Javier García-Bernardo

University of Amsterdam

Mnd, 2019

who is the largest investor in germany?

who is the largest investor in brazil?

who is the largest investor in south africa?

why?

Spoiler: Tax avoidance

professionals

PEOPLE

corporation

state

PARt 1: The corporations

the great fragmentation of the firm

Reurink and Garcia-Bernardo (2018)

Data provider: Orbis

~300 million companies

~100 million ownership links

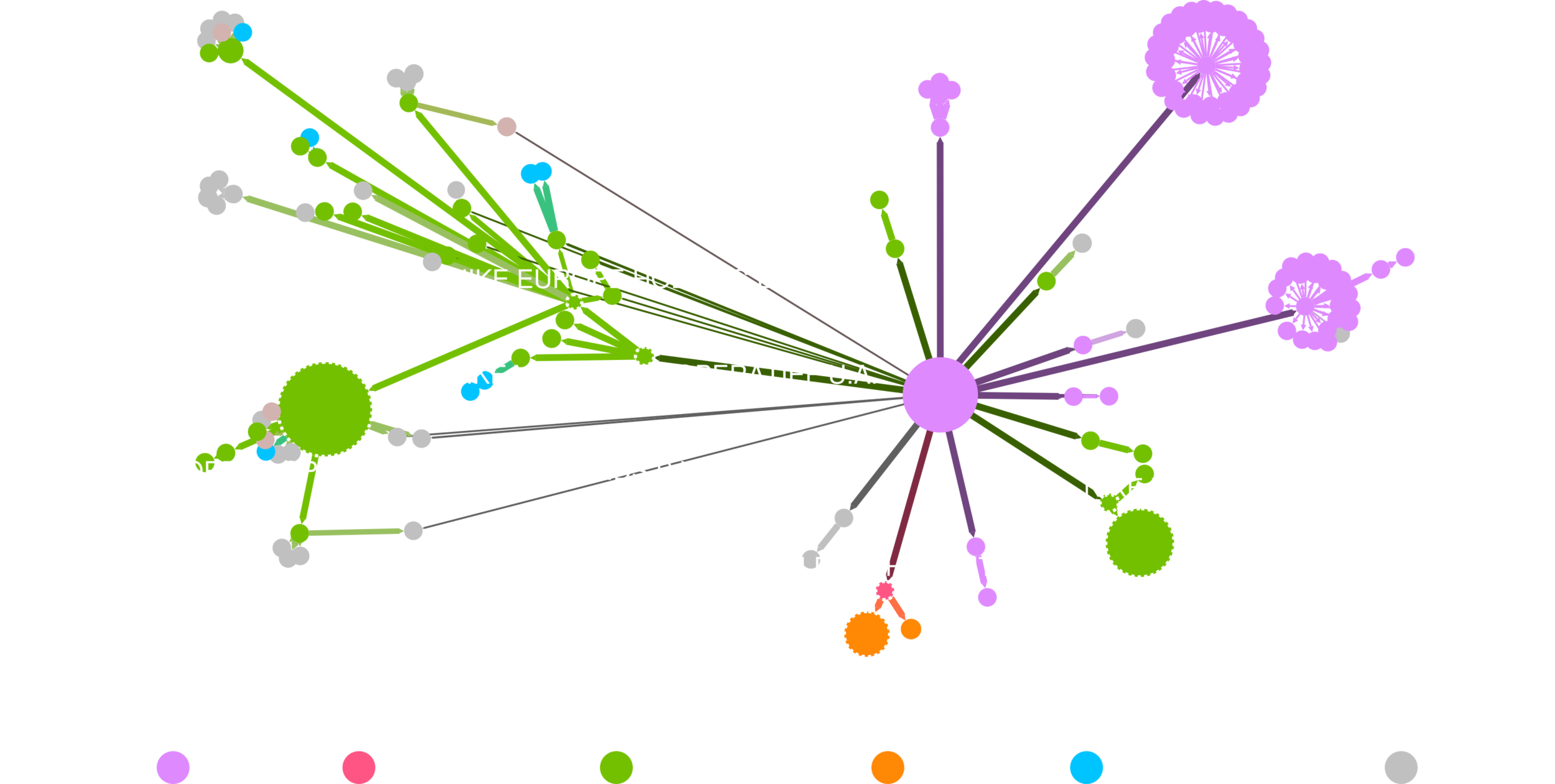

sink-OFFshore financial centers

15 companies per capita

Garcia-Bernardo, Fichtner, Takes, Heemskerk (2017)

conduit-OFFshore financial centers

Garcia-Bernardo, Fichtner, Takes, Heemskerk (2017)

incentives for the firm

We hebben u gemist

Garcia-Bernardo, Janský and Tørsløv (forthcoming)

