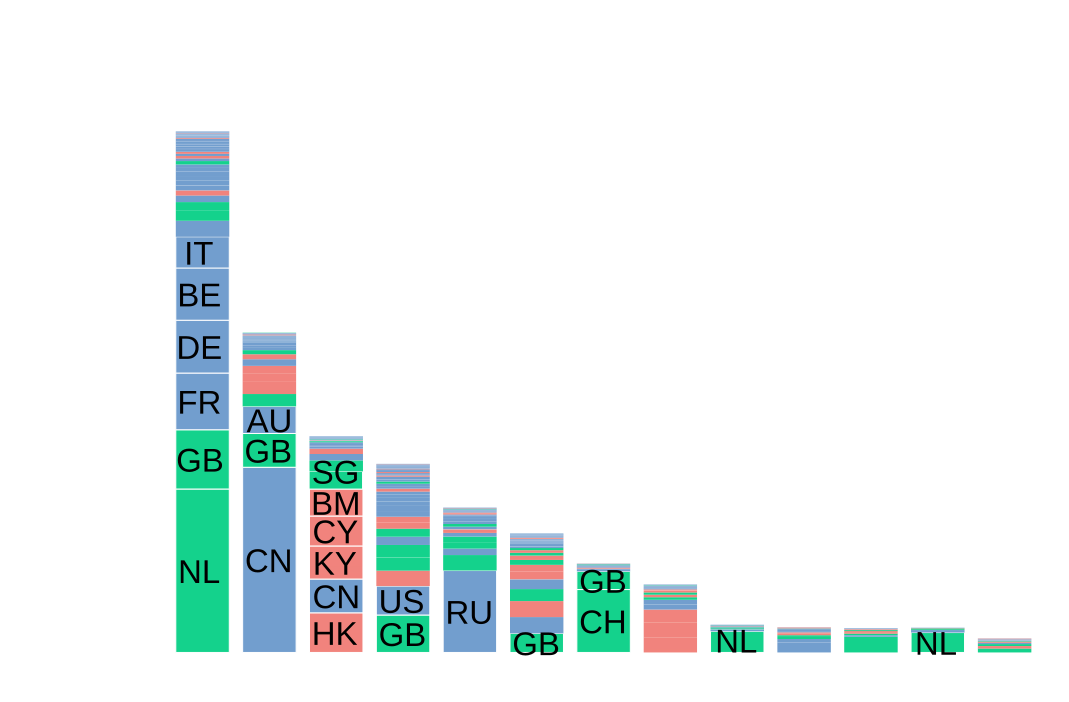

sink-OFCs

sink-OFFshore financial centers

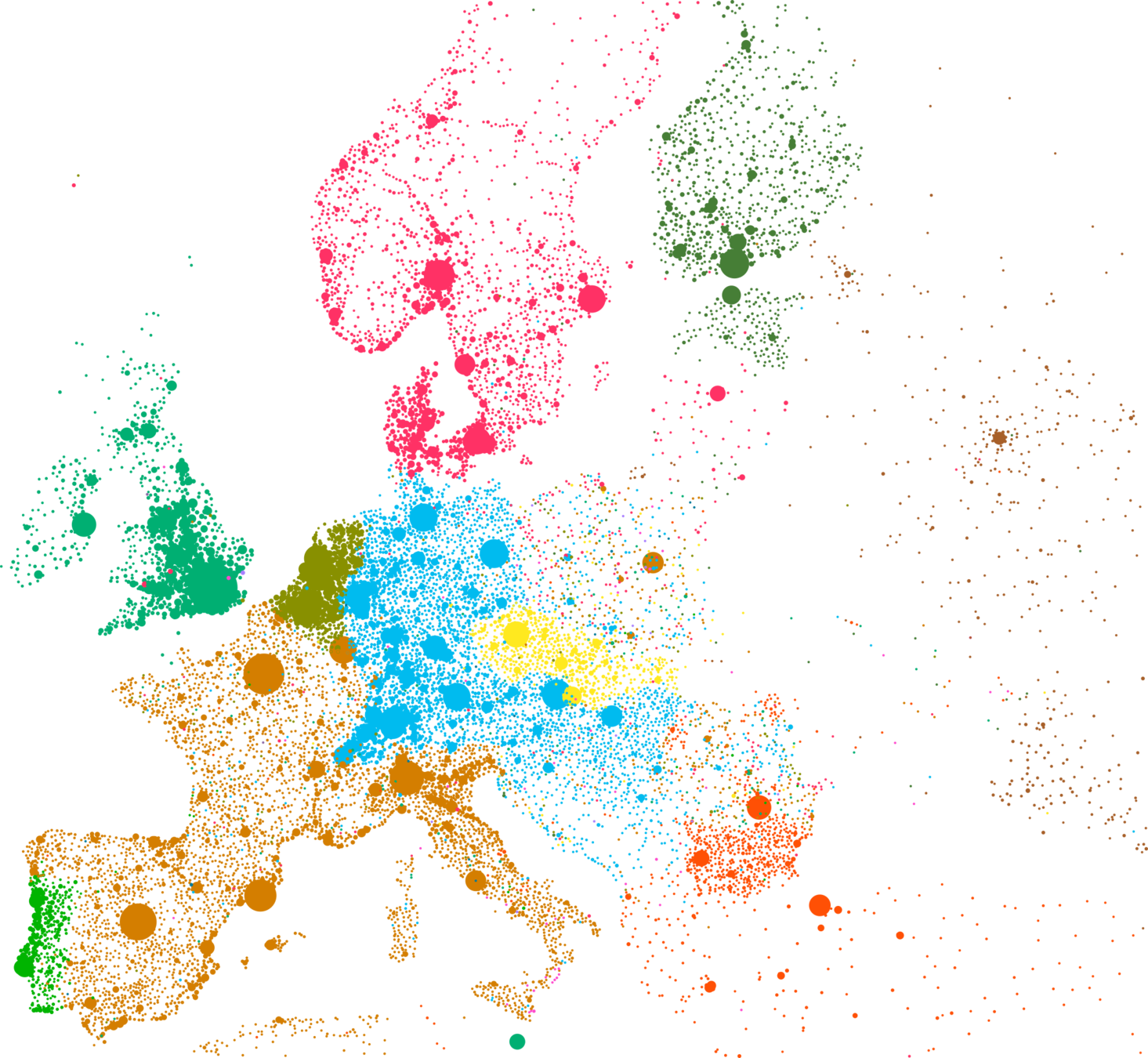

