Offshore finance and corporate tax avoidance

Javier García-Bernardo

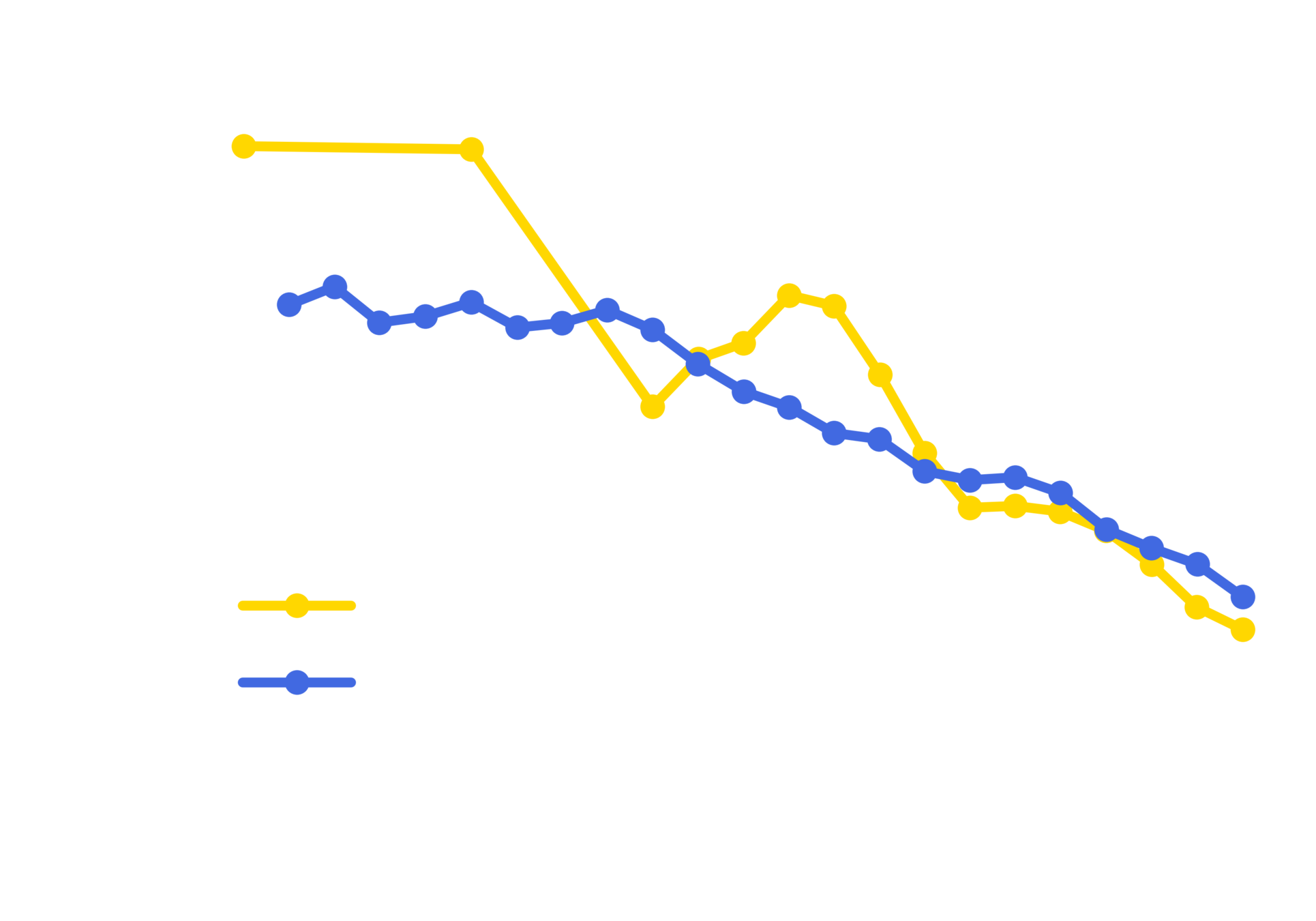

Location of profits

Location of employees

the Netherlands, Switzerland, Luxembourg, Ireland and Singapore

+5€ (coffee)

-1€ (brand)

-4€ (costs)

Starbucks Spain

Starbucks NL

EBT: 0€

EBT: 1€

+1€ (brand)

+5€ (coffee)

-4€ (costs)

Cafe Pepe

EBT: 1€

Tax: 0€

Profit: 0€

Tax: 0.07€

Profit: 0.93€

Tax: 0.25€

Profit: 0.75€

1. Which jurisdictions are OFCs?

3. to which extent do OFCs affect corporate tax rates?

2. how are OFCs used by MNCs?