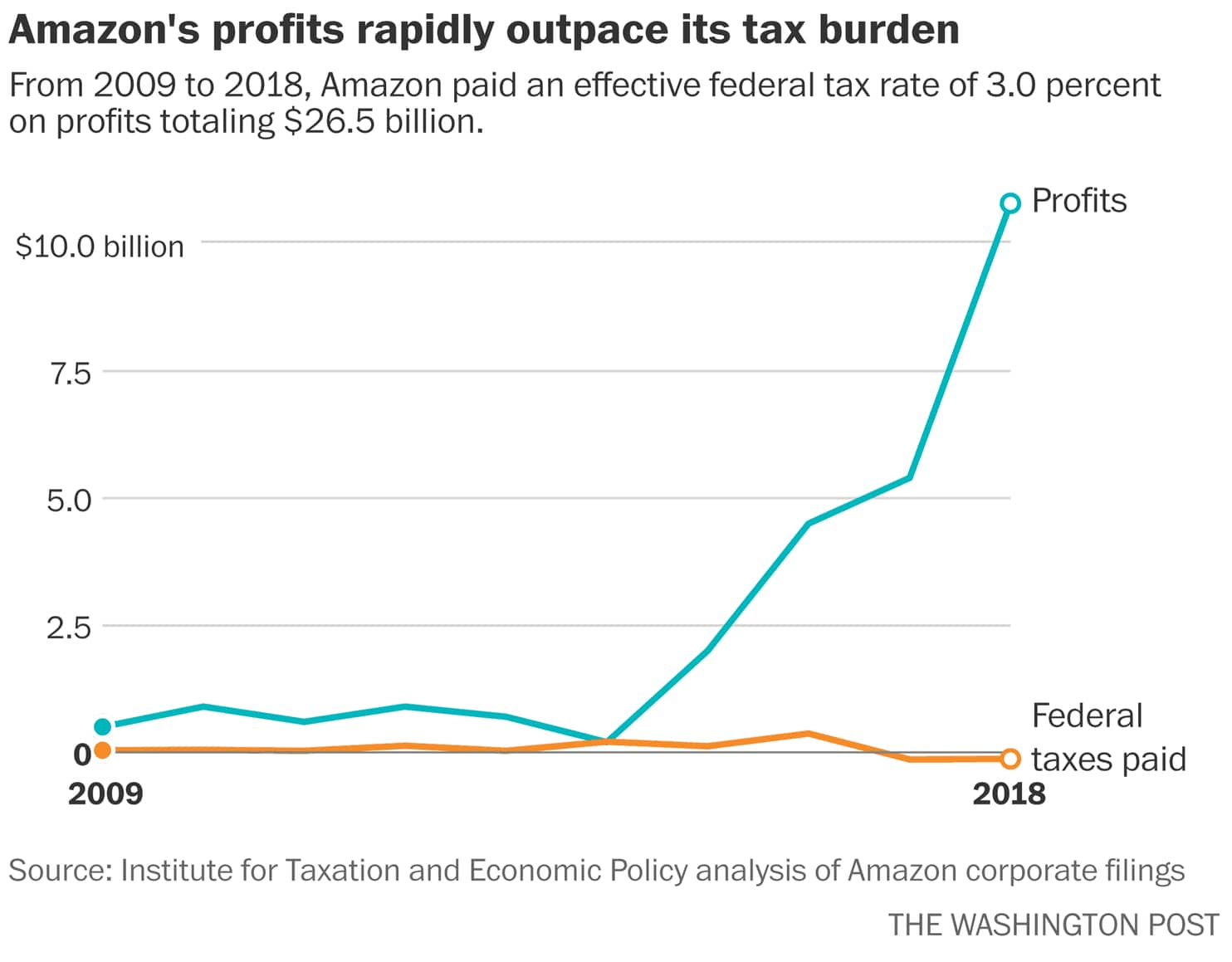

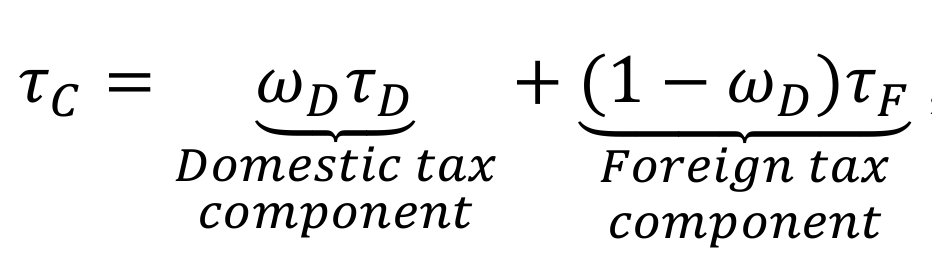

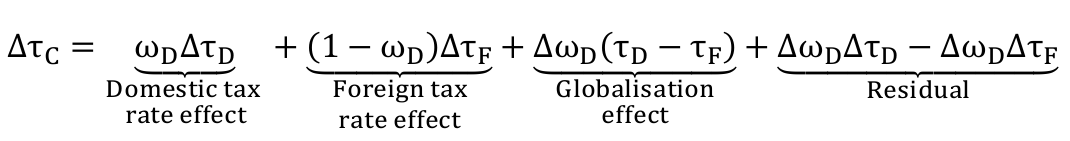

decomposing the decline in the tax rates

Garcia-Bernardo, Janský and Tørsløv (forthcoming)

decomposing the decline in the tax rates

Garcia-Bernardo, Janský and Tørsløv (forthcoming)

PARt 2: The state

Reasons

(PwC / EY / DELOITTE / KPMG)

- Logistic:

- Located in the heart of Europe.

- Outstanding infrastructure.

- Highly educated and multilingual workforce.

- Well-developed trust and management services.

- Easy to start Special Purpose Entities (BFIs)

- Beneficial tax regime:

- No withholding taxes

- Advance Tax Rulings (ATR) and Advance Pricing Agreements (APA)

- Investor protection

- Large number of bilateral investment treaties

- Advanced tax ruling system (increases certainty)

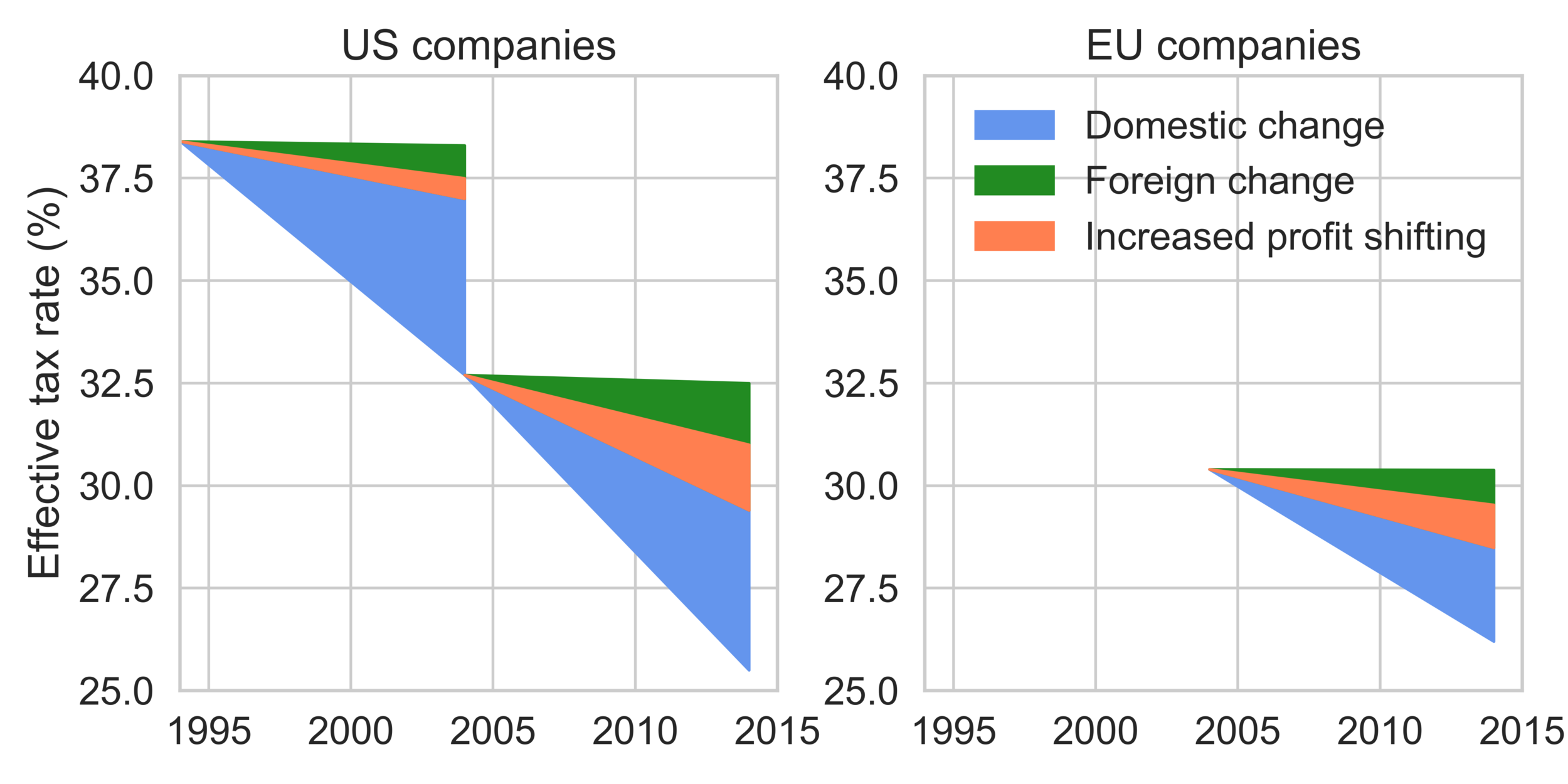

E.D. Wiebes, staatssecretaris van Financiën

vehicles: Holding companies

Crash course on "tax avoidance" (base erosion / profit shifting)

- Step 1: Sell things in a country

- Step 2: Make intra-group payments to holdings in low-tax jurisdictions (bonus points: sign a secret APA)

- Intellectual property / brand / know-how

- Interest on loans

- Services/goods

Caveat: Arm-length principle: Intra-group payments need to be priced at "market prices"

However: What's the market price of a mermaid on a coffee cup?