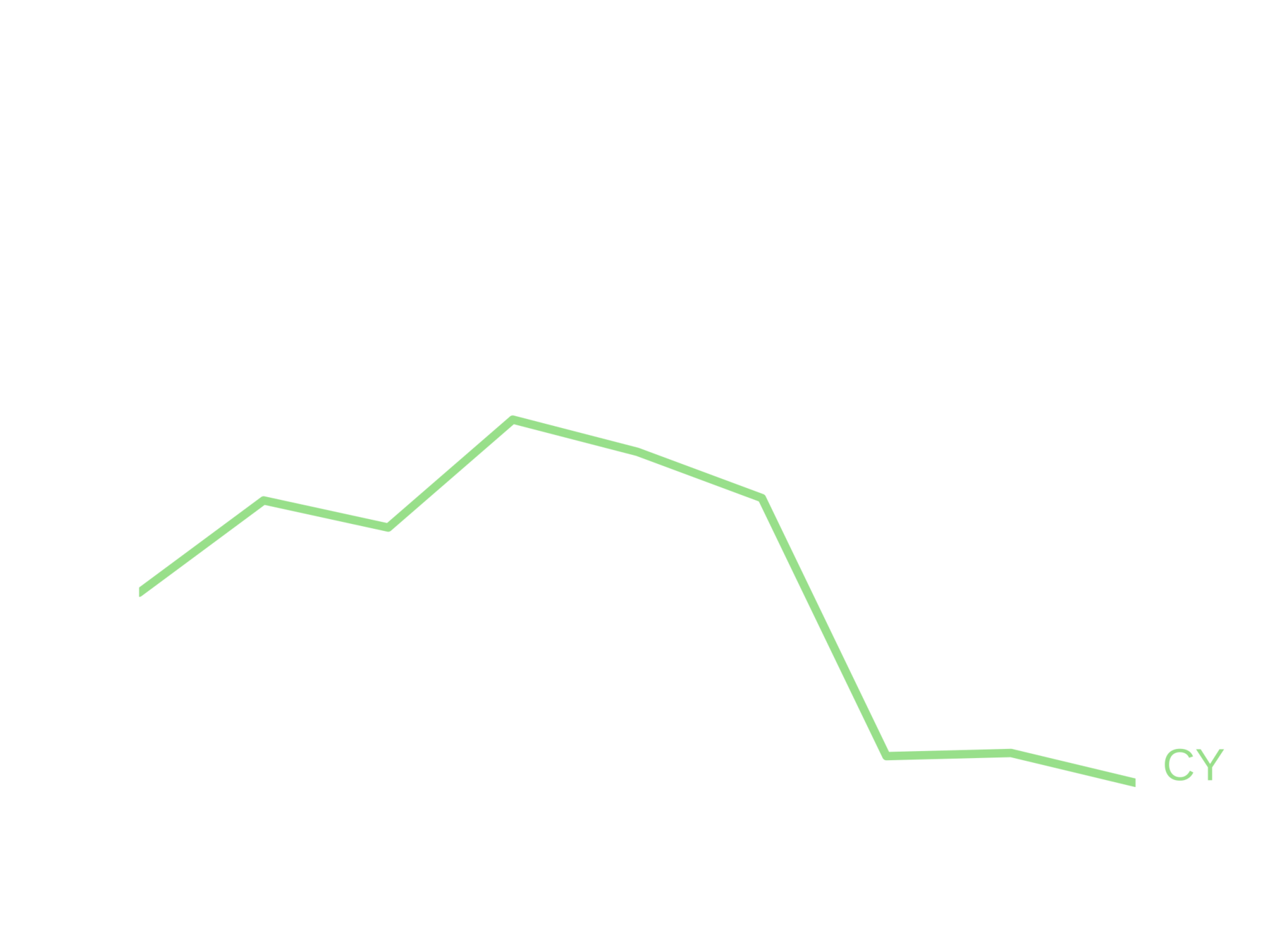

sinks are specialized geographically