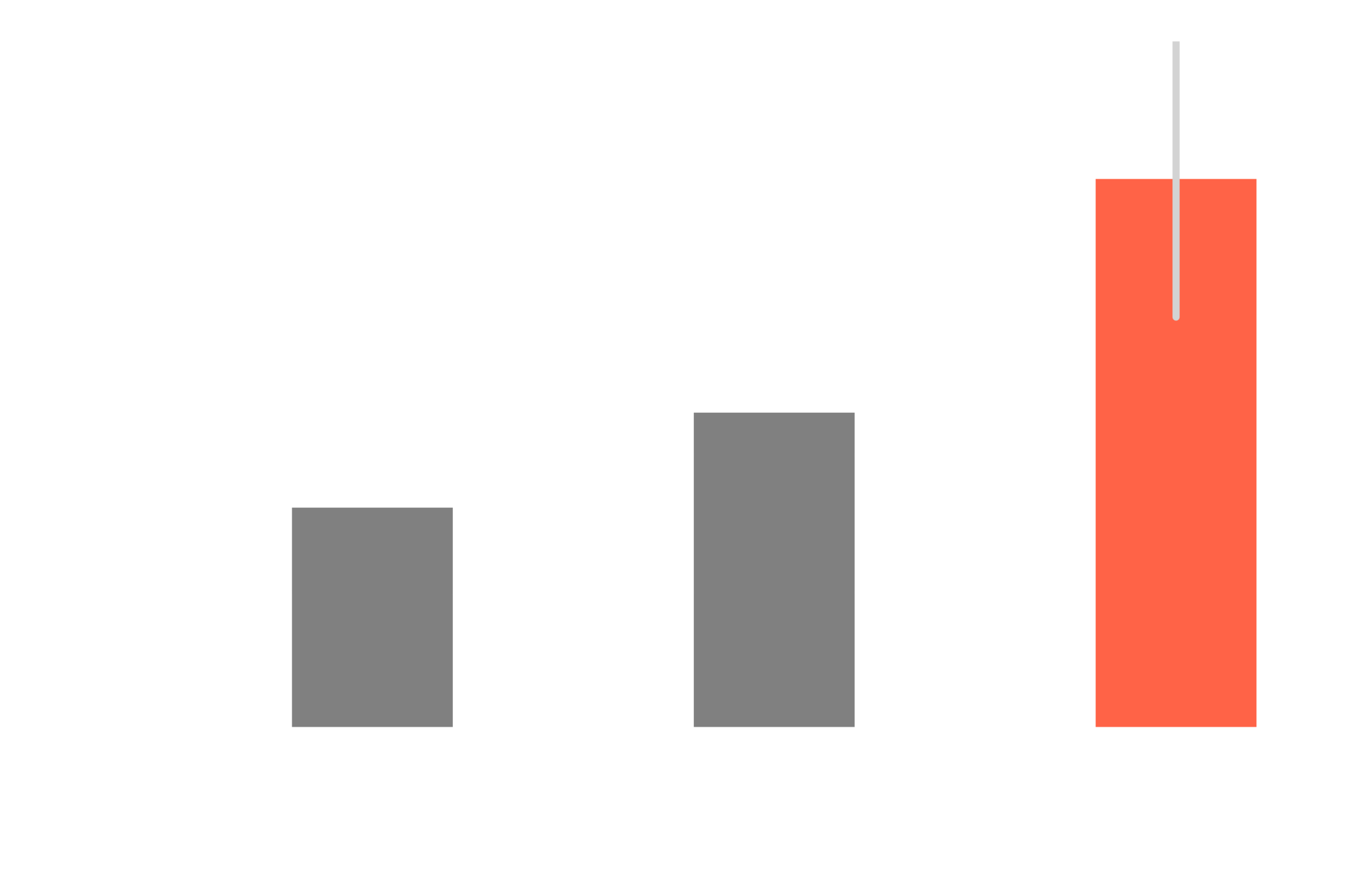

Firms shift ~$800 billion to OFCs

Four perspectives:

- Corporate ownership networks

- Fragmentation of the firm

- Location of tax professionals

- Location of profits

1&2

Profit Centers

Mainly UK colonies

No taxation

Secrecy

Avoid legislation

1&2

Coordination Centers

Developed countries

Low tax on financial profits

Conduit to profit centers

Regional management

High-value adding operations

1&2

Increased profit shifting: <30%

Decrease in tax rates: >70%

3. to which extent to OFCs affect tax rates?

Corporate tax rates are decreasing

Why is this importanT?

Revenue losses

Economic efficiency AND EQUITY

corporate power

inequality

Policy making

Javier García-Bernardo

@javiergb_com

javiergb.com

garcia@uva.nl

jgarciab

phd_defense

By Javier GB

phd_defense

- 1,484