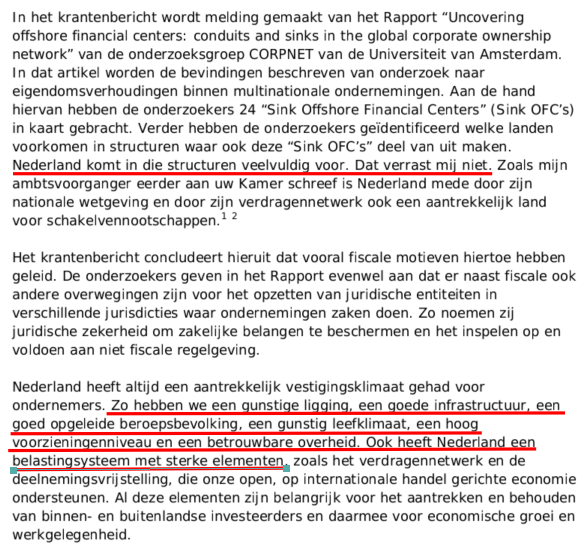

Payments for the use of intellectual property. Source: World bank data

80

60

40

20

$Billion

1994

2000

2006

2012

2017

Intellectual property payments

The Nederlandsche Bank

Interest payments

Dividendbelasting

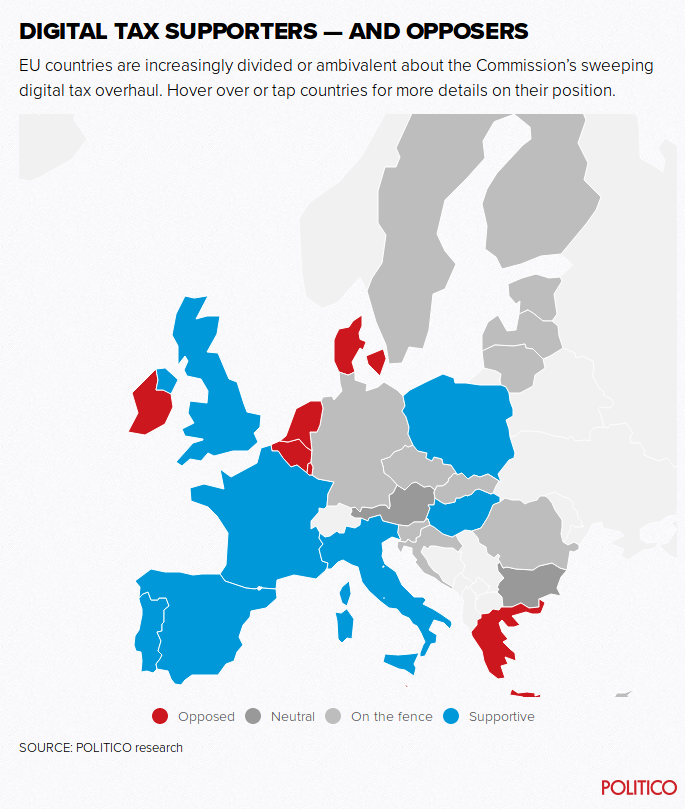

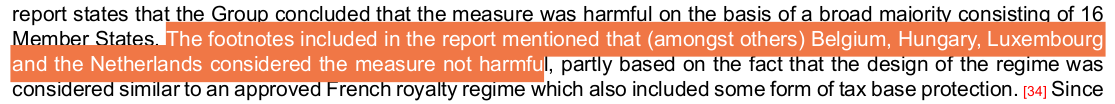

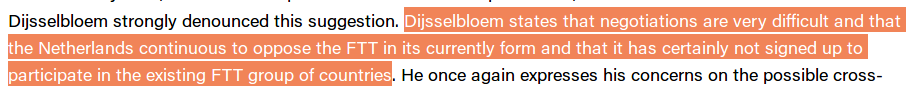

Blocking EU legislation

Always a front runner in tax competition

Low tax rates for interests and intellectual property

incentives for the country

e.g. THE NETHERLANDS

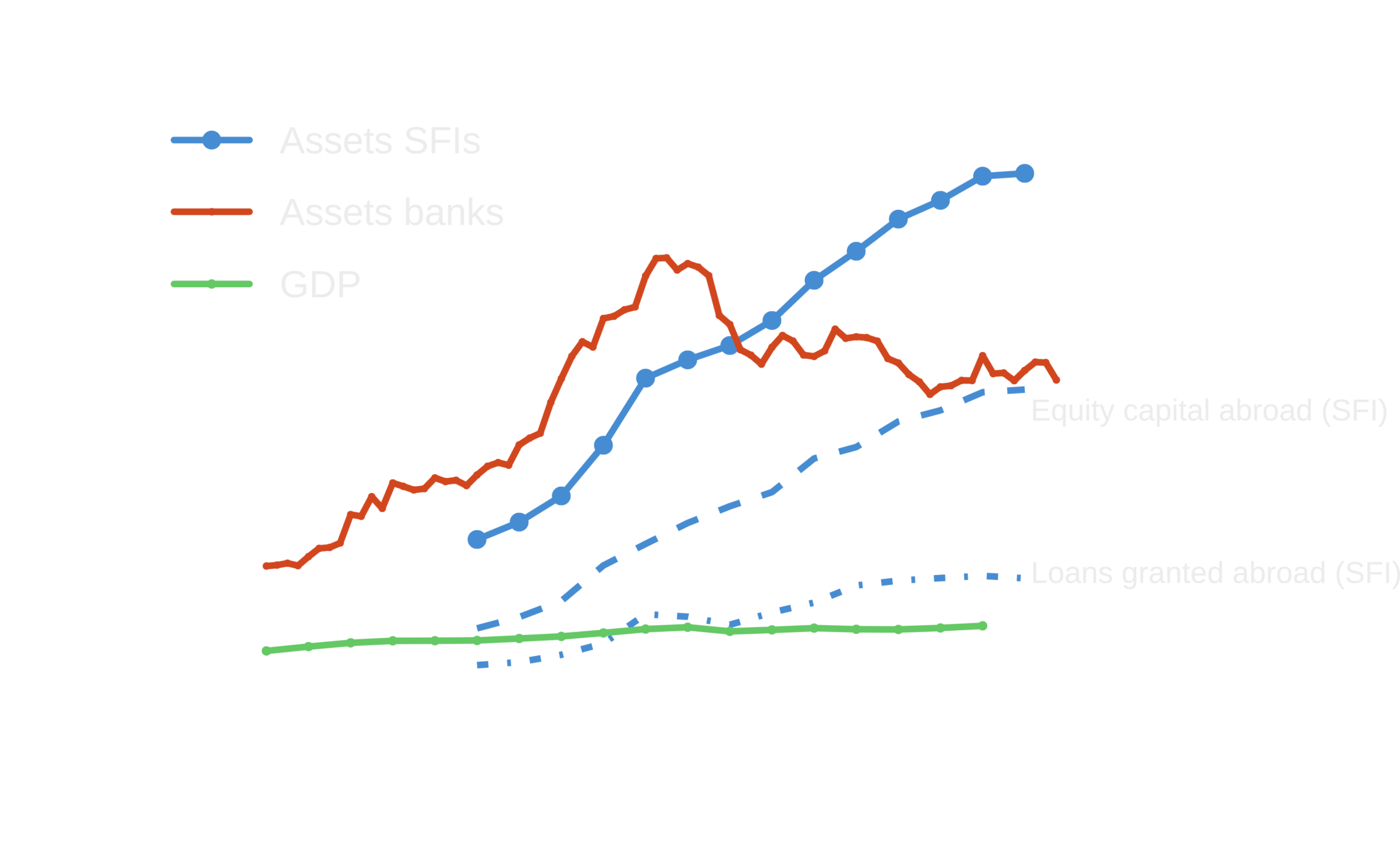

The Netherlands is extremely successful at attracting holding companies (assets ~8 times GDP).

Tax revenue collected:

- 1.5-3 billion / year

Employment:

- 3000 of business service professionals

- Some other thousands by headquarters and shared service centers

The benefits are expected to increase in the next decade

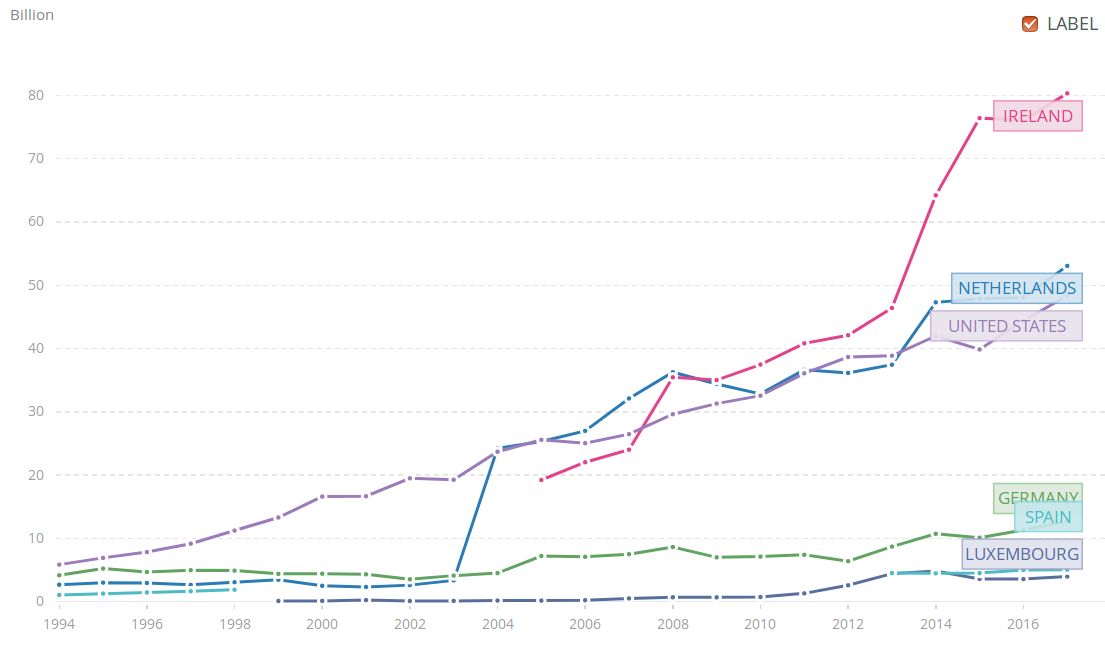

Garcia-Bernardo, Janský and Tørsløv (forthcoming)