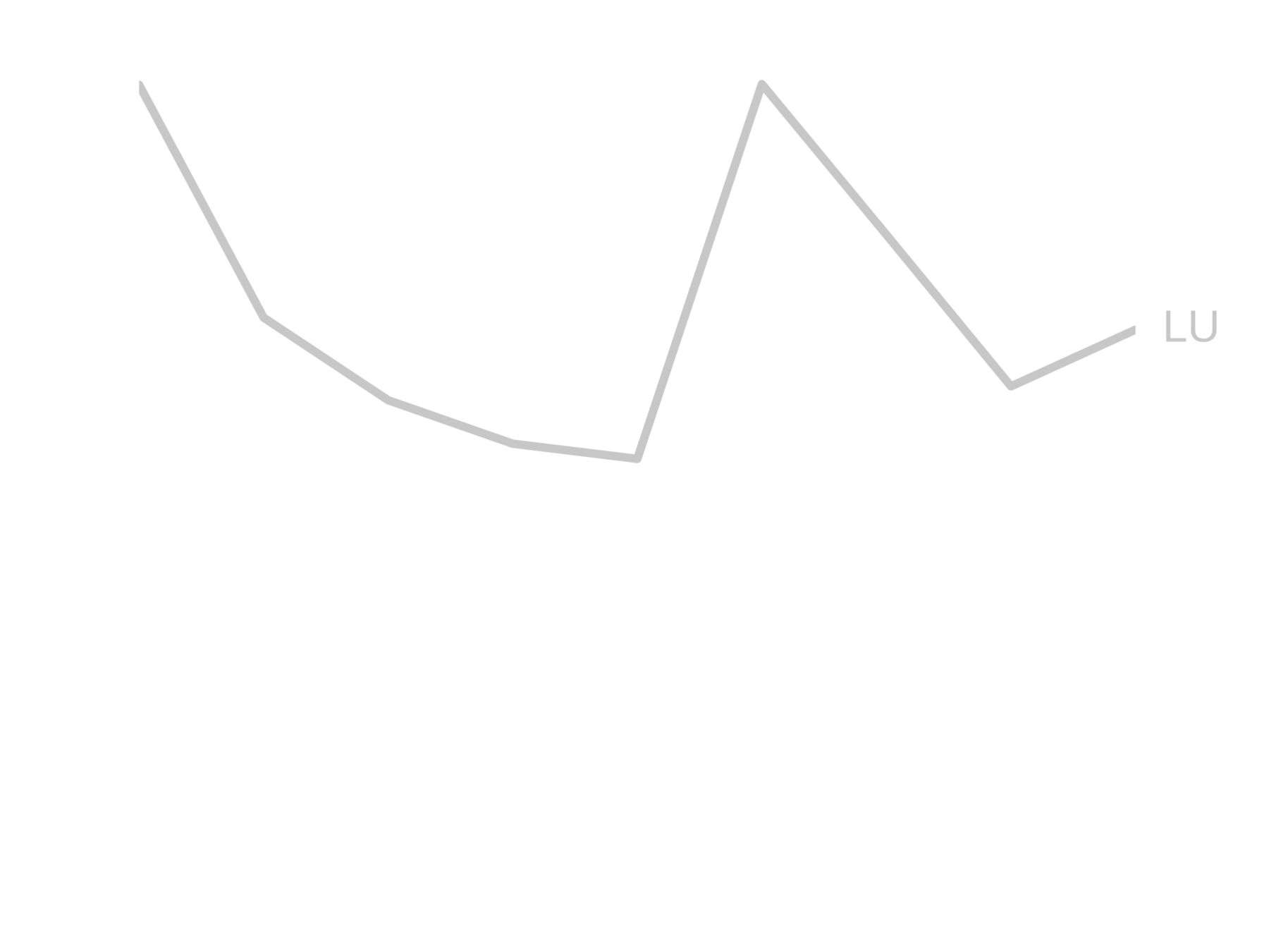

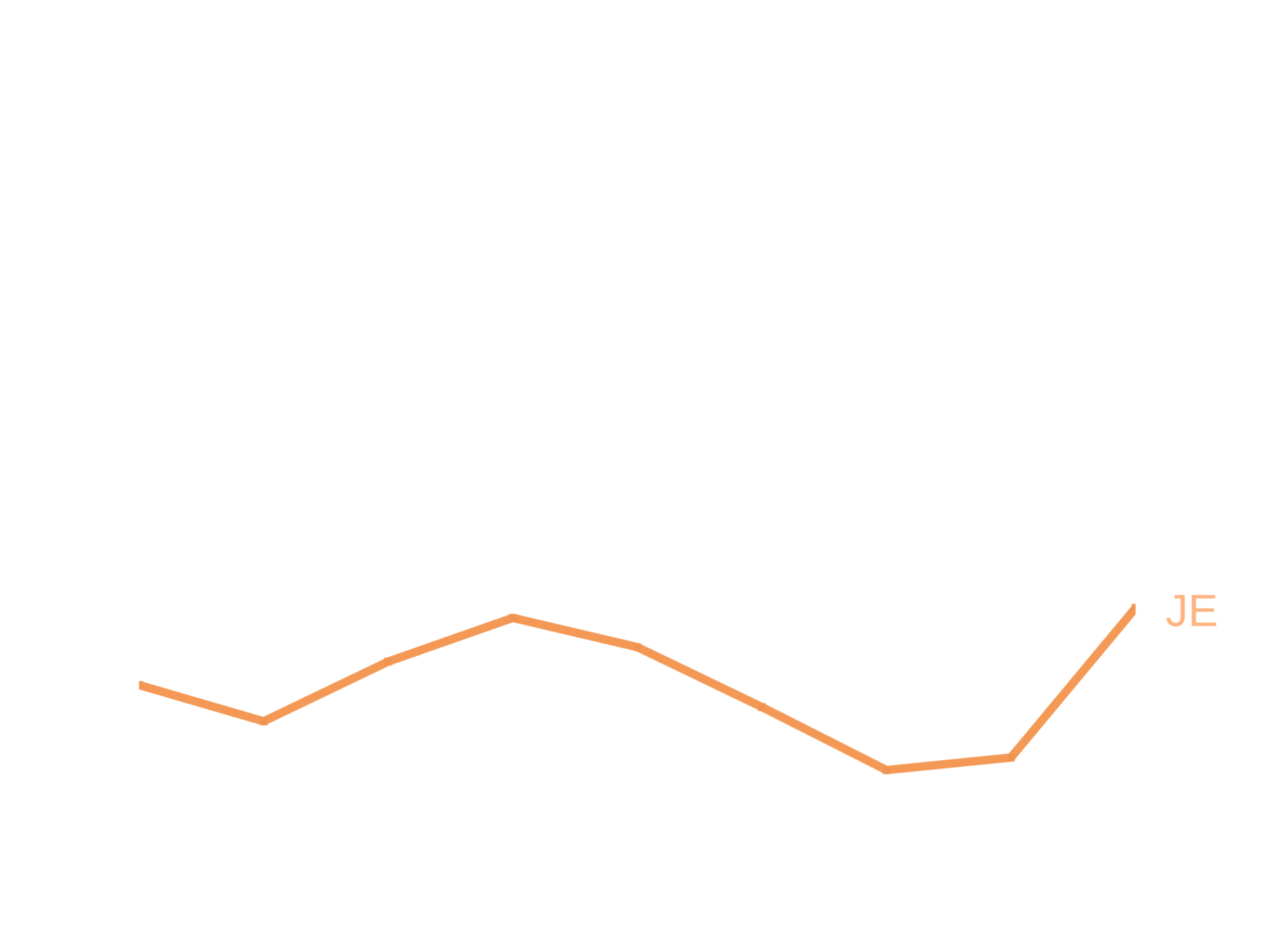

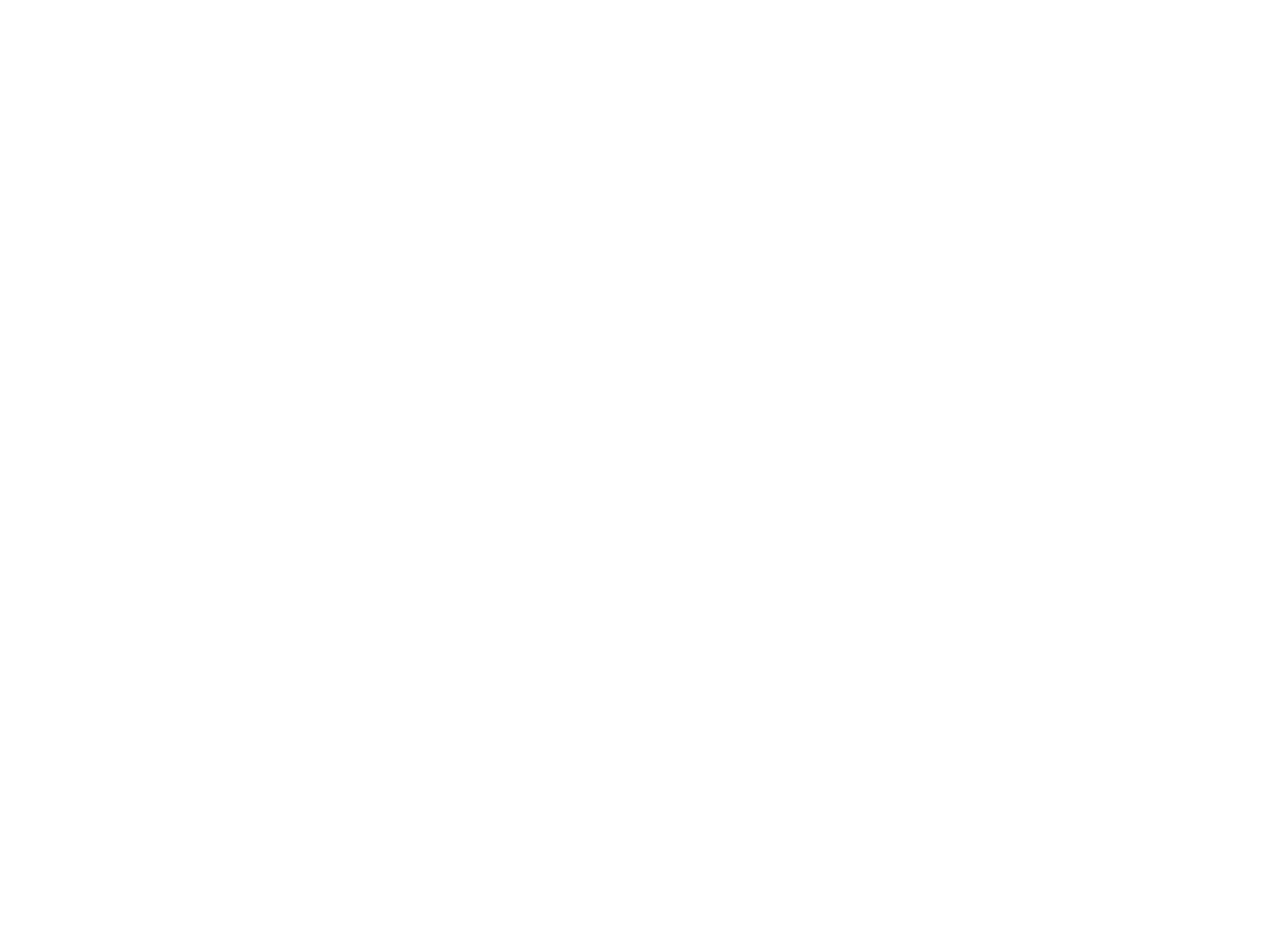

