Competing with whom? For what? And how?

Arjan Reurink & Javier Garcia-Bernardo

Tax Justice Network annual conference | London, 2-3 July, 2019

The great fragmentation of the firm, FDI attraction profiles, and the structure of international tax competition in the European Union

PART I:

THE GREAT FRAGMENTATION OF THE FIRM

Fragmentation at two levels of corporate organization

Operational level

-

Unbundling

-

Offshoring

-

Outsourcing

-

Insourcing

Legal-financial level

-

Interposition of holding companies

-

Rearrangements of assets and risks

-

Innovative financing arrangements

The anatomy and geographical dispersion of corporate groups (I)

Operational entities

-

Manufacturing affiliates

-

Shared service centers

-

R&D facilities

Legal-financial entities

-

Top holding companies

-

Full fledged global HQ

-

Legal/Tax home

-

-

Intermediate holding companies

-

Regional HQs

-

IP management

-

Leasing companies

-

Group Treasury

-

The anatomy and geographical dispersion of corporate groups (II)

PART II:

TAX COMPETITION IN THE ERA OF THE GREAT FRAGMENTATION

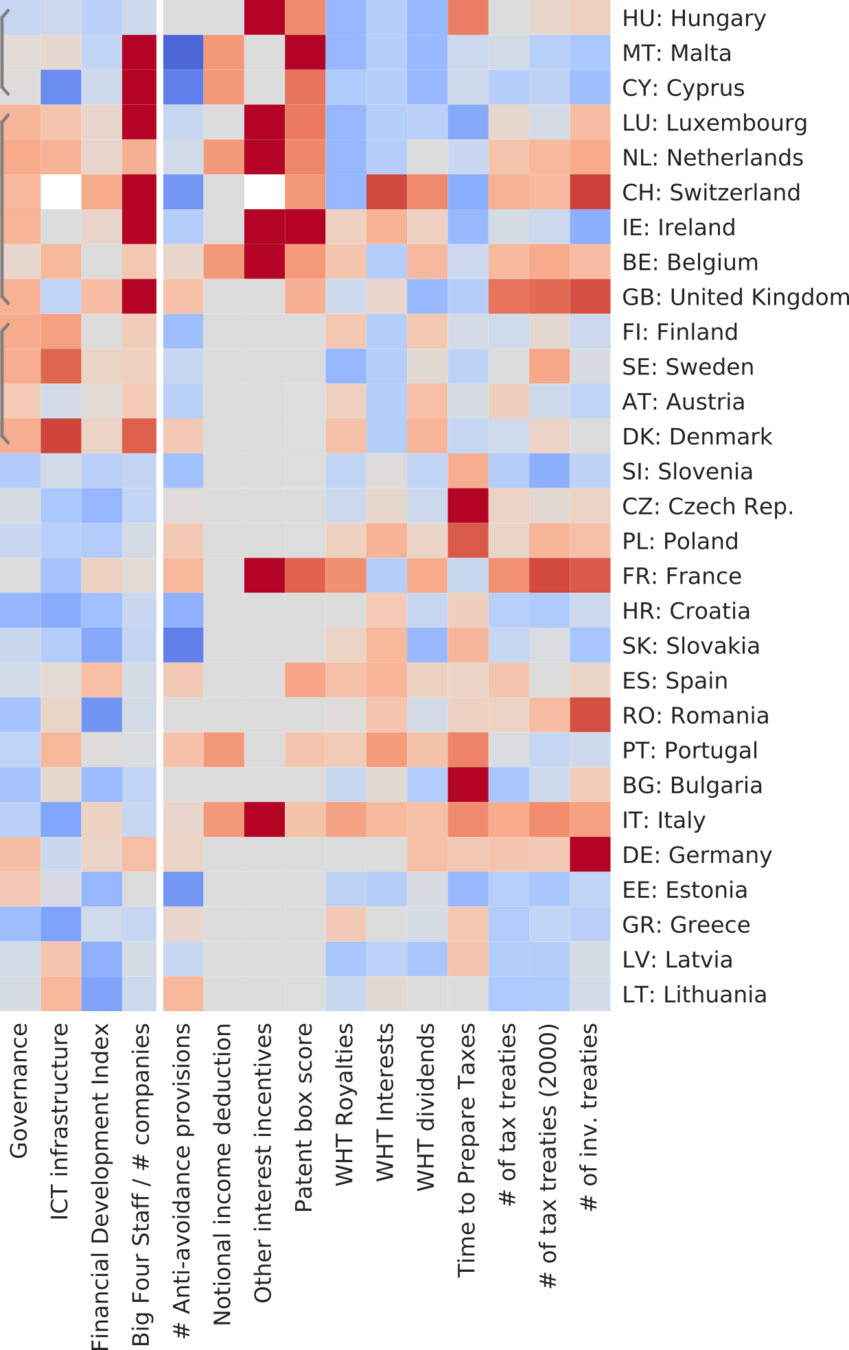

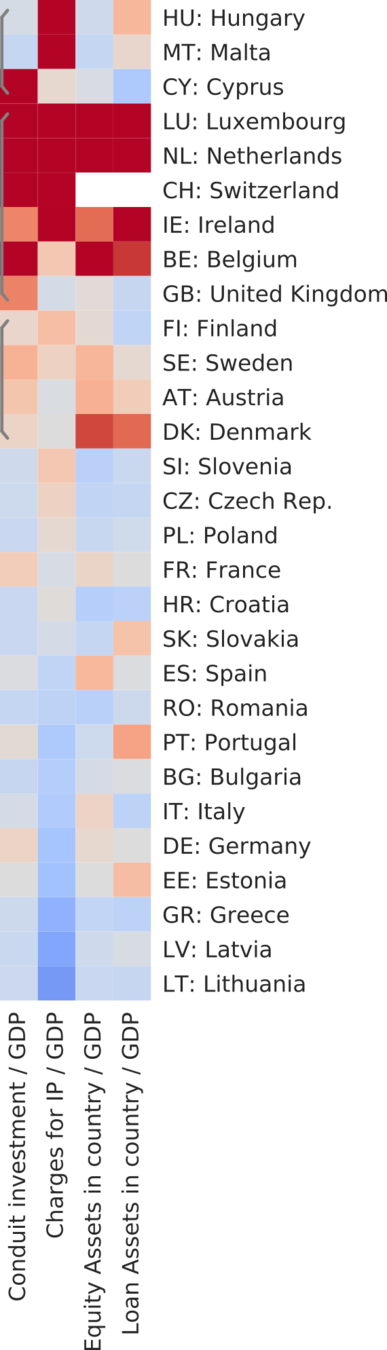

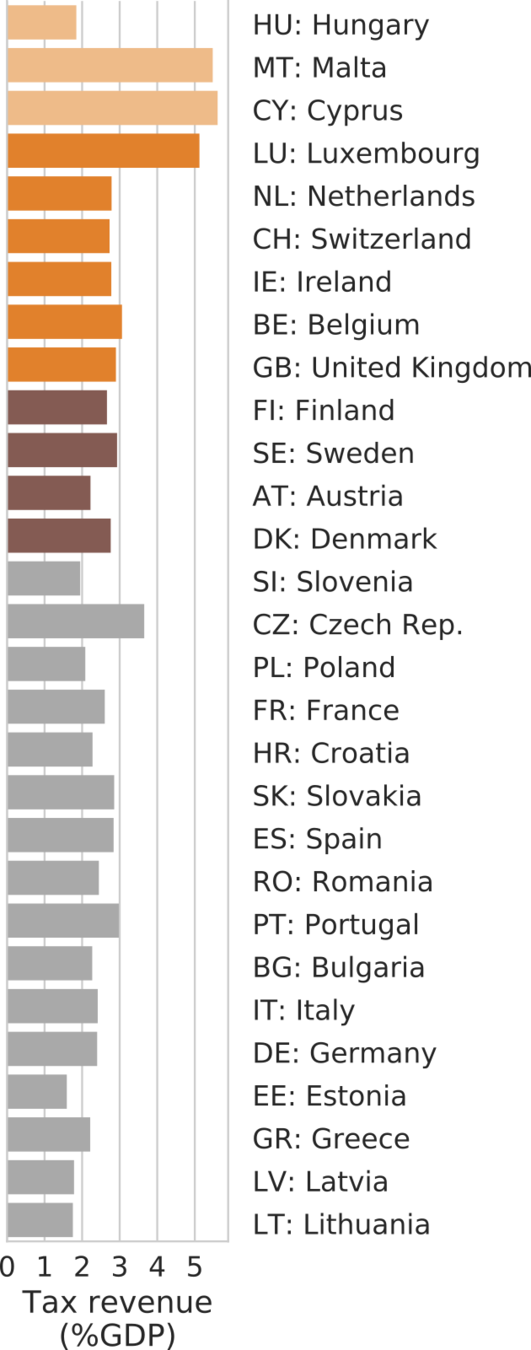

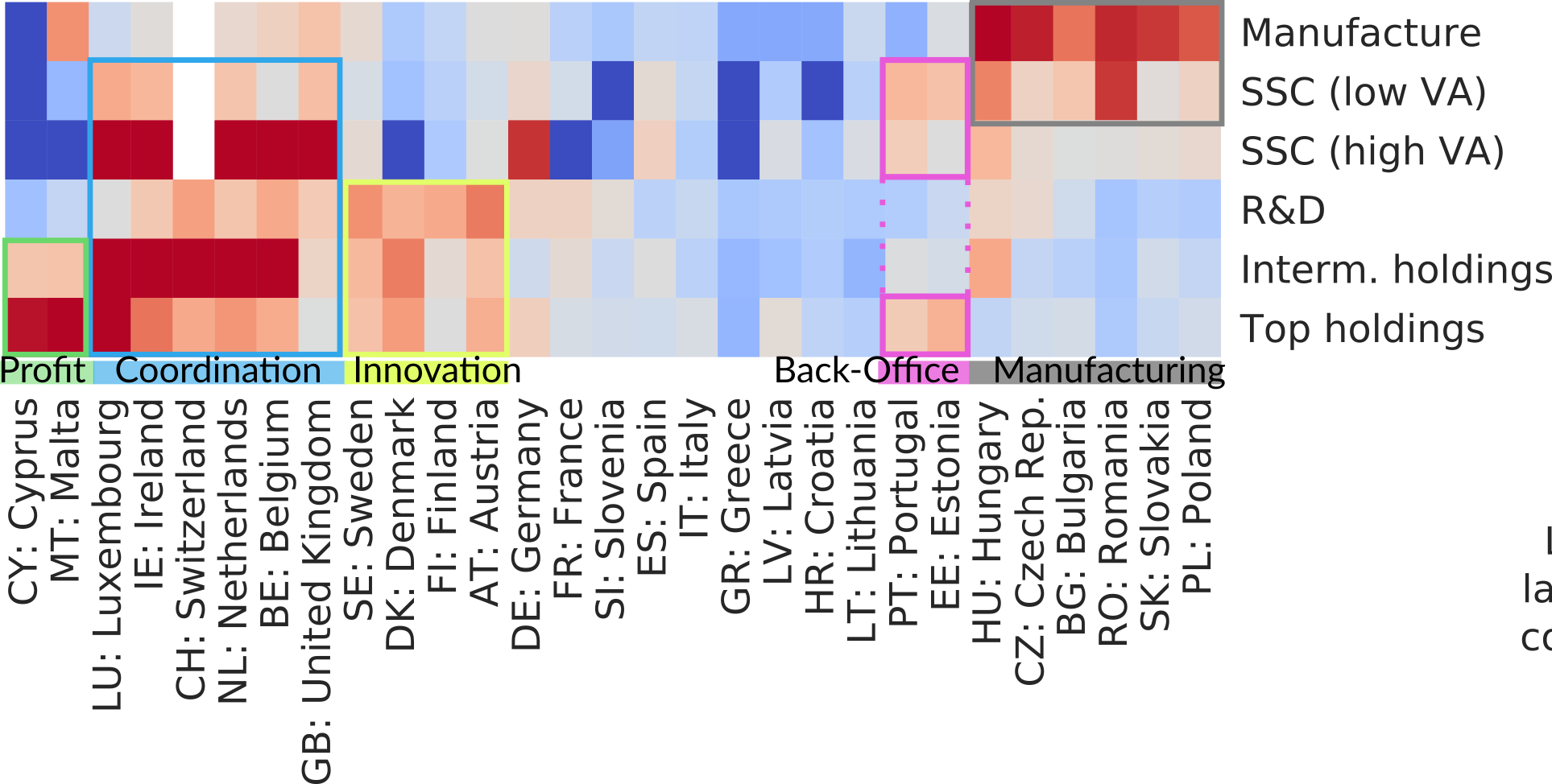

Activity indicators

Benefits

Macro-institutional features

Cluster 2

Cluster 3

Cluster 1

Tax features

Thanks!

@ArjanReurink

@JavierGB_com

FDI attraction profiles

Great fragmentation

By Javier GB

Great fragmentation

- 1,272