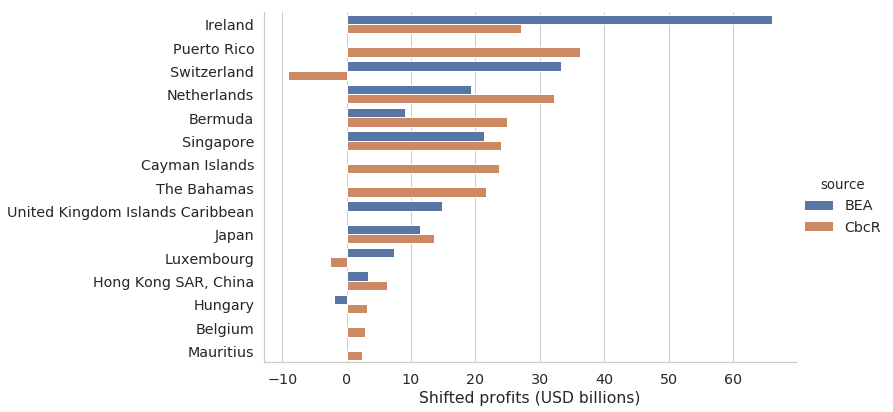

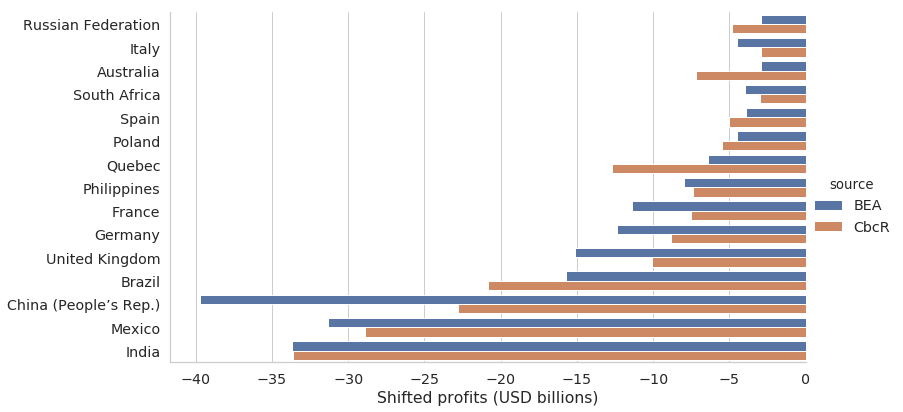

Amount of profit shifted yearly: $600-1100 billion (Tørsløv, Wier and Zucman 2018)

in general

Garcia-Bernardo, Janský and Tørsløv (forthcoming)

the other side

PARt 3: the professionals

- Corporate structures are complex for two reasons:

- Mergers/acquisitions make them complex (for corporations)

- Are created complex:

- To hedge against failures

- To avoid regulations

- To avoid taxation

- They are created by intermediaries:

- Law/trust firms (Appleby, Mossack Fonseca, Intertrust)

- Accounting/auditor firms (The Big Four)

- There are usually several layers of intermediaries involved.

- In the Netherlands:

-

The Dutch Trust Industry - SEO Economisch Onderzoek

- 94% of the services are to foreign companies

- Tax advice is the main service provided

- 250,592 entities in 100 addresses

- 762,992 entities in 1,000 addresses

-

The Dutch Trust Industry - SEO Economisch Onderzoek

the intermediaries

8150 companies

9.3/window

Source: Internal presentation by the director of compliance (Woods)

- Terrorist financing offences: “We have a current case where we are sitting on about 400K that is definitely tainted and it is not easy to deal with.”

- Set up a trust and accepted money on his behalf “without question.”