siNKS ARE RELATIVELY STABLE OVER TIME

conduit-OFCs

conduit-OFFshore financial centers

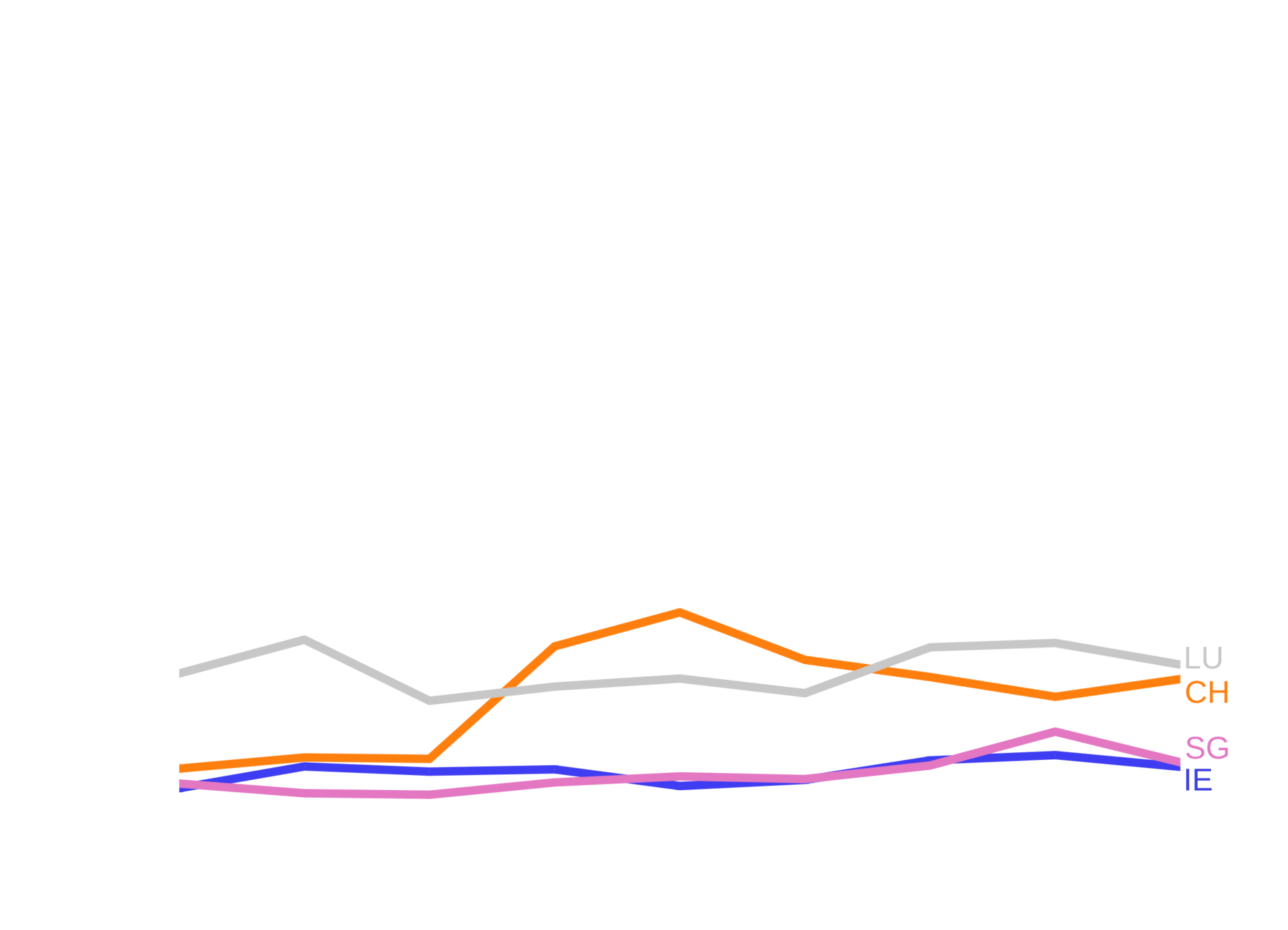