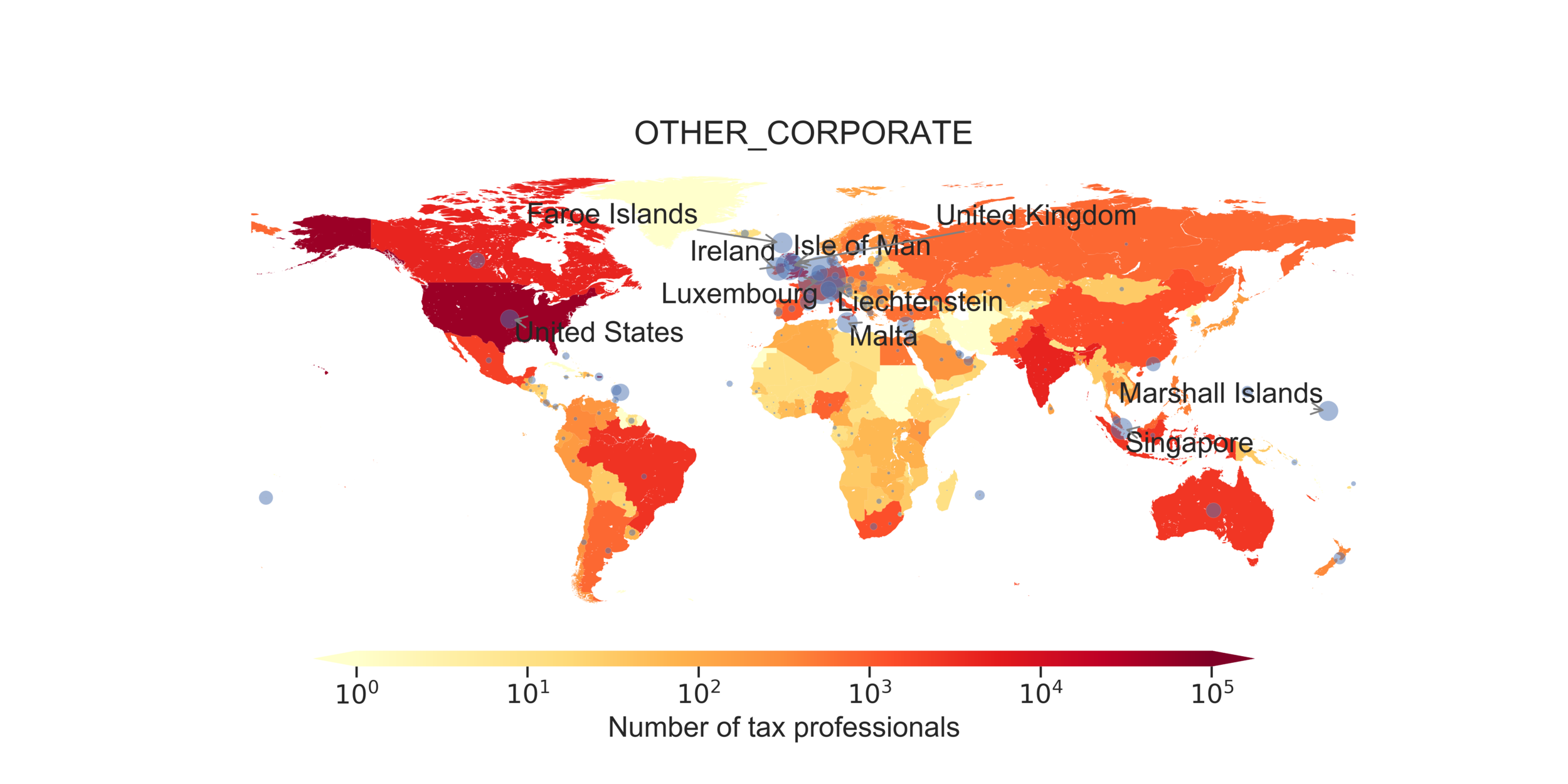

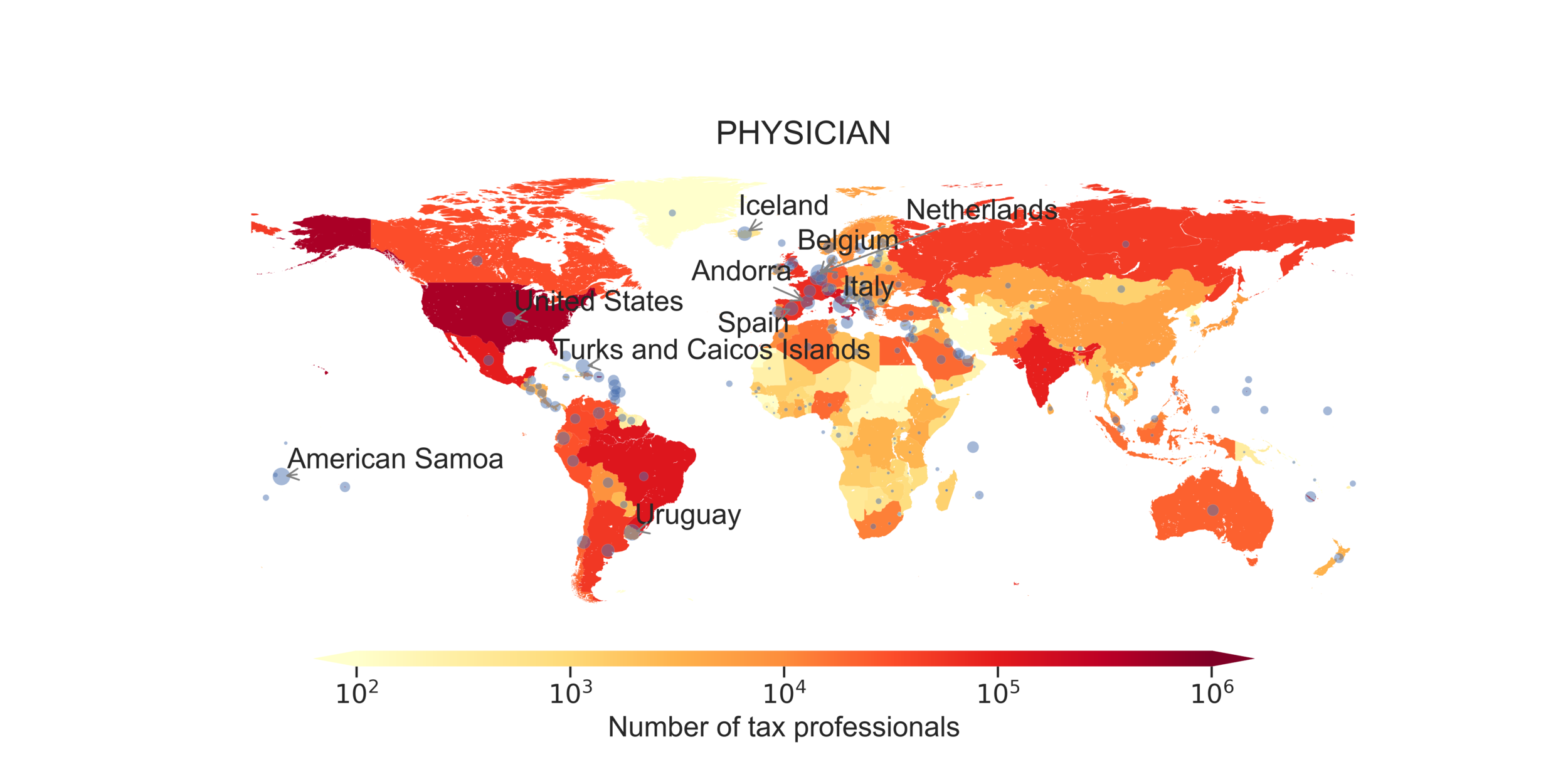

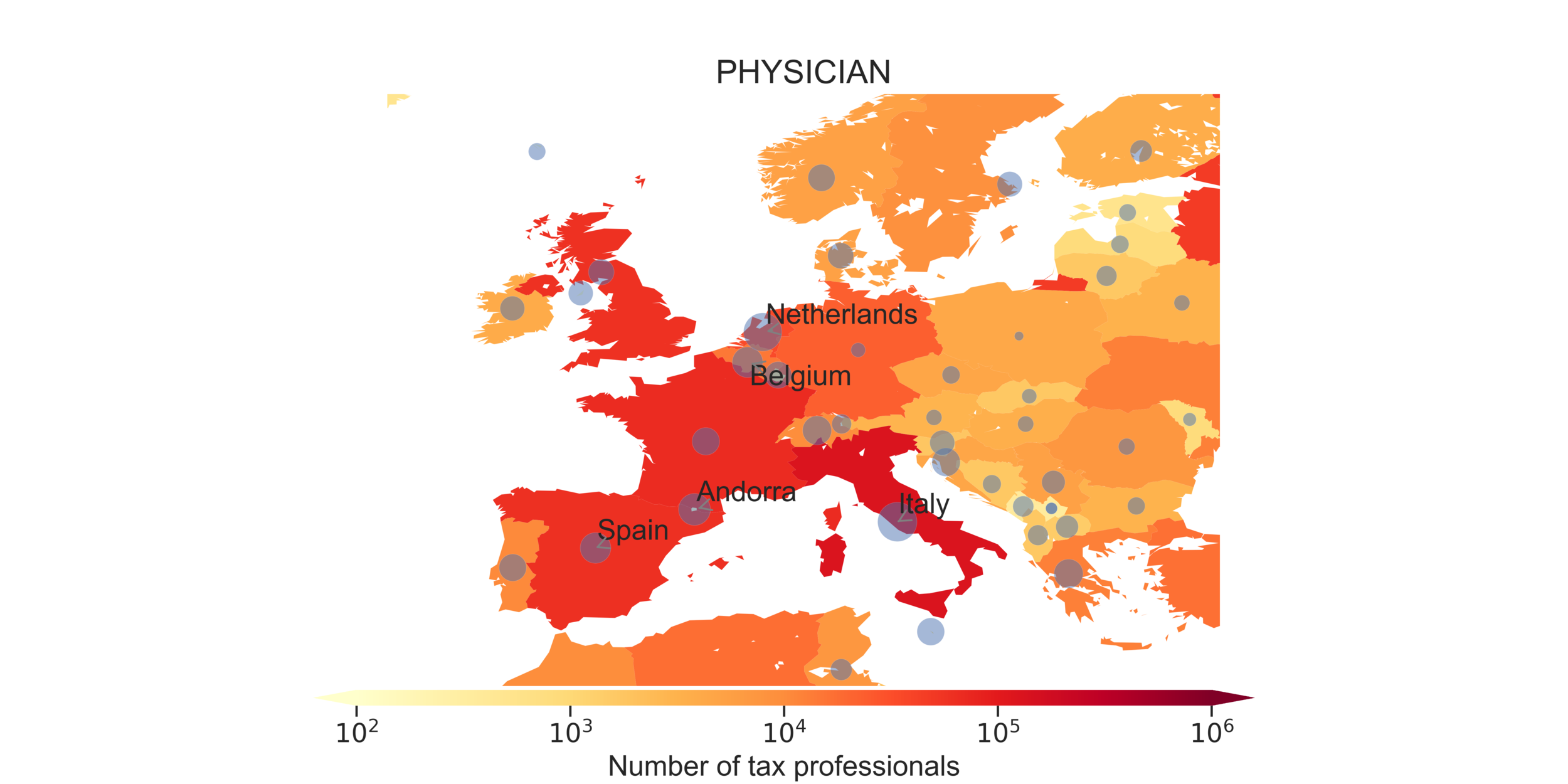

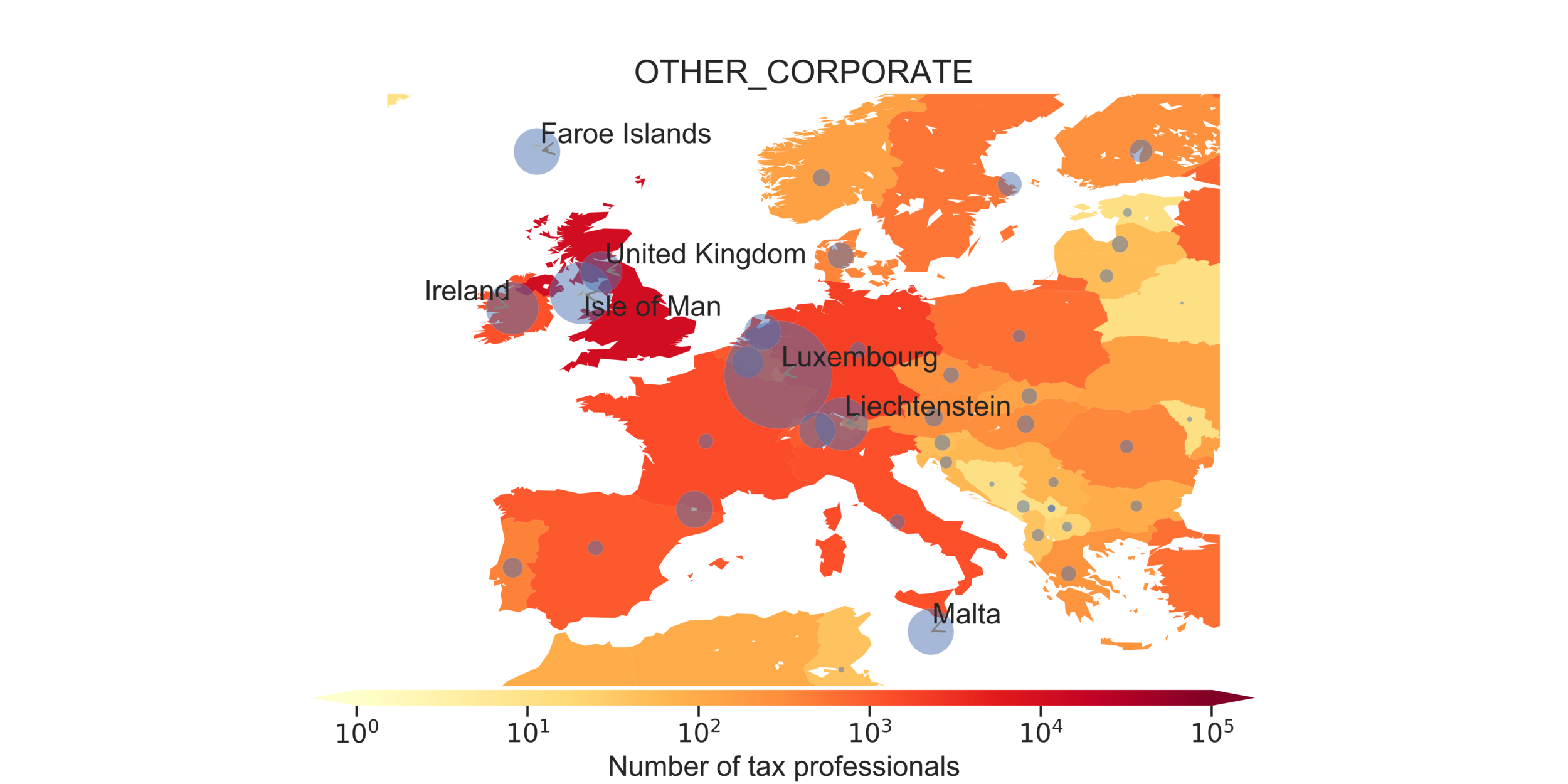

where are they located?

Garcia-Bernardo and Stausholm (forthcoming)

Data: LinkedIn ads

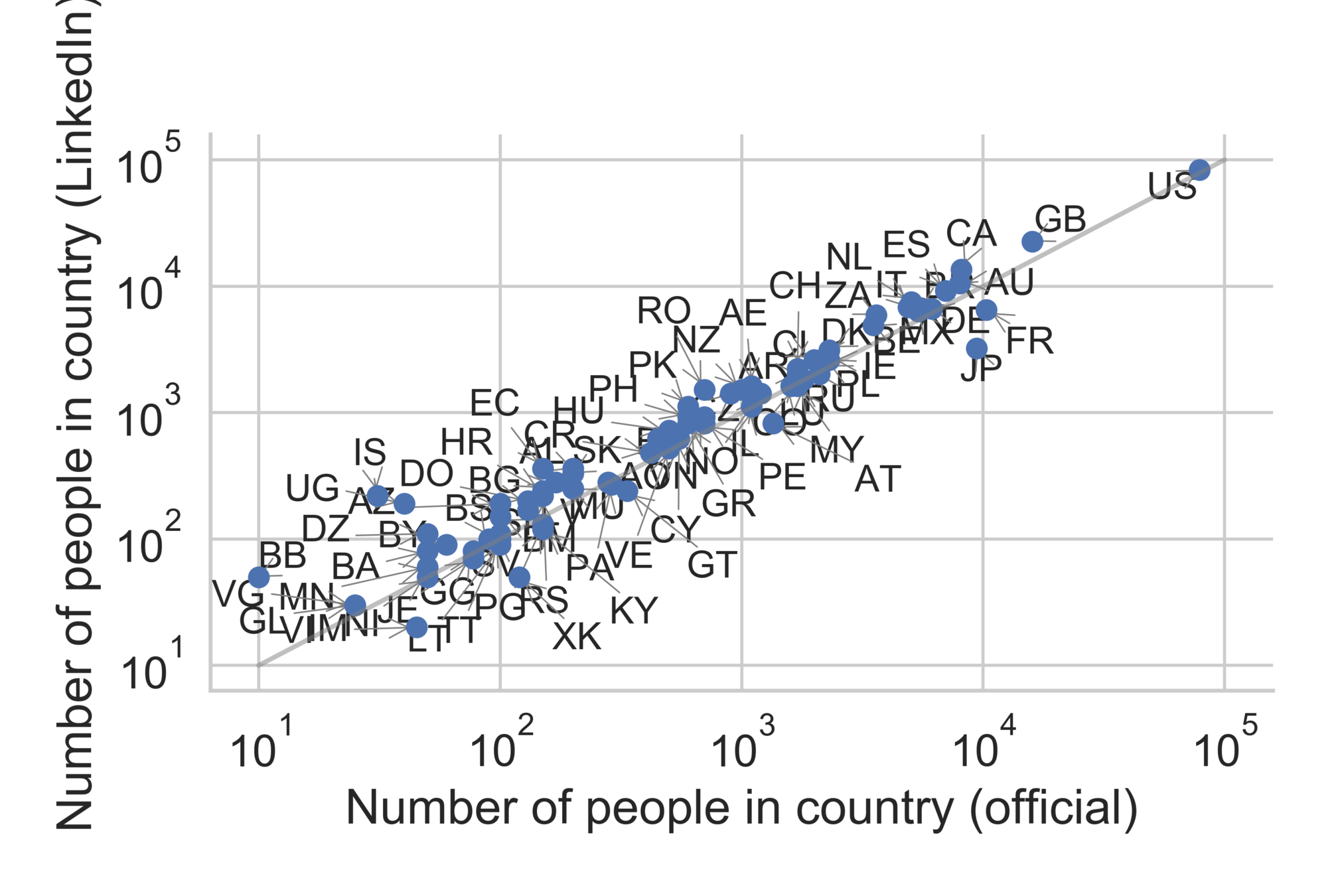

are they in linkedin?

Garcia-Bernardo and Stausholm (forthcoming)

their location doesn't align with real activity

Garcia-Bernardo and Stausholm (forthcoming)

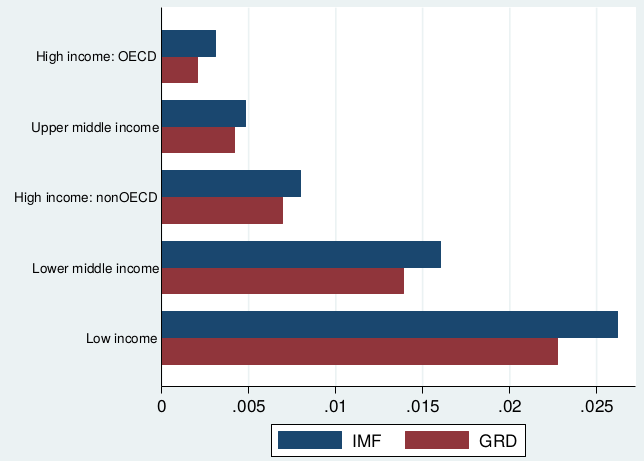

consequences: the people

Cobham and Janský (2015)

1. "aid in Reverse'

- Developing countries may lose more money than it is given in aid

- Even OFCs are not rich countries

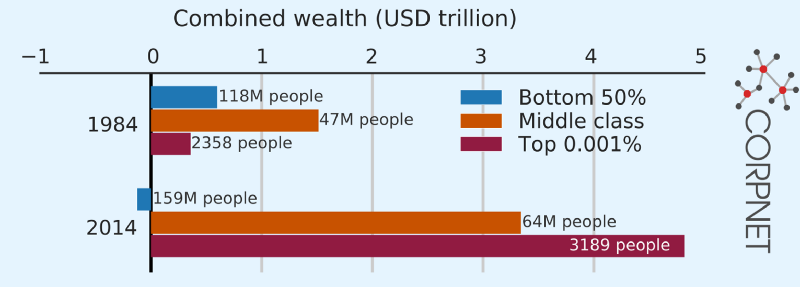

2. rising inequality

Source: World Inequality Database

Source: World Inequality Database

Wealthy people have access to better investments and lower taxation

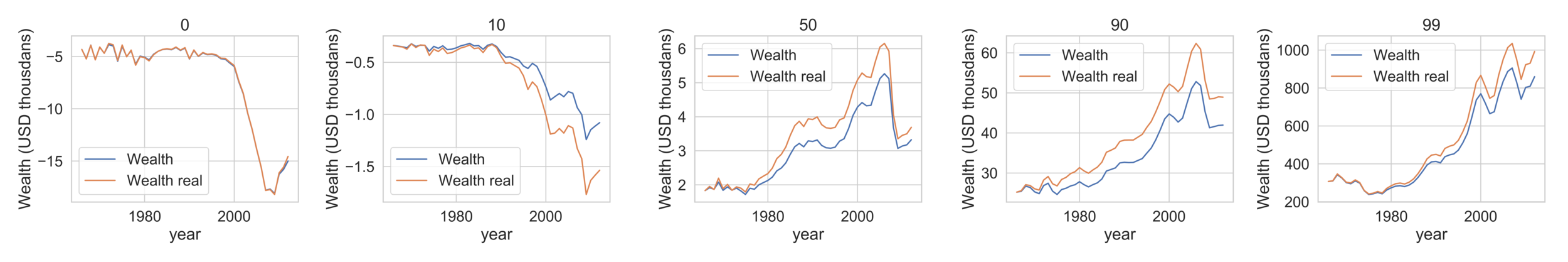

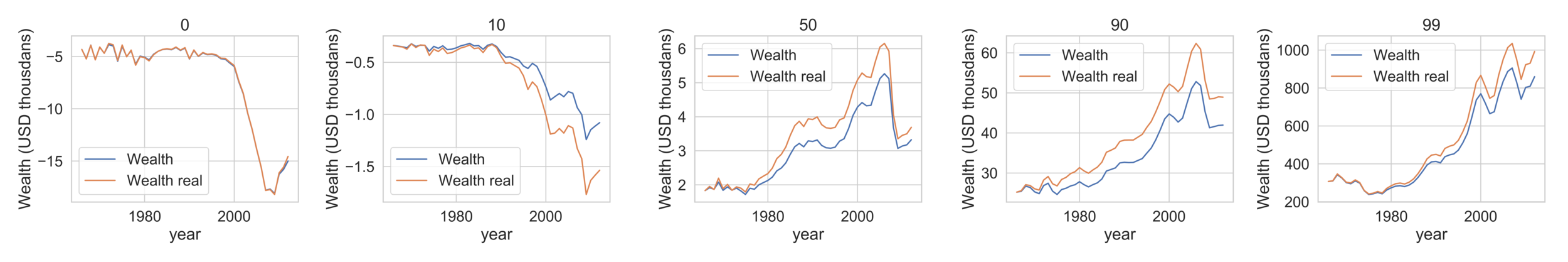

modeling wealth distribution

Labor income

Capital income

Capital gains

Savings rate

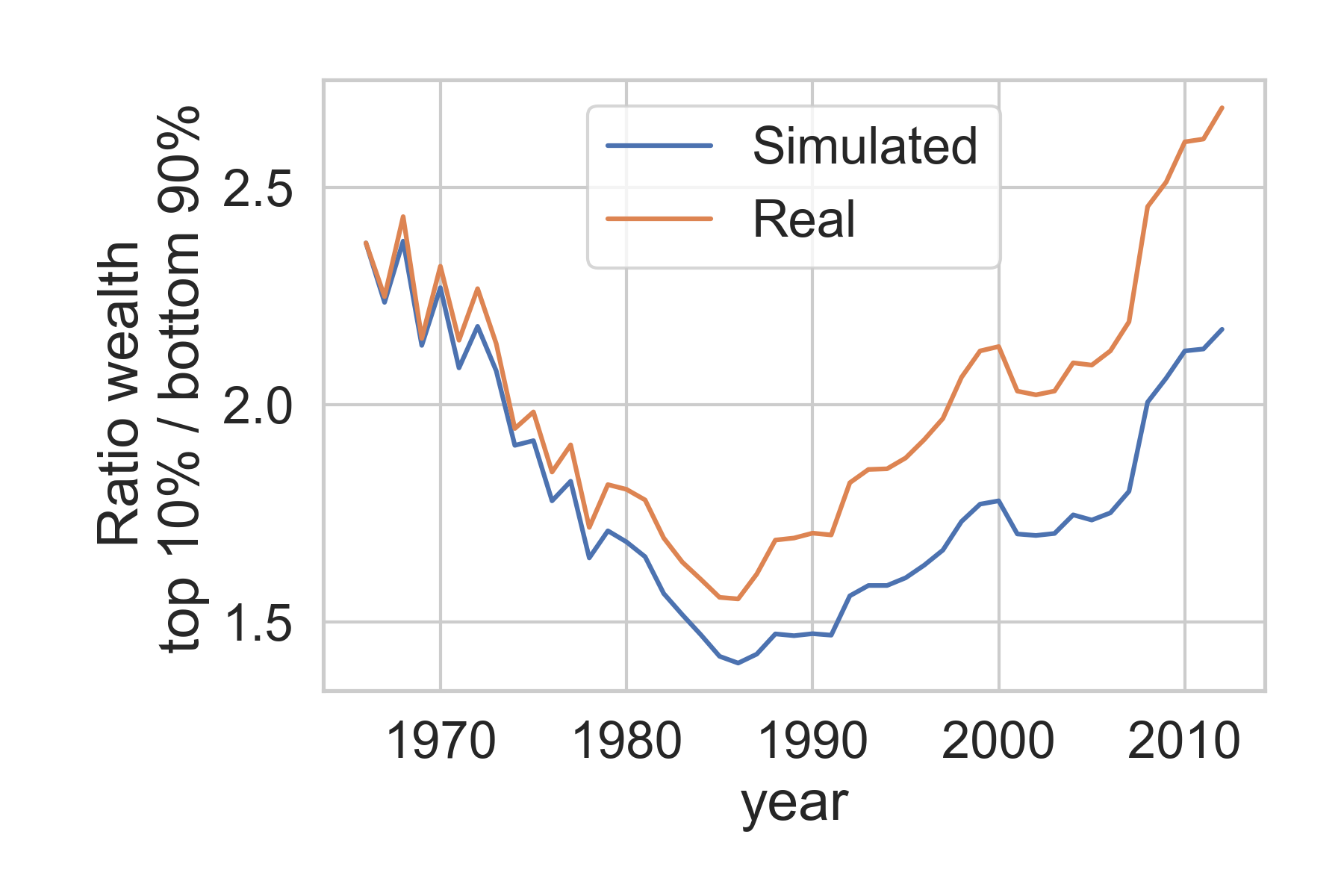

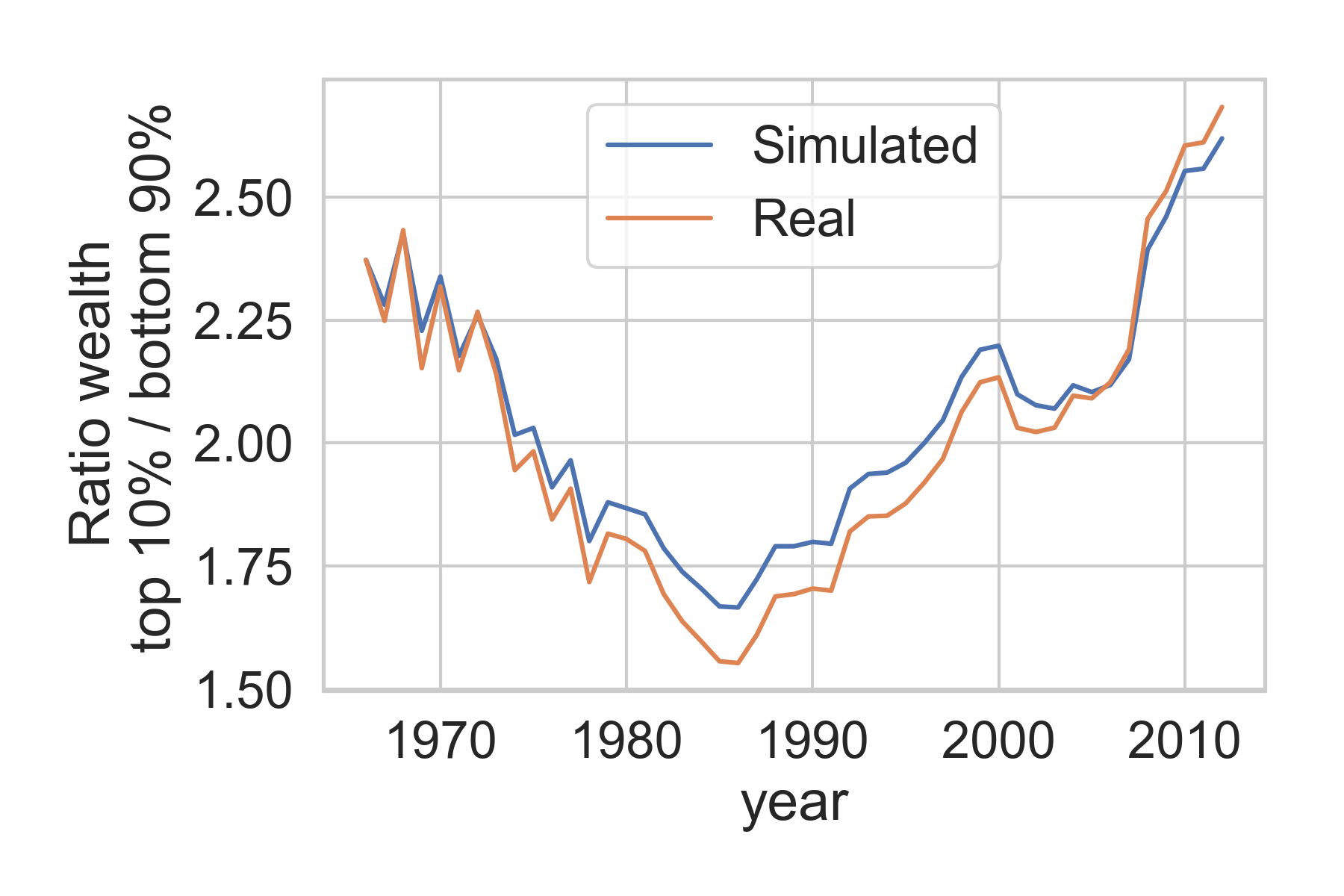

simulating the effect of taxation

Chakraborty, Venkateswaran, Pike, Huynh, Mavroeidi, Garcia-Bernardo, and Montalvo

tax labor

tax capital

(e.g. corporate profits)

simulating the effect of taxation

Chakraborty, Venkateswaran, Pike, Huynh, Mavroeidi, Garcia-Bernardo, and Montalvo

Companies have large incentives and little restrictions to move profits to low-tax jurisdictions