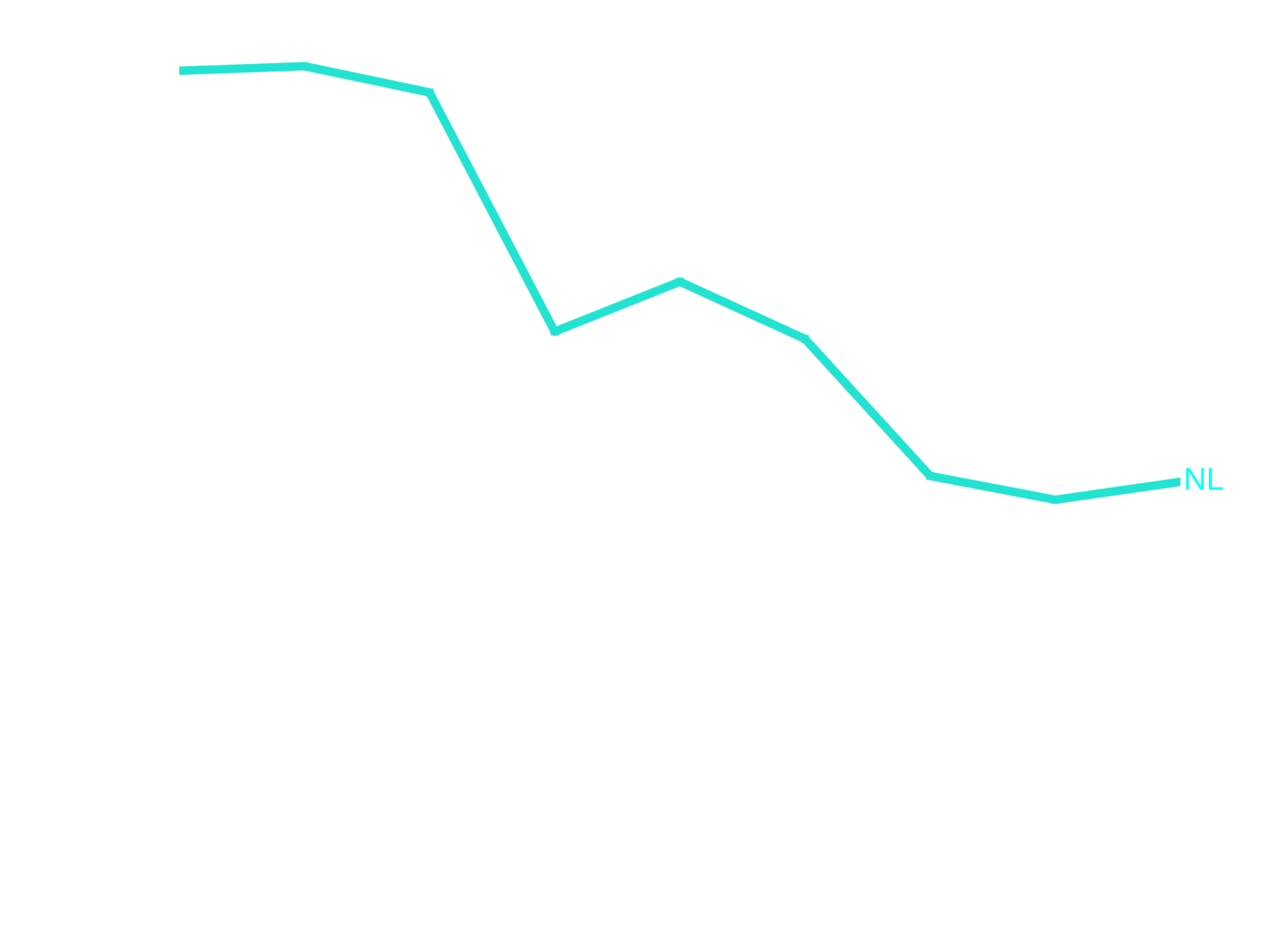

decline of the netherlands

findings

- The Netherlands is the conduit between European companies and Luxembourg, in the middle of 23% country chains.

- Hong Kong (for China) and Luxembourg (for EU countries) serve as the main countries in the route to ``tax havens''.