Some countries (OFCs) have large incentives and little restrictions to give de facto advantages to multinational corporations

This is not ideal. We need to start taxing wealth.

corpnet.uva.nl

@javiergb_com

@uvaCORPNET

javiergb.com

corpnet@uva.nl

garcia@uva.nl

This presentation: slides.com/jgarciab/ias2019

FINAL THOUGHTS

https://cssamsterdam.github.io/

https://2019.ic2s2.org/warmup/

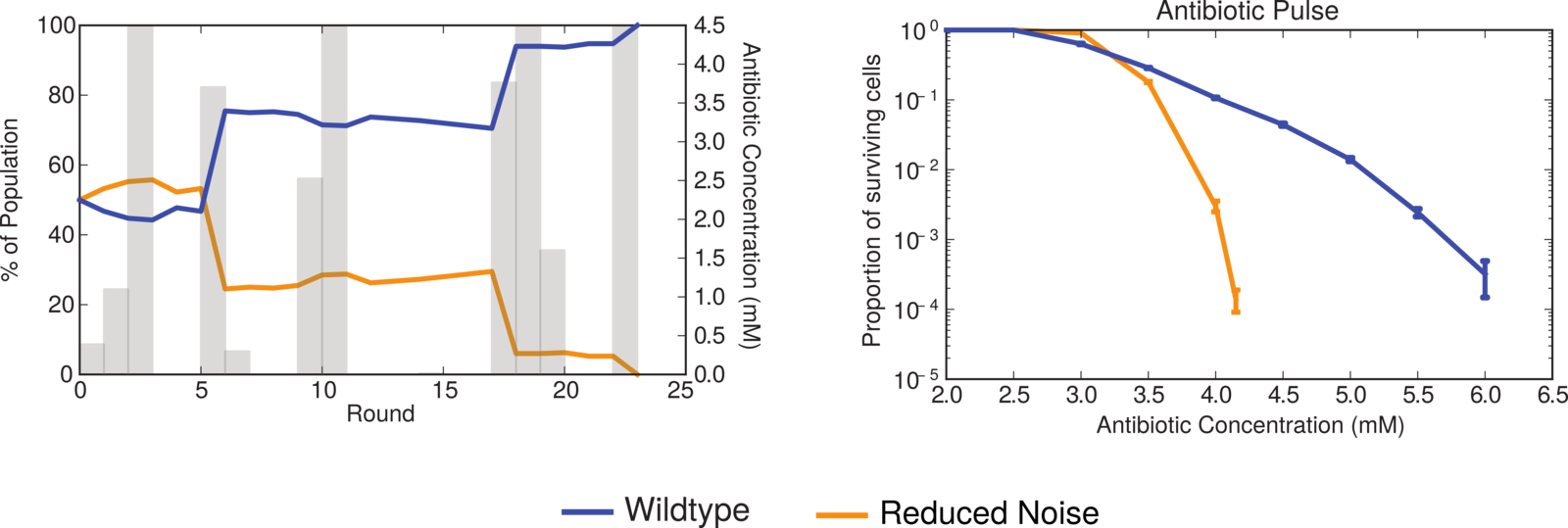

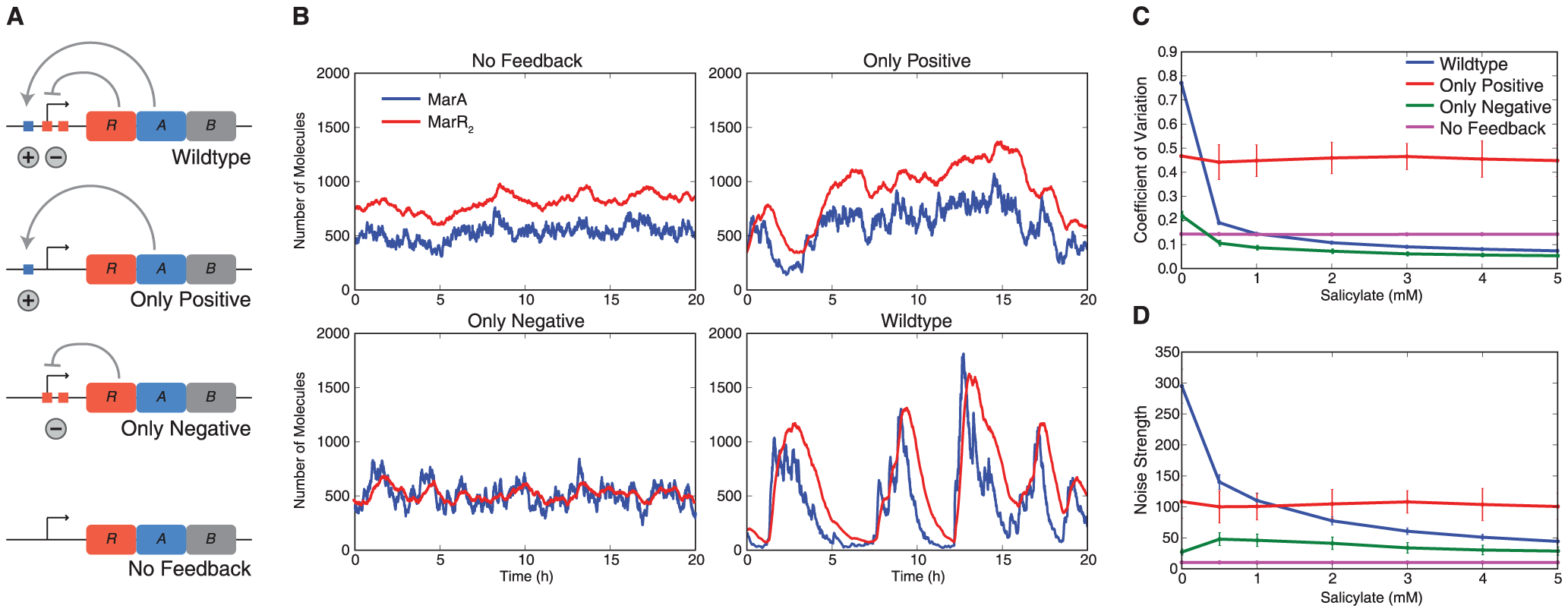

(other projects) role of noise in genetic networks

Conclusions

- Stress response in bacteria is noisy (2013)

- Noise is good (2015)

- Noise > Bimodality (2016)

Methods

- Models of gene expression

- Stochastic Simulation (Gillespie)

- Evolutionary algorithms

Simulation-based-Science March 21th IAS

By Javier GB

Simulation-based-Science March 21th IAS

sink and conduits in Corporate Structures

- 1,751