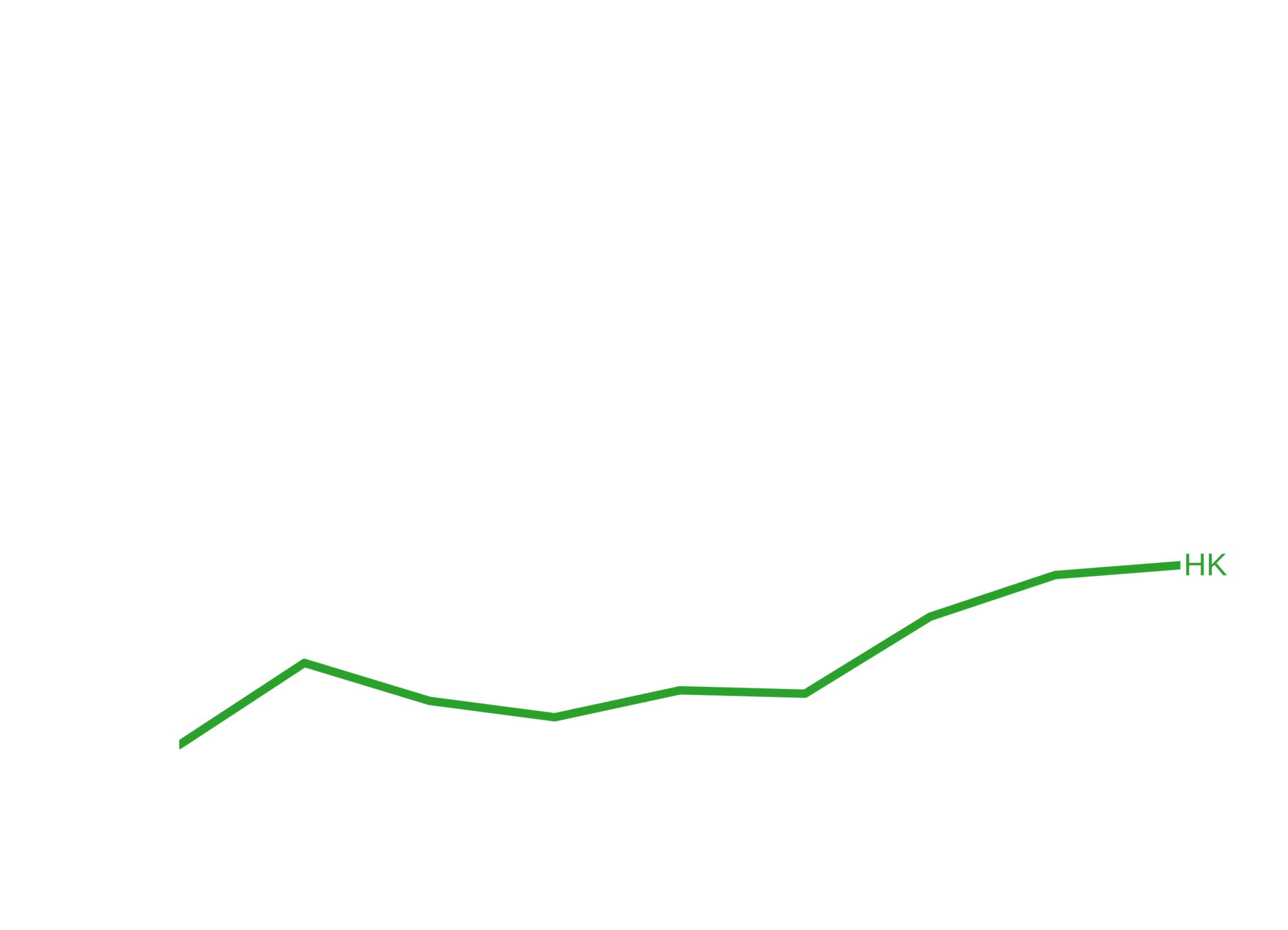

- The United Kingdom is the conduit between European countries and former members of the British Empire, such as Hong Kong, Jersey, BVI and Bermuda.

- All conduit-OFCs are on our doorsteps, and are specialized geographically and sectorally.

corpnet.uva.nl

@javiergb_com

@uvaCORPNET

javiergb.com

corpnet@uva.nl

garcia@uva.nl

This presentation: slides.com/jgarciab/offshorealert17

OffshoreAlert: sink and conduit OFCs

By Javier GB

OffshoreAlert: sink and conduit OFCs

sink and conduits in Corporate Structures

- 1,618